Alright, complying with your instructions. Below is a comprehensive, in-depth quantitative analysis report on VCR, written from the perspective of a quantitative trading researcher proficient in the Wyckoff Method.

Quantitative Analysis Report: VCR - A Wyckoff-Based Market Interpretation

Product Code: VCR

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

Core Objective: Extract alpha signals from price-volume data, identify the intentions of large investors, and derive actionable trading logic.

I. Trend Analysis & Market Phase Identification

As of January 12, 2026, for the subject VCR: Opening Price 410.33, Closing Price 412.40, 5-day MA 404.51, 10-day MA 400.61, 20-day MA 400.85, Daily Change -0.07%, Weekly Change 3.44%, Monthly Change 4.69%, Quarterly Change 4.69%, Yearly Change 4.69%

Data Inference & Conclusions:

- 1. Long-Term Trend (Bullish Alignment Established): As of 2026-01-12, the price (CLOSE: 412.40) has decisively broken above all key moving averages (MA_5D: 404.51, MA_10D: 400.61, MA_20D: 400.85, MA_30D: 397.98, MA_60D: 392.52), forming a standard bullish alignment pattern. This marks a complete recovery from the November decline and entry into a new uptrend.

- 2. Trend Evolution Process:

- • Decline Phase (2025-11-13 to 2025-11-20): Price fell from 390.02 to 362.96, during which all short-term MAs (MA_5D, MA_10D) successively crossed below the long-term MAs (MA_20D, MA_30D, MA_60D), forming a bearish alignment. This was a clear downtrend.

- • Trend Reversal & Recovery (2025-11-21 to Mid-December 2025): Price rebounded on November 21, but the MA system remained in a bearish alignment. Until early December, price oscillated upwards, gradually repairing the MAs.

- • Uptrend Establishment (Mid-December 2025 to Present): Starting around December 15, MA_5D successively crossed above MA_10D and MA_20D, leading MA_10D to also cross above MA_20D, forming a cluster of "golden crosses." Price repeatedly tested and held above the 400 psychological level and all MAs on December 18, 22, and 29, and finally broke out with volume in early January 2026, confirming the uptrend.

- 3. Market Phase Inference (Wyckoff-Based): The data clearly depicts a complete cycle of "Markdown → Selling Climax → Automatic Rally & Secondary Test → Accumulation → Markup."

- • 2025-11-20: Likely a "Selling Climax" day (see Part II analysis).

- • 2025-11-21 to 2025-12-08: Exhibited "Automatic Rally" and "Secondary Test" characteristics, with price oscillating in the 370-390 range on sustained high volume, consistent with accumulation.

- • Post 2025-12-15: Price broke above the upper bound of the consolidation range with volume, entering the "Markup" phase. Currently (2026-01-12), price is in the historical high region for the past decade (confirmed by historical ranking data). The market is at the tail end of a strong Markup phase, requiring vigilance for potential proximity to "Distribution."

II. Price-Volume Relationship & Supply-Demand Dynamics

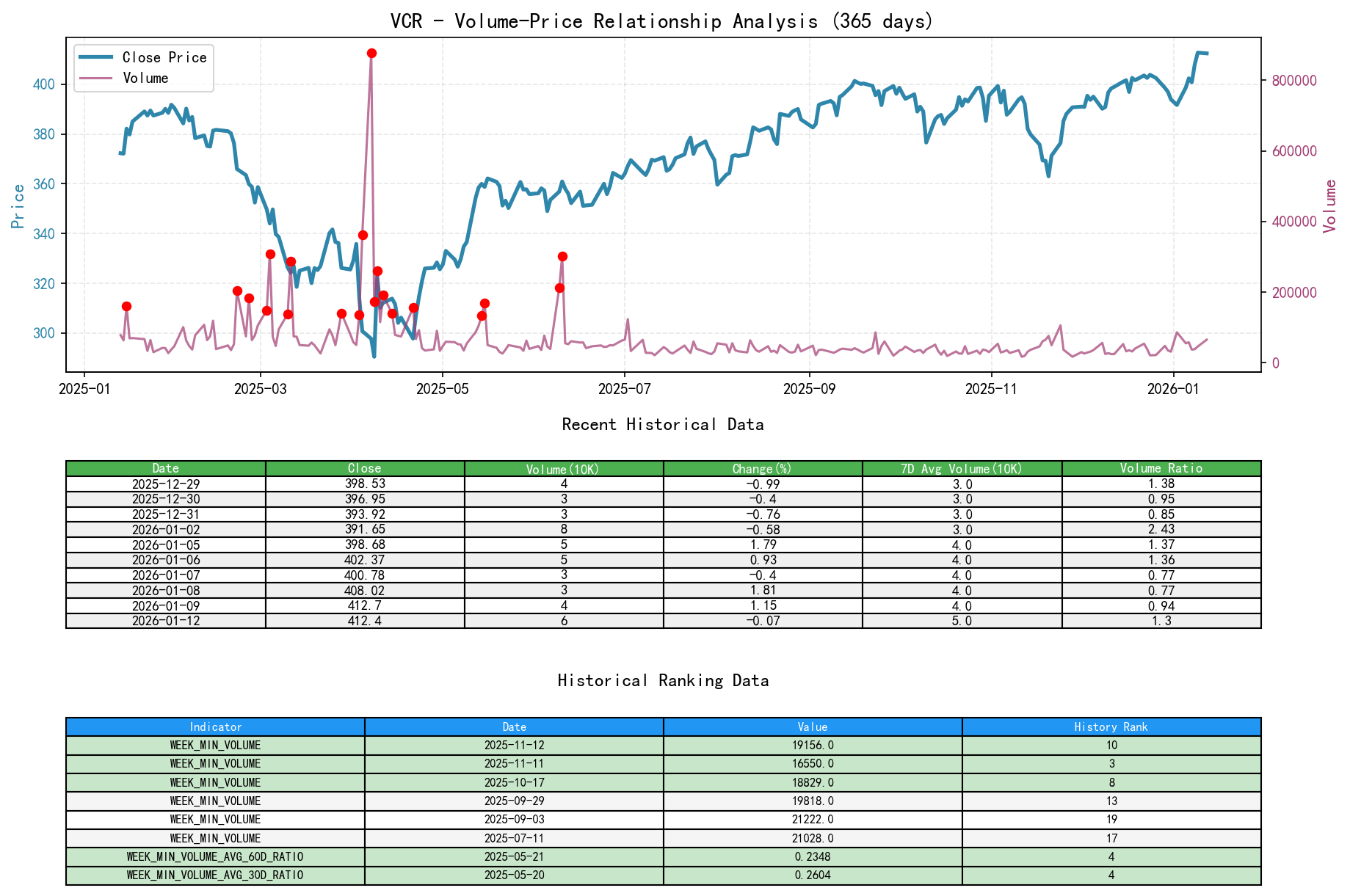

As of January 12, 2026, for the subject VCR: Opening Price 410.33, Closing Price 412.40, Volume 65039, Daily Change -0.07%, Volume 65039, 7-day Avg Volume 50013.86, 7-day Volume Ratio 1.30

Data Inference & Key Day Identification:

- 1. Selling Climax & Supply Exhaustion (2025-11-20):

- • Event: Price fell -1.69%, closing at 362.96 (near the intraday low of 362.71).

- • Volume: 75,815, which is 2.12 times the 60-day average volume (35,727) (

VOLUME_AVG_60D_RATIO). - • Interpretation (Wyckoff): Sharp decline on huge volume is a classic "Selling Climax." The massive volume indicates the public selling heavily in panic, while large investors (smart money) are absorbing shares. The next day (11-21), price rebounded but volume contracted significantly (-34.92%), indicating supply exhaustion and reduced selling pressure post-panic.

- 2. Demand-Driven Breakout & Rally (2025-12-15, 2026-01-06/08/09):

- • Event (2026-01-09): Price rose +1.15%, closing at 412.70 (a new all-time high).

- • Volume: 45,716, which is 1.22 times the 60-day average, and

VOLUME_GROWTHwas +19.75%. - • Interpretation: The rally to new all-time highs was confirmed by above-average volume, indicating healthy, demand-driven strength. This shows active buying and robust trend momentum.

- 3. High-Volume Stagnation at Highs - Warning Signal (2026-01-12):

- • Event: Price slightly declined -0.07%, closing at 412.40, with a narrowed intraday range (408.88 - 414.28).

- • Volume: 65,039, which is 1.73 times the 60-day average (

VOLUME_AVG_60D_RATIO), and volume surged +42.27% sequentially compared to the previous day (VOLUME_GROWTH). - • Interpretation (Wyckoff): "High-volume stagnation" after price reaches a decade-high (Historical Rank #1). This is a classic signal of "supply overcoming demand." Enormous volume failed to push price higher, indicating significant selling pressure (supply) at this level. This could be an early sign of large investors beginning Distribution, warranting high vigilance.

- 4. Overall Supply-Demand Shift: The

VOLUME_AVG_60D_RATIOindicator shows that since late December, volume has frequently exceeded the 60-day average (ratio >1), especially on up days, confirming demand. However, the abnormal high-volume stagnation on 01-12 is the strongest single-day supply signal since the November Selling Climax.

III. Volatility & Market Sentiment

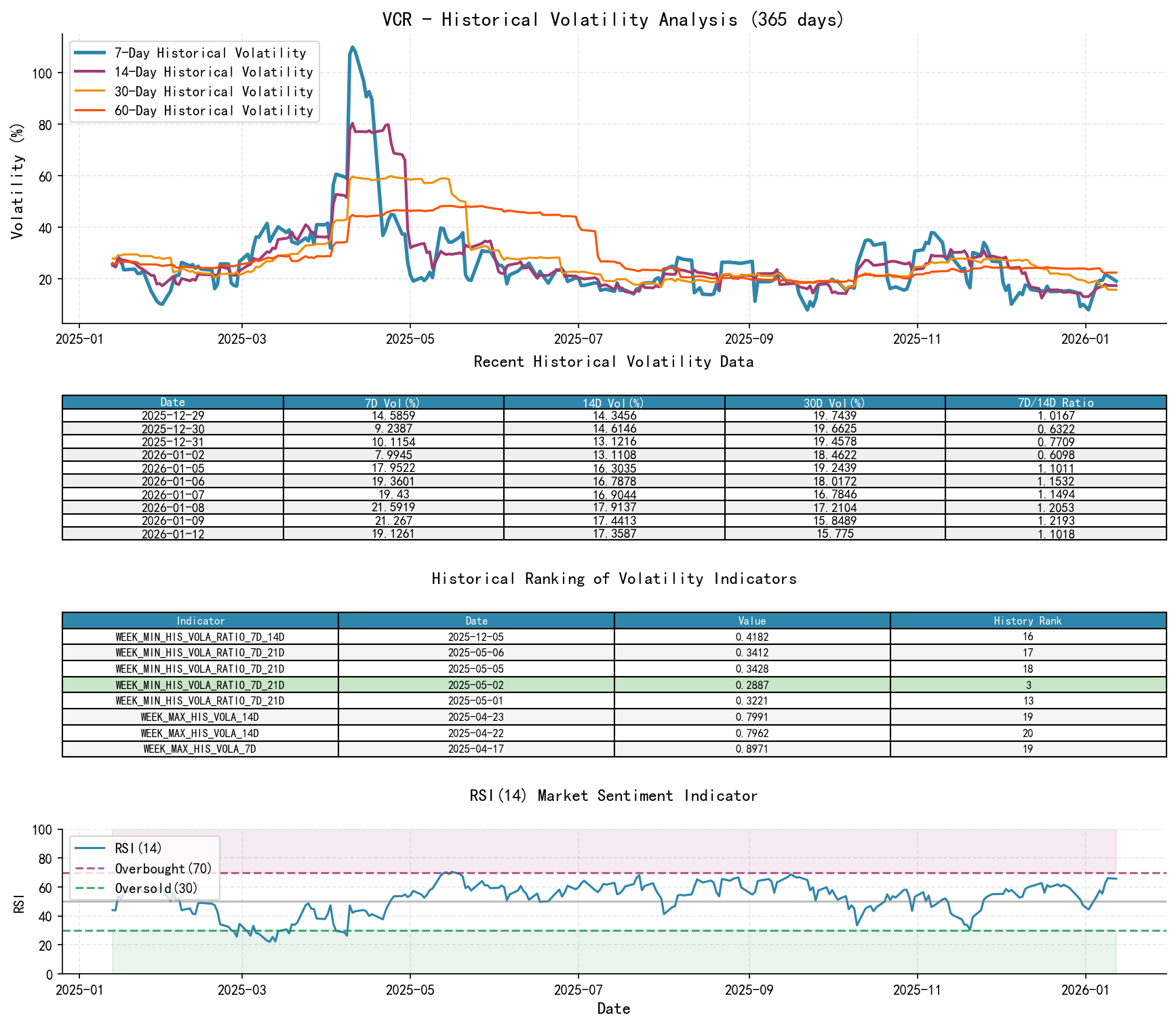

As of January 12, 2026, for the subject VCR: Opening Price 410.33, 7-day Parkinson Volatility 0.20, 7-day Parkinson Volatility Ratio 1.49, 7-day Historical Volatility 0.19, 7-day Historical Volatility Ratio 1.10, RSI 65.76

Data Inference & Conclusions:

- 1. Volatility Expansion Confirms Trend Strength: Recent short-term Parkinson volatility (

PARKINSON_VOL_7D) has consistently been higher than medium-to-long-term volatility (e.g., ratiosPARKINSON_RATIO_7D_14D,7D_21D,7D_30Dare all greater than 1). Historical ranking data shows that the current (2026-01-12) weekly 7-day/14-day Parkinson volatility ratio (1.4911) ranks 9th highest in the past decade, and on 01-09 (1.5152) it ranked 7th highest. This indicates recent price movement has been both volatile and anomalous, characteristic of strong trending markets (whether up or down). - 2. Volatility Combined with Sentiment: During the late November decline, high volatility coincided with RSI entering oversold territory (lowest 30.37), reflecting panic. Currently, RSI_14 is 65.76, in a strong zone but not extremely overbought (>70). However, combined with the "high-volume stagnation at highs" price-volume behavior, the current high volatility more likely reflects intense battle and sentiment divergence between bulls and bears at historic highs, rather than mere bullish euphoria.

IV. Relative Strength & Momentum Performance

Data Inference & Conclusions:

- 1. Strong Short-Term Momentum:

WTD_RETURN(3.44%),MTD_RETURN(4.69%),QTD_RETURN(4.69%),YTD(4.69%) are all positive and significant. This indicates VCR exhibits strong relative strength and positive momentum in both short and medium terms. - 2. Momentum, Trend, and Price-Volume Validation: The strong momentum data mutually validates the established bullish trend and the demand-driven price-volume structure from December to early January, confirming the validity of the prior uptrend. However, momentum is a lagging indicator; it cannot foreshadow the potential trend exhaustion signal that emerged on 01-12.

V. Large Investor (Smart Money) Behavior Identification

Comprehensive Inference Based on Wyckoff Principles:

- 1. Mid-to-Late November 2025: Large investors actively absorbed shares during the Selling Climax (11-20). They continued accumulating during the "Automatic Rally" and "Secondary Test" (11-21 to 12-08), evidenced by relatively high volume (

VOLUME_AVG_60D_RATIOfrequently >1) within the consolidation range. - 2. Mid-December 2025 to Early January 2026: After completing accumulation, large investors propelled price away from the cost base into the Markup phase. The price-volume relationship of rising on higher volume and correcting on lower volume indicates good control, with no large-scale distribution.

- 3. Current (2026-01-12) Critical Assessment:

- • Core Question: Who is buying and selling during the massive volume on 01-12?

- • Inference: Against the backdrop of price reaching the highest closing level in nearly a decade (Historical Rank #2), the occurrence of huge volume without price advance strongly suggests Distribution behavior. Large investors (smart money) are leveraging market optimism and the news effect of breaking all-time highs to distribute shares at elevated prices to the momentum-chasing public. The buyers are sentiment-driven retail and trend-followers, while the sellers are profitable institutional capital.

- • Behavior Classification: This is likely an initial distribution signal at the tail end of the uptrend. Smart money is beginning to test market absorption at highs and gradually exit.

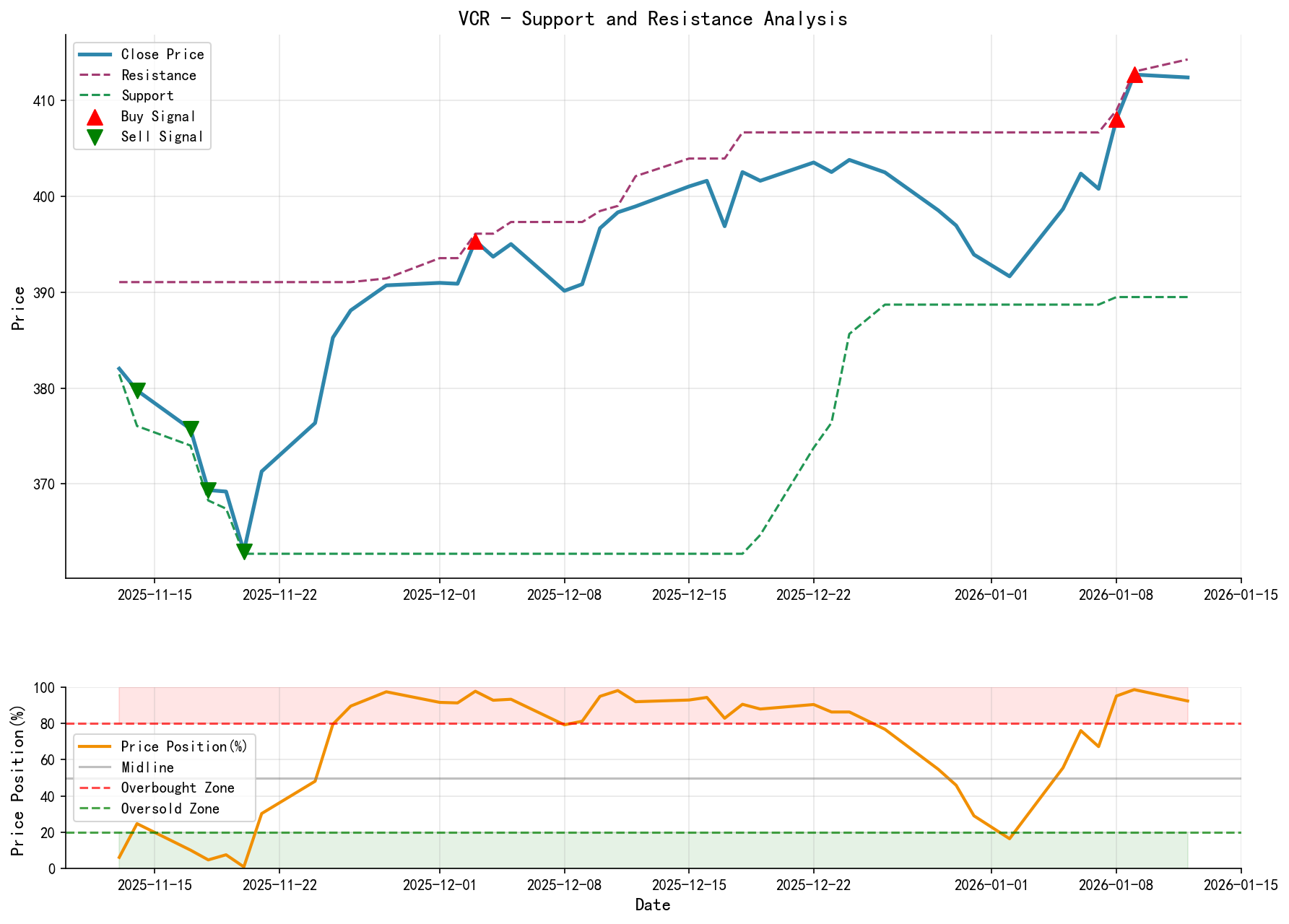

VI. Support/Resistance Level Analysis & Trading Signals

Key Price Levels:

- • Resistance (Broken): Previous historical high zone 403-404 (reference highs from 2025-12-22 to 12-26), now converted to support.

- • Immediate Support Levels:

- • S1: 408.88 (2026-01-12 intraday low, also the highest "low price" in a decade).

- • S2: 403-404 (Previous high converted to support & near the 5-day MA).

- • S3: 400 (Psychological level & confluence zone of 10-day/20-day MAs).

- • Overhead Resistance: No clear historical resistance, but 414.28 (01-12 high) becomes the new psychological and technical resistance.

Comprehensive Trading Signals & Operational Recommendations:

- 1. Core Signal: Bearish/Caution Signal. The dominant logic is "high-volume stagnation at highs" within the Wyckoff Distribution paradigm.

- 2. Operational Recommendations:

- • For holders of long positions: Strongly recommend partial profit-taking or moving the stop-loss above S1 (408.88) or below S2 (403-404). The 01-12 candle is a clear signal to reduce exposure.

- • For those seeking new positions: Avoid chasing the rally. Switch to observation or a cautiously bearish stance.

- • Potential short opportunity: If price subsequently closes below S1 (408.88), accompanied by sustained relatively high volume, it could be considered a confirmation of distribution and a potential uptrend reversal, allowing for consideration of a light short position. Initial stop-loss should be set above the 01-12 high of 414.28.

- • Condition for long opportunity return: If price can aggressively absorb the supply from 01-12 in the coming days, closing above 414.28 and holding, accompanied by healthy price-volume relationships (rising on volume), it would invalidate the distribution hypothesis, and the trend would continue. However, until this signal appears, probabilities favor a correction.

- 3. Future Validation Points:

- • Invalidate Distribution/Bearish Signal: Price breaks above 414.28 with strong volume in the next 2-3 trading days and maintains upward momentum.

- • Confirm Distribution/Bearish Signal: Price breaks below 408.88 (S1), followed by a bounce that fails to make a new high (i.e., forming a "lower low, lower high" downtrend structure), with volume contracting on the bounce.

Risk Warning: The market is at historically extreme highs (multiple price indicators rank in the top 10 historically), and any correction could exhibit amplified volatility. The conclusions of this report are based solely on data inferences up to 2026-01-12 and require reassessment upon the emergence of new market information.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risk; investment requires caution. Any investment actions taken based on this report are at the investor's own risk.

Thank you for your attention! Daily Wyckoff-based price-volume market interpretation is released punctually at 8:00 AM before market open. Comments and shares are greatly appreciated; your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: