VAW Quantitative Analysis Report (Based on the Wyckoff Method)

Product Code: VAW

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

I. Trend Analysis and Market Phase Identification

As of 2026-01-12, the underlying VAW had an open price of 223.17, a close price of 224.37, a 5-day moving average of 217.54, a 10-day moving average of 213.70, a 20-day moving average of 210.78, a daily change of 0.93%, a weekly change of 4.87%, a monthly change of 8.10%, a quarterly change of 8.10%, and an annual change of 8.10%.

- 1. Moving Average Alignment and Trend Status:

- • Initial Phase (Mid to Late November): The price (CLOSE) consistently traded below all major moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), exhibiting a standard bearish alignment. The MA_60D (203+) acted as a significant resistance level, indicating a downward medium-term trend.

- • Transition Phase (December): The price stabilized and rebounded in early December, successively breaking above the MA_5D, MA_10D, and MA_20D. The MA_5D crossed above the MA_20D (e.g., around December 1), providing an initial short-term bullish signal. However, the price encountered resistance multiple times near the MA_30D and MA_60D (e.g., on December 8), indicating supply pressure in the long-term moving average zone.

- • Establishment Phase (Early January to Present): Starting from 2026-01-02, the price broke through all moving averages decisively with significantly increased volume, driving the short-term MA (MA_5D) to cross above the long-term MA (MA_60D) rapidly. As of January 12, the price (224.37) is well above all moving averages, and the alignment MA_5D (217.54) > MA_20D (210.78) > MA_60D (202.69) forms a clear bullish alignment, confirming the establishment of an uptrend.

- 2. Market Phase Inference (Based on Wyckoff Cycle):

- • November 2025: The price declined from around 199+ to near 192, with volume expanding on down days (e.g., Nov 17, 20), exhibiting characteristics of the Markdown phase following Distribution, where supply dominated the market.

- • December 2025: The price fluctuated widely within the 192-208 range, with lows not reaching new lows, and experienced strong rebounds after panic selling (e.g., Dec 10-11). This aligns with the typical characteristics of the Accumulation phase—absorbing shares through fluctuations in preparation for an upward move.

- • January 2026 to Present: The price broke above the upper boundary of the previous consolidation range (208-210) and all key moving averages with high volume, continuously setting new highs, accompanied by active volume participation during the advance. This clearly marks the market's entry into the Markup phase, where demand has taken full control.

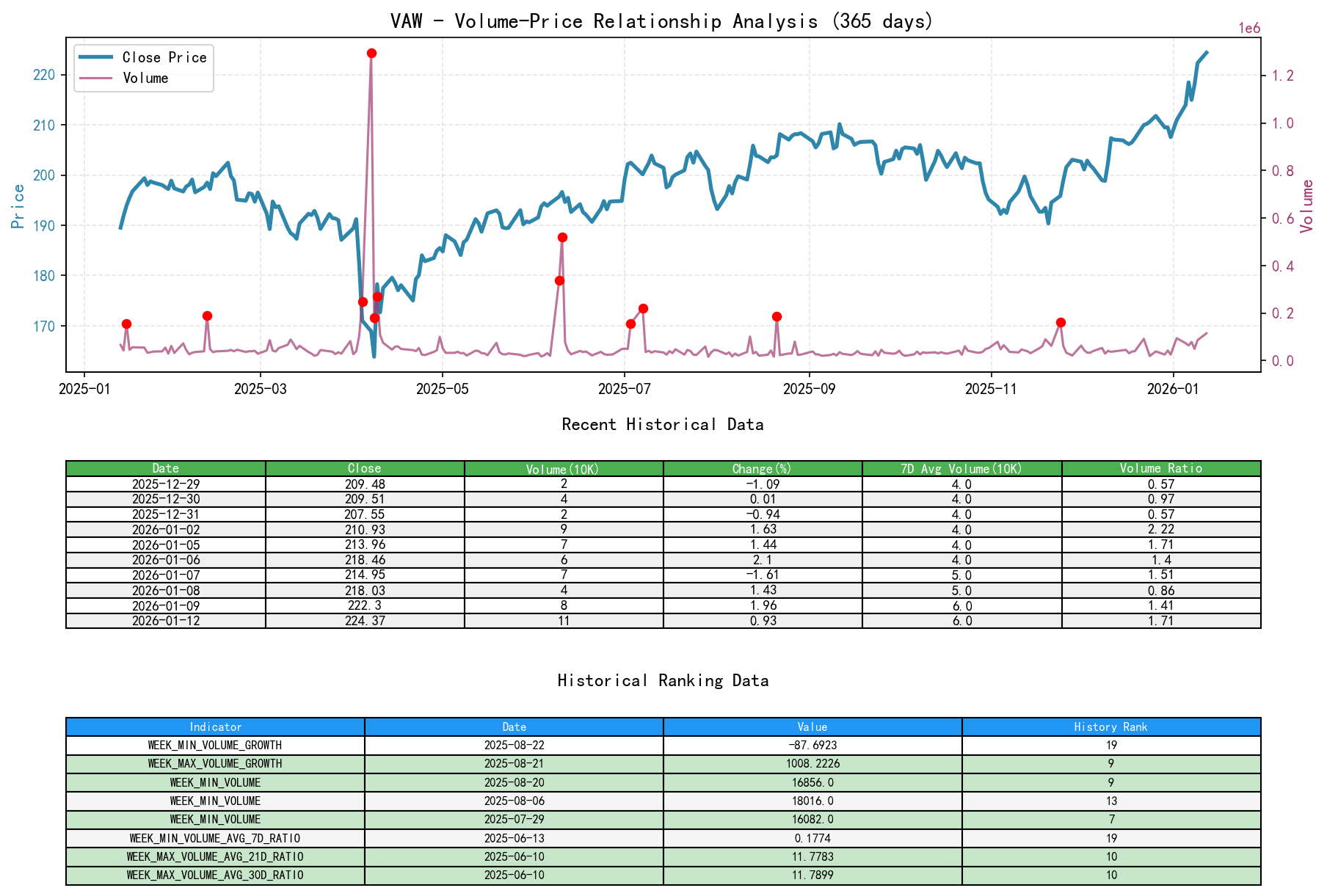

II. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-12, the underlying VAW had an open price of 223.17, a close price of 224.37, a volume of 114,951, a daily change of 0.93%, a volume of 114,951, a 7-day average volume of 67,257.57, and a 7-day volume ratio of 1.71.

- 1. Key Volume-Price Signal Analysis:

- • Supply-Dominated Days (Bearish Signals):

- • 2025-11-17: Price fell sharply by -1.58% with a volume of 52,283. The

VOLUME_GROWTHwas as high as 68.40%, and theVOLUME_AVG_7D_RATIOwas 1.29, indicating high-volume decline, signifying strong supply pushing prices lower. - • 2025-11-24: Price rose only 0.67% slightly, but volume surged to 161,533, with

VOLUME_GROWTHat 161.25% andVOLUME_AVG_7D_RATIOreaching 2.75. This is a typical case of high-volume stalling or churning, indicating encountering strong supply at higher levels, preventing price advancement.

- • 2025-11-17: Price fell sharply by -1.58% with a volume of 52,283. The

- • Demand-Dominated Days (Bullish Signals):

- • 2025-12-10/11: Two consecutive days of significant gains (1.84% / 2.39%) with volumes of 41,040 and 37,013 respectively. Although not extremely high volume, they successfully halted the decline and initiated a breakout, signaling the initial return of demand.

- • 2026-01-02: Price rose 1.63% with a volume of 94,399.

VOLUME_GROWTHreached 270.88%, and theVOLUME_AVG_60D_RATIOwas 2.09. This represents high-volume advance upon breaking through key resistance (previous highs and the annual moving average), a clear signal of strong demand influx. - • 2026-01-12 (Latest Trading Day): Price rose 0.93%, and volume further increased to 114,951, setting a recent high, with a

VOLUME_AVG_60D_RATIOof 2.33. This is sustained high volume within an uptrend, confirming solid demand supporting price increases.

- • Supply-Dominated Days (Bearish Signals):

- 2. Supply-Demand Pattern Conclusion:

- • From November to early December, the market was dominated by supply, evident in declines or weak-volume rebounds.

- • From mid to late December, a balance between bulls and bears was reached at lower levels, showing characteristics of accumulation.

- • Starting in January, the supply-demand dynamics underwent a fundamental reversal. Demand has consistently and powerfully overwhelmed supply, evidenced by effective volume expansion accompanying each key advance, along with small and brief price pullbacks during the rise. The current market is in a strong demand-dominated pattern.

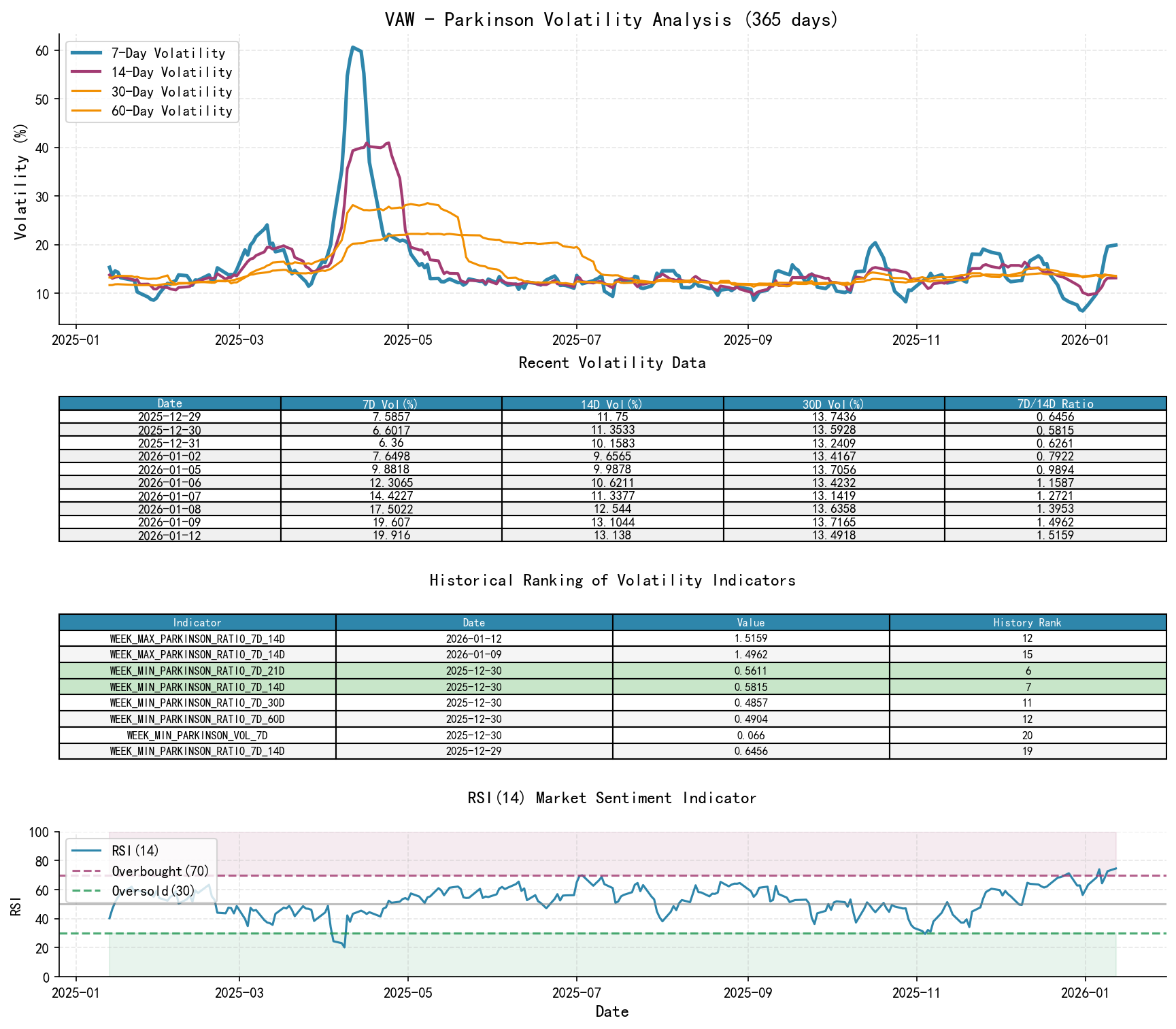

III. Volatility and Market Sentiment

As of 2026-01-12, the underlying VAW had an open price of 223.17, a 7-day intraday Parkinson volatility of 0.20, a 7-day intraday volatility ratio of 1.52, a 7-day historical volatility of 0.24, a 7-day historical volatility ratio of 1.08, and an RSI of 74.61.

- 1. Volatility Analysis:

- • Level: The latest trading day's (Jan 12) 7-day Parkinson volatility (

PARKINSON_VOL_7D) is 0.199, above its 14-day, 21-day, and 30-day averages. The 7-day historical volatility (HIS_VOLA_7D) is 0.241, also above its longer-term averages. This indicates short-term volatility has risen significantly. - • Structural Change (Key Signal): Volatility ratio indicators show short-term volatility far exceeding medium-term volatility.

- •

PARKINSON_RATIO_7D_14D= 1.516, ranking 12th in the past 10 years, indicating an extremely abnormal high level. - •

HIS_VOLA_RATIO_7D_14D= 1.078.

- •

- • Interpretation: This "short-term volatility > medium-term volatility" structure typically occurs during the acceleration phase of a trend or periods of panic/euphoria. Combined with the clear uptrend, this suggests market sentiment is becoming positive and active, with amplified volatility primarily driven by upward momentum, not disorderly panic.

- • Level: The latest trading day's (Jan 12) 7-day Parkinson volatility (

- 2. Overbought/Oversold Status:

- • The

RSI_14indicator rose rapidly from around 56 in late December with the January rally, reaching 74.61 on Jan 12, entering overbought territory. - • Interpretation: RSI overbought indicates short-term sentiment is overheated, creating pressure for a technical pullback. However, in a strong uptrend, RSI can remain in overbought territory. Observation combined with volume is required: If subsequent price action shows high-volume stalling or decline, overbought risk increases; if a pullback occurs on low volume, it is considered a healthy correction.

- • The

IV. Relative Strength and Momentum Performance

- 1. Momentum Strength:

- • Extremely Strong Short-Term Momentum:

WTD_RETURN(week-to-date) is as high as 4.87%, andMTD_RETURN(month-to-date) is 8.10%. - • Strong Mid-Term Momentum Reversal: Looking at

QTD_RETURNandYTD_RETURN(both 8.10%), the product started 2026 strongly, completely reversing the weakness seen in November 2025 (TTM_12was negative at the end of November). - • Interpretation: VAW has exhibited significant absolute and relative momentum in the recent market. From the November low (190.36) to the January high (224.68), the gain exceeds 18%, indicating ample momentum. The strong momentum, together with the aforementioned "demand-dominated volume-price relationship" and "bullish aligned trend," confirms the validity of the current uptrend.

- • Extremely Strong Short-Term Momentum:

V. Large Investor (Smart Money) Behavior Identification

- 1. Operation Intent Inference:

- • November to Early December: Smart money was likely engaged in distribution or staying on the sidelines. High-volume declines and stalling indicated large investors might have been selling into rallies or not actively participating.

- • Mid to Late December: Smart money likely began accumulating at low levels. The market found support at a critical level (around 192) and rebounded, with moderately increased volume on rebounds, consistent with institutional accumulation near the end of a decline or at the bottom of a range.

- • January to Present: Smart money is actively going long and driving the trend. This is evidenced by:

- • Extremely high volume at key resistance breakouts (Jan 2, Jan 12): This is not typical retail behavior, indicating large capital decisively entering at critical points.

- • Sustained demand control: Each pullback during the price advance was quickly met with buying support, and volume contracted during pullbacks, showing supply exhaustion and stable holdings by smart money.

- • Historical ranking corroboration: The open, close, high, and low prices on January 12 all set new decade-high records (HISTORY_RANK: 1). Pushing prices into historical high territory is necessarily the result of concerted action by large capital.

- 2. Core Question Answers:

- • Who is absorbing the massive volume? During the January rally, the massive volume (e.g., Jan 2, 12) represents large institutional investors (smart money) actively buying and building positions.

- • Who is sidelined during low volume? During the consolidation and minor pullbacks in late December (e.g., Dec 29-31), significantly reduced volume indicates light retail trading, while smart money may have been patiently waiting for better entry opportunities or had completed initial positioning.

- • Current Typical Behavior: The market is in the early stages of the Markup phase following accumulation completion. Smart money is pushing the price away from its cost base and attracting trend followers.

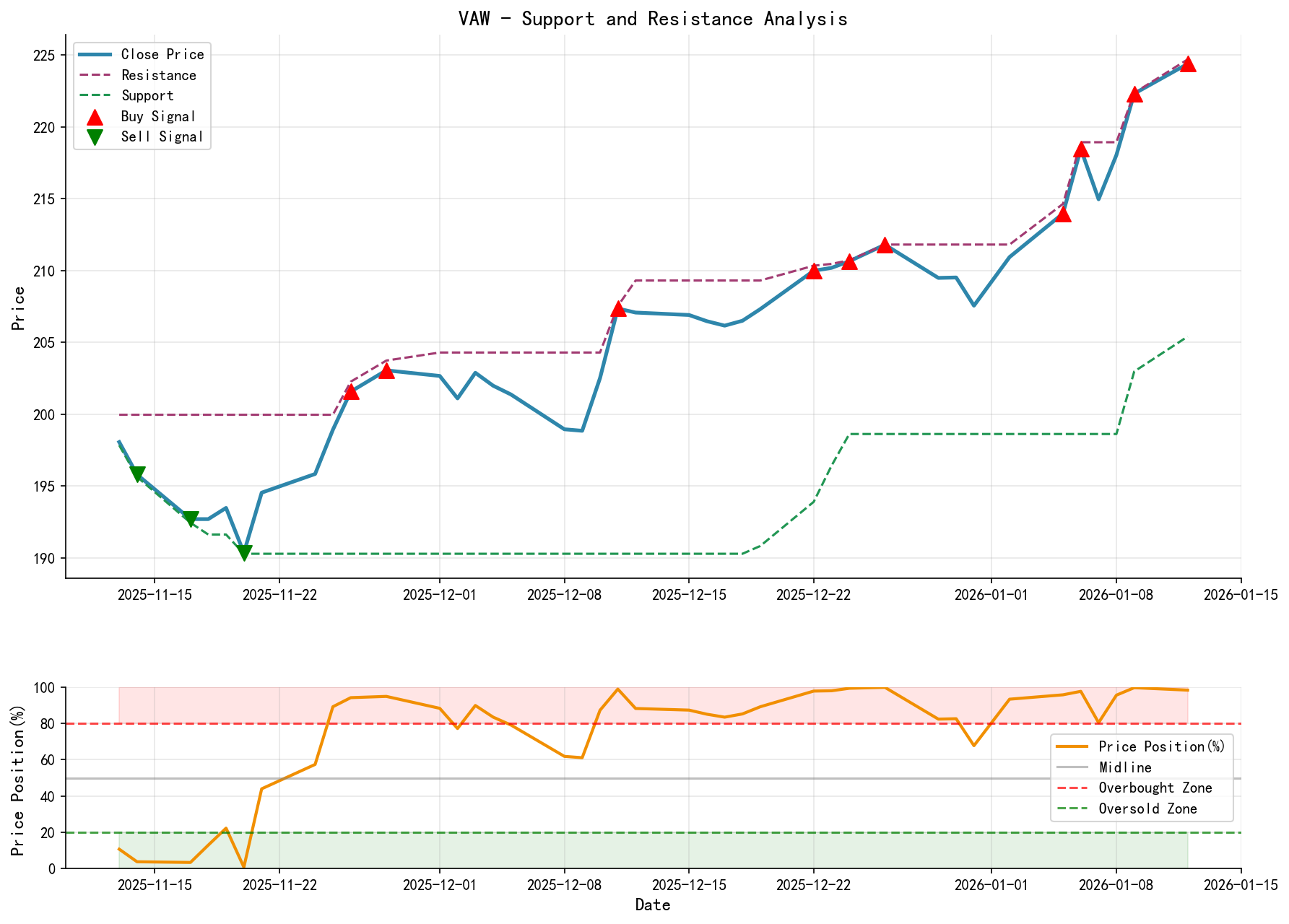

VI. Support/Resistance Level Analysis and Trading Signals

- 1. Key Price Levels:

- • Immediate Resistance: As the price has made new historical highs, there is no clear technical resistance above. Psychological resistance levels can be watched at round numbers like 225.00 and 230.00.

- • Key Support:

- • First Support Zone (Strong Correction): 218.00 - 220.00 area. This is the first platform following the recent breakout and the volume concentration area from Jan 8-9. If the price can find support above this zone, the uptrend remains intact.

- • Second Support Zone (Trend Lifeline): 215.00 - 217.00 area. This zone encompasses the MA_5D (217.54) and the breakout starting point from Jan 5-7. A break below this zone would signal exhaustion of short-term upward momentum, potentially shifting the trend to sideways.

- • Third Support Zone (Bull-Bear Divide): 210.00 - 212.00 area. This area clusters the MA_20D (210.78) and the December high platform. A decline to this zone would pose a severe test to the current uptrend.

- 2. Comprehensive Trading Signals and Operational Suggestions:

- • Wyckoff Event Signal: The market has exhibited a "price rise with increasing volume after breaking out of the accumulation range" (Jump Across the Creek, JAC), which is a strong bullish signal.

- • Operational Direction: Overall bullish. However, given the RSI entering overbought territory and the substantial recent gains, chasing the rally is not advisable.

- • Specific Suggestions:

- • Potential Entry Point 1 (Aggressive): Wait for the price to pull back on low volume to the First Support Zone (218-220) and show signs of stabilization (e.g., small-bodied candlesticks, long lower shadows), then consider establishing long positions in batches.

- • Potential Entry Point 2 (Conservative): Wait for the price to correct to the Second Support Zone (215-217) and find volume-price support (e.g., low-volume stabilization followed by a volume-backed bounce) before entering.

- • Stop-Loss Level: Initial stop-loss can be set about 1.5%-2% below the entry price, or placed below the Key Support Zone (215.00). If the price decisively breaks below 215.00, consider exiting to observe and re-evaluate the trend.

- • Target Outlook: Short-term targets can be viewed towards the 230.00 area. The medium-term trend points higher, but targets should be adjusted progressively based on subsequent volume-price action.

- • Future Validation Points:

- 1. Healthy Pullback Validation: Do subsequent pullbacks exhibit the characteristic of "price decline with contracting volume"? If yes, it confirms weak supply and strengthens the bullish view.

- 2. Demand Sustainability Validation: When the price makes new highs or during rebounds, can volume remain active or continue to expand? Sustained high-volume advances are core evidence of a healthy trend.

- 3. Risk Warning Signals: Closely monitor for the appearance of single-day or consecutive high-volume stalling or declines, especially after making new highs. This could be an early signal of smart money beginning distribution, constituting a warning for potential trend reversal. The high-volume advance on Jan 12 currently appears healthy, but subsequent price action needs tracking.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding its accuracy or completeness. The market involves risks; investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Daily Wyckoff volume-price market interpretations are released punctually at 8:00 AM before the market opens. We kindly ask for your comments and shares; your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: