As requested. Here is the professional English translation of the quantitative analysis report.

Quantitative Analysis Report: .SPX Supply and Demand Analysis and Institutional Intent Identification within the Wyckoff Framework

Product Code: .SPX

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

Core Methodology: Wyckoff Volume-Price Analysis

I. Trend Analysis and Market Phase Identification

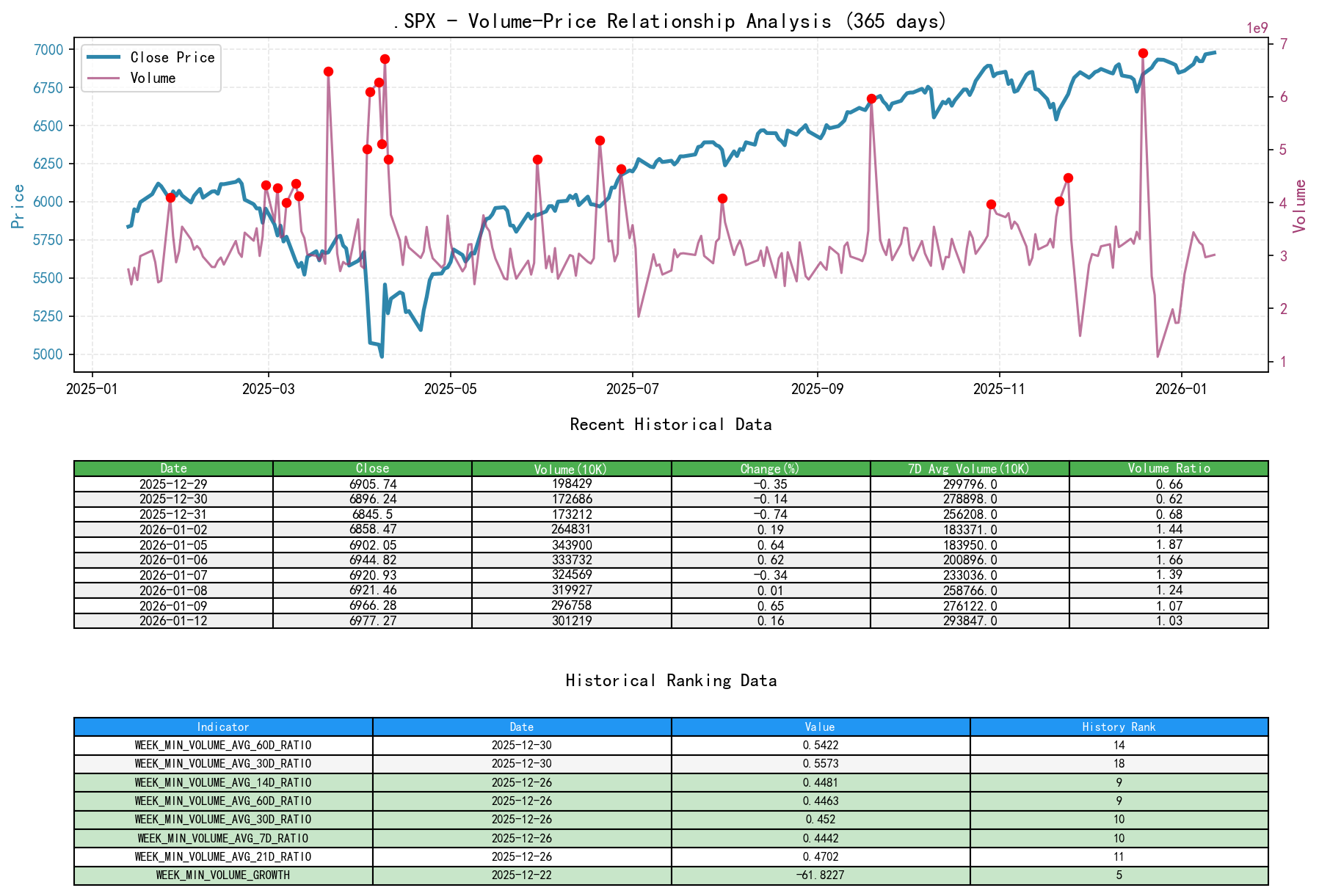

As of January 12, 2026, the underlying asset .SPX has an opening price of 6944.12, a closing price of 6977.27, a 5-day moving average of 6931.11, a 10-day moving average of 6909.14, and a 20-day moving average of 6874.38. The daily price change is +0.16%, the weekly change is +1.09%, the monthly change is +1.92%, the quarterly change is +1.92%, and the yearly change is +1.92%.

1. Moving Average Alignment and Trend Direction:

At the beginning of the data period (mid-November), the price (6737) oscillated near all major moving averages (MA_5D6795, MA_20D6785, MA_60D6652), indicating an unclear trend. Subsequently, the market underwent a significant decline - shakeout - recovery process.

- • November 17-20: Prices declined consecutively, breaking below all short-term moving averages (MA_5D, MA_10D, MA_20D), forming a bearish alignment.

- • Starting November 21: The market stopped declining and rebounded. As of the current report date (2026-01-12), the price (6977) has stabilized above all major moving averages, forming a "bullish alignment": MA_5D (6931) > MA_20D (6874) > MA_60D (6805). The MA_60D maintains a steady uptrend, defining the market's medium-to-long-term upward trend.

2. Inferred Market Phase (Based on Wyckoff Principles):

Integrating price action and volume-price relationships, the market underwent a clear phase transition during the analysis period:

- • Mid-to-late November (Nov 17 to Nov 20): Panic/Decline Phase. Prices fell on high volume (VOLUME_AVG_7D_RATIO=1.19 on Nov 20), with the RSI dropping to 34.9, indicating oversold conditions.

- • Late November to early December (Nov 21 to Dec 05): Accumulation and Shakeout Phase. High-volume rebounds occurred on November 21st and 24th, indicating demand entry. Subsequently, prices oscillated higher, reaching a new high at the time (6870) on December 5th, but volatility (PARKINSON_VOL_7D=0.071) contracted significantly, showing weakening selling pressure.

- • Mid-December (Dec 08 to Dec 17): Secondary Test and Shakeout. Prices retraced to test prior support (low of 6720 on Dec 17), with moderate volume and no new low formed, consistent with a successful "test" characteristic.

- • Late December to Present (Dec 18 to Jan 12): Uptrend and Potential Initial Distribution Phase. Prices broke through to historical highs (peak of 6986) in a "stair-step" fashion. However, concerning volume-price divergence signals emerged during the new high creation process (see Part II).

II. Volume-Price Relationship and Supply-Demand Dynamics

As of January 12, 2026, the underlying asset .SPX has an opening price of 6944.12, a closing price of 6977.27, a volume of 3,012,193,310, a daily price change of +0.16%, a volume of 3,012,193,310, a 7-day average volume of 2,938,474,574.86, and a 7-day volume ratio of 1.03.

1. Key Supply-Demand Signal Identification:

- • Demand-Dominant Signals:

- • 2025-11-24: Price surged +1.55% with abnormally high volume (VOLUME_AVG_7D_RATIO=1.31), a classic "high-volume advance" confirming the strength of the rebound.

- • 2026-01-06: Price broke out, rising +0.62% while volume remained high (VOLUME_AVG_7D_RATIO=1.66), demonstrating demand at a critical breakout level.

- • Supply-Dominant/Warning Signals:

- • 2025-12-19 (Historic Signal Day): Exhibited the strongest distribution warning in nearly a decade. Daily volume exploded by +106% (VOLUME_GROWTH), reaching the highest single-day volume in nearly a decade (Historical Rank #1). However, the price only gained +0.88%, presenting a classic "high-volume stall/advance on high volume." Its volume ratios relative to the 14-day and 21-day averages (2.16, 2.14) also ranked #12 and #20 in the past decade. This strongly suggests significant supply emerged at historical high levels.

- • 2026-01-12 (Latest Trading Day): Price made another all-time high (6977), but volume was relatively subdued (VOLUME_AVG_7D_RATIO=1.03), presenting a "new high on low/declining volume." The lack of volume confirmation during a major resistance (all-time high) breakout indicates weak demand follow-through, casting doubt on the sustainability of the advance.

2. Supply-Demand Landscape Summary:

The massive-volume stall on December 19th constitutes a clear "supply overwhelms demand" node. Despite subsequent price momentum to new highs, volume has failed to match and even contracted, indicating waning demand power. The massive supply from December 19th may not yet be fully absorbed. The current market is in a sensitive period at the end of an uptrend, with the supply-demand balance tilting towards supply.

III. Volatility and Market Sentiment

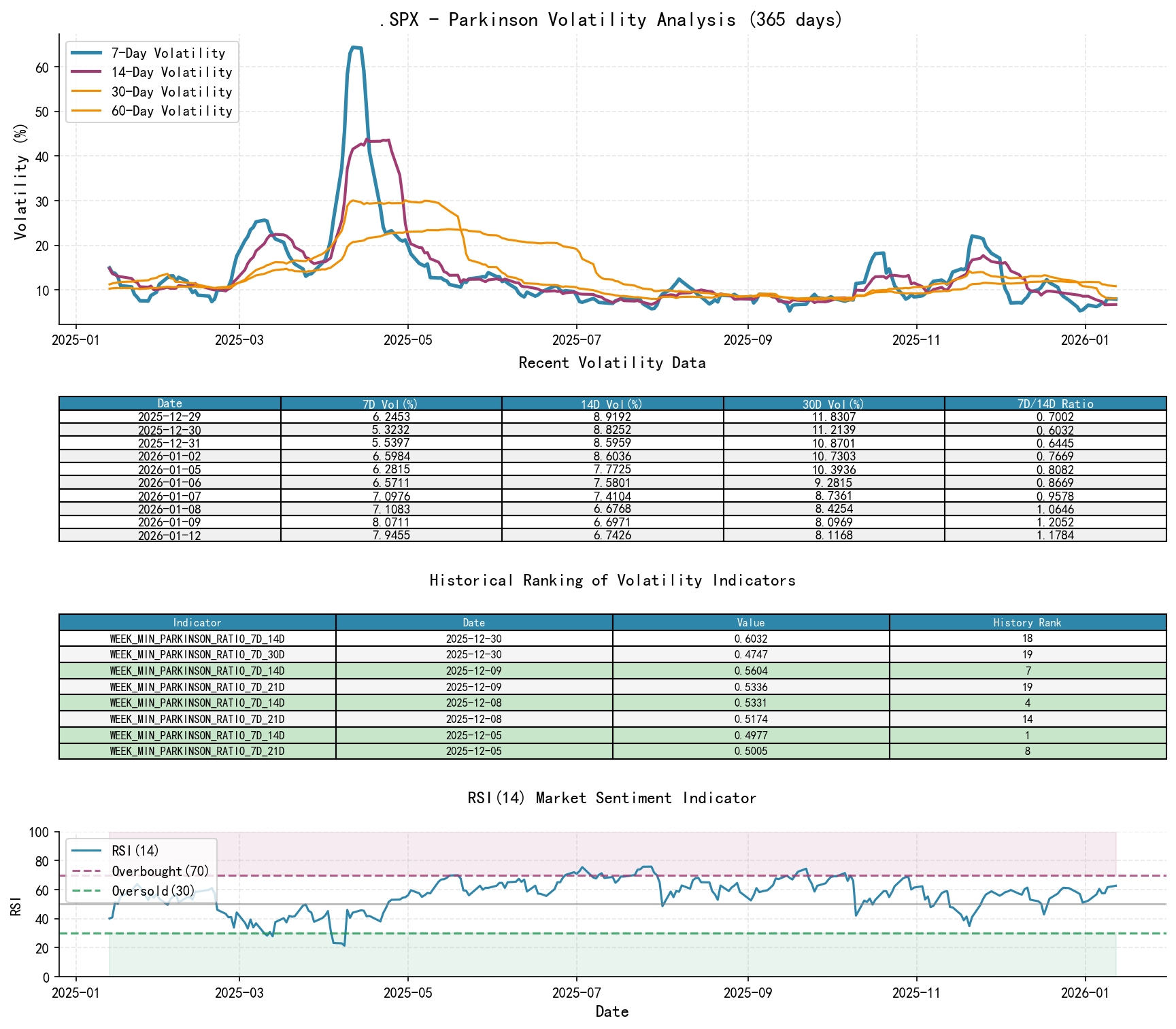

As of January 12, 2026, the underlying asset .SPX has an opening price of 6944.12, a 7-day intraday volatility of 0.08, a 7-day intraday volatility ratio of 1.18, a 7-day historical volatility of 0.07, a 7-day historical volatility ratio of 0.87, and an RSI of 62.71.

1. Volatility Analysis:

- • Volatility Contraction (Optimistic Sentiment): During the main rising phase in December (early to late December), short-term volatility (HIS_VOLA_7D, PARKINSON_VOL_7D) continuously declined and remained significantly below medium-to-long-term volatility (relevant ratios mostly below 1). For example, on December 5th, PARKINSON_RATIO_7D_14D hit its lowest value in nearly a decade (0.498, Rank #1), indicating stable market sentiment and low resistance to the advance.

- • Volatility Stealthily Rising (Initial Divergence): Entering January, despite prices making new highs, short-term volatility began rising from extremely low levels. HIS_VOLA_RATIO_7D_14D recovered from 0.47 at the end of December to 0.87 on January 12th, showing increased intraday volatility and growing market divergence.

2. Sentiment Indicator (RSI):

The RSI_14 touched the oversold zone below 35 during the panic decline in November, triggering the rebound. Throughout the uptrend, the RSI mostly operated within the healthy 50-65 range. The current RSI is 62.7, approaching but not yet entering the overbought zone (70), indicating there is still room for upside from a momentum perspective, but it has entered strong territory. Sentiment is not yet extremely optimistic, making the divergence with the "new high on low volume" noteworthy.

IV. Relative Strength and Momentum Performance

- • Strong Short-Term Momentum: WTD_RETURN (+1.09%) and MTD_RETURN (+1.92%) are both positive, indicating short-term buying momentum persists.

- • Solid but Slightly Slowing Medium-Term Momentum: QTD_RETURN (+1.92%) is flat with MTD, and YTD (+1.92%) is synchronized. However, observing the longer-term TTM_36 return (+75.2%) reveals a remarkable long-term bull market. Yet, compared to the December peak (TTM_36 once reached ~80%), recent momentum has actually slowed slightly.

- • Momentum and Volume-Price Divergence: The divergence between price making new highs (momentum appearance) and contracting volume (kinetic energy substance) suggests the quality of the current uptrend's momentum is deteriorating, and the endogenous strength of the uptrend is weakening.

V. Large Investor ("Smart Money") Behavior Identification

Based on the above volume-price, volatility, and phase analysis, the behavioral path of large investors can be inferred:

- 1. Accumulation in Late November: Following the panic decline, smart money actively intervened through consecutive high-volume bullish candles (Nov 21, 24), completing initial accumulation.

- 2. Distribution on December 19th: This is the most critical smart money behavior signal. At the time's high price level, the highest single-day volume in nearly a decade occurred with a minimal price gain. This is highly likely institutional investors "distributing" positions, exchanging筹码 (chips) with trend-chasing retail and momentum traders. Historical ranking data (volume ratio ranks within the top 20) reinforces the extremity and importance of this event.

- 3. Caution During the January New Highs: The new high movement after the New Year failed to see volume surpass or even approach the level of December 19th. Smart money may be adopting one of two strategies at this stage: either continuing with moderate distribution at higher levels, or waiting and observing, not aggressively chasing highs. "New highs on low volume" itself is a marker of declining smart money participation.

Core Inference: Large investors conducted significant and historically notable distribution operations at high levels in mid-to-late December. The current new-high rally may be driven by residual momentum buying and short covering, rather than from new, strong demand from institutional主力 (main force).

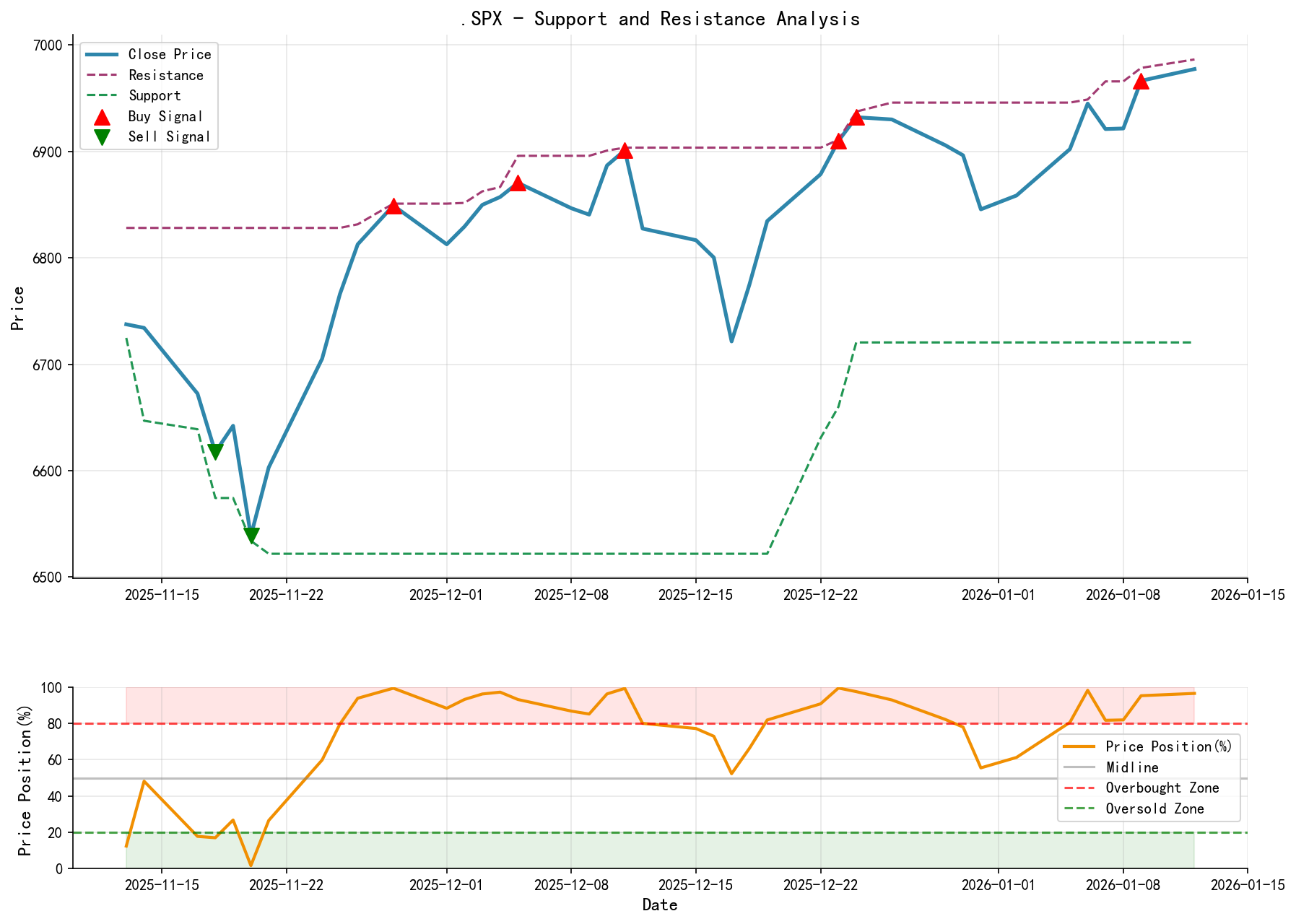

VI. Support/Resistance Level Analysis and Trading Signals

1. Key Price Levels:

- • Resistance (Tested): 6986.33 (Intraday high on 2026-01-12, all-time high). Any advance towards this level requires high-volume confirmation for a valid breakout; otherwise, it will be a false breakout and a shorting opportunity.

- • Core Support Levels:

- • S1: 6900-6920 Zone: The recently broken platform and the upper bound of the January 5-8 consolidation area. A break below this zone would signify damage to the short-term upward momentum.

- • S2: 6800-6820 Zone: The lower boundary of the late-December oscillation range and the vicinity of MA_30D, serving as the强弱 (strength/weakness) demarcation line for the medium-term trend.

- • S3: 6720 Zone: The retracement low on December 17th, also the bottom of the accumulation range, representing the strongest support.

2. Comprehensive Wyckoff Trading Signals:

| Signal Type | Judgment | Data and Principle Basis |

| Medium-Term Trend | Warning at the End of Bullish Trend | Prices at all-time highs with bullish MA alignment, but exhibiting a top divergence combination of massive-volume stall (12/19) and new highs on low volume (01/12). |

| Short-Term Trading Signal | Cautiously Bullish, Preparing for a Shift | The trend persists, but longs require strict stop-losses. More attention should be paid to the酝酿 (brewing) of shorting signals. |

| Institutional Intent | Distribution in Progress | The massive-volume stall on December 19th is a textbook distribution signal, with extreme historical rankings. |

| Operational Suggestion | Longs Reduce Exposure/Monitor, Shorts Await Confirmation Signals | Risk-reward ratio is unfavorable for longs near historical highs. |

3. Specific Operational Recommendations:

- • For Existing Long Positions: Consider partial profit-taking when prices approach the 6986 resistance without signs of high volume. Tighten stop-losses to below S1 (6900).

- • For Potential Short Positions: Patiently await shorting confirmation signals. The ideal signal is: price fails again at the 6986 resistance zone, accompanied by a high-volume decline, and a daily close below S1 (6900). Initial stop-loss can be placed above 6986.

- • For Observers: Recommend monitoring. Chasing long at current levels carries significant risk, while the timing for shorting is not fully mature. Await the market's final reaction to the massive supply from December 19th.

4. Future Validation Points:

- • Bullish Validation Point: Price breaks through and sustains above 7000点 (points) with strong volume (VOLUME_AVG_7D_RATIO > 1.5). This would allow the December 19th massive volume to be reinterpreted as "changing hands," and the uptrend would continue.

- • Bearish Validation Point: Price fails to sustain above 6950 within the next 1-2 weeks and breaks below the 6900 support (S1) on high volume. This would confirm supply has regained control of the market, the distribution from December 19th is starting to produce a downward effect, and a medium-term correction has begun.

Conclusion Summary:

Based on Wyckoff volume-price principles and historical data ranking analysis, .SPX is in a long-term bull market but faces significant medium-term reversal risk. The massive-volume stall day on December 19, 2025, with the highest volume in nearly a decade, is a clear institutional distribution signal. The subsequent new highs on low volume in January 2026 constitute a classic "demand exhaustion" divergence. Market structure indicates substantial supply has emerged at historical highs. It is recommended that investors shift from aggressive bullishness to high caution. Longs should consider defensive measures. Traders can begin preparing for potential trend reversal by positioning for short strategies, using the breakthrough of the aforementioned key price levels as the basis for action.

Disclaimer: This report is based on historical data and quantitative models and does not constitute any investment advice. Financial markets carry risks; invest with caution.

Thank you for your attention! Daily Wyckoff volume-price market interpretation is published promptly at 8:00 AM before the market opens. Please feel free to leave comments and share. Your recognition is crucial. Let's see the market signals together.

Member discussion: