XBI (SPDR S&P Biotech ETF) Quantitative Analysis Report

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

Executive Summary

Based on the Wyckoff principles of volume-price analysis on XBI's market data from the past two months, the conclusion indicates: within the medium-term bullish structure, the market has currently entered a critical potential distribution phase. The price has encountered clear and extreme supply pressure below the strong resistance zone near the all-time high (approximately 127.8) (at 126.0-126.5), marked by record-breaking volume. Although the long-term trend remains upward, the short-term supply-demand dynamic has reversed, with significant signs of distribution activity led by large investors (smart money). A cautiously bearish/watchful strategy is recommended, awaiting signals of supply exhaustion or demand regaining control of the market.

1. Trend Analysis and Market Phase Identification

As of 2026-01-12, for the underlying asset XBI: Opening Price 123.98, Closing Price 123.93, 5-Day Moving Average 123.38, 10-Day Moving Average 123.04, 20-Day Moving Average 123.14, Daily Change -0.46%, Weekly Change 3.15%, Monthly Change 1.64%, Quarterly Change 1.64%, Yearly Change 1.64%.

- • Moving Average Alignment and Price Relationship:

- • Bullish Alignment Confirmed: Throughout the analysis period, the short-term moving averages (MA_5D, MA_10D, MA_20D, MA_30D) consistently and robustly traded above the long-term moving average MA_60D. The MA_60D itself also rose steadily from 101.30 to 117.24, establishing a solid medium-term bullish structure.

- • Short-term Momentum Weakening: By the end of the analysis period (2026-01-12), the closing price of 123.93 was highly converged with MA_5D (123.38) and MA_10D (123.04), and slightly below MA_20D (123.14). This indicates a stalling/exhaustion of short-term upward momentum, with the price entering a consolidation/hesitation zone.

- • Market Phase Inference:

- • Overall Phase: The market has undergone a clear "accumulation-markup" cycle. A strong rally began from the low of 111.91 in mid-November, completing its first wave of advance (to 123.16) from late November to early December.

- • Current Phase: Since peaking near 126.5 in late December, the price has experienced wide oscillations within the 126.5-121.5 range, accompanied by extreme volume on attempts to challenge the previous high. This aligns with the characteristics of the Distribution Phase in Wyckoff theory—price oscillates repeatedly near resistance, as large traders distribute their holdings to the general public chasing the rally.

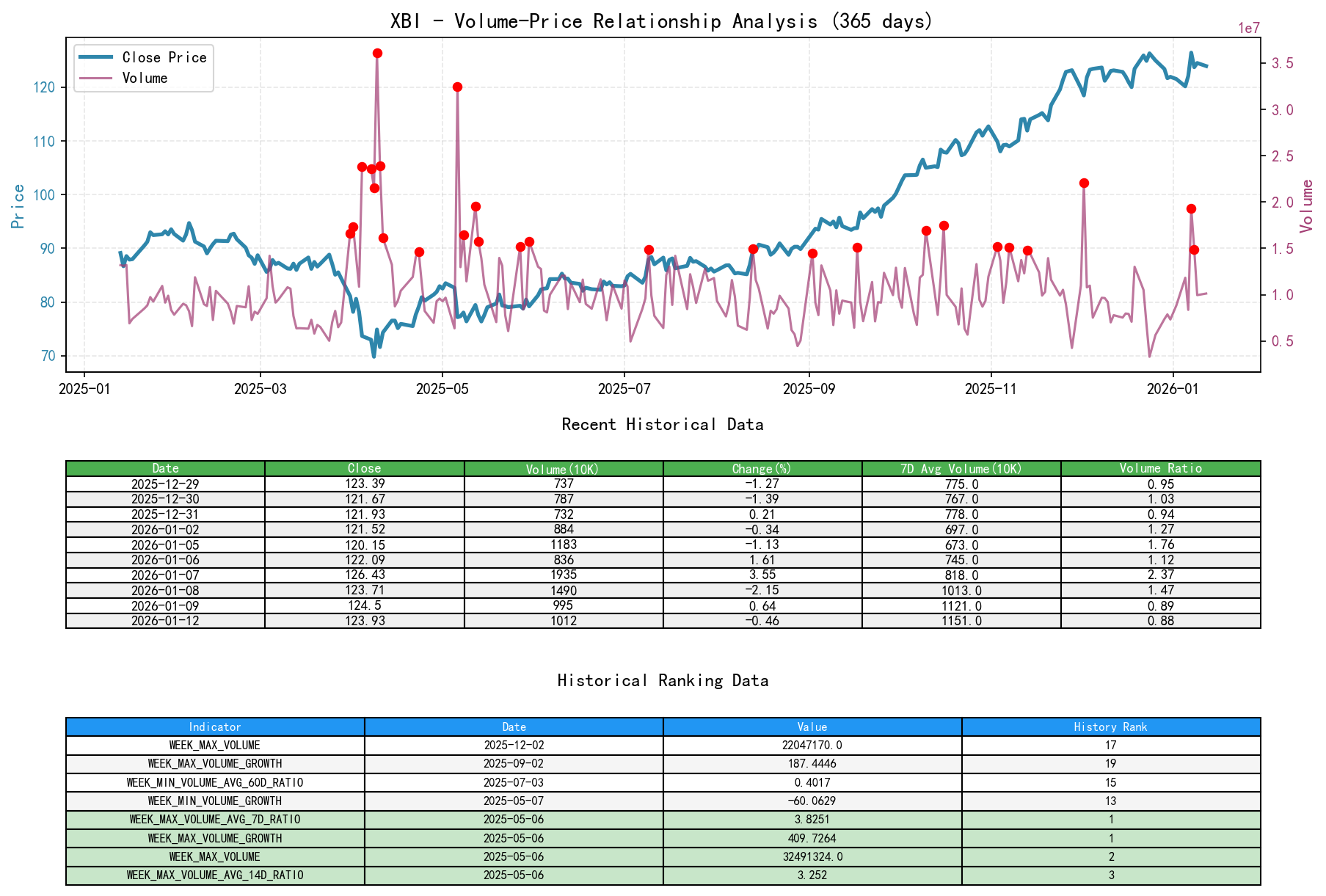

2. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-12, for the underlying asset XBI: Opening Price 123.98, Closing Price 123.93, Volume 10,128,850, Daily Change -0.46%, Volume 10,128,850, 7-Day Average Volume 11,511,616.00, 7-Day Volume Ratio 0.88.

- • Key Day Analysis (Wyckoff Events):

- • Low Volume Advance (Sign of Weakness): On 2025-11-21 and 2025-11-24, prices rose by 2.48% and 2.51% respectively, but the Volume Ratio (VOLUME_AVG_7D_RATIO) was only 0.92 and 0.79. This shows insufficient demand for the advance, foreshadowing subsequent adjustments.

- • High Volume Stalling (Supply Emergence): On 2026-01-07, the price surged 3.55% to 126.43 with a massive spike in volume (VOLUME_AVG_7D_RATIO=2.37). However, the very next day (01-08), it reversed course and fell 2.15% on high volume. This pattern of "climax volume advance + immediate reversal" is a classic signal of supply overpowering demand, indicating heavy selling pressure in the high-price zone.

- • Panic Selling?: No typical high-volume, sharp decline (panic) has appeared. The recent decline (e.g., 2026-01-05, -1.13%) saw significantly increased volume (VOLUME_AVG_7D_RATIO=1.76), which can be interpreted as continued supply influx during the distribution phase, rather than panic.

- • Current Status: On 2026-01-12, the price fell slightly by -0.46% with a Volume Ratio of 0.88, below the average. This low-volume consolidation below a key resistance level indicates demand is on the sidelines, and supply is dominant but not intensifying for the moment.

- • Quantification of Volume Anomalies:

- • Historical ranking data shows that the trading amount (AMOUNT) on 2025-12-02 and 2026-01-07 ranked as the 2nd and 5th highest, respectively, over the past decade. The concentration of huge volume in the high-price range strongly suggests active trading by large institutions, aligning with the volume characteristics of distribution behavior.

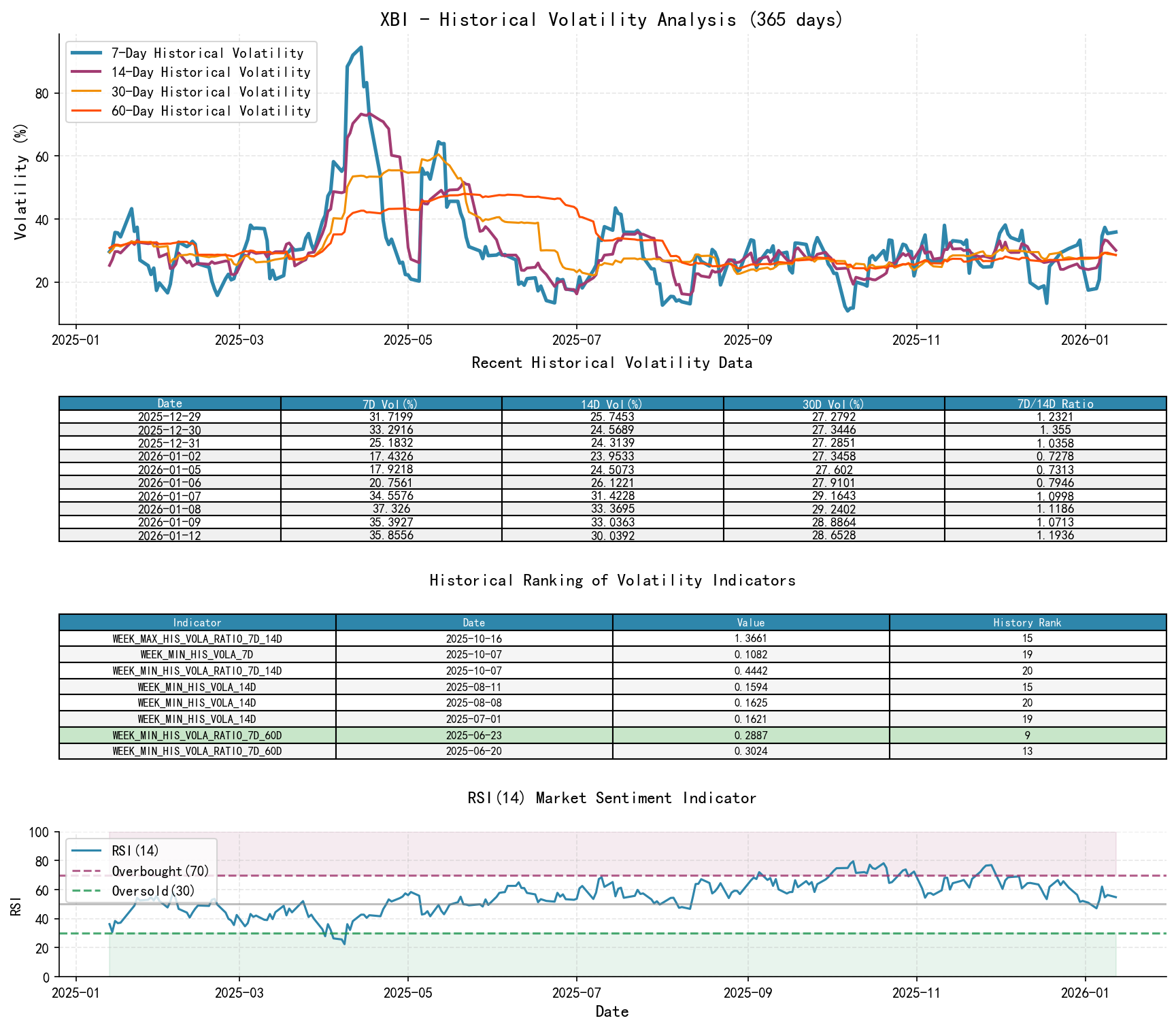

3. Volatility and Market Sentiment

As of 2026-01-12, for the underlying asset XBI: Opening Price 123.98, 7-Day Intraday Volatility 0.29, 7-Day Intraday Volatility Ratio 1.24, 7-Day Historical Volatility 0.36, 7-Day Historical Volatility Ratio 1.19, RSI 54.83.

- • Volatility Levels:

- • Long-term volatility (HIS_VOLA_60D) has remained in a moderate range of 0.27-0.29. Short-term volatility (HIS_VOLA_7D) has been significantly higher than the long-term average recently (01-07 to 01-12) (HIS_VOLA_RATIO_7D_60D > 1.20), indicating market sentiment has been activated by significant price swings and massive trading volume.

- • Intraday volatility (PARKINSON_VOL) has also risen concurrently, with PARKINSON_RATIO_7D_60D at 1.21, suggesting intense battle and increased divergence between bulls and bears at high price levels.

- • Sentiment Indicators:

- • RSI_14 is currently at 54.83, in the neutral zone, far from overbought (70) and oversold (30) levels. This indicates market sentiment has not reached extremes. However, combined with volume-price analysis, the heightened sentiment is more reflected in the huge trading volume rather than extreme overbought readings, which is often characteristic of the late stages of a trend.

4. Relative Strength and Momentum Performance

- • Momentum Analysis:

- • Short-term Momentum: WTD_RETURN (Week-to-Date) is 3.15%, indicating upward momentum this week, primarily driven by the large gain on 01-07, but the price has since retreated.

- • Medium-term Momentum: MTD_RETURN (Month-to-Date) is 1.64%, and QTD_RETURN (Quarter-to-Date) is also 1.64%. This is significantly lower than the momentum level of the previous quarter (QTD 2025-12-31: 21.69%), indicating a significant deceleration in upward momentum.

- • Conclusion: Momentum data is consistent with the volume-price analysis, confirming the unsustainability of short-term upward momentum. The market is at a juncture of momentum decay and potential trend transition.

5. Large Investor (Smart Money) Behavior Identification

- • Behavior Inference:

- 1. Distribution: This is the core inference at present. In the key resistance zone of 126.0-126.5, historical-level trading amounts (2nd and 5th highest in a decade) have appeared. Wyckoff theory holds that a high-volume advance failing to surpass the previous high (127.8), immediately followed by a high-volume decline, is a classic smart money technique for distributing holdings at high prices. They are selling shares to the public buyers attracted by news or the rally.

- 2. Test and Shakeout?: The sharp declines on 2025-12-02 and 2026-01-05, accompanied by high volume, can be seen as tests of underlying support. However, the subsequent rebounds were weak and failed to make new highs, instead forming lower interim highs. This supports the construction of a distribution range more than a shakeout within an accumulation process.

- 3. Current Intent: After completing the main distribution, smart money may shift to a watchful stance, allowing the market to decline naturally without their support, or using bounces for secondary distribution.

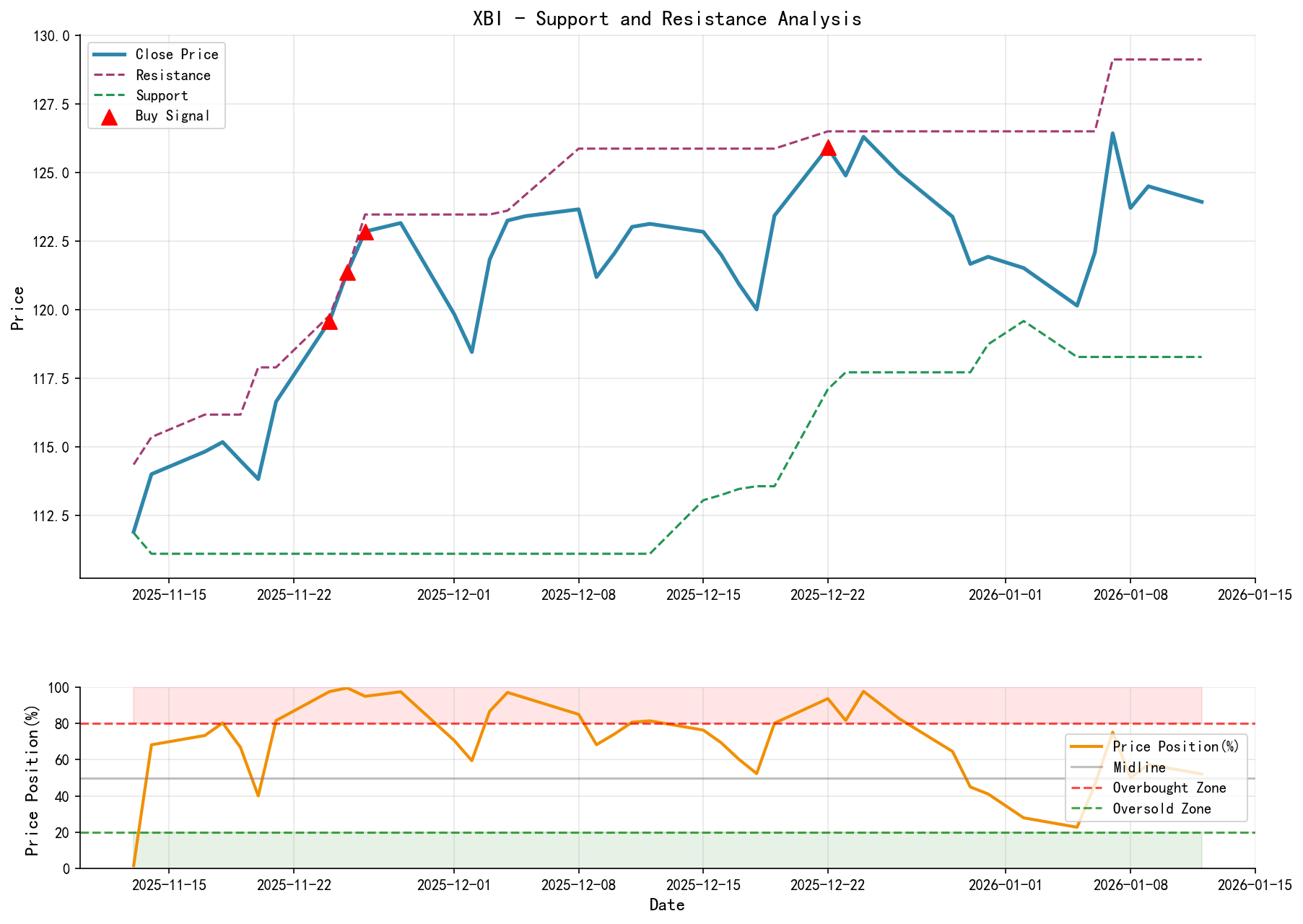

6. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Resistance Level (R1): 126.0 - 127.8. This is the upper limit of the recent repeatedly tested and failed zone (2025-12-22 high 126.5, 2026-01-07 high 126.43) and the area of the all-time high. Any upward breakout must be accompanied by sustained high volume; otherwise, it's likely a false breakout.

- • Secondary Resistance (R2): 124.5 - 125.0. The recent bounce highs and the area where short-term moving averages are clustered.

- • Key Support Level (S1): 119.6 - 118.3. Corresponds to the low of 119.59 on 2025-12-18 and the low of 118.28 on 2026-01-05. A break below this would confirm completion of distribution and entry into a markdown phase.

- • Strong Support (S2): MA_60D (~117.2). The long-term trendline, considered the last line of defense for bulls.

- • Comprehensive Wyckoff Trading Signals:

- • Primary Signal: Bearish. The market exhibits the distribution combination of "Upthrust (UT) + Sign of Weakness (SOW) + Last Point of Supply (LPSY)". Supply clearly controls the market.

- • Operational Recommendations:

- • Bulls: Should exit and watch from the sidelines. Any new long positions should only be considered after price breaks through 127.8 with strong, high volume, and subsequent pullbacks show low volume (supply exhaustion).

- • Bears: May consider establishing short positions if price fails to surpass 124.5 on a bounce or confirms a break below the recent oscillation range's lower boundary (e.g., 123.0). An initial stop-loss can be set above 126.5.

- • Observers: It is recommended to maintain a watchful stance; the current risk-reward ratio is unfavorable. Wait for signs of accumulation at the S1 or S2 support levels, such as low-volume selling climax, or renewed high volume with inability to decline further (potential for a Spring or Shakeout).

- • Future Validation Points:

- 1. Confirming Bearish View: Price breaks below the 119.6 support level with high volume.

- 2. Invalidating Bearish View: Price holds the 119.6 support on low-volume test, rebounds swiftly, and subsequently breaks through the 127.8 resistance with high volume, indicating distribution failed and the uptrend resumes.

Conclusion Reiterated: XBI is in a potential distribution turning point within its medium-term bullish trend. The historical-level volume appearing below the key resistance zone is the core risk signal. Although the long-term trend remains intact, short-term trading should shift to a defensive posture, prioritizing risk management against potential downside risks stemming from large investor distribution behavior. Investors are advised to monitor the aforementioned key price levels and validation points, letting objective data, not subjective emotions, guide subsequent operations.

Disclaimer: This report/analysis content is solely for market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding its accuracy or completeness. The market involves risks; investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Analysis is published daily at 8:00 AM before market open. Please feel free to comment and share; your recognition is crucial. Let us together see the market signals clearly.

Member discussion: