SOXX Quantitative Analysis Report (Based on Wyckoff Method)

Product Code: SOXX

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

1. Trend Analysis and Market Phase Identification

As of 2026-01-12, the underlying asset SOXX had an opening price of 325.70, a closing price of 330.35, a 5-day moving average of 323.93, a 10-day moving average of 315.08, a 20-day moving average of 307.55, a daily gain of 0.48%, a weekly gain of 3.86%, a monthly gain of 9.70%, a quarterly gain of 9.70%, and an annual gain of 9.70%.

- • Moving Average Alignment and Price Action: During the analysis period, SOXX underwent a complete transition of market phases: "Decline - Bottoming - Reversal - Breakout - Advance".

- • Bearish Alignment and Decline Phase (2025-11-13 to 2025-11-21): Price dropped sharply from 295.94 to 268.10, successively breaking below all short-term moving averages (MA_5D, MA_10D, MA_20D) during this period, and briefly fell below the MA_30D on November 21st. MA_5D<MA_10D<MA_20D formed a short-term bearish alignment, confirming the downtrend.

- • Bottoming and Accumulation Phase (2025-11-24 to 2025-11-28): Price rebounded on November 24th on increased volume (VOLUME_AVG_60D_RATIO=1.79), then rose moderately and reclaimed the MA_5D and MA_10D. Price consolidated within a narrow range, but the MA_60D continued its ascent, indicating that support from the long-term uptrend remained valid.

- • Bullish Alignment and Advance Phase (2025-12-01 to 2026-01-12): Price initiated a strong advance starting December 1st, consecutively breaking above the MA_20D and MA_30D. By the end of the reporting period (2026-01-12), CLOSE(330.35) was significantly above all moving averages, with MA_5D(323.93) > MA_10D(315.08) > MA_20D(307.55) > MA_30D(306.84) > MA_60D(299.66), forming a perfect bullish alignment pattern. Price continuously made new highs, with successive higher highs and higher lows, clearly indicating it is in the Advance Phase according to Wyckoff theory.

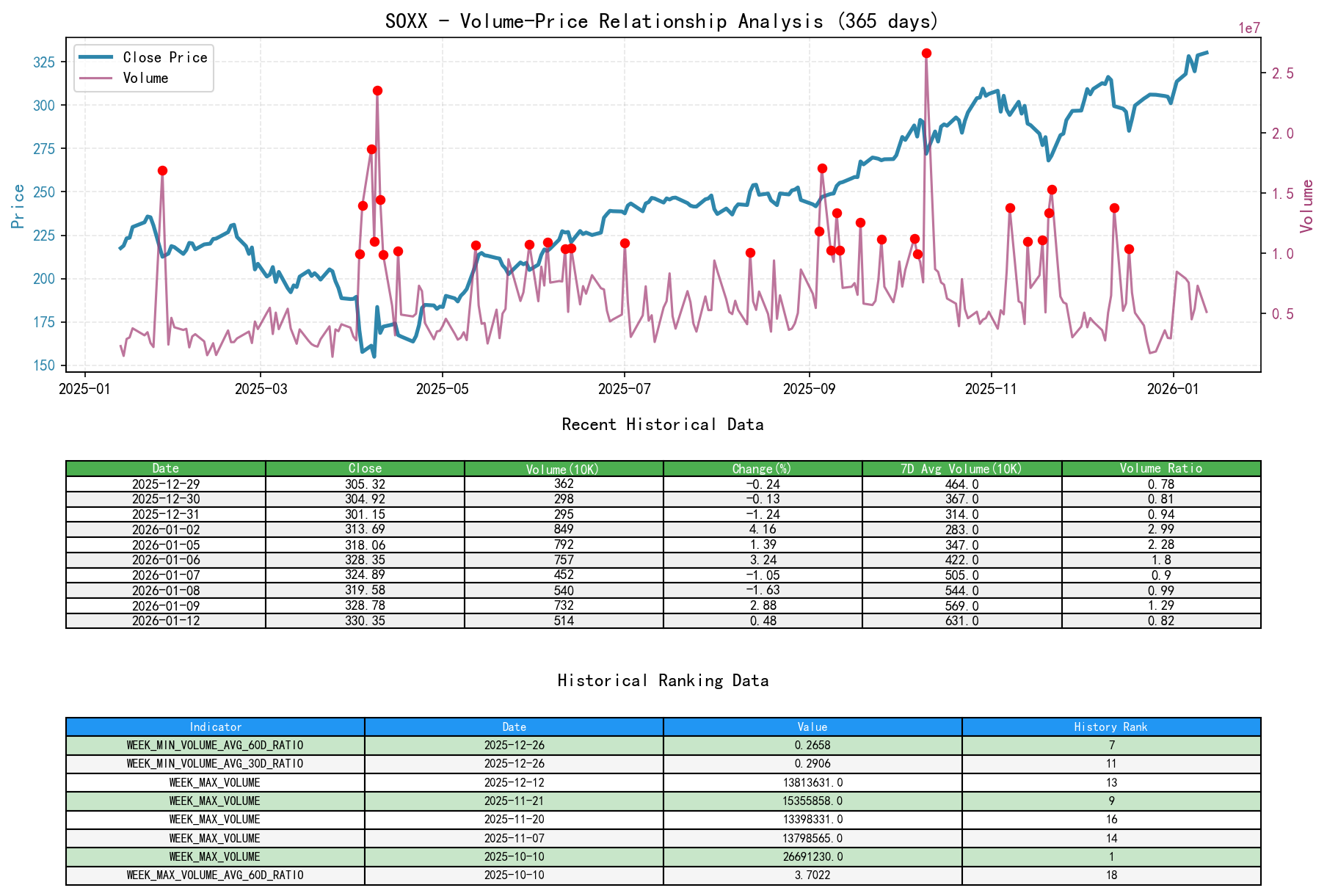

2. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-12, the underlying asset SOXX had an opening price of 325.70, a closing price of 330.35, a volume of 5,147,841, a daily gain of 0.48%, a volume of 5,147,841, a 7-day average volume of 6,315,499.29, and a 7-day volume ratio of 0.82.

- • Key Day Analysis:

- • Panic Selling (Climactic Supply): 2025-11-20, price plummeted -4.80%, volume (13.40M) surged (VOLUME_GROWTH=+162.30%, VOLUME_AVG_60D_RATIO=1.69), with turnover reaching the 7th highest in the past decade. This is a classic supply-dominated panic selling day, indicating market sentiment reached a short-term extreme.

- • Accumulation Signal (Demand Absorption): 2025-11-21, following the previous day's panic, price rebounded slightly (+1.02%), but volume expanded further to 15.36M (the 9th highest in the past decade), with turnover reaching the 4th highest in the past decade. Extremely high volume at an extreme low price level, accompanied by price stabilization and recovery, is a classic Wyckoff signal for large investors (smart money) entering the market for accumulation.

- • Shakeout and Demand Recovery: 2025-12-12, during the advance, price suddenly dropped -4.78% on high volume (13.81M, VOLUME_AVG_60D_RATIO=1.91), with turnover reaching the 3rd highest in the past decade. However, price quickly recovered the losses in the following sessions and made new highs. This high-volume decline did not alter the uptrend and can be interpreted as a major shakeout aimed at flushing out weak long positions.

- • Healthy Advance: January 2026, price continuously made new all-time highs (opening, closing, high, and low prices all reaching decade highs), but volume was not abnormally high compared to the panic/shakeout days in November (VOLUME_AVG_60D_RATIO mostly between 0.8-1.3). This indicates scarce supply and solid demand during the advance, representing healthy volume-price coordination.

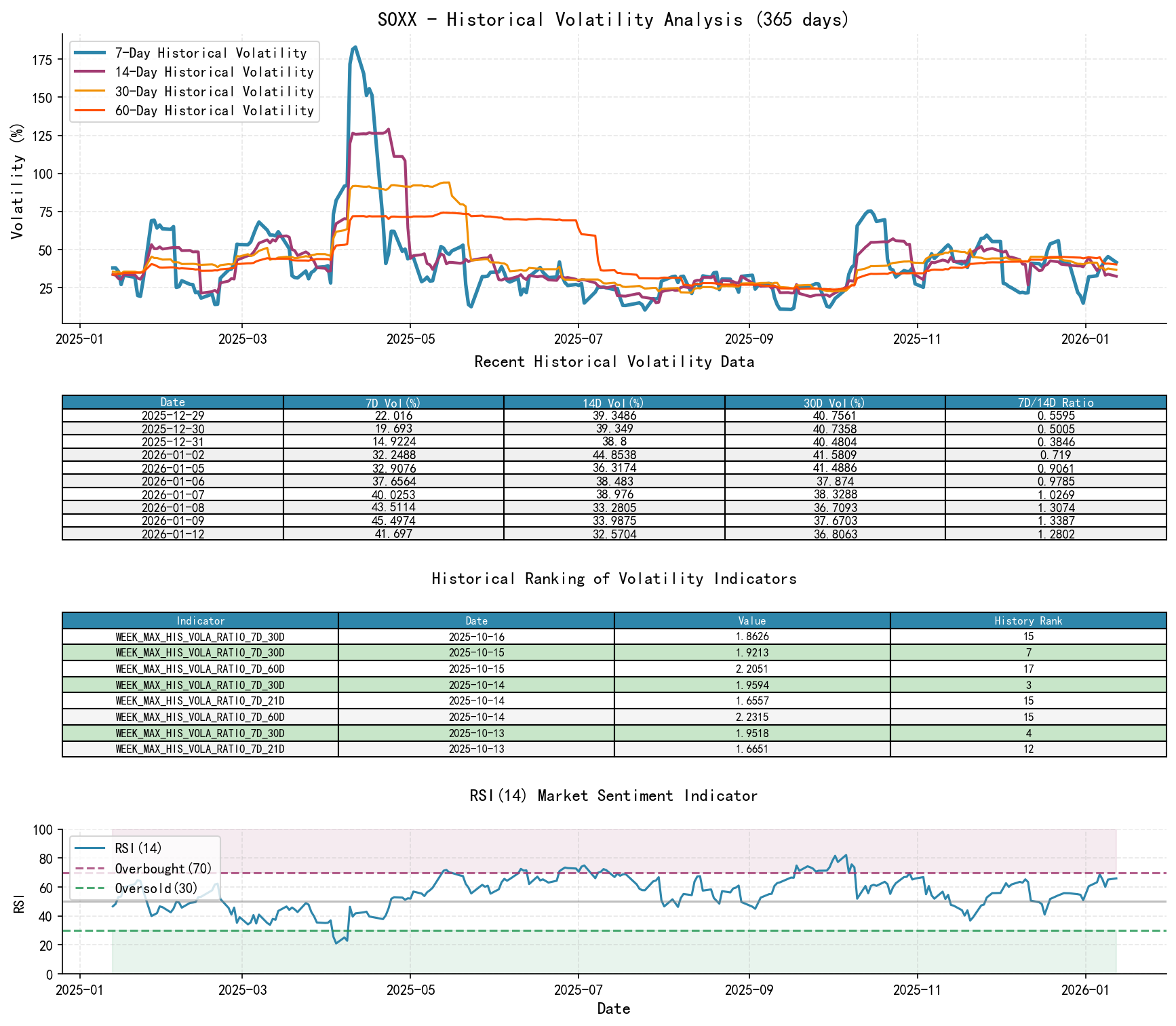

3. Volatility and Market Sentiment

As of 2026-01-12, the underlying asset SOXX had an opening price of 325.70, a 7-day intraday volatility of 0.24, a 7-day intraday volatility ratio of 1.29, a 7-day historical volatility of 0.42, a 7-day historical volatility ratio of 1.28, and an RSI of 66.01.

- • Panic and Sentiment Inflection Point: During the decline and bottoming process on November 20th-21st, short-term volatility metrics spiked sharply. PARKINSON_VOL_7D rose from 0.35 to 0.52, HIS_VOLA_7D increased from 0.38 to 0.46. The volatility ratio metric (PARKINSON_RATIO_7D_60D) reached an extreme high of 1.93 on November 21st, showing that short-term panic sentiment far exceeded the long-term average. Concurrently, RSI_14 fell to 36.84 and 38.97, nearing oversold territory, validating the extreme sentiment.

- • Sentiment Recovery and Optimism: Upon entering the advance phase in December, volatility contracted rapidly. By late December, PARKINSON_RATIO_7D_60D dropped below 0.73 (reaching 0.49 on December 30th, the 5th lowest in the past decade), indicating an unusually calm and optimistic market sentiment. RSI_14 recovered to the 60-68 range, in a strong but not extreme overbought state, supporting the sustainability of the uptrend.

4. Relative Strength and Momentum Performance

- • Momentum Shift: Short-term momentum indicators (WTD_RETURN, MTD_RETURN) turned significantly negative in November but then turned positive and strengthened comprehensively in December and January. By 2026-01-12, MTD_RETURN reached +9.70%, showing strong monthly momentum.

- • Exceptional Long-Term Momentum: Despite short-term volatility, SOXX exhibited extremely strong long-term momentum. TTM_36 (36-month return) consistently rose from 129.56% on 2025-11-13 to 157.67% on 2026-01-12. YTD (Year-to-Date return), after resetting at year-end, was already +9.70% on January 12th, indicating a very positive start-of-year momentum. Momentum performance corroborates the conclusions of price breaking to new highs and healthy volume.

5. Large Investor (Smart Money) Behavior Identification

Based on the above volume-price, volatility, and trend analysis, the operational intent of large investors is clear:

- 1. Bottom Accumulation: During the panic selling (climactic supply) on November 20th-21st and the subsequent high-volume price stabilization, the massive turnover indicates that large capital was actively absorbing panic selling from retail investors at low levels. Historical ranking data showing these two days' turnover were among the decade's extremes (4th and 7th) confirms this was not ordinary trading activity.

- 2. Mid-Advance Shakeout: The high-volume plunge (shakeout) on December 12th occurred after a period of price appreciation. Its purpose was to induce panic, forcing out weak longs and profit-takers, while smart money likely used this opportunity for secondary accumulation or position adjustment. The swift price recovery and new highs prove supply was effectively absorbed.

- 3. Driving the Advance and Controlling Pace: During the advance to new all-time highs in January, volume was moderate, indicating that large investors held stable positions and were not engaging in large-scale distribution at highs. The advance was primarily driven by steady demand with minimal supply pressure, aligning with typical characteristics of smart money-driven trends.

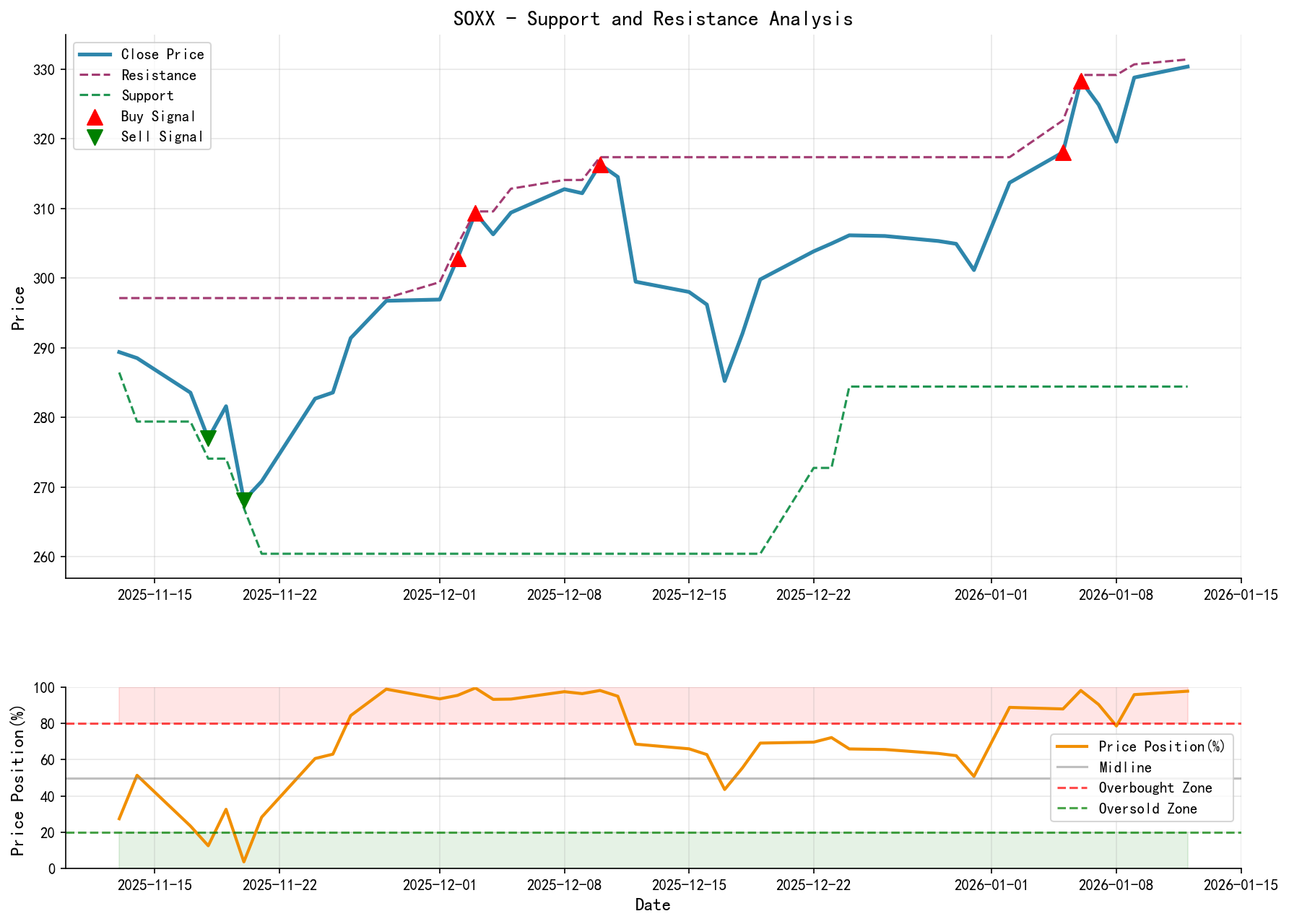

6. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- • Primary Support: ~260.44 (the low of the panic day on 2025-11-21). This level was tested with massive volume and is the lower boundary of a significant accumulation zone.

- • Secondary Support: ~284.43 (the pullback low on 2025-12-17) and MA_20D (~307.55). Within the current uptrend, MA_20D has formed dynamic support.

- • Key Resistance Levels:

- • Price has broken through all historical highs and is in a resistance-free zone. The next psychological resistance can be observed at round-number levels (e.g., 340.00).

- • Comprehensive Wyckoff Events and Trading Signals:

- • Market Phase: Clearly in the Advance Phase (Markup).

- • Dominant Force: Demand controls the market, supply is weak.

- • Trading Signal: Bullish.

- • Operational Recommendations:

- • Long Strategy: Current price is near short-term overbought levels; chasing the advance is not advisable. Consider waiting for a price pullback near MA_20D (307-310 zone) or the previous breakout platform (312-315), and look for a low-volume stabilization signal as an opportunity for adding or initiating long positions.

- • Stop-Loss Reference: Any long position should have a stop-loss set below key support levels, for example, a close below MA_30D (~306.50) or 284.43, to manage trend reversal risk.

- • Risk Monitoring: Future signs such as "high-volume stagnation at highs (single-day or consecutive days of reduced price range with abnormally high volume)" or "high-volume break below the short-term uptrend line" would be warning signals that large investors may be initiating distribution. High vigilance and consideration for position reduction are warranted.

Executive Summary: SOXX experienced a classic bottoming structure in late November, characterized by panic selling and smart money accumulation, followed by a strong advance initiated in December, culminating in new all-time highs in January 2026. The current market is in a healthy, demand-driven advance phase with a sound volume structure, moderate volatility, and no clear signs of smart money distribution. The strategic outlook is bullish, but chasing the rally should be avoided. Patiently await low-risk entry opportunities on pullbacks to key support zones.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding accuracy or completeness. Markets involve risks; investment requires caution. Any investment actions taken based on this report are at the investor's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Analysis is published daily at 8:00 AM before the market opens. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals.

Member discussion: