Understood. Following your instructions, I will write a comprehensive, in-depth quantitative analysis report from the perspective of a quantitative trading researcher proficient in the Wyckoff Method, based on the provided PEPEUSDT data and historical ranking indicators.

Wyckoff Quantitative Analysis Report: PEPEUSDT

Product Code: PEPEUSDT

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

1. Trend Analysis and Market Phase Identification

As of 2026-01-12, the target PEPEUSDT opened at 0.00, closed at 0.00, with moving averages MA_5D 0.00, MA_10D 0.00, MA_20D 0.00, daily change 0.00%, weekly change -17.14%, monthly change +43.92%, quarterly change +43.92%, yearly change +43.92%.

Based on the relationship between price and moving averages (MAs), two main phases can be clearly delineated:

- • Prolonged Downtrend (2025-11-13 to 2025-12-31): During this period, the price (CLOSE) consistently traded below all key moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), forming a standard bearish alignment. The price fluctuated downward from 0.00000542 to a low of 0.00000363 (2025-12-18), a maximum decline of 33%. Long-, medium-, and short-term MAs exhibited bearish divergence, clearly indicating the market was in a primary downtrend.

- • Severe Rebound and Correction Phase (2026-01-01 to 2026-01-12): Entering 2026, the market underwent a reversal. From 2026-01-01 to 01-04, the price surged sharply with extremely high volume (details in Section 2), rapidly breaking through all short-term MAs, and temporarily causing the MA_5D to cross above the MA_20D, forming a short-term golden cross. The price peaked at 0.00000718 (01-04), a rebound of nearly 98% from the late-December low. However, the rally failed to sustain, and the price subsequently retreated amidst similarly high volume. As of 01-12, the price has fallen below the MA_5D and MA_10D but remains above the MA_20D, MA_30D, and MA_60D. The current market structure can be characterized as: a rapid, sharp but unsustainable bear market rally driven by massive volume, currently in a post-rally high-level correction and consolidation phase. Whether the long-term downtrend has reversed remains to be observed.

Wyckoff Market Phase Inference:

- • November-December 2025: Overall exhibited characteristics of "Markdown" and "Panic." Prices declined on shrinking volume followed by an accelerated, high-volume plunge (e.g., 2025-11-21, volume 24 trillion, price -7.40%). RSI entered oversold territory (minimum 25.08, historical rank 18th lowest).

- • Early January 2026: Signs of a "Buying Climax" emerged. The price rose rapidly and steeply on historically extreme volume (see below), with RSI entering severely overbought territory (82.15 on 01-04, historical rank 16th highest), followed immediately by high-volume stagnation and decline. This aligns with the Wyckoff theory's typical pattern of large investors conducting "Distribution" by exploiting public euphoria.

- • Current (01-12): The market may be in a "Secondary Test" or "Weak Rally" phase following distribution, testing underlying support (e.g., MA_20D) and the true demand at this price level.

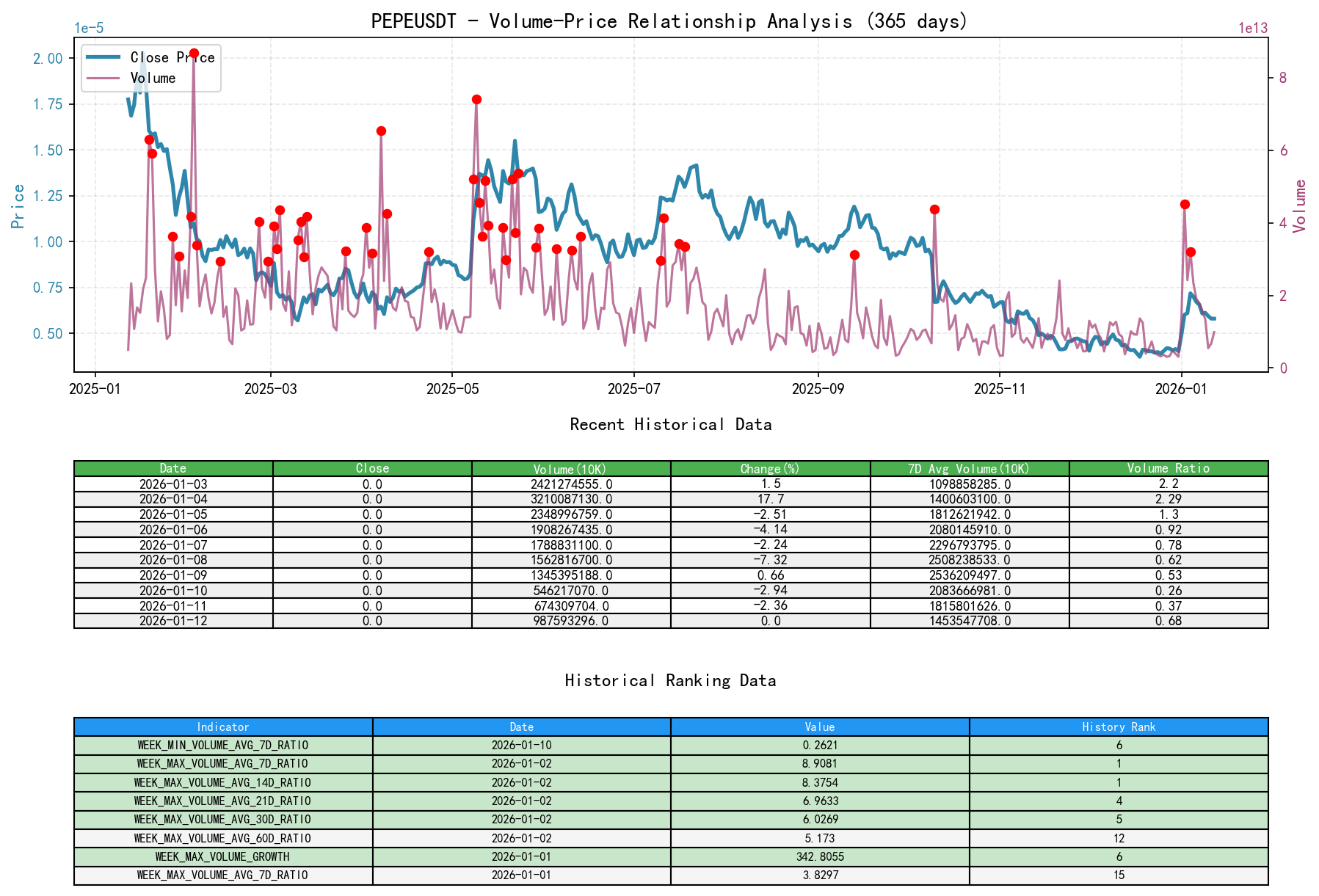

2. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-12, the target PEPEUSDT opened at 0.00, closed at 0.00, volume 9875932964312.00, daily change 0.00%, volume 9875932964312.00, 7-day average volume 14535477084544.57, volume ratio to 7-day average 0.68.

Volume data reveals key inflection points in the shift of market supply and demand forces:

- • Demand-Driven Buying Climax (2026-01-01 to 01-04):

- • 01-01: Price increased by 22.08%. Volume (13.67 trillion) was 3.83 times the 7-day average (

VOLUME_AVG_7D_RATIO), ranking 15th highest in the past 10 years. - • 01-02: Price increased by 22.15%. Volume surged to 45.13 trillion, 8.91 times the 7-day average. Both

VOLUME_AVG_7D_RATIOandVOLUME_AVG_14D_RATIO(8.38x) reached a historic extreme, ranking 1st in the past 10 years. This is clear evidence of extreme, irrational demand influx. - • Alpha Signal: The simultaneous historic extremes (rank #1) in

VOLUME_AVG_7D_RATIOandVOLUME_AVG_14D_RATIO, coupled with the sharp price increase, constitute a strong signal of short-term demand influx. However, it also suggests extreme sentiment, often a precursor to a trend reversal.

- • 01-01: Price increased by 22.08%. Volume (13.67 trillion) was 3.83 times the 7-day average (

- • Supply Emergence and Distribution (2026-01-05 to 01-12):

- • Despite prices turning negative from 01-05 to 01-08 (-2.51%, -4.14%, -2.24%, -7.32%), daily average volume remained at very high levels (over 1.5 trillion per day on average). This "decline on high volume" clearly indicates supply beginning to overwhelm demand, with significant selling pressure emerging.

- • 01-10 and 01-11: Prices continued to drift lower. While volume shrank compared to the previous peak,

VOLUME_AVG_7D_RATIO(0.26, 0.37) shows it remained significantly below the short-term average. However,VOLUME_AVG_14D_RATIO(0.34, 0.42) andVOLUME_AVG_30D_RATIO(0.49, 0.61) indicate volume was still above the medium- and long-term averages. This suggests there was persistent, above-average selling pressure (supply) during the decline, not merely a consolidation on low volume.

- • Early Accumulation Signs (Late December 2025):

- • During the drifting decline from December 15th to 31st, volume continued to shrink. Trading volume on several days reached stage or even historical lows (e.g., December 31st volume of 3.09 trillion was the lowest in the past 10 years, rank #1). This aligns with the Wyckoff characteristics of the "End of Supply" or "Preliminary Support" phase — selling pressure exhaustion with shrinking volume. This provided potential energy reserves for the violent rebound in early January.

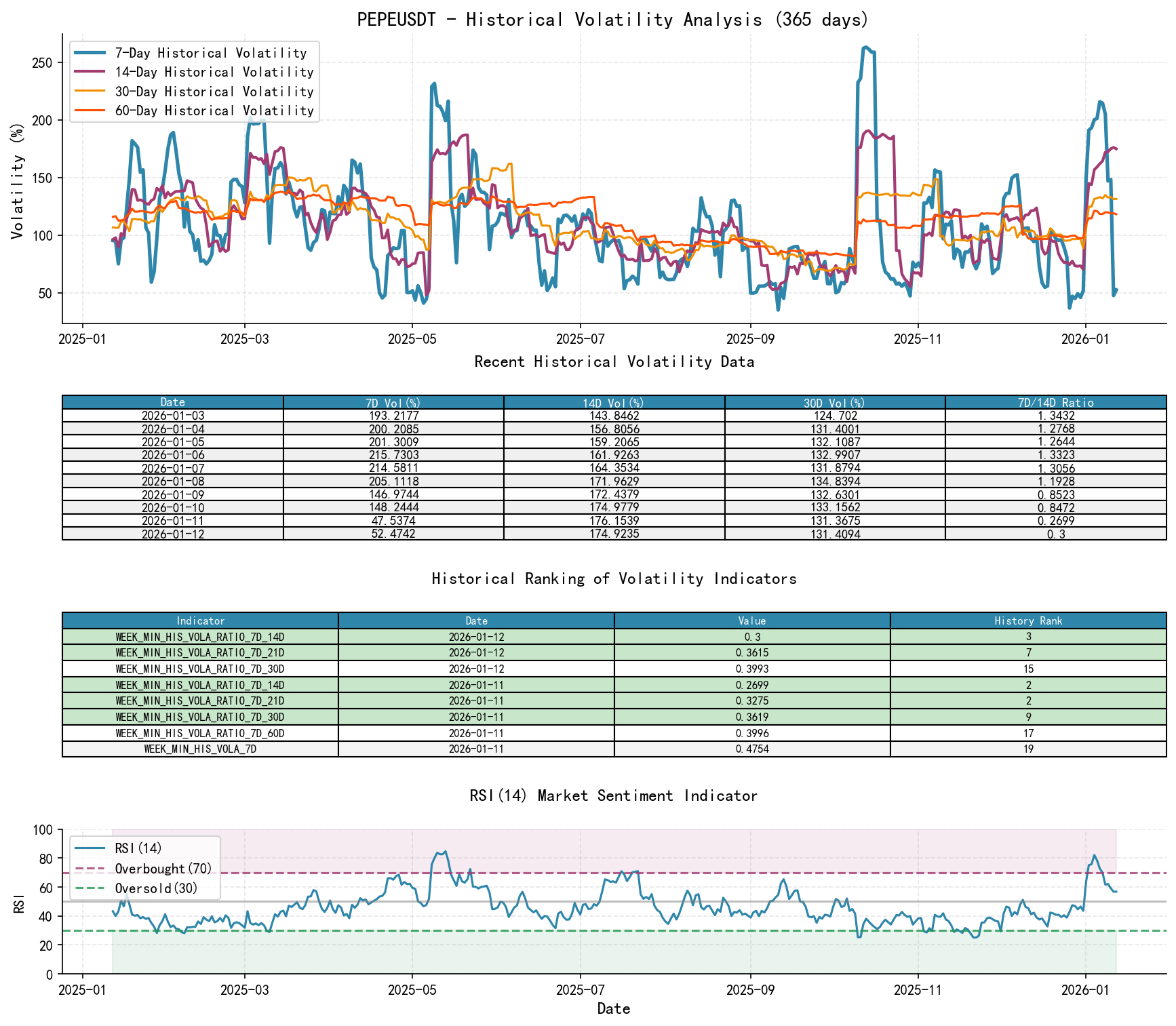

3. Volatility and Market Sentiment

As of 2026-01-12, the target PEPEUSDT opened at 0.00, 7-day intraday volatility 0.92, 7-day intraday volatility ratio 0.75, 7-day historical volatility 0.52, 7-day historical volatility ratio 0.30, RSI 56.84.

Volatility indicators and RSI together depict the violent swing in market sentiment:

- • Volatility Explosion and Contraction:

- • During the early January rebound, short-term volatility spiked sharply.

HIS_VOLA_7Dreached 2.00 on 01-04, far exceedingHIS_VOLA_30D(1.31), with a ratio (HIS_VOLA_RATIO_7D_30D) of 1.53.PARKINSON_VOL_7Dpeaked at 1.62 on 01-06. - • More critically, the volatility structure:

PARKINSON_RATIO_7D_14Dreached 1.47 and 1.48 on 01-06 and 01-07 respectively, ranking 19th and 18th highest in the past 10 years. This confirms that the abnormal amplification of short-term volatility relative to medium-term volatility reached historically extreme levels, quantitatively reflecting a market state of intertwined euphoria and panic. - • As of 01-12,

HIS_VOLA_7D(0.52) has significantly retreated belowHIS_VOLA_14D(1.75) andHIS_VOLA_30D(1.31). The volatility ratios (HIS_VOLA_RATIO_7D_14D0.30, rank 3rd lowest;HIS_VOLA_RATIO_7D_30D0.40, rank 15th lowest) show that short-term volatility has rapidly converged, indicating the market has cooled from extreme sentiment.

- • During the early January rebound, short-term volatility spiked sharply.

- • Sentiment Pendulum:

- • Overbought Confirmation: RSI_14 peaked at 82.15 on 01-04 (historical rank 16th highest), confirming the price increase had entered an extremely overbought zone, providing momentum-based evidence for the rebound top.

- • Oversold Review: During the earlier decline, RSI_14 touched 25.16 and 25.08 on 11-21 and 11-22 respectively (historical ranks 19th and 18th lowest), confirming the deeply oversold state of the market at that time.

4. Relative Strength and Momentum Performance

Momentum indicators reveal a significant "V-shaped" reversal and its subsequent exhaustion:

- • Short-Term Momentum Shift:

MTD_RETURNpeaked at +78.16% on 01-04 but had retreated to +43.92% by 01-12.WTD_RETURNwas +23.58% for the week ending 01-08 but turned to -17.14% for the week ending 01-12. This indicates that short-term upward momentum has completely exhausted and turned negative. - • Long-Term Momentum Remains Weak: Despite the violent rebound,

YTDreturn is +43.92%, but the longer-termTTM_12(past 12 months) remains at -67.32%. This indicates that from a longer-term perspective, the asset is still in a deep downtrend, and the January rebound has not yet reversed the long-term weakness.

5. Large Investor (Smart Money) Behavior Identification

Integrating the above dimensions, the operational path of large participants can be inferred:

- 1. Silent Accumulation/Observation in the Bottom Area (December 2025): During the period of price drift and volume shrinkage to historical lows, smart money may have been conducting small-scale test buying or maintaining a watchful stance, waiting for signals of complete supply exhaustion.

- 2. Creating and Exploiting the "Buying Climax" for Distribution (Early January 2026): This is the core smart money behavior of this market move. They likely established some long positions at the absolute lows in late December/early January, then rapidly marked up the price to create the illusion of a "bull market launch." The historically ranked #1 volume surge attracted massive retail follow-through buying (demand). When prices reached highs and market sentiment became extremely euphoric (RSI overbought, volatility at historical extremes), they began large-scale selling (supply), manifested as price stagnation at highs followed by decline on high volume. The enormous volume on 01-02 included a significant amount of smart money selling being absorbed by retail buyers.

- 3. Current Secondary Distribution and Testing (2026-01-05 to present): During the price retreat from highs, volume remains active (above medium- and long-term averages). This suggests distribution behavior may still be ongoing, with smart money continuing to use any rally to sell remaining holdings. Simultaneously, they are testing market absorption capacity (demand) at the current price level (e.g., around 0.00000580) and the effectiveness of underlying moving average support.

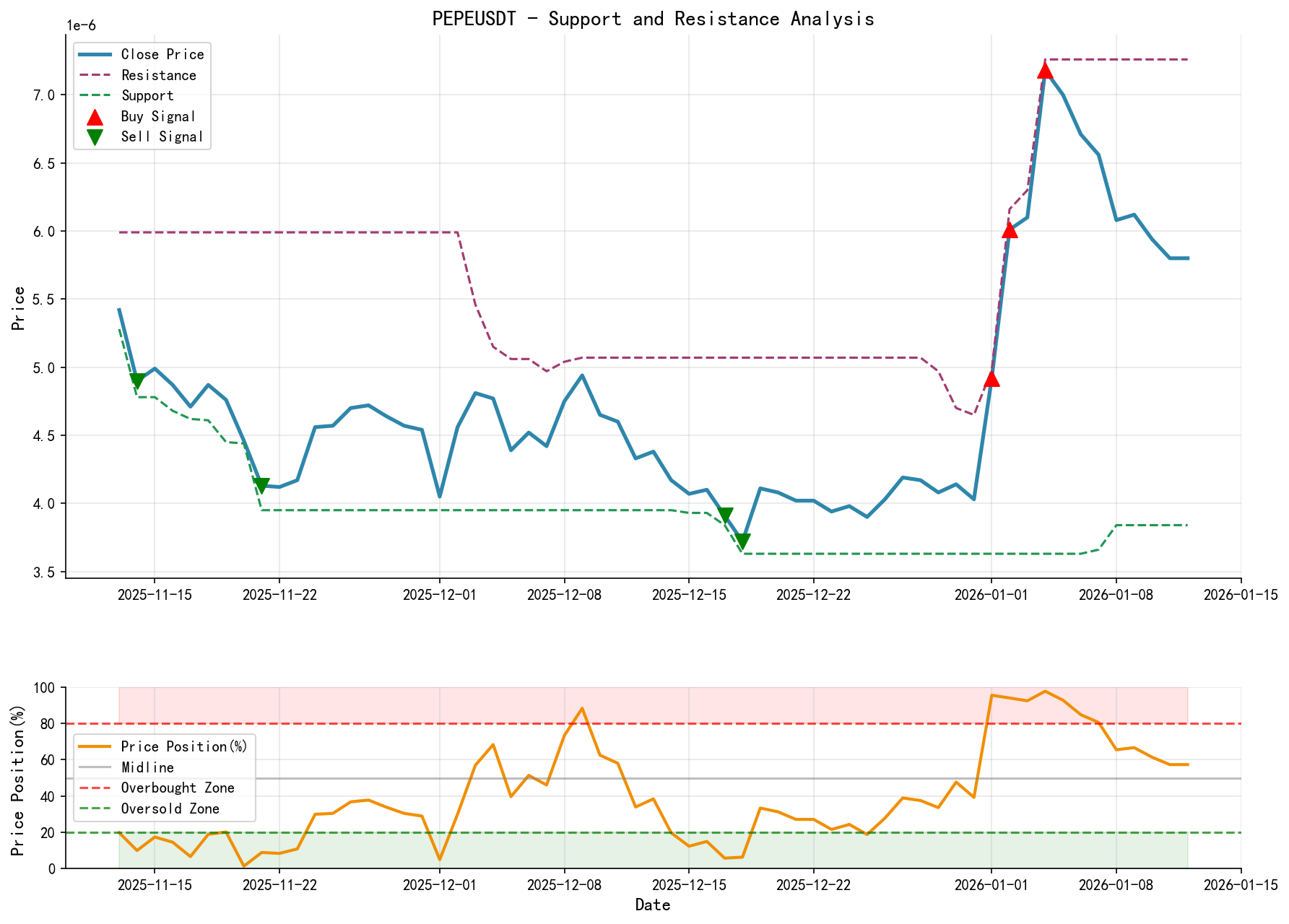

6. Support/Resistance Level Analysis and Trading Signals

- • Key Resistance Levels:

- • R1: 0.00000718 - The peak of this rebound, also the clear upper boundary of the distribution zone. Strong resistance.

- • R2: 0.00000671 / 0.00000610 - Minor peaks formed during the post-rebound correction, constituting secondary resistance.

- • Key Support Levels:

- • S1: 0.00000363 - The cycle low set on 2025-12-18, the last point tested by bears. Strong support.

- • S2: 0.00000405 / 0.00000471 - The consolidation platform from late December 2025 to early January 2026 before the rebound started, and the current areas near MA_20D (0.00000524) and MA_30D (0.00000485).

- • Wyckoff Integrated Trading Signal:

- • Overall Assessment: Bearish/Watchful. The market structure shows a typical "Buying Climax - Distribution" process. The current price is in the correction phase post-distribution, with short-term trend weakening and heavy resistance above.

- • Operational Suggestions:

- • Short Opportunity: If the price rebounds to the 0.00000610 - 0.00000671 resistance zone and shows signs of volume expansion with weak price advancement (stagnation), consider establishing short positions at highs. Stop loss can be placed above 0.00000718.

- • Long Opportunity (Caution Required): A genuine long opportunity requires clear signals of supply drying up and demand re-entering. Focus on price performance when falling to the S2 (0.00000405 - 0.00000485) or even S1 (0.00000363) support zones. It is essential to observe Wyckoff accumulation structures at these supports, such as "strong bullish candles with high volume halting the decline" or "consolidation on low volume followed by renewed advance on high volume," before considering a light long position. At this stage, bottom-fishing carries extremely high risk.

- • Future Validation Points:

- 1. Demand Validation: Can the price show significant and sustained high-volume stabilization or rebound at the S2 or S1 support levels? This is key to judging whether the downtrend has ended.

- 2. Supply Validation: When the price rebounds to R1 or R2, does high-volume stagnation or long upper shadows reappear? This would confirm that distribution is continuing.

- 3. Volatility Validation: If volatility (especially short-term) experiences another historic surge similar to early January, it often signals a new major directional move, which needs to be judged in conjunction with the volume-price structure at that time.

Summary Conclusion: PEPEUSDT experienced a revenge rebound in early January 2026, driven by historically massive volume, following a prolonged decline. However, volume-price, volatility, and momentum analyses strongly suggest this rebound aligns more with the characteristics of the "Buying Climax" and subsequent "Distribution" phases in Wyckoff theory, rather than marking the start of a trend reversal. Large investors likely utilized retail euphoria to complete high-level筹码置换. The current market is in a post-distribution correction period, with short-term technical structure weakening. Traders should prioritize strategies of selling on rallies or await clear signals of demand re-entry at key support levels before making decisions. The market needs time to digest the impact of this massive volatility and re-establish balance.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risk; investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Daily Wyckoff Volume-Price Market Analysis is released promptly at 8:00 before market open. We sincerely appreciate your comments and shares. Your recognition is paramount. Let's work together to see the market signals clearly.

Member discussion: