Understood. As a quantitative trading researcher proficient in the Wyckoff Method, I will compose a comprehensive, in-depth quantitative analysis report based on the provided TRUMPUSDT data and historical rankings.

TRUMPUSDT Quantitative Analysis Report (Wyckoff Perspective)

Product Code: TRUMPUSDT

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

Executive Summary

Based on a comprehensive analysis of TRUMPUSDT data from the past two months (2025-11-13 to 2026-01-12), integrating Wyckoff principles of price-volume analysis and historical ranking data, the key conclusions are as follows:

- • Market Phase Transition: The market has transitioned from the Panic Decline and Accumulation phase (Nov-Dec 2025) to the Markup phase in early January 2026.

- • Shift in Supply and Demand Dynamics: In late December 2025, when the price hit a new low (4.801), both trading volume and volatility reached historical extremes, indicating exhausted supply. In early January 2026, the price rebounded strongly on massive volume, clearly signaling demand dominance.

- • Large Investor Behavior: Data indicates that large investors (smart money) systematically accumulated positions at the lows in late December 2025. Their behavior during the early January markup has been to "push the price higher to test supply pressure at elevated levels", preparing for potential subsequent actions (e.g., distribution).

- • Key Levels: The 4.80-4.90 zone serves as the recent key support (bottom of the accumulation zone), while the 5.60-5.70 zone is a prior breakdown level and current strong resistance.

- • Composite Signal: Short-term momentum is bullish, and the market structure has shifted from bearish to bullish. The market is currently in a technical correction following the markup; as long as key support holds, this is viewed as a continuation pattern within the uptrend. Operationally, it is advisable to seek buying opportunities on pullbacks to support zones while closely monitoring price-volume behavior near resistance areas.

Below is the detailed data analysis and reasoning across various dimensions.

1. Trend Analysis & Market Phase Identification

As of 2026-01-12, for the instrument TRUMPUSDT: Opening Price 5.45, Closing Price 5.38, 5-Day Moving Average (MA) 5.40, 10-Day MA 5.38, 20-Day MA 5.14, Daily Change -1.28%, Weekly Change -4.27%, Monthly Change +12.04%, Quarterly Change +12.04%, Year-to-Date Change +12.04%

- • Price-Moving Average Relationship:

- • Decline Phase (2025-11-13 ~ 2025-12-31): Price consistently traded below all moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), exhibiting a standard bearish alignment. The MAs were arranged in descending order (MA_5D < MA_10D < MA_20D < MA_30D < MA_60D), indicating a strong downtrend.

- • Trend Reversal Point (Starting 2026-01-01): Price began a continuous rise from 2026-01-01 (close at 4.891) and successfully broke above all short-term moving averages (MA_5D, MA_10D, MA_20D) on 2026-01-05. As of 2026-01-12, the price (5.379) remains above MA_5D (5.403), MA_10D (5.385), and MA_20D (5.145), but below MA_30D (5.165) and MA_60D (5.711). This indicates that the short-term trend has turned from bearish to bullish, while medium-term (30/60-day) resistance remains. The market is in the initial markup phase following an oversold rebound.

- • Market Phase Inference (Wyckoff Theory):

- • Nov-Dec 2025: Panic Decline and Accumulation

- • Observation: Price declined persistently from 7.247 to 4.801 (-33.7%), with several high-volume down days (e.g., 2025-11-21, -5.88%; 2025-12-01, -4.63%), indicating panic selling (supply dominance).

- • Key Signal: Around the time the price touched its lowest point of 4.801 (2025-12-31), volume shrank dramatically (e.g., 2025-12-30, volume 714k, hitting a recent low), and both historical and intraday volatility dropped to their lowest levels in nearly a decade (see historical rankings: HIS_VOLA_14D, PARKINSON_VOL_14D, etc., all ranked in the top 5 lowest). This aligns with the Wyckoff characteristics of "automatic rally after panic selling" and "low volatility and volume in the accumulation zone", suggesting exhaustion of supply and accumulation by large players.

- • Early January 2026 to Present: Markup

- • Observation: Price rallied sharply on consecutive large bullish candles, from 4.801 to a high of 5.619 (+17.0%), accompanied by a massive surge in volume (e.g., 2026-01-03, volume 8.676 million, a recent peak). This is a clear signal of strong demand entering.

- • Current Status: On 2026-01-12, the price experienced a minor correction (-1.28%) with volume (1.897 million) below the recent peak but still above the 60-day average volume (2.777 million). This can be viewed as a healthy correction after a rapid advance or a test of prior resistance. As long as the correction does not breach key support, the markup structure remains intact.

- • Nov-Dec 2025: Panic Decline and Accumulation

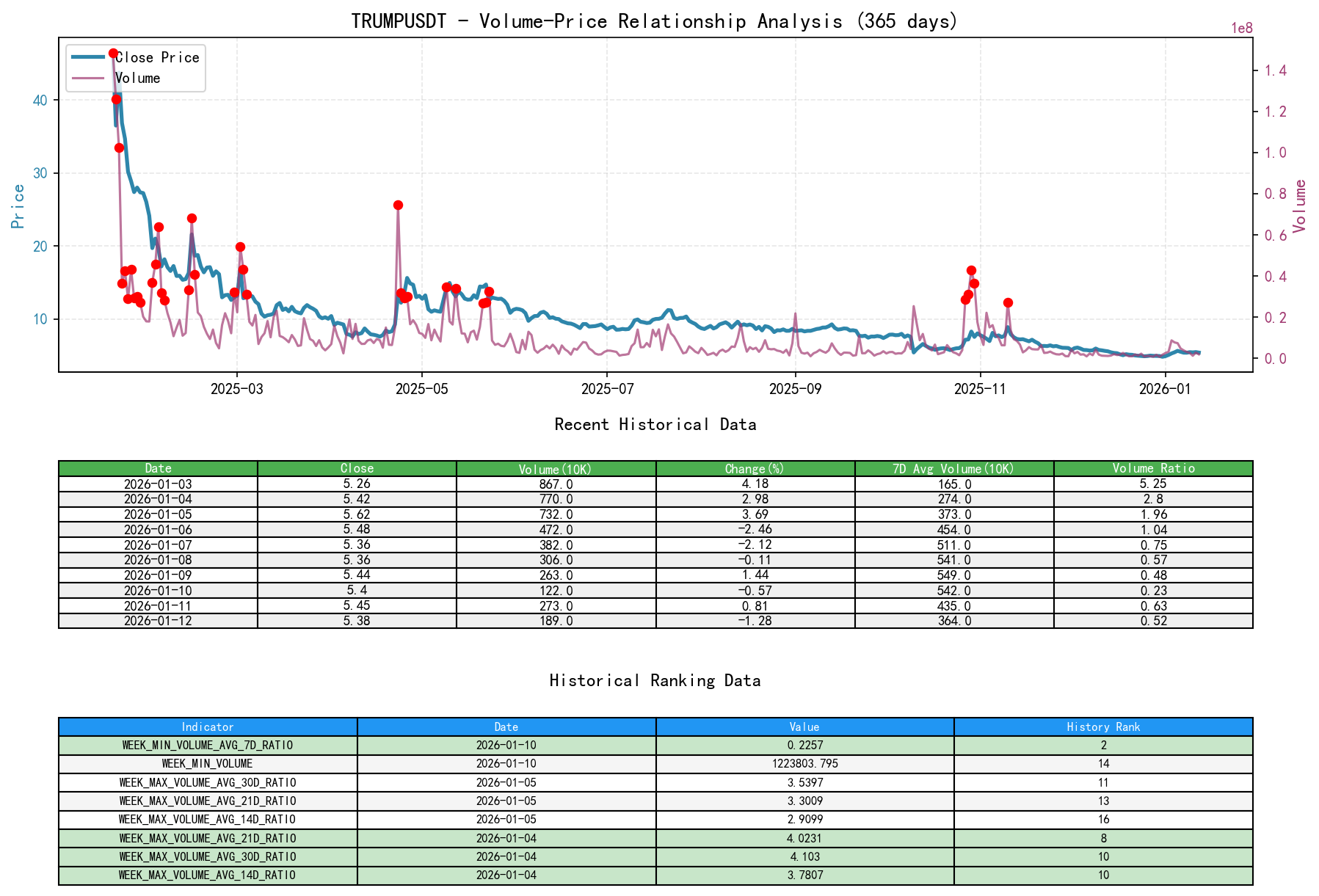

2. Volume-Price Relationship & Supply-Demand Dynamics

As of 2026-01-12, for the instrument TRUMPUSDT: Opening Price 5.45, Closing Price 5.38, Volume 1,897,377.82, Daily Change -1.28%, Volume 1,897,377.82, 7-Day Average Volume 3,647,652.20, 7-Day Volume Ratio 0.52

- • Key Day Analysis:

- 1. Panic Selling Day (2025-12-01): Price fell -4.63% on a volume of 4.195 million, a massive increase of 326.87% from the previous day (this increase ranks 8th in nearly a decade). This is classic panic selling. However, note that the closing price (5.724) was higher than the low (5.608), leaving a long lower shadow, hinting at buying interest near the lows.

- 2. Demand-Dominated Launch Day (2026-01-03): Price surged +4.18% on a volume of 8.676 million, the absolute recent peak volume. The volume/14-day average volume ratio was as high as 5.8375 (ranking 4th in nearly a decade), and the volume/21-day average volume ratio was 5.5820 (ranking 3rd). This is an extremely strong signal of demand influx, confirming the initiation of the markup phase.

- 3. Supply Test Day (2026-01-06): Price corrected -2.46% on a volume of 4.723 million, still significantly above average (volume/7-day average ratio 1.039). This is the first notable correction during the markup, which can be seen as a test of conviction among recent buyers and the release of floating supply.

- 4. Low-Volume Correction Days (2026-01-10, 2026-01-12): Price experienced two consecutive days of minor declines, with volume shrinking to 1.224 million and 1.897 million respectively. The volume/7-day average ratios dropped to 0.23 and 0.52. This is a "low-volume pullback", indicating limited supply pressure and weak selling interest, which is conducive to trend continuation.

- • Supply-Demand Conclusion: In late December 2025, supply was exhausted during the panic. In early January 2026, massive demand entered and completely dominated the market. The current pullback exhibits low-volume characteristics, suggesting effective washing out of weak hands. The supply-demand balance remains demand-dominated.

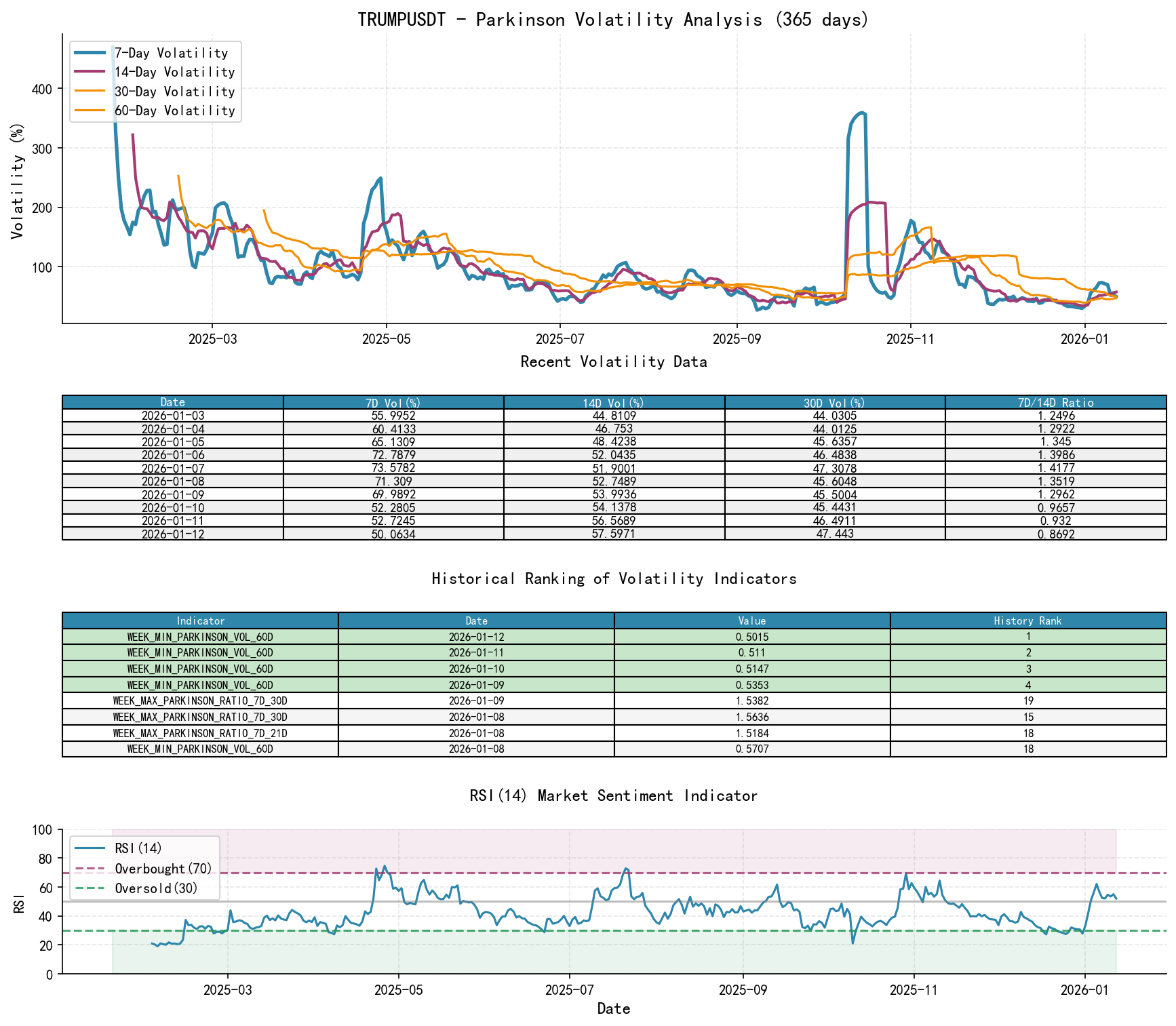

3. Volatility & Market Sentiment

As of 2026-01-12, for the instrument TRUMPUSDT: Opening Price 5.45, 7-Day Intraday Volatility 0.50, 7-Day Intraday Volatility Ratio 0.87, 7-Day Historical Volatility 0.28, 7-Day Historical Volatility Ratio 0.64, RSI 52.04

- • Volatility Level & Changes:

- • Sentiment Freeze (Late Dec 2025): Historical volatility (HIS_VOLA) and Parkinson intraday volatility across various periods dropped to historical extremes. For example,

MIN_HIS_VOLA_14D(0.2599) andMIN_PARKINSON_VOL_14D(0.3454) both reached new lows in nearly a decade. This reflects extreme market pessimism and inactivity, a classic end-of-trend characteristic. - • Sentiment Activation & Short-Term Overheating (Early Jan 2026): As the price rose, short-term volatility spiked rapidly. Key indicators:

WEEK_MAX_PARKINSON_RATIO_7D_30D(1.5659, ranking 14th in nearly a decade) andWEEK_MAX_PARKINSON_RATIO_7D_60D(1.2494, value extremely high though not top 20). This indicates that 7-day volatility far exceeded 30-day and 60-day volatility, meaning market sentiment was rapidly activated and may have become short-term overheated. - • Current Status: As of 2026-01-12, volatility ratios have moderated (e.g.,

PARKINSON_RATIO_7D_30D=1.055) but remain above 1, showing market activity is still above long-term norms, with sentiment in a post-excitement adjustment period.

- • Sentiment Freeze (Late Dec 2025): Historical volatility (HIS_VOLA) and Parkinson intraday volatility across various periods dropped to historical extremes. For example,

- • RSI Overbought/Oversold Validation:

- • At low points on dates like 2025-12-18/24/25/31,

RSI_14dipped into the 27.29-28.30 range (ranking 14th-20th lowest in nearly a decade), confirming the market was in a severely oversold state. - • At the rebound high on 2026-01-05,

RSI_14reached 62.10 (ranking 15th highest), entering the strong zone but not extreme overbought (>70), leaving room for further advance. - • Currently (2026-01-12),

RSI_14is at 52.04, in a neutral-to-strong and healthy position.

- • At low points on dates like 2025-12-18/24/25/31,

4. Relative Strength & Momentum Performance

- • Return Analysis:

- • Long-Term Weakness:

QTD_RETURN(quarter-to-date) andMTD_RETURN(month-to-date, referencing December) were deeply negative (-20% to -35%) at the start of the analysis period, indicating a strong, persistent downtrend. - • Strong Momentum Reversal: January 2026 was the key turning month.

MTD_RETURN(month-to-date, referencing January) rose rapidly from +1.87% on Jan 1st to +17.04% on Jan 5th, currently (Jan 12th) at +12.04%. AlthoughWTD_RETURN(week-to-date) turned negative due to weekend correction (-4.27%), the weekly momentum burst in early January was extremely powerful.

- • Long-Term Weakness:

- • Momentum Conclusion: Short-term (monthly, weekly) momentum has achieved a V-shaped reversal from negative to positive, with considerable strength. This provides momentum-level validation for the price transition from "Accumulation" to "Markup".

5. Large Investor (Smart Money) Behavior Identification

Based on cross-validation of the above four dimensions, the inferred intent of large investors is as follows:

- 1. Accumulation Behavior: Occurred in mid-to-late December 2025. Evidence chain:

- • Price Location: Price declined persistently into a historical low range.

- • Volume-Price Action: On the day of the new low (4.801, 2025-12-31) and surrounding days, volume was extremely low (

WEEK_MIN_VOLUMEranked in top 10 lowest), indicating public selling interest had dried up. - • Volatility: Market volatility hit historical lows, allowing smart money to build positions calmly in a low-volatility, low-attention environment.

- • Historical Ranking Corroboration: Multiple average volume (7D, 14D, 21D, 30D, 60D) and volatility indicators hit near-decade lows in late December. This environment is typical for stealthy accumulation by large capital.

- 2. Markup & Testing Behavior: Occurred in early January 2026. Evidence chain:

- • Launch Signal: On January 3rd, a high-volume bullish candle (volume ratio ranked 3rd-5th in nearly a decade) appeared. This is not retail behavior but a clear signal of smart money concentrating force to propel the price away from the cost zone.

- • Purpose Inference: The rapid markup served two purposes: first, to move away from the accumulation zone and prevent cheap筹码 from being acquired by others; second, to test supply pressure at higher levels. The corrections on January 6th and recent days can be viewed as smart money observing whether significant selling pressure (supply) exists in the market near key resistance (e.g., 5.60-5.70).

- • Current Intent: After successfully driving a markup wave, smart money is likely currently in a phase of "observing test results" and "guiding market sentiment". The low-volume correction indicates they are not distributing heavily at these levels but are managing the pullback to maintain market interest.

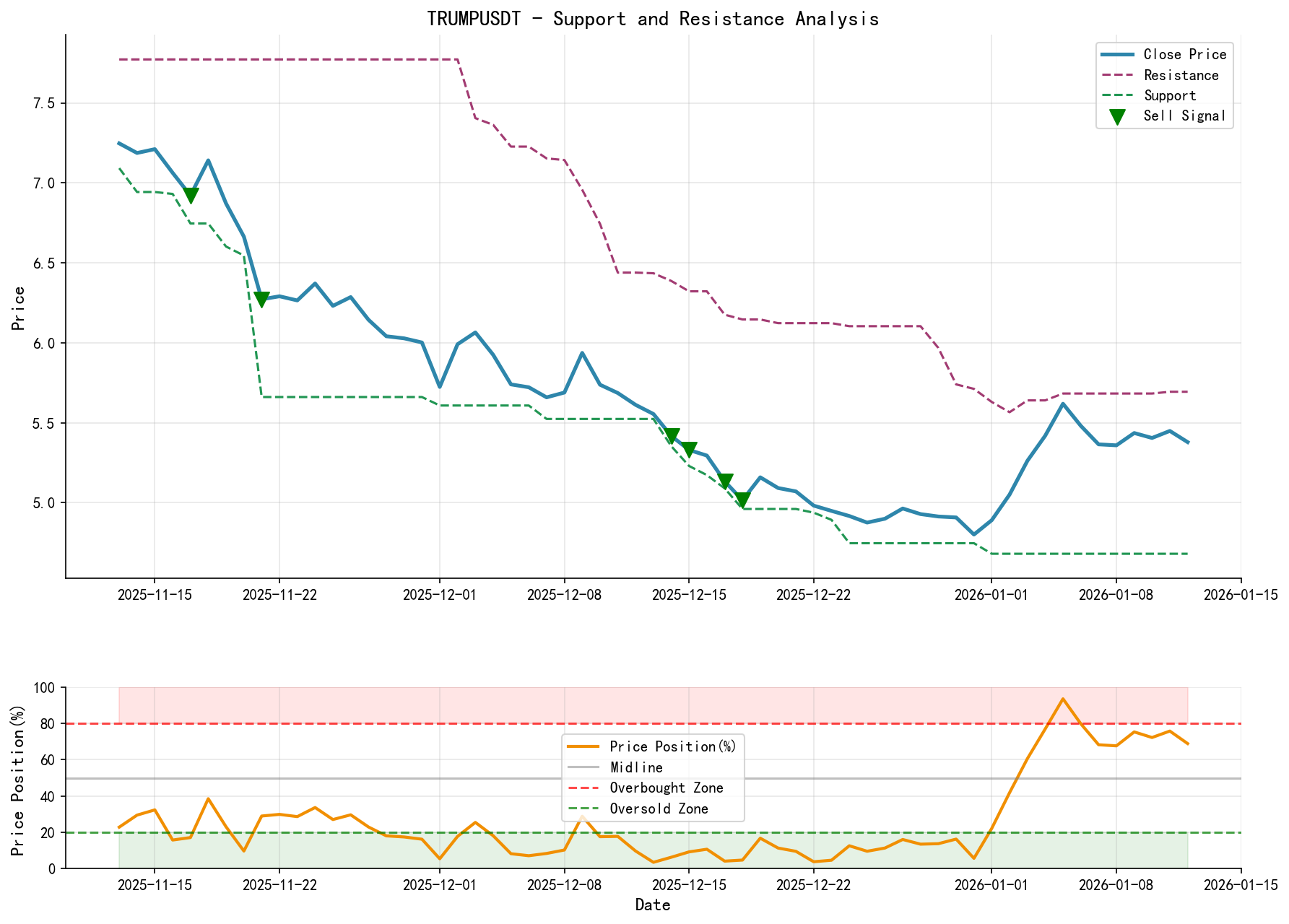

6. Support/Resistance Analysis & Trading Signals

- • Key Support Levels:

- • S1 (Strong Support): 4.80 - 4.90 zone. This is the bottom of the accumulation range formed in late December 2025 and the location of the recent low. A breakdown below this zone would imply accumulation failure and damage the markup structure.

- • S2 (Dynamic Support): 5.15 - 5.20 zone. This area coincides with the current MA_20D (5.145) and the lower boundary of the recent consolidation platform, serving as the first significant pullback support for the uptrend.

- • Key Resistance Levels:

- • R1 (Near-Term Resistance): 5.60 - 5.70 zone. This area marks the January 5th high (5.619) and a prior consolidation platform from late November 2025, acting as the first major resistance for the uptrend.

- • R2 (Medium-Term Resistance): ~6.00 psychological level and vicinity of MA_60D (5.711). The 60-day moving average is a watershed for medium-term trend strength.

- • Composite Wyckoff Trading Signals:

- • Overall View: Bullish, but not blindly chasing highs. The market has completed "Accumulation" and entered the "Markup" phase, with smart money driving the current move.

- • Specific Operational Recommendations:

- 1. Long Strategy (Preferred): Await a price pullback to the S2 (5.15-5.20) or S1 (4.80-4.90) support zones. Watch for the emergence of Wyckoff buy signals such as "low-volume selling climax" or "high-volume rebound" (e.g., Spring or Jump Across the Creek). If these appear, consider them buying opportunities.

- • Reference Entry Levels: 5.20-5.25 (light position test) or 4.90-5.00 (adding).

- • Stop-Loss Placement: Below the corresponding support zone (e.g., below 5.10 or below 4.80).

- • Initial Target: R1 (5.60-5.70).

- 2. Short Strategy (Avoid): As long as the current markup structure remains intact, counter-trend shorting is not recommended. Only if the price rallies to the R1 or R2 zones and shows clear supply-dominant signals such as "high-volume stalling" or "rejection with long upper shadows" should short-term counter-trend plays be considered.

- 1. Long Strategy (Preferred): Await a price pullback to the S2 (5.15-5.20) or S1 (4.80-4.90) support zones. Watch for the emergence of Wyckoff buy signals such as "low-volume selling climax" or "high-volume rebound" (e.g., Spring or Jump Across the Creek). If these appear, consider them buying opportunities.

- • Future Validation Points:

- 1. Uptrend Confirmation: A decisive, high-volume breakout above R1 (5.70), with price sustained above the MA_60D, would confirm the start of a medium-term uptrend, opening targets above 6.00.

- 2. Trend Failure Risk: If the price breaks below S1 (4.80) on high volume, it suggests this rebound might be a "secondary distribution" or "failed accumulation", necessitating an immediate shift to a bearish bias.

- 3. Smart Money Distribution Warning: In the future, if the price rises to higher levels (e.g., 6.00+), and shows consecutive days of high volume with price stalling or even declining slightly, be highly alert to large investors beginning "Distribution". At that time, indicators like

VOLUME_AVG_RATIOandHIS_VOLA_RATIOare expected to again show extreme high rankings.

Disclaimer: All conclusions in this report are derived based on the provided historical data and quantitative models and do not constitute any investment advice. Markets involve risks; investment requires caution.

Thank you for your attention! Daily Wyckoff price-volume analysis is published promptly at 8:00 AM before market open. Your comments and shares are sincerely appreciated, as your recognition is crucial. Let us work together to see the market signals clearly.

Member discussion: