As a quantitative trading researcher well-versed in the Wyckoff Method, I will compose a comprehensive, in-depth quantitative analysis report for the provided TONUSDT data, strictly derived from the data.

TONUSDT Wyckoff Quantitative Analysis Report

Product Code: TONUSDT

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

I. Trend Analysis and Market Phase Identification

As of 2026-01-12, the subject TONUSDT had an open price of 1.75, a close price of 1.74, a 5-day moving average of 1.79, a 10-day moving average of 1.83, a 20-day moving average of 1.71, a daily change of -0.57%, a weekly change of -8.18%, a monthly change of 4.88%, a quarterly change of 4.88%, and a yearly change of 4.88%.

- 1. Moving Average Alignment and Trend Structure:

- • Long-term Trend (Bearish): The current price (1.740) remains significantly below the MA_60D (1.64045) and MA_30D (1.6385), and all long-term moving averages (MA_60D, MA_30D, MA_20D) exhibit a clear downward trajectory, confirming the market is in a long-term downtrend.

- • Mid-term Trend (Retracement after Rebound): After hitting a low of 1.437 in mid-to-late December 2025, the price initiated a rebound. The MA_5D and MA_10D once crossed above the MA_20D, forming a short-term bullish alignment. However, recently (since 2026-01-09), the price has retreated. The MA_5D (1.7936) has turned downward and is about to cross below the MA_20D (1.7067), signaling the entry of this rebound into a corrective phase.

- • Key Signal: The potential "death cross" between MA_5D and MA_20D (MA_CROSS_5_20 signal turning negative) quantifies the exhaustion of short-term momentum.

- 2. Market Phase Inference (Based on Wyckoff Cycle):

- • Previous Phase (Nov-Dec 2025): Price continuously declined from 2.010 to 1.437, accompanied by multiple episodes of panic selling (e.g., 2025-11-20, with a single-day drop of -9.49% and a volume surge of 43%). This aligns with the characteristics of the Wyckoff "decline-panic" phase.

- • Current Phase (Late Dec 2025 - Present): Following the panic low (1.437), the market experienced an Automatic Rally (AR), reaching a high of 1.950 (2026-01-06). Subsequently, the price showed signs of distribution (e.g., on 2026-01-02, volume surged 220% but price gains narrowed) near the 1.9 level and has since been oscillating and retreating within the 1.85-1.74 range with shrinking volume. This presents early features typical of a Secondary Test (ST) and accumulation range oscillation. The market may be transitioning from the "panic" phase to an "accumulation" phase, but the quality of support at the test low (1.705) needs observation.

Summary: The long-term bearish market structure remains unchanged. The short-term is in a retracement/consolidation phase following the rebound. The price is testing the support zone formed during the recent rebound, potentially constructing a nascent accumulation structure. The impending cross of MA_5D below MA_20D is a key signal of short-term weakness.

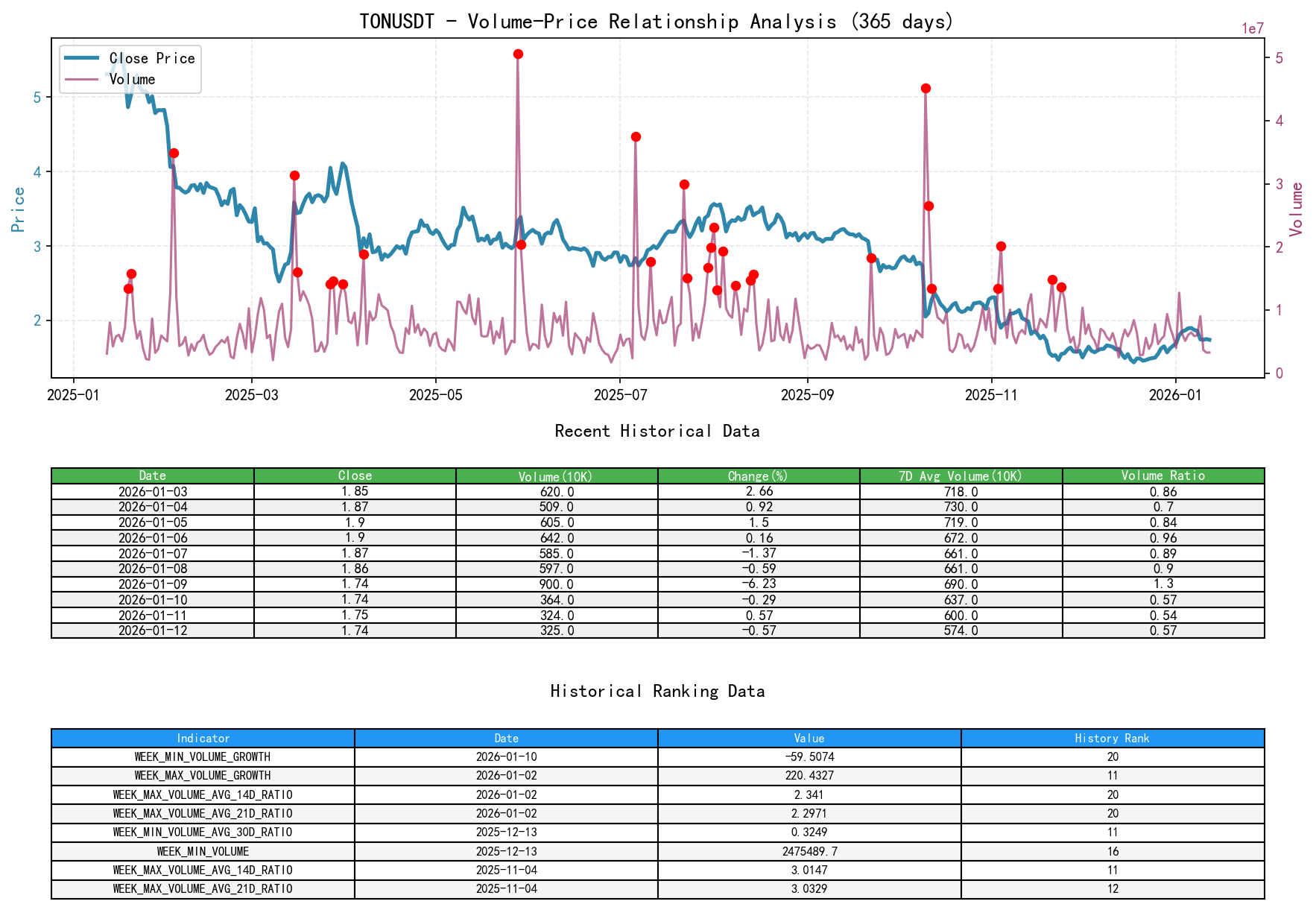

II. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-12, the subject TONUSDT had an open price of 1.75, a close price of 1.74, a volume of 3256984.04, a daily change of -0.57%, a volume of 3256984.04, a 7-day average volume of 5744296.24, and a 7-day volume ratio of 0.57.

- 1. Key Day Volume-Price Analysis:

- • Panic Selling (Supply Climax): On 2025-11-20, price plummeted -9.49% with significantly amplified volume (VOLUME_AVG_14D_RATIO=1.36). The next day (2025-11-21), the decline narrowed to -2.56%, but volume reached a higher peak (VOLUME_AVG_14D_RATIO=1.87, one of the highest levels in nearly a decade), forming a "high-volume price stabilization on decline," suggesting panic selling was absorbed in large quantities, indicating initial signs of supply exhaustion.

- • Demand-Driven Rally: On 2026-01-02, price surged 6.38% with a volume explosion of 220.43% (VOLUME_AVG_14D_RATIO=2.34), ranking this volume surge as the 11th highest in nearly a decade. This is a clear signal of substantial demand entry, driving the main upward phase of this rebound.

- • Re-emergence of Supply and Lackluster Demand:

- • On 2026-01-09, price fell sharply -6.23% with volume increasing 50.58% (VOLUME_AVG_7D_RATIO=1.30), constituting a high-volume decline, indicating supply re-emerged at the rebound highs.

- • Recently (2026-01-10 to 12), price experienced minor declines on diminishing volume, with volume quickly shrinking below its average (VOLUME_AVG_7D_RATIO dropped to around 0.57), presenting a low-volume decline. This indicates active selling pressure (supply) has weakened, but demand is also not actively buying at this price level, suggesting the market has entered a wait-and-see mode.

- 2. Volume Energy Analysis:

- • On-Balance Volume (OBV) Equivalent Inference: Integrating volume and price, around the 1.437 low and the initial stages of the subsequent rebound (late Dec 2025 to 2026-01-02), the alignment of rising price and increasing volume was favorable, with demand in control. However, since price approached 1.90, divergences such as "rising price on shrinking volume" or "falling price on increasing volume" appeared, indicating insufficient follow-through demand and increased supply resistance.

- • Current State: Both VOLUME_AVG_7D_RATIO (0.567) and VOLUME_AVG_14D_RATIO (0.503) are below 1, indicating subdued trading activity and a state of low-volume consolidation with weak supply-demand balance.

Summary: The volume-price relationship clearly reveals the evolution of market sentiment: panic selling -> strong demand absorption and counterattack -> encountering supply resistance at highs -> current low-volume retracement. The recent low-volume decline signals diminished selling pressure but also highlights the temporary absence of demand.

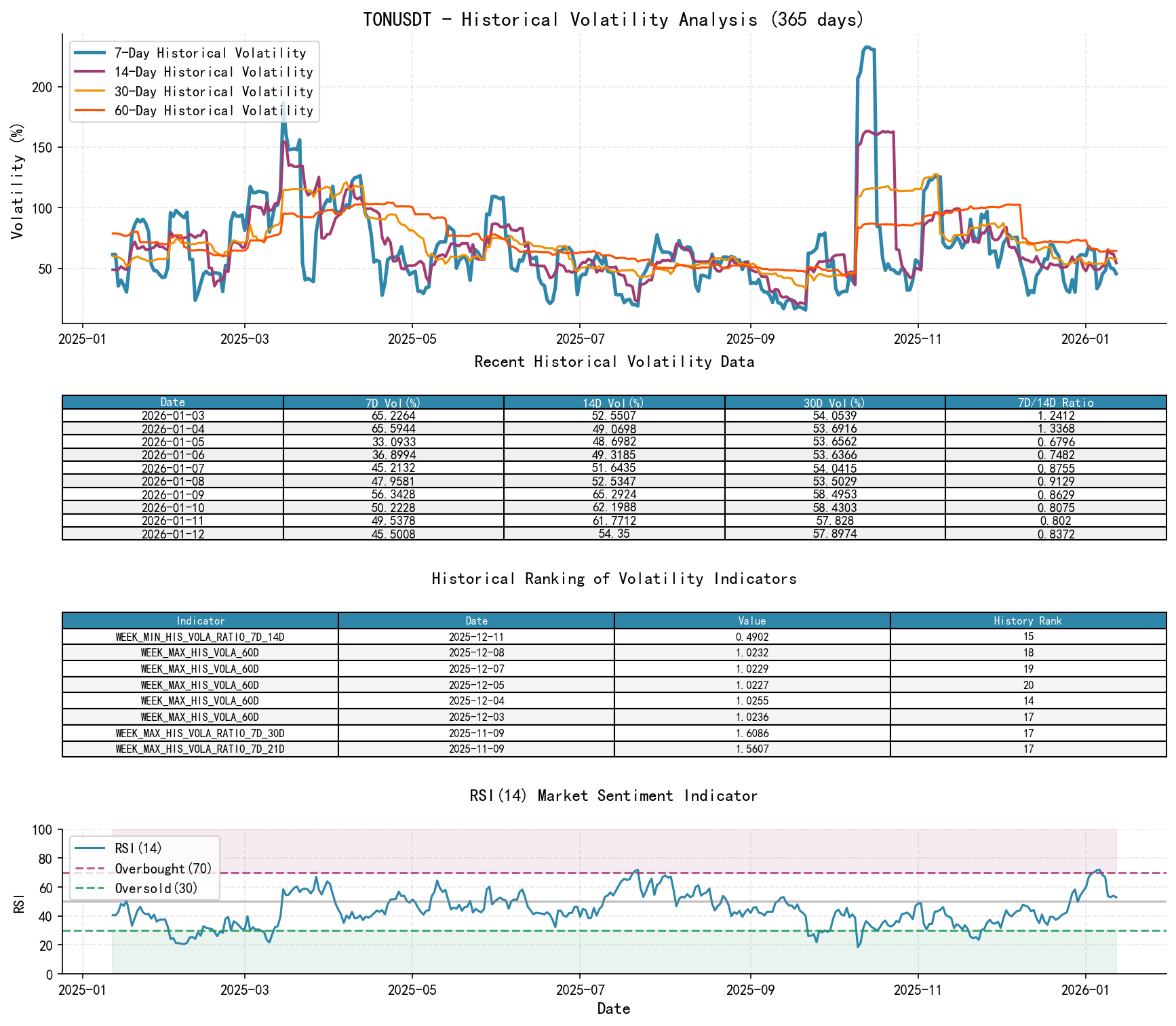

III. Volatility and Market Sentiment

As of 2026-01-12, the subject TONUSDT had an open price of 1.75, a 7-day intraday volatility of 0.53, a 7-day intraday volatility ratio of 0.86, a 7-day historical volatility of 0.46, a 7-day historical volatility ratio of 0.84, and an RSI of 52.94.

- 1. Volatility Level and Changes:

- • Historical Extreme Volatility Period: From late November to early December 2025, PARKINSON_VOL_60D repeatedly reached historically extreme highs (e.g., 1.0389 on 2025-12-08 was the highest in nearly a decade). This corresponds to the market's period of panic decline and violent oscillation.

- • Volatility Contraction: Recently, both short-term (7D) values for historical volatility (HIS_VOLA) and intraday volatility (PARKINSON_VOL) are significantly lower than their long-term (60D) values. For instance, PARKINSON_RATIO_7D_60D is 0.819, and HIS_VOLA_RATIO_7D_60D is 0.709. This indicates market volatility has contracted substantially from extreme highs, entering a relatively calm consolidation period.

- 2. Market Sentiment (RSI):

- • Overbought and Retracement: RSI_14 peaked at 71.85 on 2026-01-06, ranking as the 4th highest in nearly a decade, confirming the short-term rebound had entered an overbought state. Subsequently, RSI retreated and currently stands at 52.94, in the neutral-to-weak zone.

- • Sentiment Shift: The RSI's decline from the overbought zone to neutral, coupled with the price retracement, completes the cooling process after overheated sentiment. This sets the stage for the market to accumulate new upward momentum at key support levels.

Summary: The market has moved past the high-volatility panic period and is currently in a low-volatility sentiment consolidation stage. The RSI's retreat from extreme overbought to neutral levels indicates short-term speculative overheating has been released.

IV. Relative Strength and Momentum Performance

- 1. Momentum Cycle Analysis:

- • Short-term Momentum (Weak): WTD_RETURN (-8.18%) is significantly negative, confirming a retracement pattern this week.

- • Mid-term Momentum (Still Supported Post-Rebound): MTD_RETURN (4.88%) and QTD_RETURN (4.88%), although not high, remain positive, indicating that from a mid-term (monthly, quarterly) perspective, the rebound effect since December has not been completely erased.

- • Long-term Momentum (Absolute Weakness): YTD (4.88%) resets due to the new year, but TTM_12 (-67.21%) reveals the asset's extreme weakness over a longer cycle.

- 2. Momentum, Trend, and Volume-Price Synergy:

- • Short-term negative momentum (WTD) aligns with price falling below short-term moving averages and shrinking volume.

- • Mid-term positive momentum (MTD/QTD) corresponds to the initial rebound wave from the 1.437 low, which is currently being tested by the retracement.

Summary: The momentum structure presents a pattern of "short-term weakness, mid-term rebound under test." The market needs to hold key recent support to prevent the mid-term rebound's momentum structure from being completely broken.

V. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff principles and the aforementioned data analysis, inferences regarding large investor behavior are as follows:

- 1. Accumulation During the Panic Phase: During the panic-driven high-volume declines in late November 2025 (especially the massive volume on Nov 21), it is highly likely that large capital was absorbing panic selling. This is typical "smart money accumulation post-panic" behavior.

- 2. Leading the Rally: The massive bullish candlestick on 2026-01-02, with volume ranking among the highest historically, could not have been achieved by retail activity alone. This indicates large investors concentrated their efforts to lead this rebound, aiming to quickly move away from their cost zone and test overhead supply.

- 3. Distribution and Observation at Highs: As price approached the 1.90-1.95 zone, signs of distribution on high volume (Jan 3-5) and the subsequent high-volume decline (Jan 9) emerged. This suggests some early-entering smart money may have distributed or reduced positions in this area, exchanging chips with demand chasing the highs.

- 4. Current Behavior (Testing and Gathering): During the price's low-volume retracement to around 1.74, volume has become extremely thin. Large investors are likely observing and testing the market's natural support, checking whether there is sufficient natural demand (or the degree of weak-holding liquidation) between the panic low (1.437) and the rebound starting point (e.g., the 1.70 area) to support the next move. They may be awaiting a "successful low-volume test" signal for potential secondary accumulation.

Summary: The trajectory of smart money behavior is clear: accumulation during panic -> active leadership of the rebound -> partial distribution at resistance -> current entry into a low-volume testing and observation phase. Their subsequent actions will depend on the outcome of testing key support levels.

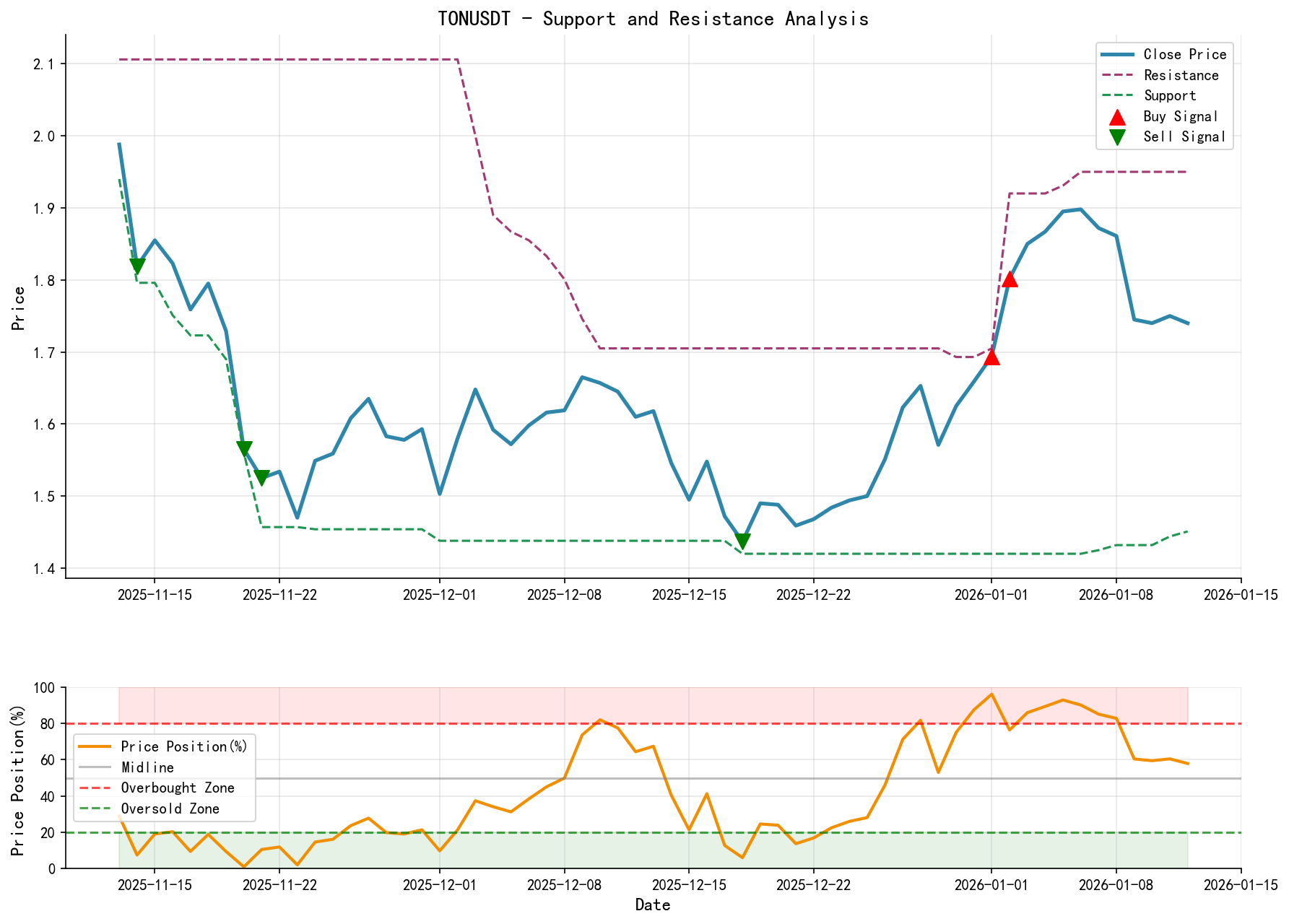

VI. Support/Resistance Level Analysis and Trading Signals

- 1. Key Price Levels:

- • Strong Support:

- • S1: 1.705 - 1.680 (Recent retracement low and the upper boundary of the late Dec 2025 consolidation platform). This is the lifeline for maintaining the short-term rebound structure.

- • S2: 1.437 (Historical panic low, ultimate support).

- • Strong Resistance:

- • R1: 1.850 - 1.870 (Recent post-rebound supply zone, also where the MA_20D currently resides).

- • R2: 1.920 - 1.950 (Peak of this rebound wave, also a previous high-volume transaction area, a heavy supply zone).

- • Strong Support:

- 2. Integrated Wyckoff Events and Trading Signals:

- • Current Event Assessment: The market is likely in the process of a Secondary Test (ST) following the Automatic Rally (AR). The test target is the 1.705-1.680 zone. An ideal bullish scenario would be: price tests this zone with extremely low volume (indicating supply exhaustion), followed by a high-volume upward "jump" behavior (Spring or Jump Across the Creek).

- • Trading Signals and Suggestions:

- • Primary View: Cautious observation, awaiting completion signals for the test. Prior to clear signals, the market bias is towards consolidation.

- • Bullish Scenario (Requires Validation): If price finds support in the 1.705-1.680 zone and presents a composite signal of "low-volume price stabilization + high-volume bullish candlestick reclaiming 1.780", it could be considered a successful Secondary Test, indicating potential smart money re-entry. This represents a potential long entry opportunity, with an initial stop-loss set below 1.670.

- • Bearish Scenario (Requires Validation): If price breaks below 1.680 on high volume, it would signify a failed Secondary Test and a broken rebound structure, potentially leading to a deeper support test. The subsequent bounce would then become a new shorting opportunity (retracement towards 1.750), targeting below 1.550.

- • Observation Zone: Between 1.720 - 1.850, lacking clear Wyckoff event guidance, observation is advised.

- 3. Future Validation Points:

- • Confirming Bullish Judgment: ① Price stabilizes with low volume in the support zone. ② Appearance of a bullish candlestick with a single-day gain > 3% and VOLUME_AVG_7D_RATIO > 1.5. ③ Price closes and stabilizes above 1.850.

- • Confirming Bearish Judgment: ① Price closes below 1.680. ② Upon a bounce to the 1.80-1.85 zone, signs of high-volume price stalling or long upper shadows reappear.

Final Conclusion: TONUSDT experienced a technical rebound led by smart money in December 2025 following a prolonged decline and panic selling. This rebound has now entered a retracement testing phase post-distribution at highs. The market is at a critical decision point. Its next directional move will depend on the outcome of testing the 1.705-1.680 support band. Traders should exercise patience, waiting for the market itself to provide clear supply-demand victory signals through volume-price action. The current strategy should prioritize defense and observation, preparing for the impending directional breakout.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality in the content but makes no guarantees regarding its accuracy or completeness. The market carries risks; investment requires caution. Any investment actions based on this report are undertaken at your own risk.

Thank you for your attention! Daily Wyckoff volume-price market interpretations are released promptly before the 8:00 AM market open. Your comments and shares are greatly appreciated. Your recognition is crucial. Let us work together to see the market signals.

Member discussion: