Quantitative Analysis Report on META (Based on the Wyckoff Method)

Ticker: META

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Time: 2026-01-13

I. Trend Analysis and Market Phase Identification

As of 2026-01-12, for the subject META, the opening price was 652.53, the closing price was 641.97. The 5-day moving average (MA_5D) is 653.44, the 10-day MA (MA_10D) is 656.57, and the 20-day MA (MA_20D) is 656.70. The daily return was -1.70%, weekly return -2.55%, monthly return -2.75%, quarterly return -2.75%, and yearly return -2.75%.

- 1. Moving Average Alignment and Price Structure:

- • Long-term Trend (Bearish Dominance): From the start of the analysis period (2025-11-13), the price (CLOSE) has consistently remained below all major moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D). By the end of the period (2026-01-12), the alignment is MA_60D (658.17) > MA_30D (655.06) > MA_20D (656.70) > MA_10D (656.57) > MA_5D (653.44), showing a bearish alignment with converging spacing. The price (641.97) remains below all MAs, indicating the medium-to-long-term downtrend has not reversed.

- • Mid-term Rebound and Failure: From late November to early December 2025, the price experienced a strong rebound from 590.32 (11-19) to 673.42 (12-05), a gain of approximately 14.1%. This rebound briefly breached the MA_5D and MA_10D but was capped by the MA_20D and longer-term MAs. After the rebound ended, the price turned downward again, failing to alter the bearish alignment structure.

- • Market Phase Judgment: According to Wyckoff theory, combined with price action and MA relationships, the market has experienced a clear sequence since mid-November: "Panic Selling (mid-to-late November) -> Automatic Rally/Secondary Test (late November to early December) -> Rally Failure/Distribution (mid-to-late December) -> New Downtrend (early January to present)". The current price (2026-01-12) is in a downtrend after breaking below recent support, likely searching for a new supply-demand equilibrium or conducting a secondary test.

II. Volume-Price Relationship and Supply-Demand Dynamics

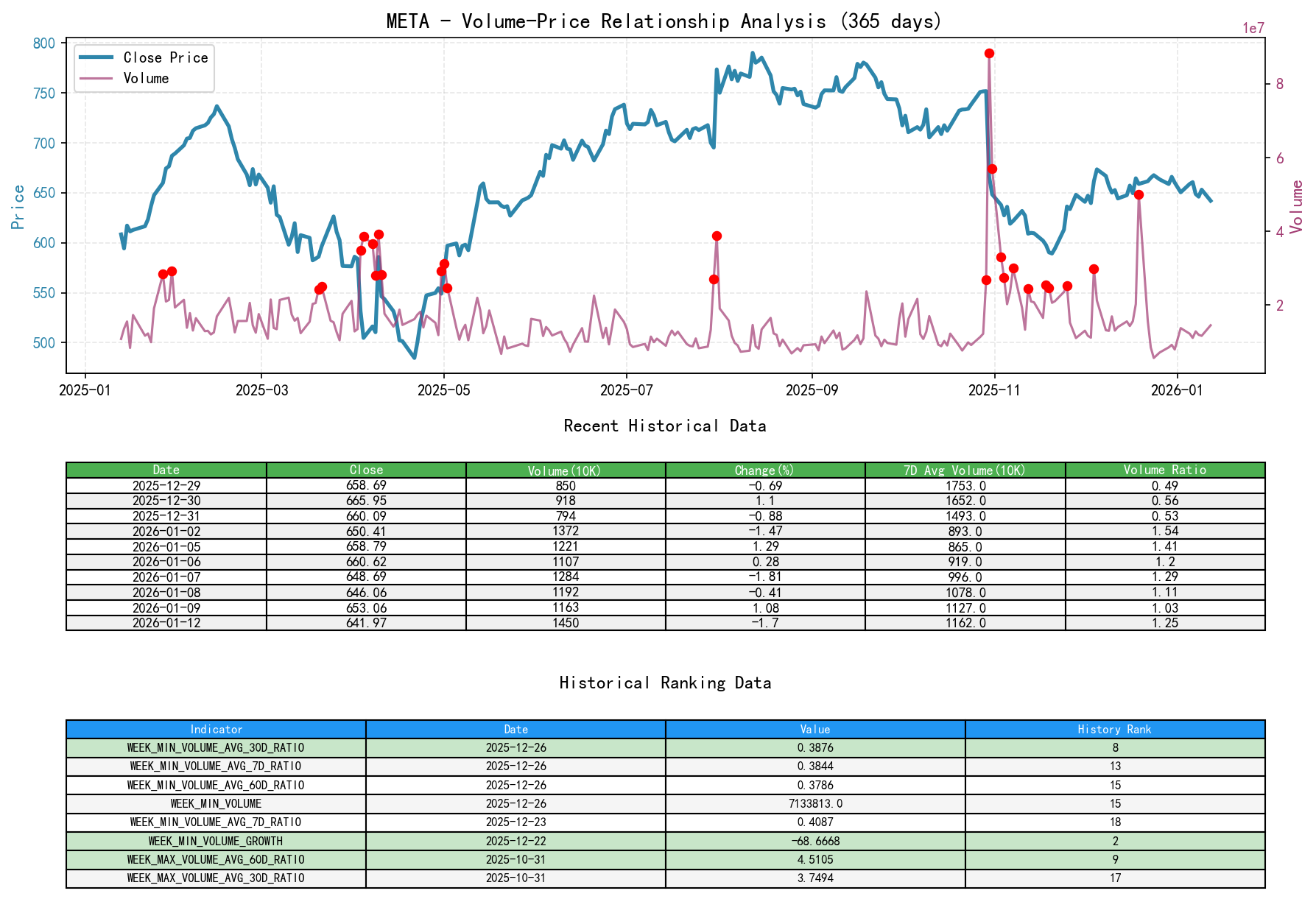

As of 2026-01-12, for the subject META, the opening price was 652.53, the closing price was 641.97, volume was 14501056, the daily return was -1.70%, volume was 14501056, the 7-day average volume was 11622566.43, and the 7-day volume ratio was 1.25.

- 1. Key Day Volume-Price Analysis:

- • Panic Selling (Supply Climax): On 2025-11-18, price declined (-0.72%) accompanied by a volume surge of 54.54% to 25.5 million, with

VOLUME_AVG_30D_RATIOreaching a high of 1.29, indicating panic selling. The next day (11-19) saw another high-volume decline (VOLUME_AVG_30D_RATIO1.23), confirming massive supply emergence. RSI_14 dropped to 23.32, at an extreme oversold level historically (8th percentile rank). - • Automatic Rally (Demand Entry): On 2025-11-24 and 11-25, price staged consecutive strong rallies (+3.16%, +3.78%) with significantly elevated volume (

VOLUME_AVG_30D_RATIO1.12 and 1.17 respectively). This was a demand-driven powerful rally, confirming the validity of the panic low. - • Rally Climax and Potential Distribution: On 2025-12-04, price surged 3.43% to 661.53 with an explosive volume increase of 168.31% to 29.87 million,

VOLUME_AVG_30D_RATIOreaching 1.33. However, the candlestick for that day had a long upper shadow (high of 676.10), closing well below the high. This "high-volume price rejection" is a classic sign of supply overwhelming demand, suggesting large investors may have been distributing during the rally. - • Weak Rally and Demand Exhaustion: On 2025-12-23, 12-24, and 12-26, prices rose but volume shrank to 8.48M, 5.62M, and 7.13M respectively, with

VOLUME_AVG_30D_RATIOas low as 0.45, 0.30, and 0.39. The volume on 12-26 ranked as the 15th lowest in nearly a decade. Low-volume rallies indicate severely insufficient follow-through demand, making the advance unsustainable and foreshadowing an impending pullback. - • New Supply Emergence: On 2026-01-12, price fell -1.70% with volume increasing 24.63% from the previous day to 14.5M,

VOLUME_AVG_30D_RATIOrecovering to 1.00. Decline accompanied by expanding volume indicates renewed supply pressure.

- • Panic Selling (Supply Climax): On 2025-11-18, price declined (-0.72%) accompanied by a volume surge of 54.54% to 25.5 million, with

- 2. Supply-Demand Pattern Summary: The market completed the process of "supply exhaustion -> demand entry" at the panic low in late November. The early December rally was terminated by encountering strong supply (Dec 4). Subsequently, demand rapidly dried up, and the market entered a low-volume consolidation. Entering January, supply has regained market dominance as price broke down.

III. Volatility and Market Sentiment

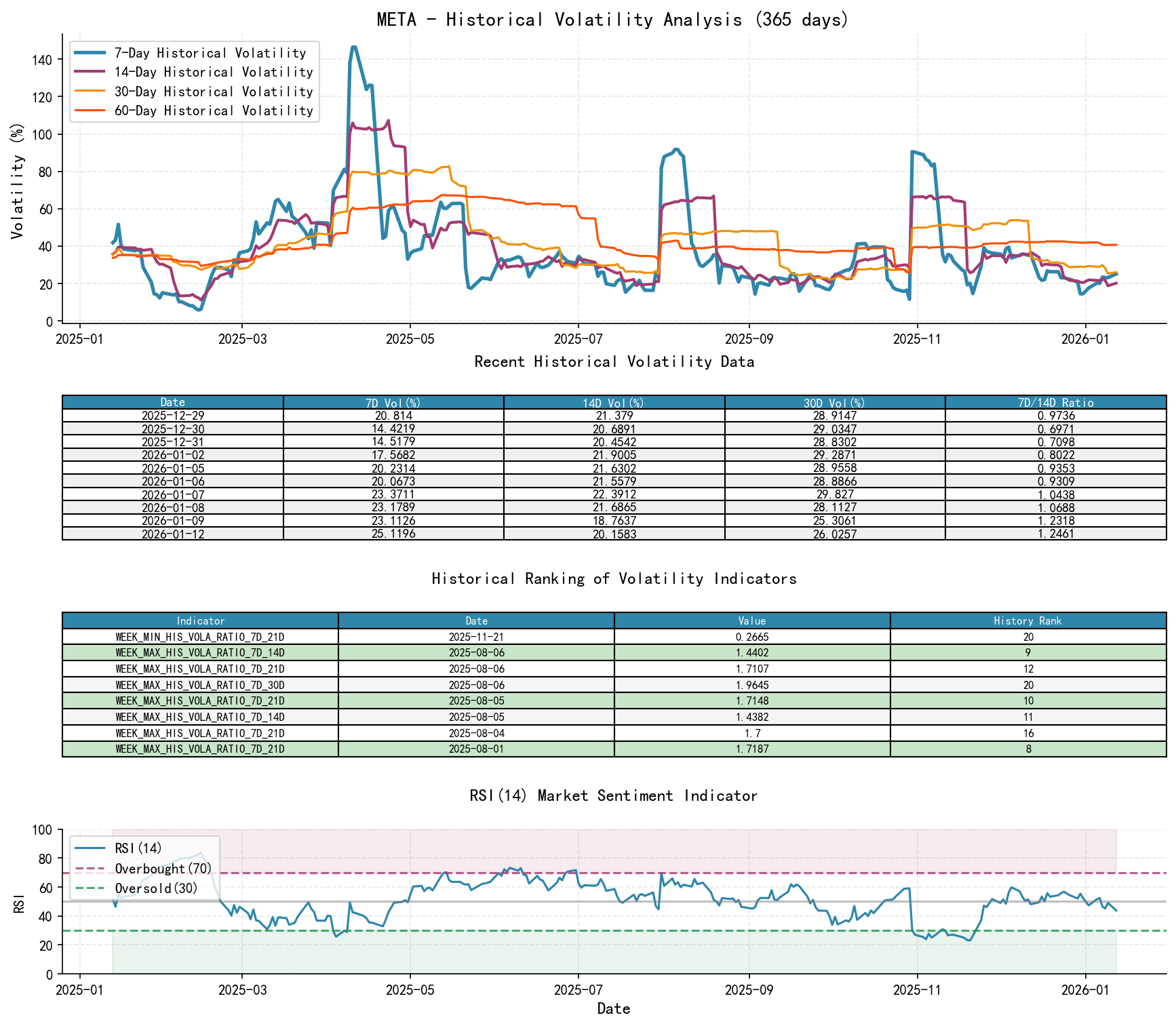

As of 2026-01-12, for the subject META, the opening price was 652.53, the 7-day intraday volatility is 0.26, the 7-day intraday volatility ratio is 1.24, the 7-day historical volatility is 0.25, the 7-day historical volatility ratio is 1.25, and RSI is 43.81.

- 1. Volatility Levels and Changes:

- • High Volatility During Panic Phase: In mid-to-late November 2025,

HIS_VOLA_14Dreached as high as 0.66 andPARKINSON_VOL_14D0.34, indicating extreme market panic and confusion. - • Volatility Compression During Rally: During the December rally, short-term volatility first declined then rose.

PARKINSON_RATIO_7D_60Dfell below 0.68 in late December (12-26, 12-29, 12-30), reaching historically extreme lows (e.g., 0.624 on 12-29 ranked 19th lowest in nearly ten years), indicating abnormally tight intraday price ranges and a market in a state of watchful hesitation. - • Recent Volatility Uptick: Entering January 2026, as price declined,

HIS_VOLA_7DandPARKINSON_VOL_7Dbegan to rise from their lows.PARKINSON_RATIO_7D_14Dsurged from 0.59 on Jan 2 (8th lowest historical rank) to 1.24 on Jan 12, showing short-term volatility is accelerating, and market unease is intensifying.

- • High Volatility During Panic Phase: In mid-to-late November 2025,

- 2. Overbought/Oversold Status:

- • RSI_14 touched an extreme low of 23.10 on Nov 19-20 (6th lowest in nearly ten years), confirming the panic selling bottom.

- • During the December rally, RSI_14 peaked at 59.84 (Dec 5), not entering the overbought zone above 70, indicating limited rally strength.

- • The current (2026-01-12) RSI_14 is 43.81, in a neutral-to-weak zone, not yet oversold, suggesting room for further decline if supply persists.

IV. Relative Strength and Momentum Performance

- 1. Periodic Return Analysis:

- • Weak Short-term Momentum:

WTD_RETURN(weekly return) for the most recent week (2026-01-12) is -2.55%, andMTD_RETURN(monthly return) is -2.75%, both negative. - • Weak Medium-term Momentum:

QTD_RETURN(quarterly return) is -2.75%, andYTD(year-to-date) is -2.75%, indicating META is in a negative momentum trend from medium to long-term perspectives. - • Conclusion: Momentum indicators across all timeframes are negative, consistent with the conclusion of a bearish price trend and bearish MA alignment, confirming the current market's weak structure.

- • Weak Short-term Momentum:

V. Large Investor (Smart Money) Behavior Identification

Based on the above volume-price, trend, and volatility analysis, large investor behavior is inferred:

- 1. Accumulation in Late November: During the panic characterized by price plunges, record-low RSI, and high volume, smart money provided support. This is evidenced by high-volume declines with narrowing losses on Nov 18-19, followed by the demand-driven strong rally on Nov 24-25.

- 2. Rally and Distribution in Early December: Smart money fueled the early December rally but conducted large-scale distribution (huge volume with long upper shadow) on Dec 4 when price approached prior resistance, capitalizing on market optimism.

- 3. Testing and Watching in Mid-to-Late December: After distribution, price consolidated on low volume near highs, with volume hitting multi-year lows (supported by historical rank data). Smart money ceased buying, shifting to observe market reaction and the strength of remaining demand.

- 4. Supply Re-emergence in Early January: Once the market confirmed demand could not push price above resistance, new selling pressure (potentially from institutions or stop-losses) emerged, leading to the high-volume decline on Jan 12. No clear signs of significant large-scale smart money support at the current level have been observed yet.

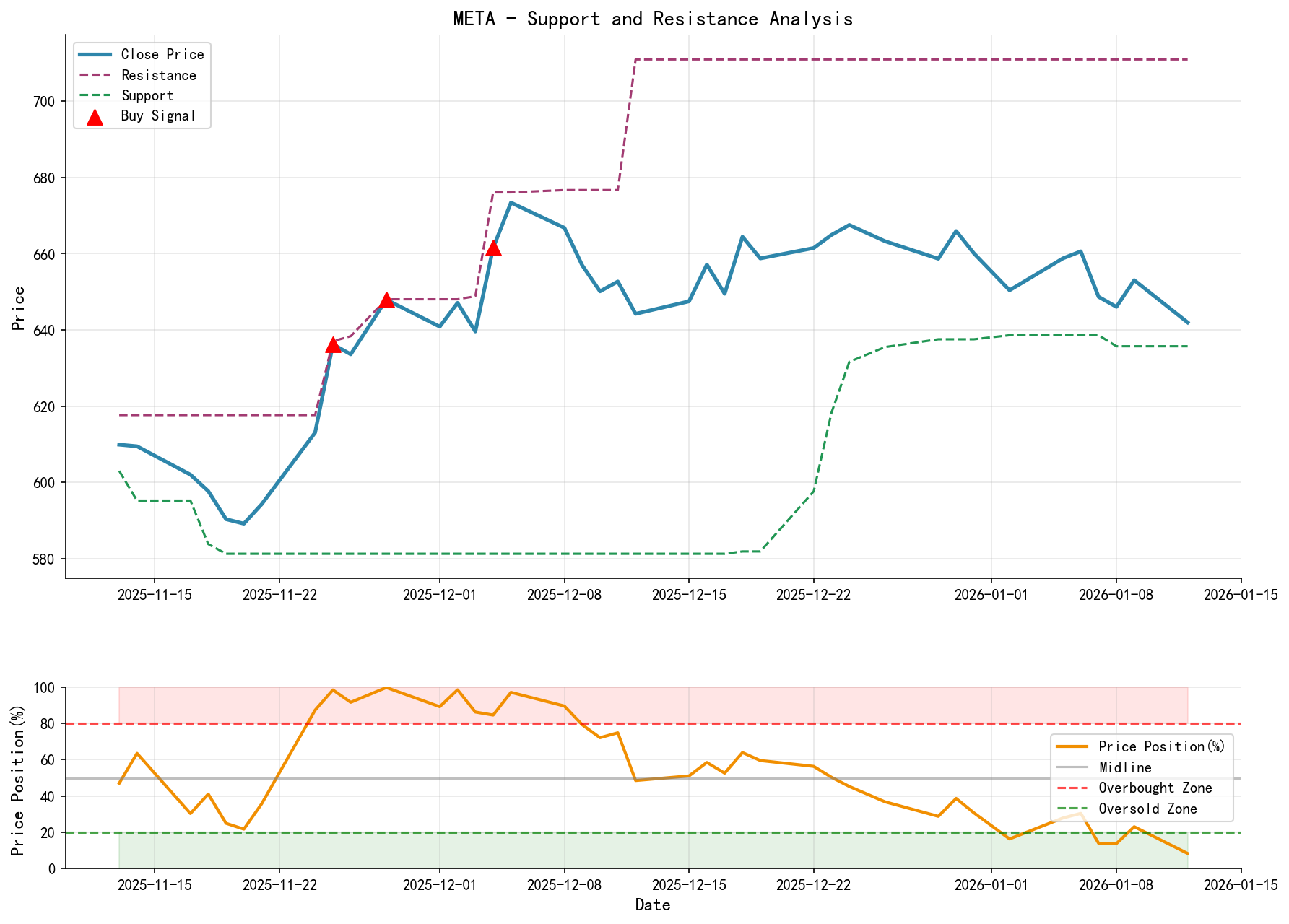

VI. Support/Resistance Level Analysis and Trading Signals

- 1. Key Price Levels:

- • Primary Support: 590 - 600 Zone. This is the low area formed during the November 2025 panic selling and the starting point of the December rebound, holding significant psychological and technical importance.

- • Secondary Support: 640 - 650 Zone. This is the recent (early January) trading range and area near the current price, but it has been breached and now acts as resistance.

- • Primary Resistance: 670 - 676 Zone. The December 4, 2025 rebound high and the upper bound of the subsequent consolidation range, a clear supply zone.

- • Long-term Resistance: MA_60D (658) and MA_30D (655). Under bearish MA alignment, these moving averages constitute dynamic resistance.

- 2. Integrated Trading Signals and Operational Suggestions:

- • Current Assessment (Wyckoff Event): The market is in a downtrend, with recent signs of supply re-emergence (high-volume decline on Jan 12). The rally demand phase has proven to be a failure.

- • Operational Suggestion: Watchful/Cautiously Bearish. Blind bottom-fishing at the current price (~642) is not recommended.

- • Specific Plan:

- • Bearish Scenario (Higher Probability): If the price rallies to the 650-655 zone (former support, now resistance) and shows signs of stalling (e.g., small-bodied candles, upper shadows) with low volume, it could be viewed as a shorting opportunity on a failed secondary test. Place stops above 660.

- • Bullish Scenario (Awaiting Signals): Closely monitor the 590-600 key support zone. If the price reaches this zone and exhibits Wyckoff reversal signals such as "high-volume stabilization after a decline" or "high-volume rebound following a panic drop" (e.g., Spring or UTAD), accompanied by RSI nearing or entering oversold territory again, consider establishing long positions in phases. Until such signals appear, treat any bounce as a rally within a downtrend, not a trend reversal.

- • Watchful Scenario: If the price fluctuates without direction between 640-660 with persistently low volume, maintain a watchful stance.

- • Future Validation Points:

- 1. Confirming Downtrend Continuation: Price closes below 640 and subsequent rallies fail to reclaim the 640 level.

- 2. Confirming Potential Bottom: Price tests the 590-600 zone and exhibits the defined Wyckoff buying signals of "high-volume stabilization" or "panic shakeout".

- 3. Confirming Trend Reversal (Premature): Price breaks through and sustains above the 670-676 resistance zone on high volume, with the MA system (at least MA_5D/10D/20D) beginning to turn upward into a bullish alignment.

Risk Disclosure: This report is based on historical data analysis and does not constitute any investment advice. The market involves unpredictable risks; please make independent decisions based on the latest information.

Disclaimer: The content of this report/interpretation is solely market analysis and research based on publicly available information and does not represent any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risk, investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Analysis is published daily at 8:00 AM before the market opens. Your feedback and shares are greatly appreciated. Let's work together to see the market signals clearly.

Member discussion: