Please find below the quantitative analysis report prepared based on the NDX data and historical ranking indicators you provided. This report strictly adheres to the principles of Wyckoff volume-price analysis, with all conclusions derived from the data.

NDX (NASDAQ-100 Index) Wyckoff Quantitative Analysis Report

Product Code: NDX

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

Analyst Perspective: Quantitative Trading Researcher proficient in the Wyckoff Method

1. Trend Analysis and Market Phase Identification

As of January 12, 2026, the underlying NDX had an opening price of 25616.81, a closing price of 25787.66, with moving averages: 5-day MA at 25593.66, 10-day MA at 25505.68, 20-day MA at 25392.96. Price change: +0.08%, weekly change: +1.52%, monthly change: +2.13%, quarterly change: +2.13%, yearly change: +2.13%.

Data Derivation and Observations:

- • Moving Average Alignment: As of 2026-01-12, the closing price (25787.664) is above all key moving averages (MA_5D: 25593.66, MA_10D: 25505.68, MA_20D: 25392.96, MA_30D: 25446.11, MA_60D: 25312.76), exhibiting a standard bullish alignment. Since the low of 24054.379 on November 20, the price has successfully reclaimed the 60-day MA, indicating an upward intermediate-term trend.

- • Moving Average Crossovers: During the analysis period, after briefly dipping below the 20-day and 30-day MAs in late November, the 5-day MA formed a golden cross and diverged upward again in early December. Currently, the short-term MA cluster (5-day, 10-day) is operating above the long-term MA cluster (20-day, 30-day, 60-day), providing technical support for the bullish structure.

- • Price Action and Phase Identification: Synthesizing volume-price relationships (detailed in Part 2), the market has undergone the following phases:

- 1. Panic and Accumulation (2025-11-20 to 21): Price experienced a sharp, high-volume decline to the low of 24054, followed by a high-volume rebound. RSI entered oversold territory, aligning with characteristics of panic selling and initial accumulation.

- 2. Markup (2025-11-24 to 12-10): Price broke above the prior downtrend with significant volume expansion, followed by orderly, demand-driven price increases.

- 3. Distribution and Consolidation (2025-12-12 to 12-18): After reaching a local high, the price experienced a high-volume decline (12-12) and a low-volume rebound (12-15), indicating the emergence of supply and active turnover at high levels.

- 4. Secondary Test and New Markup Effort (2025-12-19 to present): A massive volume rebound occurred on December 19 (volume historically ranked 2nd), suggesting large buyer entry. Subsequently, volume contracted during the holiday period with price moving in a narrow range. Entering January, prices have risen modestly, but volume has failed to expand effectively, exhibiting a "rising on low volume" characteristic. This indicates the current markup effort lacks strong demand follow-through, potentially placing the market in the later stages of accumulation or the hesitant initial phase of a markup.

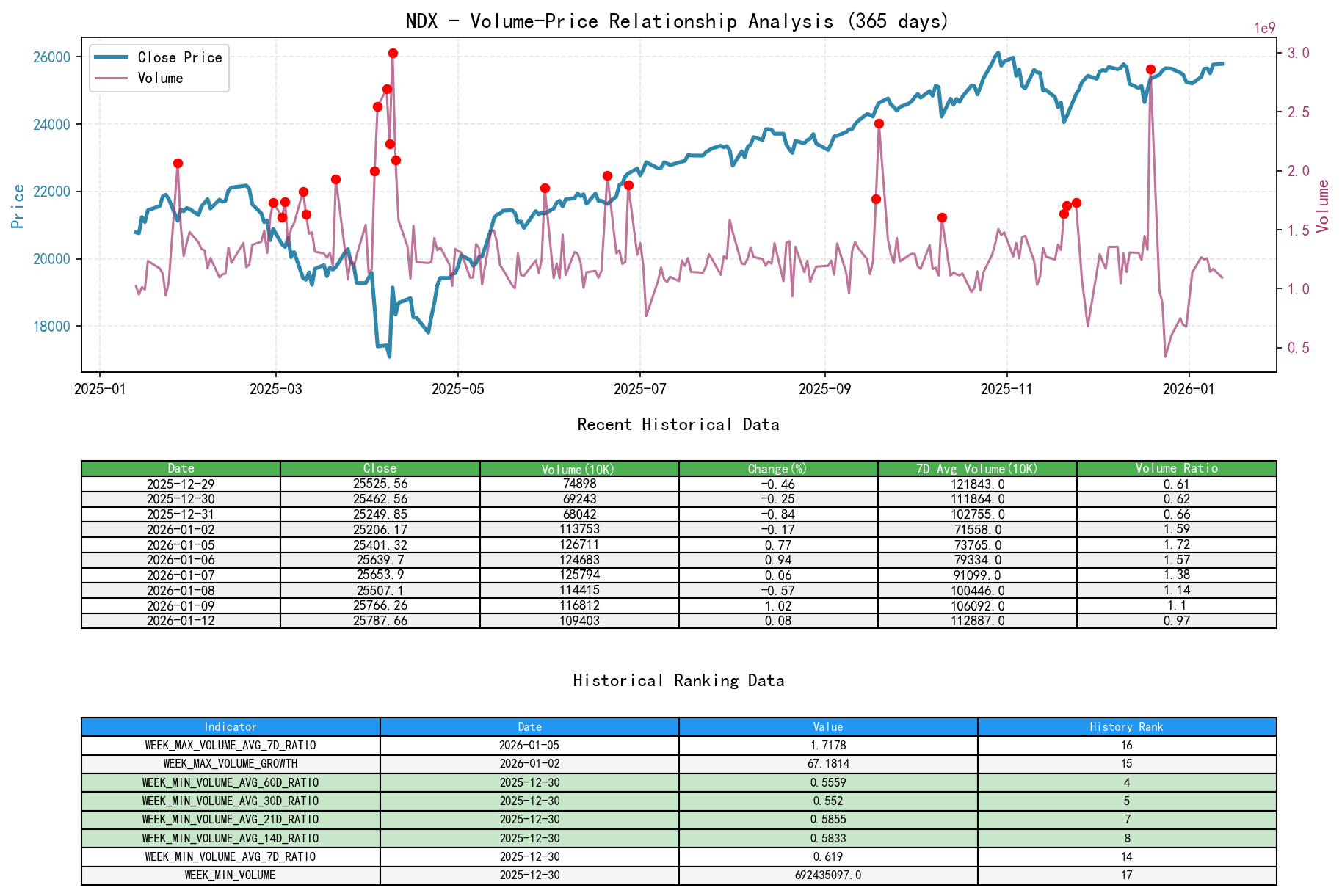

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 12, 2026, the underlying NDX had an opening price of 25616.81, a closing price of 25787.66, volume of 1094036191, price change of +0.08%, volume of 1094036191, 7-day average volume of 1128876851.86, and a 7-day volume ratio of 0.97.

Core Data and Key Day Analysis:

- • Panic Selling (Supply Climax): 2025-11-20, price fell -2.38%, volume surged 23.44%, with

VOLUME_AVG_7D_RATIOas high as 1.32. A clear panic-driven release of supply. - • Automatic Rally and Accumulation Signs: 2025-11-21, price rebounded slightly by 0.77%, with volume remaining high (

VOLUME_AVG_7D_RATIO: 1.28), indicating demand absorbing supply near the panic low. - • Demand-Driven Markup: 2025-11-24, price surged 2.62% with expanding volume (

VOLUME_AVG_14D_RATIO: 1.29), a healthy "price up, volume up" demand signal. - • High-Level Distribution Signal: 2025-12-12, price declined -1.91% with expanding volume (

VOLUME_AVG_14D_RATIO: 1.04), a "price down, volume up" scenario indicating supply overpowering demand at high levels. - • Massive Volume Rebound - Large Demand Intervention: 2025-12-19, price rebounded 1.31%, volume exploded by 115.34%, with

VOLUME_AVG_7D_RATIOreaching 2.21. Historical ranking data shows that the daily volume growth (VOLUME_GROWTH) hit a 10-year high (Rank 1), and the absolute volume (VOLUME) reached a 10-year high (Rank 2). This is an extremely strong demand signal, indicating large capital entered the market aggressively following a pullback. - • Markup Effort with Hesitant Demand: 2026-01-07 to 01-12, prices experienced consecutive small gains, but volume consistently remained below various moving average levels (

VOLUME_AVG_7D_RATIOdeclined from 1.38 to 0.97). This "rising on low volume" indicates the current price increase lacks broad, strong demand support, potentially driven by limited buying interest with declining market participation, making the advance fragile.

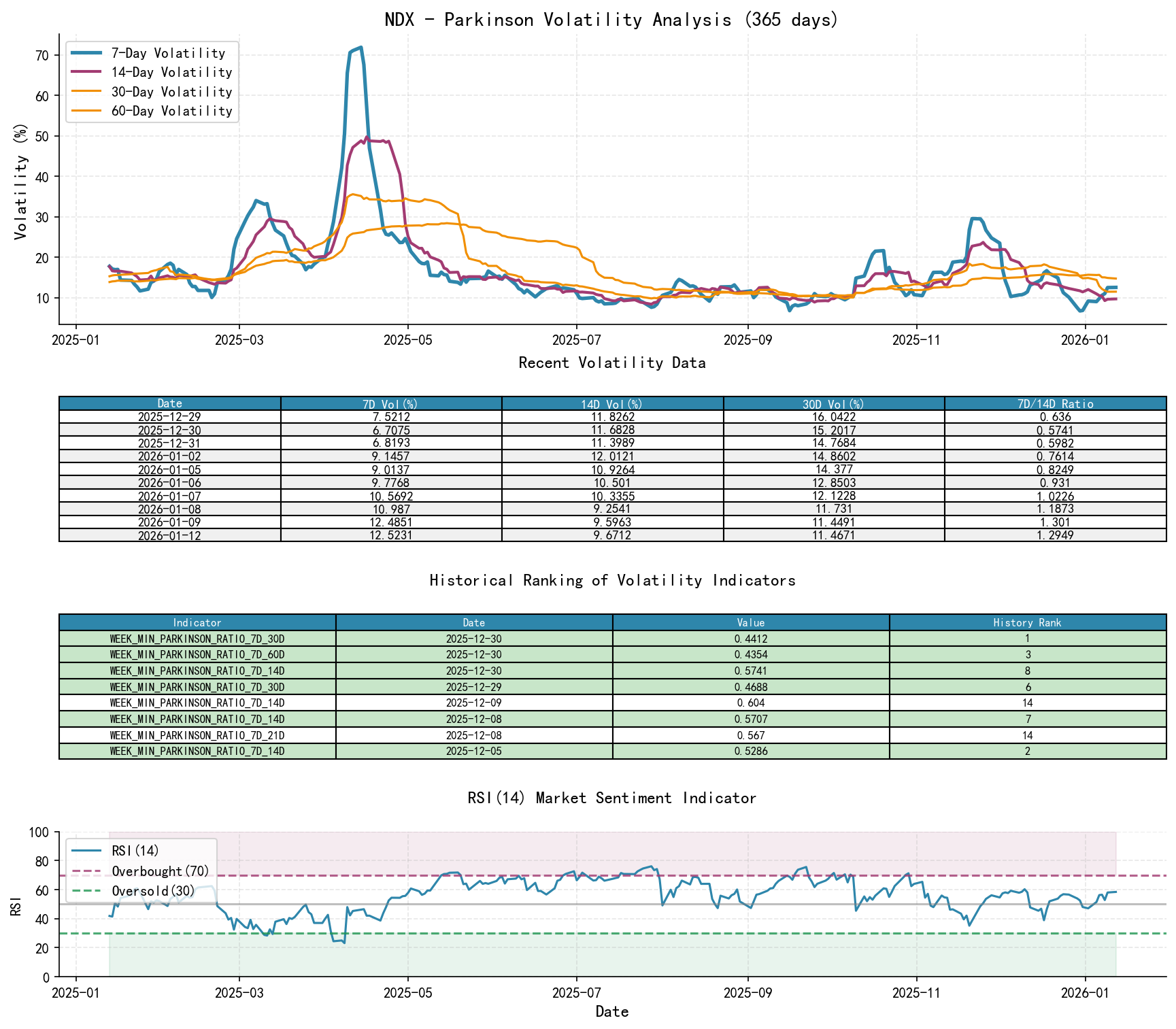

3. Volatility and Market Sentiment

As of January 12, 2026, the underlying NDX had an opening price of 25616.81, with 7-day Parkinson Volatility at 0.13 (7-day ratio: 1.29), 7-day Historical Volatility at 0.12 (7-day ratio: 1.08), and RSI at 58.45.

Data Derivation and Observations:

- • Volatility Level: Current short-term volatility (

HIS_VOLA_7D: 0.1163,PARKINSON_VOL_7D: 0.1252) has retreated significantly from the highs in late November (HIS_VOLA_7D> 0.3,PARKINSON_VOL_7D> 0.29) and is well below mid-to-long-term volatility levels (HIS_VOLA_60D: 0.1990). - • Volatility Ratios:

HIS_VOLA_RATIO_7D_14D(1.078) is slightly above 1, butPARKINSON_RATIO_7D_14D(1.295) is relatively high, indicating intraday volatility has expanded compared to the recent past. However, compared to longer cycles, short-term volatility is at very low levels (HIS_VOLA_RATIO_7D_60D: 0.584,PARKINSON_RATIO_7D_60D: 0.851). Historical rankings show that periods withHIS_VOLA_RATIO_7D_60Dbelow 0.6 have occurred frequently recently (e.g., 12-10, 12-11), which, within the past 10 years, represents periods of abnormally low volatility convergence, suggesting market sentiment has stabilized and lacks momentum for a directional breakout. - • RSI Sentiment Indicator: The current RSI_14 value is 58.45, in the neutral-to-strong zone, neither overbought nor oversold. RSI dipped to the oversold zone at 35.18 in late November, corresponding to the panic selling, and did not enter the overbought zone above 70 during the December rebound high, indicating relatively rational overall sentiment.

4. Relative Strength and Momentum Performance

Data Derivation and Observations:

- • Short-Term Momentum (WTD): +1.52%, positive performance, but the weekly price action shows signs of upward fatigue (see volume-price relationship).

- • Mid-Term Momentum (MTD/QTD): +2.13% (MTD) / +2.13% (QTD), maintaining positive returns year-to-date, indicating recovery in intermediate-term momentum.

- • Long-Term Momentum (YTD/TTM): +2.13% (YTD, due to the short period), but the trailing 12-month return (TTM_12) is a strong +23.70%, indicating robust long-term absolute momentum.

- • Conclusion: NDX shows positive short-term and mid-term momentum, indicating a complete recovery from the November 2025 decline and the achievement of new recovery highs. However, the short-term momentum (weekly) diverges from the contracting volume, raising questions about the quality of momentum and warranting caution regarding the sustainability of the advance.

5. Large Investor ("Smart Money") Behavior Identification

Based on the comprehensive analysis of the above volume-price, volatility, and historical ranking data, inferences about large investor behavior are as follows:

- 1. Late November Absorption: The high-volume decline and subsequent rebound on November 20-21 implied panic selling by weak hands, concurrently absorbed by institutional capital at low levels, completing a classic post-panic selling accumulation.

- 2. Mid-December Distribution: The high-volume decline on December 12 and subsequent consolidation showed distribution activity at the previous rebound highs (25500-25700 zone), likely representing profit-taking by early buyers or exit by investors hesitant about the outlook.

- 3. Decisive Buying on December 19: The record volume growth and absolute volume on this day (historical rankings: Top 2), following a price pullback, is a classic "large demand entry" signal. This highly likely represents concentrated, planned buying by institutional investors near a key support zone (around 25000), marking the beginning of a new accumulation phase or markup.

- 4. Hesitation in the Current Phase: Since the massive buying on December 19, market volume has contracted sharply, and price advances have been slow. This indicates:

- • Smart Money is Observing: The large capital that bought earlier may be observing market reactions and is not in a hurry to push prices higher.

- • Supply Exhaustion: Low volume also suggests selling pressure (supply) is light, requiring minimal buying to sustain prices.

- • Behavioral Interpretation: This aligns with the characteristics of the final stages of an accumulation range according to Wyckoff theory—the Shakeout has occurred (November crash), the Sign of Strength (massive buying) has been completed (December 19), and the market is now in a Testing phase, using low-volume, minor price fluctuations to test whether supply is truly exhausted, preparing for a subsequent markup.

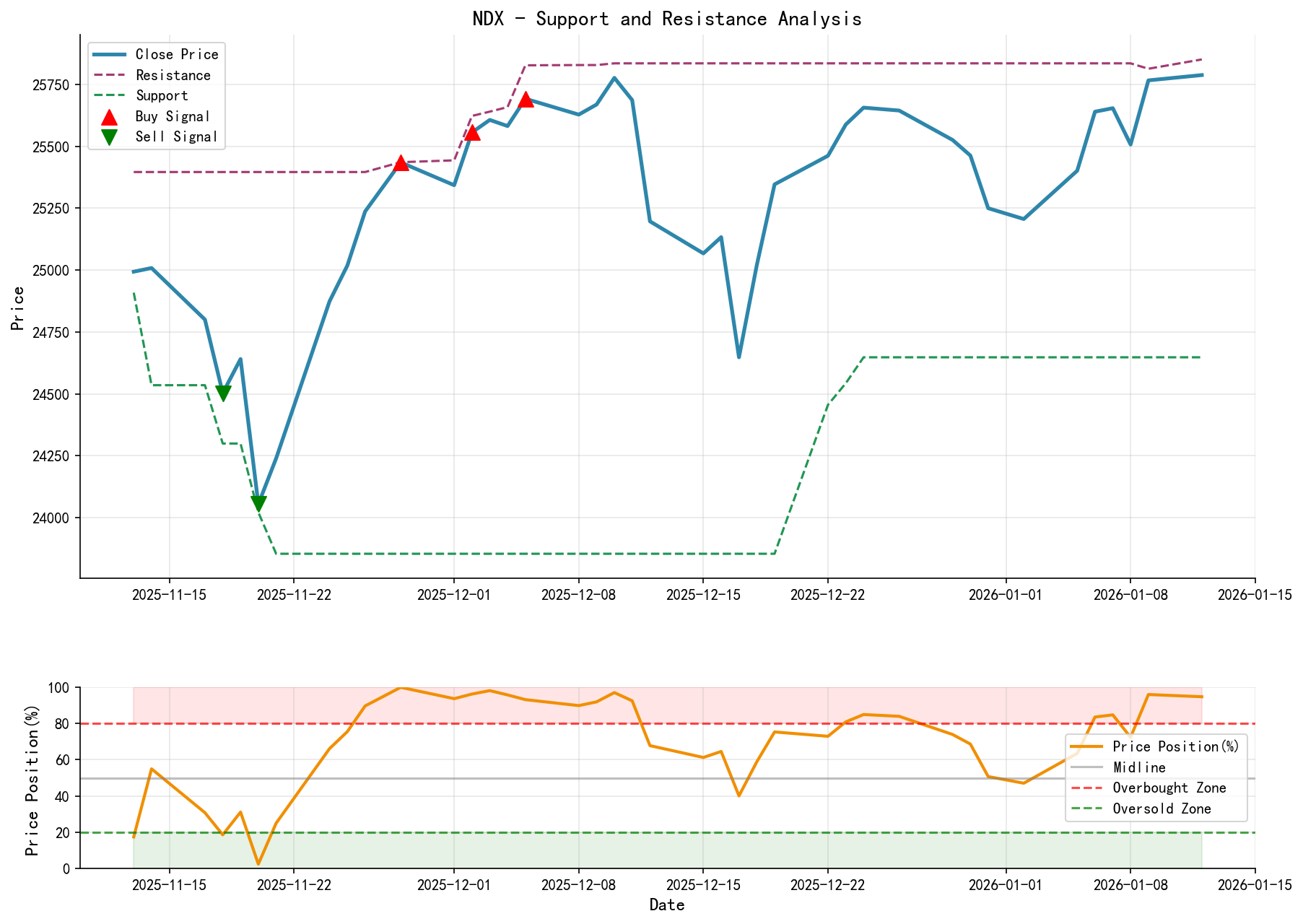

6. Support/Resistance Level Analysis and Trading Signals

Key Price Levels:

- • Near-Term Resistance: 25850-25900 (2026-01-12 high of 25850.855, near a psychological level). A breakout above this zone would confirm the resumption of the uptrend.

- • Core Support: 25500-25600 (lower boundary of the recent consolidation range, coinciding with the MA_5D and MA_10D). A break below this zone would indicate insufficient demand, potentially leading to a test of lower support.

- • Strong Support: 25200-25300 (MA_20D/30D cluster, and early January pullback low). Ultimate Support: 24600-24000 (November 2025 panic low and accumulation zone).

Comprehensive Wyckoff Event Analysis and Operational Suggestions:

- 1. Market State Judgment: The market is in the final stages of an accumulation range or the initial testing phase of a new uptrend. Smart money established significant positions on December 19 and is currently testing market stability in a low-volume environment.

- 2. Trading Signal: Bullish bias, but awaiting confirmation. The current "rising on low volume" is a warning; chasing highs is not advisable.

- 3. Specific Operational Suggestions:

- • Aggressive Scenario (Recommended): Wait for a confirmation signal of high-volume (

VOLUME_AVG_7D_RATIO> 1.2) breakout above the 25850 resistance. This signal would validate the return of demand and represent an ideal entry or add-on point. - • Conservative Scenario: Within the current narrow range of 25500-25850, consider accumulating long positions in batches near the 25500-25600 support area (close to the MA cluster), with a stop-loss set below 25200 (strong support). This strategy is based on the assumption of "exhausted supply near smart money's cost area," offering a relatively favorable risk-reward ratio.

- • Strictly Avoid: Chasing the rally near the 25850 resistance on low volume (

VOLUME_AVG_7D_RATIO< 0.9).

- • Aggressive Scenario (Recommended): Wait for a confirmation signal of high-volume (

- 4. Future Validation Points:

- • Confirmation Signal: Price breaks above 25850 with accompanying volume (volume recovers above average) and holds the level. RSI remains above 50.

- • Invalidation Signal: Price breaks below the 25500 support on high volume, especially if volatility indicators like

PARKINSON_VOL_7Dspike simultaneously. This would signify new supply entering the market, necessitating a reassessment of whether the market is entering a distribution or markdown phase, requiring decisive stop-loss execution.

Report Summary: Following the panic selling in November 2025, NDX has completed a classic accumulation process, with institutional capital clearly expressing bullish intent via massive transactions on December 19. The current market is in a "calm testing period" before a potential advance, with contracted volume being the primary concern. Strategically, preference should lean towards establishing long positions near support levels with strict stop-losses, awaiting the key signal of a demand-driven, high-volume breakout. Historical ranking data highlights the extremity and importance of the December 19 buying event, providing solid data support for the current bullish bias.

Disclaimer: This report/interpretation is solely for market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. While the author strives for objectivity and fairness, no guarantees are made regarding its accuracy or completeness. Markets involve risks; invest cautiously. Any investment actions taken based on this report are at your own risk.

Thank you for your attention! Wyckoff Volume-Price Market Interpretation is published daily at 8:00 AM before the market opens. Your feedback and shares are greatly appreciated and crucial. Let's work together to see the market signals clearly.

Member discussion: