POLUSDT Quantitative Analysis Report (Based on the Wyckoff Method)

Product Code: POLUSDT

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Time: 2026-01-13

I. Trend Analysis and Market Phase Identification

As of January 12, 2026, for the subject POLUSDT: Opening Price 0.16, Closing Price 0.15, 5-Day MA 0.15, 10-Day MA 0.14, 20-Day MA 0.12, Daily Change -6.21%, Weekly Change 23.20%, Monthly Change 53.23%, Quarterly Change 53.23%, Yearly Change 53.23%.

Data Inference and Observations:

- 1. Moving Average Alignment: Throughout the observation period (2025-11-13 to 2025-12-31), the price (CLOSE) consistently traded below all key moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), exhibiting a perfect bearish alignment, confirming a long-term downtrend. The MA_60D declined continuously from 0.210 to 0.135, defining a strong descending channel.

- 2. Trend Reversal Signal: A structural shift occurred entering January 2026. Starting from 2026-01-02, the price broke strongly above the MA_5D and MA_10D, leading the MA_5D to cross above the MA_20D on 01-05 (MA_5D: 0.1115 > MA_20D: 0.1079), issuing the first technical signal for a short-term trend reversal. As of 01-12, the MA_5D is now above the MA_20D, with the short-term moving average system (5/10/20-day) showing nascent bullish alignment, although the price remains suppressed by the MA_60D (0.1260).

- 3. Price Action and Market Phase:

- • 2025-11-13 to 2025-12-31: The market was in a clear downtrend, accompanied by multiple panic selling episodes. A landmark event was on 2025-12-01, where the price plunged -9.86% with a surge in volume of 310.24% (

VOLUME_GROWTH), recording the second-highest daily gain in nearly a decade (HISTORY_RANK: 2), consistent with the characteristics of Panic Selling in Wyckoff theory. - • 2026-01-01 to 2026-01-10: The market entered a phase of strong rebound / potential markup following accumulation. The price rose significantly and consecutively from absolute lows (0.1005), especially on 01-09 and 01-10 with gains of 14.64% and 13.93% respectively, accompanied by record-breaking high volumes (Volume Historical Rank #1 and #5). This is a classic manifestation of demand (buying) completely overwhelming supply (selling).

- • 2026-01-11 to 2026-01-12: After hitting a high of 0.1866, the price corrected for two consecutive days, with volume remaining high while the price fell. This aligns with the initial characteristics of Distribution or a Secondary Test, where large investors may be supplying inventory near resistance levels.

- • 2025-11-13 to 2025-12-31: The market was in a clear downtrend, accompanied by multiple panic selling episodes. A landmark event was on 2025-12-01, where the price plunged -9.86% with a surge in volume of 310.24% (

Wyckoff Phase Inference: The market likely completed a full "Panic Selling - Automatic Rally - Secondary Test - Accumulation" bottoming area (December 2025) and entered a rapid markup phase in early January 2026. Currently (01-12), it is likely in a Distribution or Shakeout Test phase following the recent massive gains.

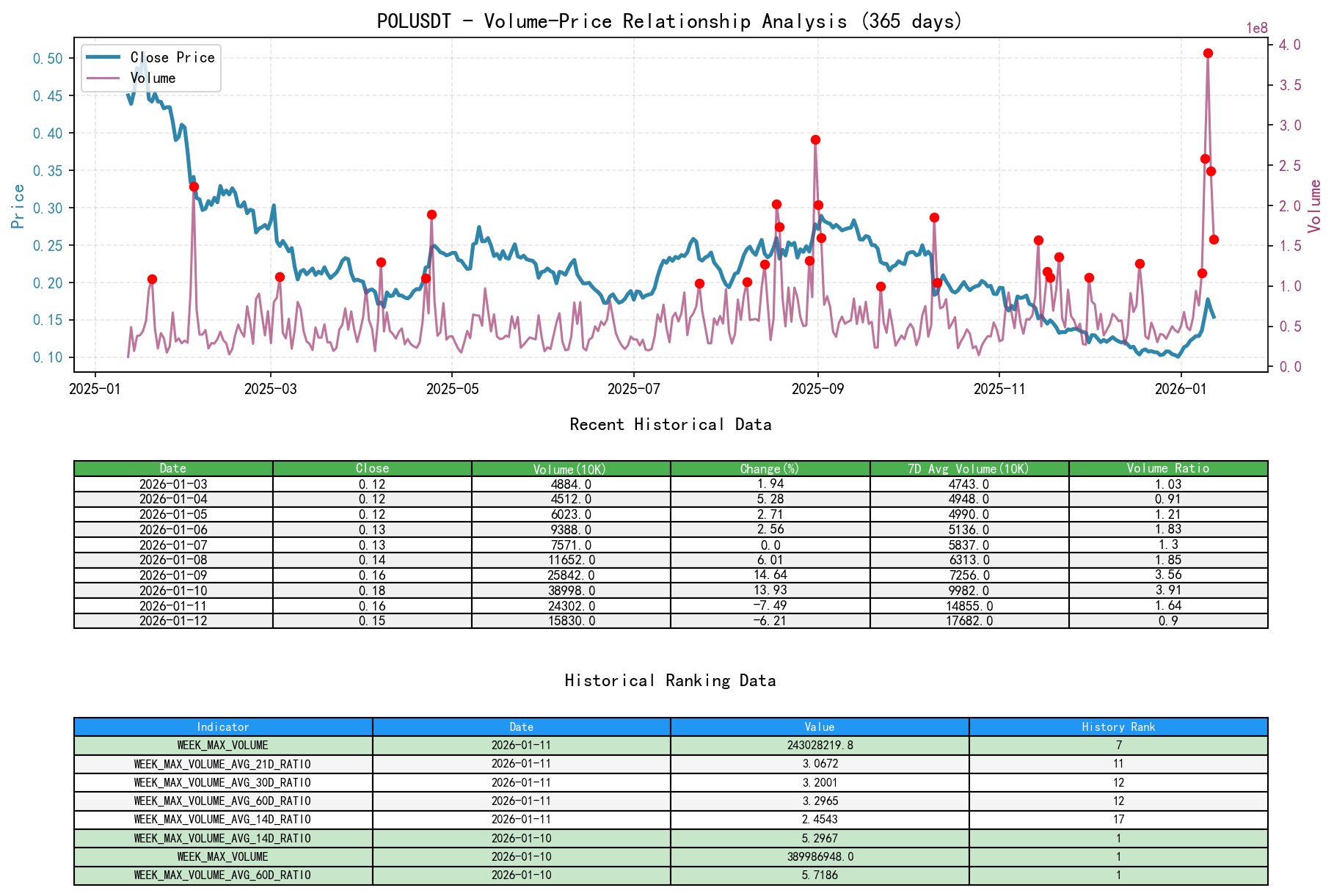

II. Volume-Price Relationship and Supply-Demand Dynamics

As of January 12, 2026, for the subject POLUSDT: Opening Price 0.16, Closing Price 0.15, Volume 158302487.40, Daily Change -6.21%, Volume 158302487.40, 7-Day Average Volume 176826382.37, 7-Day Volume Ratio 0.90.

Core Alpha Signal Extraction:

- 1. Panic Selling and Demand Entry (2025-12-01): A price collapse (-9.86%) accompanied by a volume spike (

VOLUME_AVG_7D_RATIO: 2.10) signifies a clear supply-dominated panic day. However, the price did not make new lows in the following sessions, and high-volume up bars appeared at low levels (e.g., 12-02), suggesting significant buying (demand) was absorbing supply below panic prices, indicative of potential Wyckoff "Last Point of Support (SCL)" formation. - 2. Demand Explosion and Trend Initiation (2026-01-08 to 01-10): This is the most critical supply-demand shift point in the cycle.

- • 01-09: Price surged 14.64% with volume of 258.4M, and the

VOLUME_AVG_14D_RATIOreached a high of 4.46 (Historical Rank #3). High-volume advance, indicating extremely strong demand. - • 01-10: Price rose another 13.93% with a record-breaking volume of 389.99M (

HISTORY_RANK: 1), and theVOLUME_AVG_21D_RATIOsoared to 6.24 (Historical Rank #1). This is the classic signature of a Buying Climax, marking a peak in short-term sentiment.

- • 01-09: Price surged 14.64% with volume of 258.4M, and the

- 3. Supply Re-emergence and Distribution Signs (2026-01-11 to 01-12):

- • 01-11: Price rallied then reversed to close down (-7.49%), with volume still very high at 243.03M (Historical Rank #7). High-volume stalling/down day at highs, indicating supply (profit-taking) began to appear in force, overwhelming demand.

- • 01-12: Price continued to decline (-6.21%) with volume of 158.30M. Although lower than the previous two days, the

VOLUME_AVG_7D_RATIO(0.90) shows volume remains significantly above recent average levels. This signals continuing supply.

Supply-Demand Regime Conclusion: Supply and demand forces reversed violently within a short period. The demand surge (smart money building/ markup) in early January 2026 climaxed on 01-10 and was quickly replaced by stronger supply. The current market is supply-dominated. Subsequent observation is needed to see if a "low-volume pullback" occurs to verify whether demand is still absorbing stealthily.

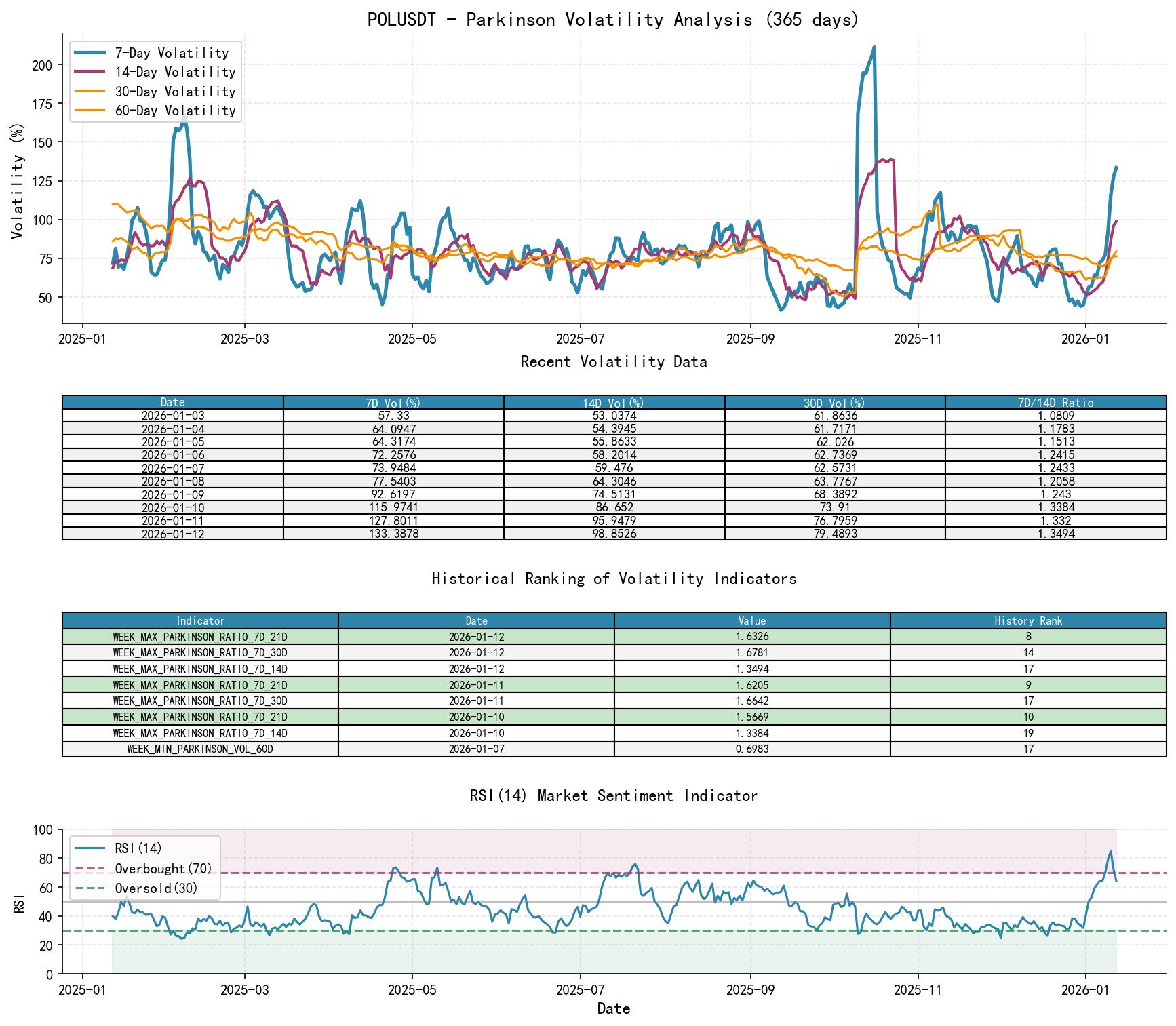

III. Volatility and Market Sentiment

As of January 12, 2026, for the subject POLUSDT: Opening Price 0.16, 7-Day Intraday Volatility 1.33, 7-Day Intraday Volatility Ratio 1.35, 7-Day Historical Volatility 1.63, 7-Day Historical Volatility Ratio 1.37, RSI 64.26.

Data Inference and Sentiment Extremum Identification:

- 1. Volatility Spike: Short-term volatility (

HIS_VOLA_7D) reached 1.6301 on 01-12, ranking #12 highest in nearly a decade. The volatility structure is severely distorted:HIS_VOLA_RATIO_7D_60D(1.898) ranks #12,HIS_VOLA_RATIO_7D_30D(1.678) ranks #8. This indicates short-term volatility far exceeds long-term normal levels, placing the market in a high-stress, high-emotional state. - 2. Sentiment Extremes and Reversals: RSI_14 is a direct measure of sentiment.

- • Extreme Oversold: On 2025-12-01, RSI dropped to 24.61 (Historical Rank #3 lowest), confirming extreme market pessimism, aligning with "Panic Selling".

- • Extreme Overbought: On 2026-01-10, RSI soared to 84.80 (Historical Rank #1 highest), indicating market sentiment reached a frenzied state in the short term, a typical overbought climax, laying the groundwork for a trend reversal. By 01-12, RSI has retreated to 64.26, showing sentiment cooling.

- 3. Volatility Ratio Warnings: Multiple cross-period Parkinson volatility ratios (e.g.,

PARKINSON_RATIO_7D_60D) were at historically high levels (>1.75, high ranking) on 01-12, consistent with the conclusion from historical volatility ratios. Together, they show the market's volatility structure has severely deviated from a steady state, often presaging significant trend changes or sharp corrections.

Sentiment Cycle Conclusion: Within just a month and a half, the market completed a full emotional cycle from "extreme pessimism" (RSI historical lows) to "extreme optimism" (RSI historical highs). Current volatility indicators are at historically high levels, showing the market is receding from its frenzied state into a high-volatility distribution or correction phase.

IV. Relative Strength and Momentum Performance

Multi-Period Momentum Analysis:

- 1. Short-Term Momentum (Explosive):

WTD_RETURNandMTD_RETURNreached an astonishing 53.55% and 76.62% respectively on 01-10, showing extremely strong short-term momentum. However, by 01-12,MTD_RETURNhad retreated to 53.23%, indicating significant decay in short-term upward momentum. - 2. Medium-Term Momentum (Turning Positive):

QTD_RETURNrapidly recovered from around -55% at the end of 2025 to +53.23% on 01-12, achieving a V-shaped reversal at the quarterly level. Medium-term momentum has turned positive. - 3. Long-Term Momentum (Still Weak): Although

YTD(based on 2026) is +53.23%, the longer-termTTM_12return remains -65.81%. This indicates that despite the powerful recent rebound, the long-term downtrend has not yet been technically confirmed as reversed. The price still needs to overcome more long-term moving average resistance.

Momentum Verification: Explosive short-term momentum resonated with record volume and extreme RSI, validating the existence of the "Buying Climax". The rapid decay of momentum (negative returns on 01-11, 01-12) synchronized with the high-volume decline from highs, verifying that the uptrend faces substantial supply pressure.

V. Large Investor (Smart Money) Behavior Identification

Operation Intent Inference Based on Wyckoff Events:

- 1. Accumulation: During the panic decline (e.g., 12-01) and low-level consolidation in December 2025, patterns of "price down, volume up" followed by "price stabilizing, volume contracting" emerged, suggesting organized capital was quietly absorbing inventory from retail panic selling at low levels. This is typical institutional accumulation behavior.

- 2. Markup & Buying Climax: The consecutive massive-volume surges in early January 2026 are typical markup actions following accumulation. The historically extreme volume and gains on 01-09 and 01-10 are markers of dominant capital marking up prices to attract market followers (public frenzy buying). Smart money achieved rapid floating profits during this process. At this point, large investors are leveraging market frenzy to gradually distribute inventory to the chasing public.

- 3. Distribution: The high-volume stalling/decline on 01-11 and 01-12 is a textbook Wyckoff distribution phase signal. Huge volume indicates active trading, but the inability of prices to advance and their subsequent decline shows that, within this price range, the supply (selling) willingness of large investors (early low-price buyers) exceeds the demand (buying) willingness of the public. Smart money is locking in profits.

- 4. Current Behavior Judgment: The behavior of large investors on 01-12 has shifted from "markup" to "distribution testing". They are testing market support at higher levels and may use high volatility for shakeouts, preparing for the next step (continued distribution or another markup). "Who is taking the other side of the huge volume?" – On 01-10 and earlier, it was the following public. On 01-11 and later, it was latecomers still dreaming of trend continuation. "Who is selling into the huge volume?" – It is the smart money that accumulated at low levels and now holds substantial profits.

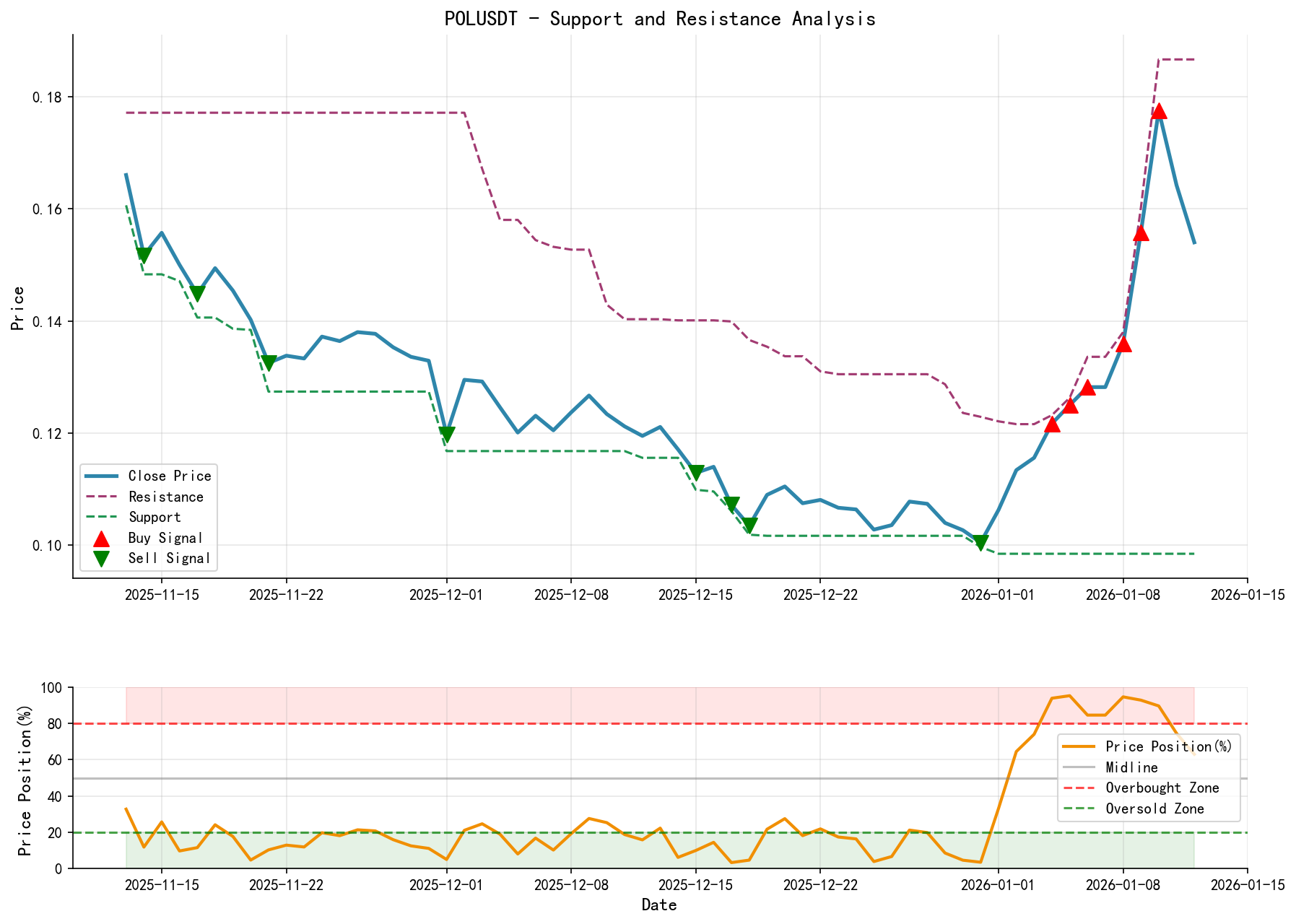

VI. Support/Resistance Level Analysis and Trading Signals

Key Price Level Identification:

- • Primary Support Zone: Based on historical lows, the 0.100 - 0.103 area is a strong support band formed by multiple tests in December 2025 (panic selling zone), and is also the starting point of this rebound, constituting the ultimate support.

- • Secondary Support / Demand Test Zone: The 0.135 - 0.140 area is the key platform broken in early January, also near the MA_30D, and should be regarded as the recent bull-bear dividing line and a retest/buying area.

- • Primary Resistance / Distribution Zone: The 0.160 - 0.186 area is the massive-volume trading zone formed around 01-10 to 01-11, accumulating significant trapped longs and profit-takers, making it the current core supply area (resistance).

- • Near-Term Resistance: The 01-12 closing price around 0.1540 itself constitutes the first level of resistance.

Comprehensive Trading Signals and Strategy Based on Wyckoff Theory:

- 1. Comprehensive Judgment: Following an extreme sentiment-driven violent rebound, the market is showing stalling and decline at historical volume levels, fitting the "Buying Climax - Distribution" model. The short-term trend is bearish, with the probability of correction far exceeding that of immediate further advance.

- 2. Operational Recommendation (Bearish Bias):

- • Signal Type: Bearish / Sell on rallies.

- • Potential Entry Area: On a price rebound to the 0.160 - 0.165 area (lower bound of the core distribution zone), if signs of weakening momentum and relatively contracting volume appear, it could be considered a selling opportunity.

- • Stop Loss Level: Should be placed above 0.1866 (recent high) to account for false breakout risks.

- • Target Zone: First target looks towards the secondary support 0.135 - 0.140 zone; if broken, a retest of the primary support 0.100 - 0.103 is possible.

- 3. Bullish Defense Scenario and Future Validation Points:

- • Bearish Thesis Invalidation Condition: If, in the next few sessions, the price can stabilize above 0.150 on low volume and subsequently break above 0.165 on high volume, it would indicate supply is being absorbed, distribution is not occurring, and it may develop into a continuation pattern. The bearish position should then be abandoned.

- • Key Validation Points:

- • Supply Test: Observe price action in the 0.135 - 0.140 support zone. If, after falling to this zone, volume contracts significantly (indicating exhaustion of supply), it may provide a swing trading rebound opportunity.

- • Demand Confirmation: Any new advance must be accompanied by effective volume expansion on rising prices, and ideally a closing price firmly above 0.160, to reassess trend continuation potential.

Summary: POLUSDT is currently at a critical inflection window defined by historical extreme data (volume, volatility, RSI). Wyckoff volume-price analysis clearly reveals the smart money behavioral path from "Panic Accumulation" to "Frenzied Markup" to the current "Initial Distribution". Based on the data, the risk-reward ratio favors establishing bearish positions near resistance areas with strict stop losses, while closely monitoring the aforementioned key validation points for dynamic strategy adjustment.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding its accuracy or completeness. Markets involve risks, and investments require caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Daily Wyckoff Volume-Price market interpretations are released promptly at 8:00 AM before the market opens. Your comments and shares are sincerely appreciated and are of utmost importance. Let's work together to see the market signals clearly.

Member discussion: