PPH Quantitative Analysis Report (Based on Wyckoff Principles)

Product Code: PPH

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Time: 2026-01-13

I. Trend Analysis and Market Phase Identification

As of January 12, 2026, the underlying PPH had an opening price of 105.83, a closing price of 105.62, a 5-day moving average of 104.98, a 10-day moving average of 104.39, a 20-day moving average of 103.23, with daily, weekly, monthly, quarterly, and yearly changes of 0.37%, 2.48%, 2.37%, 2.37%, and 2.37% respectively.

- 1. Trend Status:

- • Bullish Alignment Established: As of 2026-01-12, the closing price

105.6193is above all moving averages (MA_5D104.976> MA_10D104.389> MA_20D103.226> MA_30D102.239> MA_60D98.714). The short-term, medium-term, and long-term moving averages show a standard bullish alignment, indicating the market is in a clear uptrend. - • Key Breakthrough and Support: Since 2025-12-30, the MA_5D has been consistently operating above the MA_60D, signifying consolidation of the medium-to-long-term uptrend. The price correction from 2025-12-01 to 2025-12-09 found strong support and stabilized around the MA_60D (approximately

101.0), validating its effectiveness as dynamic support. - • Trend Strength: The price continues to trade above short-term moving averages (MA_5D, MA_10D), and the slopes of these short-term MAs are upward, indicating strong short-term upward momentum.

- • Bullish Alignment Established: As of 2026-01-12, the closing price

- 2. Moving Average Crossover Signals:

- • The MA_CROSS indicator is not directly provided in the data. However, from sequence observation, the MA_5D crossed above the MA_20D and MA_30D successively in mid-to-late November, followed by the MA_10D and MA_20D subsequently crossing above longer-term moving averages. This series of golden cross signals served as early technical confirmation points for the current uptrend.

- 3. Market Phase Inference (Based on Wyckoff Theory):

- • Phase Evolution:

- • Potential Distribution and Shakeout (Mid-to-Late November 2025): Price surged rapidly from

99.43on November 13 to103.21on November 25, a significant increase, during which the RSI exceeded 80 (overbought). The subsequent correction (to101.10on December 1) was accompanied by massive volume (VOLUME_AVG_60D_RATIO reached 1.71), possibly indicating a "shakeout" or minor distribution. - • Secondary Test and Accumulation Confirmation (Early December 2025): Following the high-volume decline on December 1, the price did not collapse further in the subsequent trading days but stabilized on low volume above the MA_60D (e.g., volume on December 5 was only 27% of the 60-day average), showing "stopping action." This aligns with a "Secondary Test" (ST) following "Panic Selling" (SC) in Wyckoff theory, suggesting large investors may have been absorbing the selling pressure.

- • Markup Phase (Mid-December 2025 to Present): Since the volume-backed rebound on December 10, the price initiated a new upward wave, consistently making new highs. The price-volume relationship has been generally healthy (higher volume on advances, lower volume on pullbacks), and the moving average system exhibits a perfect bullish alignment, consistent with the characteristics of Wyckoff's "Markup Phase." The price is currently in the higher range of this rally.

- • Potential Distribution and Shakeout (Mid-to-Late November 2025): Price surged rapidly from

- • Phase Evolution:

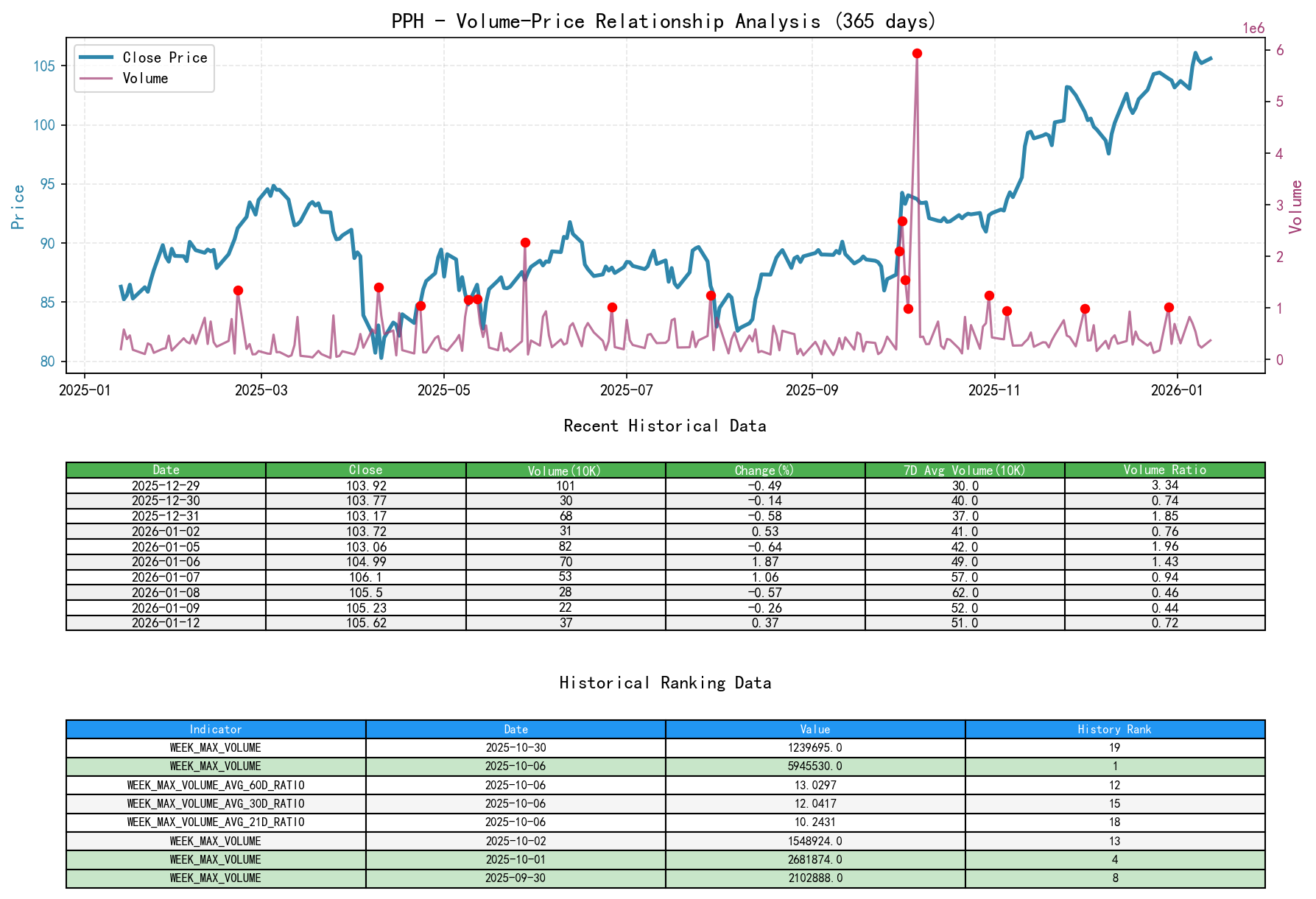

II. Volume-Price Relationship and Supply-Demand Dynamics

As of January 12, 2026, the underlying PPH had an opening price of 105.83, a closing price of 105.62, volume of 370,174, a daily change of 0.37%, volume of 370,174, a 7-day average volume of 511,068.43, and a 7-day volume ratio of 0.72.

- 1. Key Day Analysis:

- • Demand-Driven Advance (2025-11-25): Price increased by

2.83%on volume of463,557. Although volume wasn't significantly high (VOLUME_AVG_7D_RATIO 1.18), the strong price breakthrough above previous highs shows demand overcoming supply. - • Panic Selling (Supply Climax - SC) (2025-12-01): Price fell

-1.38%while volume surged to993,863, an absolute recent high (VOLUME_AVG_60D_RATIO 1.71). Historical ranking data shows that the trading amount (AMOUNT) on that day was the 18th highest in the past ten years. This is a classic panic selling day with massive share turnover. - • Stopping Action and Demand Entry (2025-12-02, 12-04): Following the panic day, prices continued to decline but volume remained elevated (VOLUME_AVG_60D_RATIO 0.62 and 1.11 respectively), with closing prices near the daily highs. This indicates strong demand actively absorbing the sell-off, preventing further price declines.

- • Demand Return Confirmation (2025-12-15): Price increased

1.84%on volume of357,527(VOLUME_AVG_60D_RATIO 0.59). The advancing price on higher volume confirmed demand had regained control of the market. - • Weakening Upward Thrust (2026-01-07 to Present): Price reached a new high of

106.10on January 7, but subsequent sessions showed weak upward momentum, with small-body candlesticks at high levels (e.g., January 9, 12). Concurrently, volume has significantly diminished compared to the peak in December (VOLUME_AVG_60D_RATIO 0.83 on January 12). This suggests that at high price levels, demand may be hesitant, and the upward thrust is weakening.

- • Demand-Driven Advance (2025-11-25): Price increased by

- 2. Supply-Demand Strength Transition:

- • The data clearly shows a complete cycle of "concentrated supply release -> strong demand absorption -> demand-driven advance." The massive volume on December 1 represents the climax of panic supply outflow. The subsequent days of sustained high volume while prices stabilized are a clear signal of demand actively absorbing supply. Currently, supply has not shown significant increases during the price advance, but the follow-through intensity of demand (volume) has declined, warranting caution for a potential shift in the supply-demand balance.

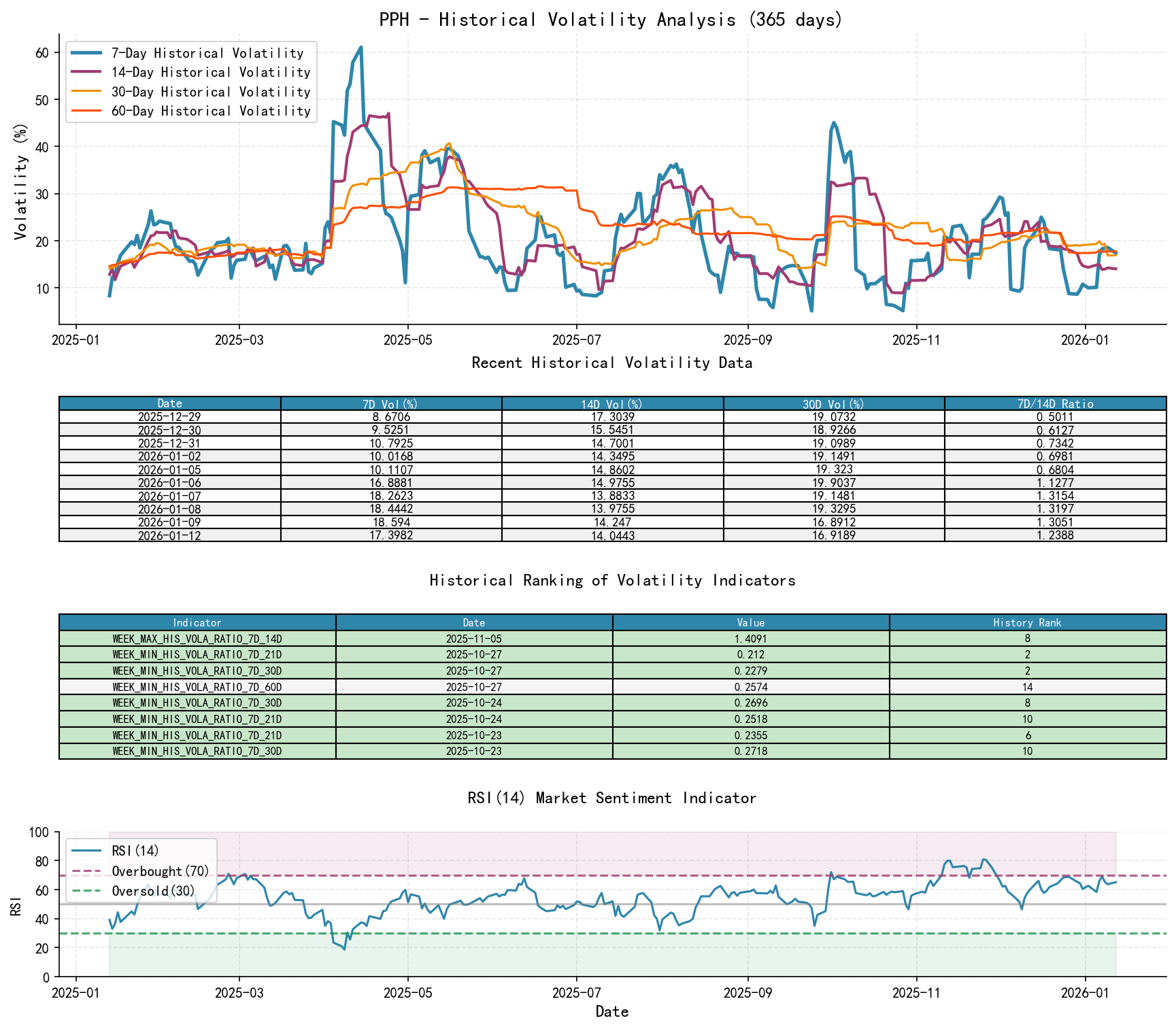

III. Volatility and Market Sentiment

As of January 12, 2026, the underlying PPH had an opening price of 105.83, a 7-day intraday volatility of 0.18, a 7-day intraday volatility ratio of 1.42, a 7-day historical volatility of 0.17, a 7-day historical volatility ratio of 1.24, and an RSI of 65.16.

- 1. Volatility Level and Changes:

- • Volatility Spike During Panic Period: During the correction in early December, the ratios of the 7-day Historical Volatility (HIS_VOLA_7D) and Parkinson Volatility (PARKINSON_VOL_7D) relative to their longer-term (30D, 60D) averages (HIS_VOLA_RATIO_7D_30D, PARKINSON_RATIO_7D_60D) peaked (>1.3), indicating abnormal short-term volatility expansion and heightened market tension.

- • Volatility Convergence: Entering late December and January, short-term volatility rapidly declined. All volatility ratios fell back to around or below 1.0 (e.g., HIS_VOLA_RATIO_7D_60D was

0.98on January 12), indicating market sentiment recovered from panic, and the trend operation became more stable.

- 2. Overbought/Oversold Status (RSI_14):

- • Extreme Overbought: On November 25, RSI_14 reached

80.92. Historical ranking data shows this value was the second highest in the past ten years (HISTORY_RANK: 2). This was a strong short-term overbought signal, setting the stage for the subsequent correction. - • Sentiment Repair: Following the early December correction, the RSI bottomed at

46.52on December 9, effectively releasing overbought pressure. - • Current Status: As of January 12, the RSI is

65.16, within the strong zone but not at extreme overbought levels. This indicates the current advance still has some sentiment support but is approaching an area requiring vigilance.

- • Extreme Overbought: On November 25, RSI_14 reached

IV. Relative Strength and Momentum Performance

- 1. Momentum Trend:

- • Strong Short-Term Momentum: WTD_RETURN (weekly return) reached a high of

2.84%in the week of January 7, and currently (Jan 12) is2.48%, maintaining positive short-term momentum. - • Solid Medium-Term Momentum: MTD_RETURN (monthly return) peaked at

11.53%on November 25. After the December correction, it currently (Jan 12) stands at2.37%, showing the medium-term uptrend remains intact, although momentum has slowed compared to the earlier peak. - • Excellent Long-Term Momentum: QTD_RETURN (quarterly return)

2.37%, YTD (yearly return)2.37%(projected based on January data), and TTM_36 (three-year return)33.75%indicate the underlying has very strong long-term performance, providing fundamental momentum support for the current advance.

- • Strong Short-Term Momentum: WTD_RETURN (weekly return) reached a high of

- 2. Momentum and Volume-Price Validation: The strong momentum in late November (high MTD_RETURN) coincided with price breakthroughs and RSI overbought conditions, later corrected by the high-volume pullback. The momentum recovery starting in mid-December was supported by a healthy volume-price structure of "higher volume on advances, lower volume on pullbacks." Current momentum, while not at new highs, remains positive, consistent with the price consolidation at high levels.

V. Large Investor (Smart Money) Behavior Identification

- 1. Behavior Inference:

- • Potential Distribution in Late November: During the rapid price surge and extreme market optimism (RSI hitting the second-highest level in a decade), volume did not show a significant proportional increase. Smart money may have utilized the market frenzy for covert distribution.

- • Panic Absorption (Accumulation) in Early December: Key Evidence. The high-volume decline on December 1 and the following days, yet prices stabilized above the key moving average (MA_60D). Combined with the historical ranking showing high trading amounts, this strongly suggests smart money engaged in large-scale accumulation (Accumulation) during public panic selling. This is classic accumulation behavior following a "shakeout."

- • Controlled Markup in Mid-to-Late December: After absorbing sufficient supply, the market entered the markup phase. The pattern of "moderately higher volume on advances, significantly lower volume on pullbacks" during this period indicates smart money was systematically marking up prices while controlling costs and avoiding attracting excessive followers.

- • Current Behavior at High Levels: After the price reached a new high (

106.10), volume failed to expand correspondingly and even showed contraction. Smart money may be reducing buying intensity or even beginning small-scale, tentative distribution. The market is entering a sensitive period requiring observation of whether demand can sustain its follow-through.

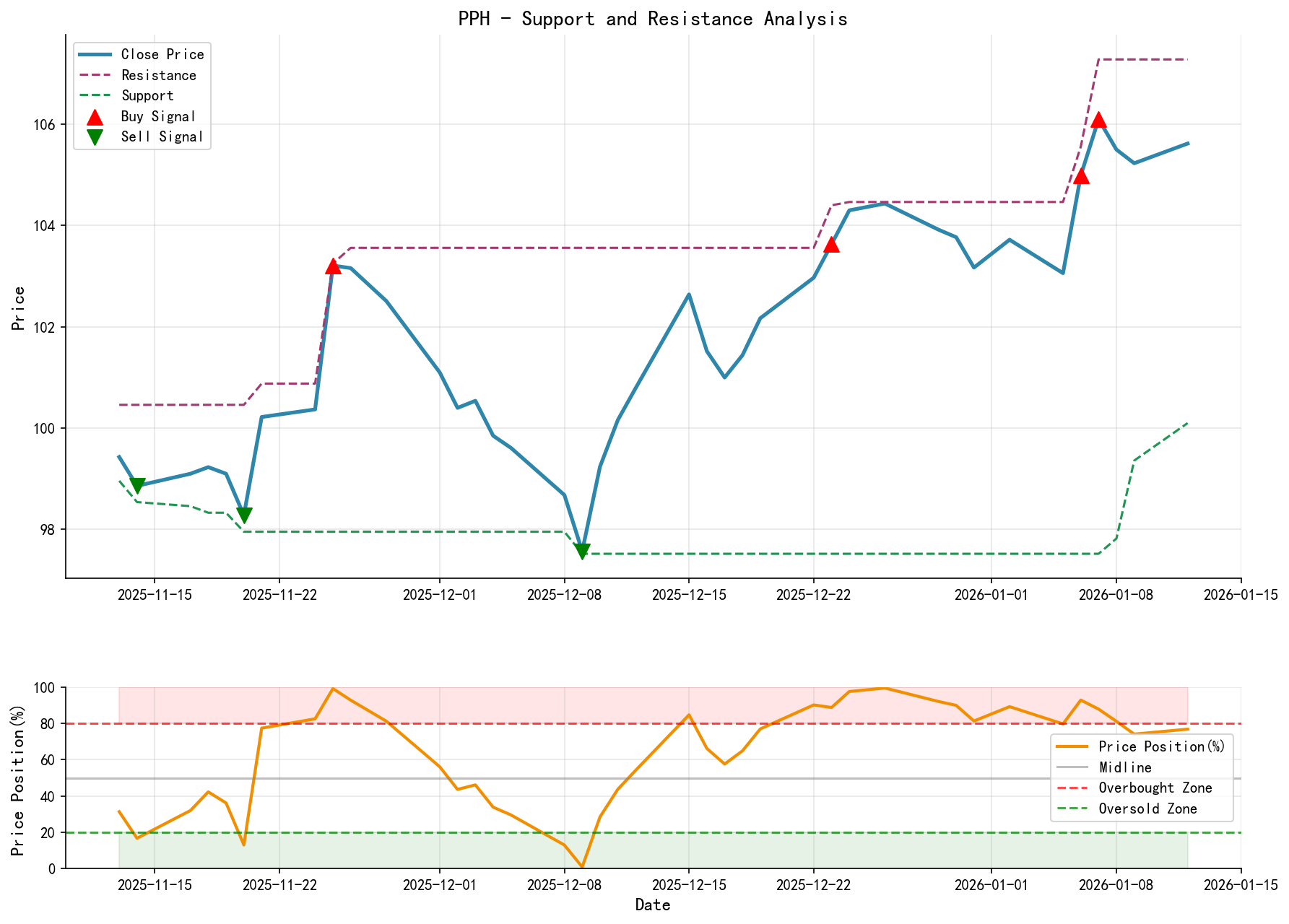

VI. Support/Resistance Level Analysis and Trading Signals

- 1. Key Price Levels:

- • Primary Support:

- •

101.0 - 101.5Zone: The low point of the 2025-12-01 correction (101.10) and the subsequent volume consolidation area over multiple sessions, also the current convergence zone for MA_20D and MA_30D. This is a crucial defensive line for bulls. - •

97.5 - 98.0Zone: The current level of the MA_60D and the interim lows from 2025-12-08/09. This is the ultimate support for the uptrend; a break below could signal a fundamental trend change.

- •

- • Primary Resistance:

- •

106.0 - 107.3Zone: The recent all-time high area (January 7 high107.28). Price is attempting to break through this zone. Historical ranking data shows that opening, closing, high, and low prices have all recently reached near ten-year highs, indicating entry into a strong zone free of historical overhead supply. However, this also means a lack of historical resistance references, making further upside dependent on incremental capital. - • Near

103.2: The previous high (November 26), now transformed into minor support.

- •

- • Primary Support:

- 2. Integrated Wyckoff Events and Trading Signals:

- • Current Signal: Cautiously bullish, alert to upward exhaustion. The market is in the late stages of the Wyckoff Markup Phase. Trend and momentum remain upward, but the volume-price divergence and weakening upward thrust constitute warning signals. Smart money may be shifting from active promotion to观望 or minor distribution.

- • Operational Recommendations:

- • Existing Long Positions: Can be held, but protective stop-losses should be tightened to below

101.0. If the price cannot break through the previous high of107.3on significant volume and shows clear signs of high-volume stalling or bearish candlesticks (e.g., long upper shadows) at high levels, consider taking partial profits. - • Potential Longs (New Entries): Not recommended to chase the current high. Wait for low-risk entry opportunities after a healthy pullback. The ideal entry zone is near the

101.0 - 101.5support band, accompanied by low-volume stabilization signals (e.g., small-body candles, shrinking volume). Stop-loss can be set below97.5. - • Short Traders: Counter-trend shorting carries high risk at present. Wait for clear trend reversal signals, such as a high-volume break below the

101.0support leading to a death cross in the short-term moving average system.

- • Existing Long Positions: Can be held, but protective stop-losses should be tightened to below

- • Future Validation Points:

- 1. Bullish Validation: If the price can break through and stabilize above

107.3on high volume (VOLUME_AVG_60D_RATIO > 1.2) within the next 1-2 weeks, the uptrend may resume, targeting higher levels. - 2. Bearish Validation: If the price breaks below

101.0on high volume and rebounds cannot reclaim a position above it, this would indicate the early December accumulation failed, and the market may enter a distribution or downtrend phase. - 3. Neutral/Wait Signal: If the price continues to oscillate narrowly within the

105.0 - 107.3range with persistently low volume, it indicates market僵局, requiring等待 for a directional breakout.

- 1. Bullish Validation: If the price can break through and stabilize above

Conclusion Reiterated: PPH is in a high-level consolidation phase within a long-term uptrend. Based on Wyckoff volume-price analysis, smart money successfully accumulated in early December and drove the subsequent advance. The price is currently at new highs, but signs of weakening demand follow-through have emerged, placing the market at a potential inflection point. Existing positions are advised to be held cautiously with protective stops. New entries should patiently await opportunities at key support levels or for a high-volume breakout above the previous high to confirm trend continuation. All judgments are derived from current data and require dynamic assessment based on future validation points.

Disclaimer: This report/interpretation is for informational purposes only, based on publicly available market analysis and research. It does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. The market carries risks; investment requires caution. Any investment actions based on this report are undertaken at one's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Analysis is published daily before the 8:00 AM market open. Please feel free to comment and share; your recognition is vital. Let's work together to see the market signals clearly.

Member discussion: