Wyckoff Quantitative Analysis Report: POOL (As of 2026-01-12)

Report Date: 2026-01-13

Analysis Period: 2025-11-13 to 2026-01-12 (Approximately Two Months)

I. Trend Analysis and Market Phase Identification

As of January 12, 2026, the subject POOL had an opening price of 256.78, a closing price of 258.46, a 5-day moving average (MA_5D) of 241.54, a 10-day moving average (MA_10D) of 235.91, a 20-day moving average (MA_20D) of 235.67, a daily change of +2.45%, a weekly change of +9.40%, a monthly change of +12.99%, a quarterly change of +12.99%, and a yearly change of +12.99%.

- • Moving Average Alignment and Price Relationship:

- • Initial State (Until 2025-12-19): The price (CLOSE) consistently traded below all moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), showing a clear bearish alignment. MA_60D (~300 to 260) > MA_30D > MA_20D > MA_10D > MA_5D, with all moving averages diverging bearishly, confirming a long-term downtrend.

- • Trend Reversal Signal (Starting 2026-01-05): The price began breaking above short-term moving averages. By 2026-01-12, the price (258.46) had clearly established itself above the MA_5D (241.54) and MA_10D (235.91) and was challenging the MA_20D (235.67), though it remained constrained by the MA_30D (237.59). This marks a break in the short-term downtrend, signaling entry into a recovery or reversal attempt phase.

- • Moving Average Crossover Signal: During the data period, MA_5D remained below MA_20D from late November through most of December, maintaining a bearish state. Around 2026-01-09, MA_5D (237.03) began ascending towards MA_20D (235.08), forming a potential golden cross setup by 2026-01-12. This is a data signal for strengthening short-term momentum.

- • Market Phase Inference:

- • Earlier Phase (2025-11-13 to 2025-12-19): Combining consecutive new lows (from 245.93 to 232.01), deeply oversold RSI (low of 21.35), and panic selling on key days (e.g., 2025-11-24), this aligns with the Wyckoff concepts of "Panic Selling" and subsequent "Secondary Test". The market was in the "Accumulation Phase" at the end of the decline.

- • Recent Phase (2026-01-02 to 2026-01-12): Following the secondary test low (226.10 on 2026-01-02), there were consecutive high-volume rallies with significant gains (+12.99%), breaking above the short-term downtrend line and moving average resistance. This matches the initial characteristics of a "Demand-driven Markup" phase following the completion of accumulation. The market is attempting to transition from "Accumulation" to "Markup".

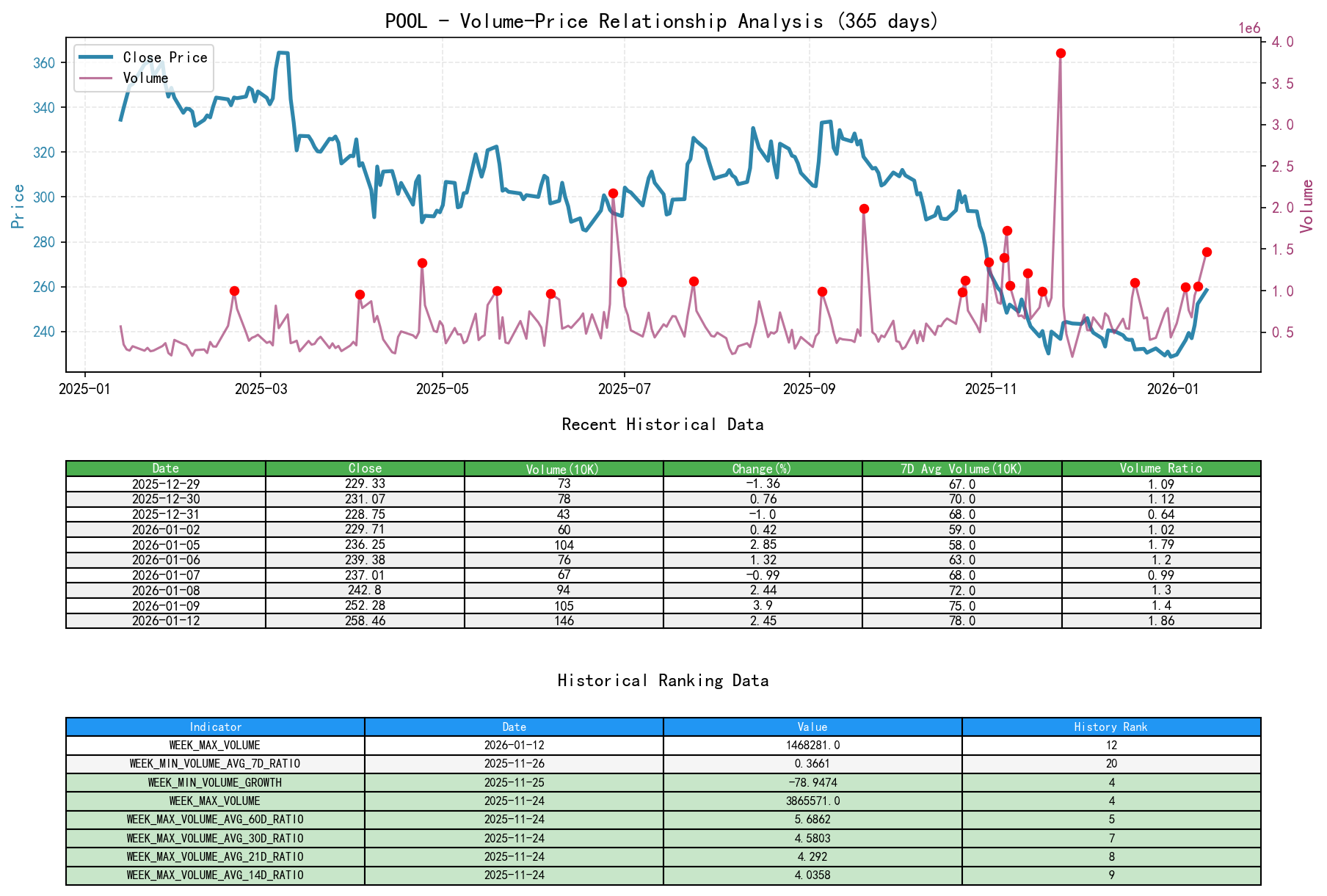

II. Volume-Price Relationship and Supply-Demand Dynamics

As of January 12, 2026, the subject POOL had an opening price of 256.78, a closing price of 258.46, a daily volume of 1,468,281, a daily change of +2.45%, a daily volume of 1,468,281, a 7-day average volume of 788,800.86, and a 7-day volume ratio of 1.86.

- • Key Day Analysis (Based on Wyckoff Principles):

- 1. Panic Selling Day (2025-11-24): Price fell (-1.36%), but volume surged to 3,865,571 shares, an increase of 322.79% from the previous day. The

VOLUME_AVG_7D_RATIOwas as high as 4.28. According to historical rankings, the volume itself ranked as the 4th highest in nearly a decade, and the volume growth rate ranked 9th. This is a classic "Panic Selling" signal, indicating a concentrated release of supply (selling pressure) under extreme sentiment. - 2. Absorption/Support Day (2025-11-25): The day after the panic, the price rebounded (+3.03%) on significantly reduced volume (-78.95% shrinkage, historically ranking 4th lowest shrinkage rate), closing near the high. This indicates supply exhaustion post-panic, where minimal demand pushed prices higher, preliminarily validating the panic low.

- 3. Supply Test Day (2025-12-19): After a consolidation period, another high-volume decline occurred (-1.84%), with volume at 1,100,687 shares (

VOLUME_AVG_60D_RATIO=1.48). This was a "Secondary Test" of the earlier panic low. Despite the decline, volume was far lower than the panic levels of November 24th, suggesting supply was not as overwhelming, indicating a potentially successful test. - 4. Demand-Driven Breakout Days (2026-01-05, 01-09, 01-12): Price initiated rallies with significantly elevated volume.

- • 01-05: Gain of +2.85%, volume 1,044,582 shares (

VOLUME_AVG_14D_RATIO=1.63). - • 01-09: Strong gain of +3.90%, volume 1,050,486 shares (

VOLUME_AVG_30D_RATIO=1.62), reaching a new high for the phase. - • 01-12: Gain of +2.45%, volume surged to 1,468,281 shares, with

VOLUME_AVG_14D_RATIOas high as 1.99. This volume ranks 12th historically in nearly a decade. This is a classic "rally on expanding volume", confirming strong demand effectively absorbing prior supply.

- • 01-05: Gain of +2.85%, volume 1,044,582 shares (

- 1. Panic Selling Day (2025-11-24): Price fell (-1.36%), but volume surged to 3,865,571 shares, an increase of 322.79% from the previous day. The

- • Supply-Demand Dynamic Conclusion:

The data clearly illustrates a complete Wyckoff bottom structure: from "Concentrated Supply Release (Panic)" -> "Supply Exhaustion Test" -> "Strong Demand Return". The recent rally has been effectively supported by volume. The supply-demand relationship has shifted from oversupply to demand exceeding supply.

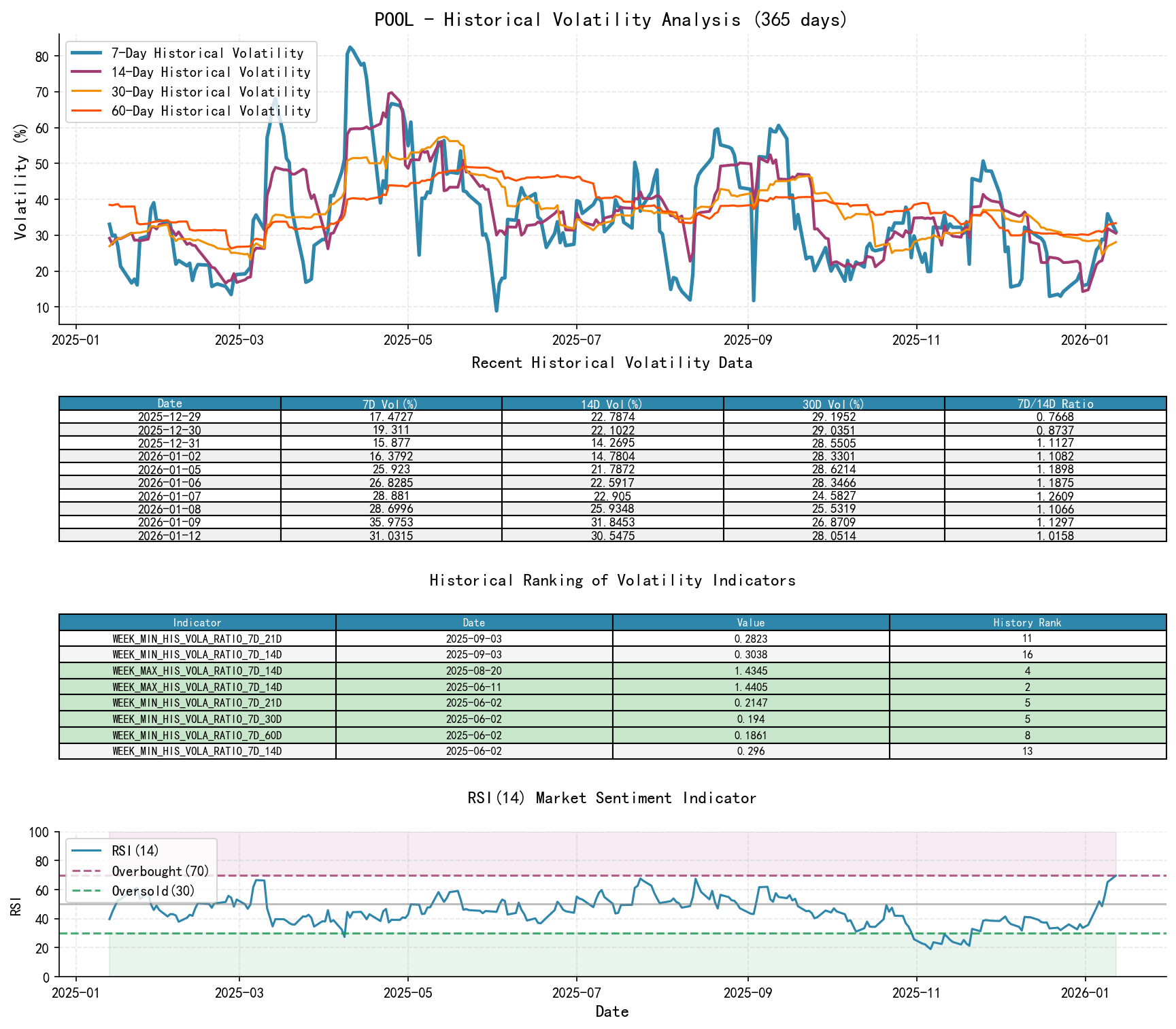

III. Volatility and Market Sentiment

As of January 12, 2026, the subject POOL had an opening price of 256.78, a 7-day intraday volatility of 0.37, a 7-day intraday volatility ratio of 1.33, a 7-day historical volatility of 0.31, a 7-day historical volatility ratio of 1.02, and an RSI of 69.65.

- • Volatility Levels:

- • During the decline and base-building period (Nov-Dec), short-term historical volatility (

HIS_VOLA_7D,HIS_VOLA_14D) and Parkinson volatility (PARKINSON_VOL_7D) were at moderately high levels (0.3-0.45). - • Key Signal: During the consolidation/basing period from 2025-12-05 to 2026-01-02, short-term volatility (

HIS_VOLA_7D) repeatedly dropped to extremely low levels (minimum 0.1555), significantly below long-term volatility (HIS_VOLA_RATIO_7D_60Das low as 0.43). According to historical rankings, some intraday volatility (PARKINSON_VOL_7D) also reached cyclical lows. This aligns with the characteristic "Volatility Contraction" at the end of the Wyckoff Accumulation phase—market sentiment shifts from panic to apathy, accumulating energy for a subsequent directional breakout. - • Breakout Period Volatility: Following the rally initiation on 2026-01-05, short-term volatility (

HIS_VOLA_7D,PARKINSON_VOL_7D) quickly recovered, withPARKINSON_RATIO_7D_60Drising to 1.19, indicating reignited market activity and sentiment.

- • During the decline and base-building period (Nov-Dec), short-term historical volatility (

- • RSI Sentiment Indicator:

- • On 2025-11-20,

RSI_14reached a deeply oversold value of 21.35, ranking as the 10th lowest in the data cycle, verifying extreme pessimism in market sentiment, corresponding to panic selling. - • Currently (2026-01-12),

RSI_14is at 69.65, entering strong territory but not yet at extreme overbought (>80), indicating ample upward momentum that is not yet overheating.

- • On 2025-11-20,

IV. Relative Strength and Momentum Performance

- • Momentum Trend Reversal:

- • Long-term Momentum:

TTM_12,TTM_24,TTM_36returns are deeply negative (-20% to -42%), indicating severe weakness over the past 1-3 years. - • Recent Momentum Reversal: The key pivot occurred in 2026. The

YTDreturn reversed strongly from -32.91% on 2025-12-31 to +12.99% on 2026-01-12. BothMTD_RETURN(+12.99%) andWTD_RETURN(+9.40%) show strong positive momentum.

- • Long-term Momentum:

- • Conclusion: POOL's short and medium-term momentum has undergone a fundamental reversal, shifting from long-term weakness to short-term strength. This momentum strengthening is highly consistent with the "demand return" conclusion from volume-price analysis and the "breaking moving averages" conclusion from trend analysis, forming multiple confirmations.

V. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff events and volume-price data, large investor intent can be inferred:

- 1. Who was buying during the "Massive Selling" on November 24th? During retail panic selling, massive volume necessarily corresponds to equally large buying. The data indicates that large capital was actively absorbing shares at panic prices. This is typical "smart money" accumulation behavior.

- 2. Who was dominating the "Low-Volume Testing and Consolidation" in December? Narrow price consolidation with shrinking volume suggests large investors had completed initial accumulation at lower levels, entering a phase of "re-testing" and "shaking out", aiming to cleanse weak holders and confirm support. Floating supply diminished.

- 3. Who is driving the "High-Volume Rally" in early January? Sustained high volume during the breakout of key resistance indicates that the large investors who accumulated earlier have begun actively marking up the price, while also attracting trend followers, creating a snowball effect in demand. This is a marker of the shift from "accumulation" to "markup".

Comprehensive Assessment of Large Investor Behavior: The data clearly depicts the smart money's complete process: "Absorbing during Panic Selling" -> "Shaking out during Consolidation Testing" -> "Initiating during High-Volume Markup". Currently, it is in the early stage of the markup phase.

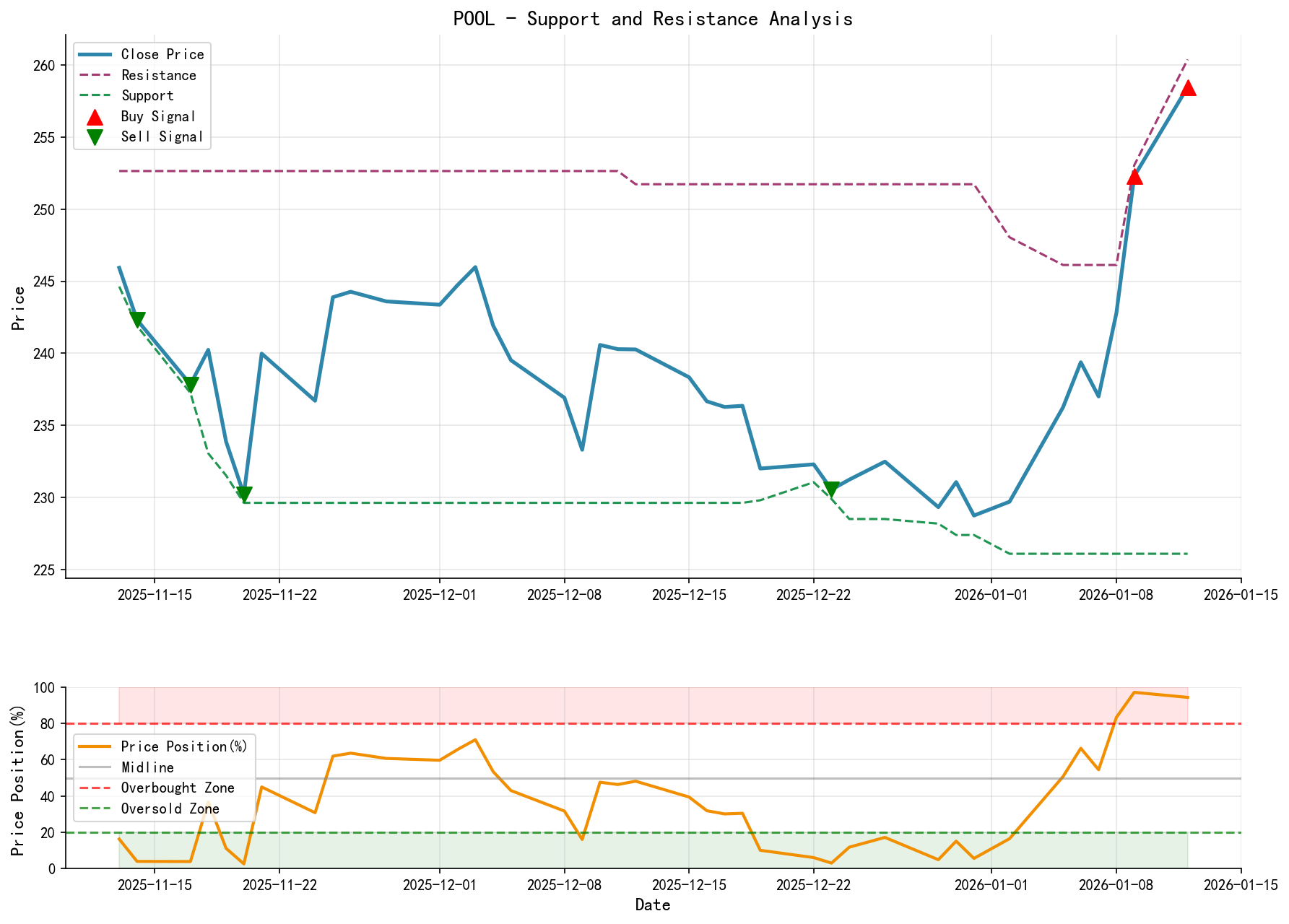

VI. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Strong Support Zone: 226.10 - 232.00. This area comprises the recent panic low (226.10) and secondary test low (232.01), serving as the starting point for the current rally and the main line of demand.

- • First Resistance/Target Zone: 260.00 - 265.00. This is near the 2026-01-12 high (260.38) and also a minor congestion area from the prior downtrend.

- • Core Resistance Zone: 275.00 - 283.00. This is the breakdown point from the previous decline, corresponding to the long-term pressure area of MA_30D and MA_60D.

- • Upper Resistance: The 300.00 psychological level and above, corresponding to long-term moving average resistance.

- • Comprehensive Wyckoff Trading Signals:

- • Current Signal: Bullish. The market has shown a clear bottom structure (SOW -> LPS -> SOS), completed the initial JOC (Jump Over Creek) breakout, and entered a demand-driven markup phase.

- • Operational Suggestions:

- • Long Strategy: Consider looking for entry opportunities if the price pulls back to the 240.00 - 245.00 area (short-term moving average support zone).

- • Stop-Loss Placement: Should be set below the key support zone, e.g., 225.00. A break below this level would necessitate re-evaluation of the bottom structure hypothesis.

- • Initial Target: 260.00 - 265.00.

- • Adding to Position/Holding Validation: If, after reaching the 260-265 zone, there is a low-volume pullback followed by another high-volume breakout to new highs, the uptrend is likely sustainable, with targets extending to the 275-283 zone.

- • Future Key Validation Points:

- 1. Bullish Failure Signal: Price falls back below 240 on high volume and fails to recover quickly. This would indicate a failed breakout, with demand unable to hold ground.

- 2. Bullish Confirmation Signal: Price consolidates with low volume (low volatility pullback) above current levels, followed by a new high on expanding volume. This is a sign of a healthy uptrend.

- 3. Trend Upgrade Signal: Price successfully breaks through and establishes itself above the 275-283 core resistance zone. At that point, the long-term trend would be expected to reverse completely.

Disclaimer: All content in this report is based on objective analysis of the provided historical data and Wyckoff principles and does not constitute any investment advice. Markets involve risks; invest with caution.

Thank you for your attention! Wyckoff Volume-Price Market Interpretations are released daily at 8:00 AM before market open. Please feel free to comment and share; your recognition is vital. Let's work together to see the market signals clearly.

Member discussion: