Comprehensive Quantitative Analysis Report on KWEB (Based on the Wyckoff Method)

Product Code: KWEB

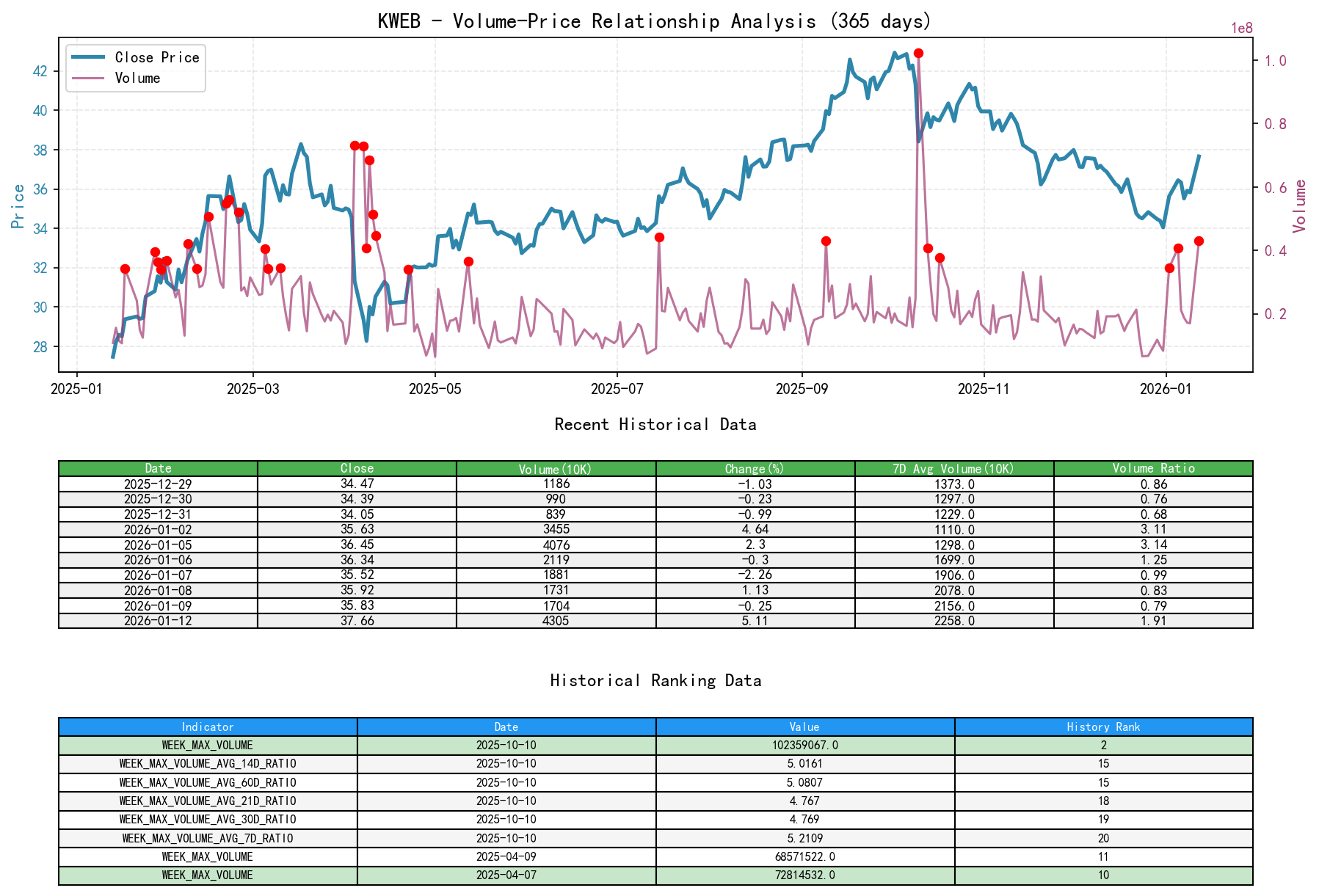

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

1. Trend Analysis and Market Phase Identification

As of 2026-01-12, the underlying asset KWEB opened at 36.77, closed at 37.66, with moving averages: 5-day MA at 36.01, 10-day MA at 35.34, and 20-day MA at 35.61. Daily change: +5.11%, Weekly change: +3.32%, Monthly change: +10.60%, Quarterly change: +10.60%, Year-to-date change: +10.60%.

1.1 Moving Average Alignment and Trend Structure:

- • Long-term Downtrend (2025-11-13 to 2025-12-31): From the beginning of the period to year-end, the price (CLOSE) fell from 38.81 to 34.05, a decline of 12.3%. All moving averages (MA_5D/10D/20D/30D/60D) exhibited a standard bearish alignment (MA_5D < MA_10D < MA_20D < MA_30D < MA_60D). The price consistently traded below all MAs, confirming a strong downtrend.

- • Short-term Trend Reversal (2026-01-02 to 2026-01-12): At the start of the new year, the price initiated a rebound. On January 12th, the closing price of 37.66 has successively broken above the MA_5D (36.01), MA_10D (35.34), and MA_20D (35.61), but remains below the MA_30D (36.21) and MA_60D (37.72). The short-term MA (MA_5D) has crossed above the MA_20D to form a golden cross, indicating the exhaustion of short-term downward momentum and the initiation of an upward corrective move.

- • Market Phase Inference: Applying Wyckoff theory, the decline from November to December represents a "Panic Selling" phase, characterized by accelerated price decline and increased volume (e.g., November 20th, December 22nd). The rebound in January, particularly the high-volume rallies on January 2nd and January 12th, suggests the market may be transitioning from the late downtrend's "Accumulation" phase to the initial stage of "Preliminary Demand Support" or the "Markup" phase. The price successfully tested the lows from late December (the 34.05-34.50 zone), accompanied by strong demand entering the market.

Key Data Support:

- • Low:

34.05(2025-12-31) -> High:37.66(2026-01-12), representing a rebound of10.6%. - • 2026-01-12: CLOSE

37.66> MA_5D36.01, and MA_5D > MA_20D, forming a short-term golden cross.

2. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-12, the underlying asset KWEB opened at 36.77, closed at 37.66, with volume at 43053808, daily change +5.11%, volume 43053808, 7-day average volume 22584902.29, 7-day volume ratio 1.91.

2.1 Analysis of Key Supply-Demand Transition Points:

- • Panic Selling (Supply Dominance):

- • 2025-11-20: Price fell sharply by

-2.87%with volume surging80.95%. TheVOLUME_AVG_7D_RATIOreached1.66. This is a classic panic selling day, with supply in complete control. - • 2025-12-22: Price dropped significantly by

-4.77%with volume up27.49%. TheVOLUME_AVG_21D_RATIOwas1.24, confirming another episode of panic selling.

- • 2025-11-20: Price fell sharply by

- • Lackluster Demand (Feeble Rebound):

- • 2025-11-21 and 2025-11-24: Price staged a minor rebound after the sharp drop, but volume contracted by

-33.59%and-13.21%respectively (VOLUME_AVG_7D_RATIO< 1), indicating the rebound was driven by short covering or weak buying, lacking follow-through from major demand.

- • 2025-11-21 and 2025-11-24: Price staged a minor rebound after the sharp drop, but volume contracted by

- • Strong Demand Entry (Reversal Signal):

- • 2026-01-02: On the first trading day of the new year, price rose

4.64%with volume exploding311.61%. TheVOLUME_AVG_60D_RATIOwas as high as1.71. This is "High-volume Absorption After Panic", a strong signal that smart money (large investors) began accumulating. - • 2026-01-12 (Report Date): Price surged

5.11%with volume again spiking152.57%. TheVOLUME_AVG_21D_RATIOreached2.49andVOLUME_AVG_30D_RATIOwas2.58. This confirms the prior accumulation and showcases renewed demand strength, pushing the price through short-term resistance.

- • 2026-01-02: On the first trading day of the new year, price rose

2.2 Conclusion on Supply-Demand Structure:

A fundamental shift has occurred in the market's supply-demand structure. The decline at the end of December occurred alongside historically low volatility (see below), indicating supply was drying up. The consecutive "high-volume rallies" in early January clearly signal that demand is entering the market actively and on a large scale, successfully absorbing selling pressure. According to Wyckoff principles, this is the classic pattern of Sign of Strength (SOS) following Supply Climax (SC).

Historical Ranking Integration: On the key demand day (2026-01-12), the volume ratios relative to the 21-day and 30-day moving averages (2.49, 2.58) were absolute highs for the recent period. Historical ranking data shows that "MIN_7-Day Intraday Volatility" ranked 19th-20th historically on dates like 2025-12-08, -10, and -29 (extremely low), indicating the market was in a state of extreme compression and hesitation before the rally, accumulating energy for the subsequent breakout.

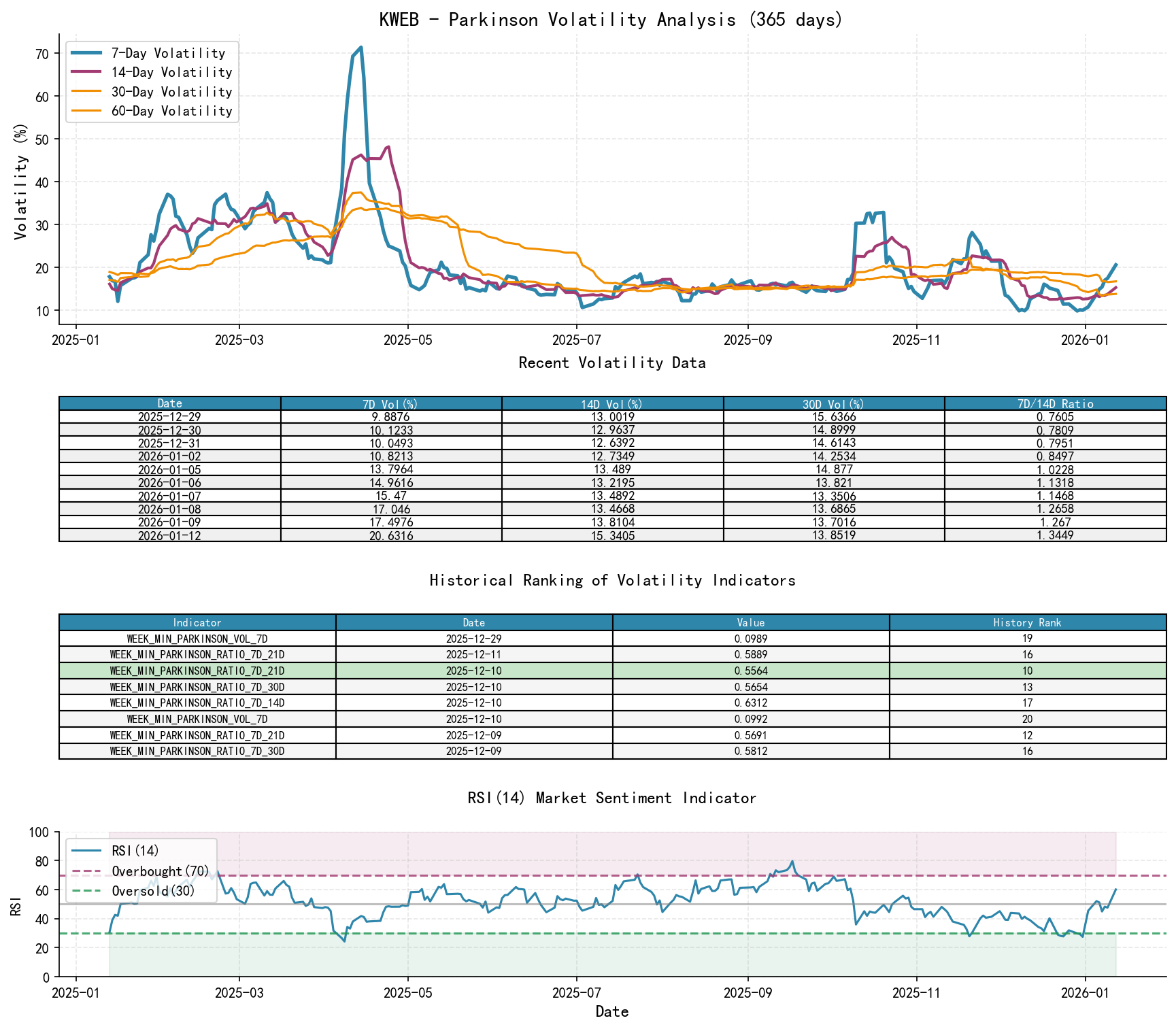

3. Volatility and Market Sentiment

As of 2026-01-12, the underlying asset KWEB opened at 36.77. 7-Day Intraday Volatility 0.21, 7-Day Intraday Volatility Ratio 1.34, 7-Day Historical Volatility 0.51, 7-Day Historical Volatility Ratio 1.05, RSI 60.15.

3.1 Volatility Levels and Changes:

- • High Volatility During Panic Periods: On panic days like November 20th and December 22nd, both

HIS_VOLA_7DandPARKINSON_VOL_7Dwere elevated, indicating tense market sentiment. - • Low Volatility and Spike During Transition: In late December 2025, volatility dropped to historical lows. For example,

PARKINSON_VOL_7Dfell to0.0989on December 29th, ranking 19th lowest historically over the past decade (extreme level). This shows market sentiment entered a state of apathy and hesitation after the panic, often a precursor to trend reversal. Subsequently, in early January 2026, volatility rebounded rapidly alongside the price surge.HIS_VOLA_7Dsoared from around0.35at the end of December to0.51on January 12th, indicating renewed market activation. - • Volatility Ratios: On January 12th,

HIS_VOLA_RATIO_7D_60Dwas1.64andPARKINSON_RATIO_7D_60Dwas1.23, meaning short-term volatility has significantly exceeded the long-term volatility center, confirming the initiation of a trending move.

3.2 Overbought/Oversold Status (RSI):

- • The RSI_14 touched a low of

27.47on 2025-12-31, confirming an extreme technical oversold condition. - • Following the strong rally on January 12th, the RSI_14 recovered to

60.15, moving out of the oversold zone into a neutral-to-strong area, indicating healthy upward momentum and not yet reaching short-term overbought levels.

Sentiment Conclusion: Market sentiment has completed the full cycle from "Panic" -> "Despair/Apathy" -> "Hope/Optimism". The current volatility expansion coincides with price increases, characteristic of healthy "markup volatility," not panic.

4. Relative Strength and Momentum Performance

4.1 Momentum Turns Positive Across All Timeframes:

- • Short-term (WTD):

3.32%(positive), strong performance. - • Medium-term (MTD/QTD):

10.60%/10.60%(positive), achieving significant positive returns since January, confirming a mid-term momentum inflection point. - • Long-term (YTD):

10.60%(positive), excellent start to the year.

Momentum Conclusion: Momentum has turned positive across all observed timeframes (weekly, monthly, quarterly, year-to-date) with significant strength. This aligns closely with the "demand-driven, upward trend" conclusion from the volume-price analysis. It indicates that KWEB is not merely experiencing a technical bounce; its relative strength is being rebuilt within the market.

5. Identification of Smart Money Behavior

Based on the above analysis of volume-price, volatility, and momentum, the operational path of large investors (smart money) can be clearly inferred:

- 1. Accumulation: In late December 2025, the price consolidated narrowly in the 34-35 zone with shrinking volume and volatility hitting historical lows. This is a classic "accumulation range". Smart money conducted stealthy, patient accumulation during the retail panic selling (Dec 22nd) and the market sentiment freeze.

- 2. Test and Demand Confirmation: The "massive bullish candle on the first trading day of 2026" (Jan 2nd) served as the first test and confirmation of demand within the accumulation range. Smart money announced its intention and power with overwhelming buying pressure.

- 3. Markup: The second "massive bullish candle" on 2026-01-12 is the mark where smart money, after preliminary shakeout of weak hands (minor pullback from Jan 6-8), formally initiated the markup phase. The concentration of volume during the price advance indicates "demand overcoming all supply".

Source of High Volume Analysis: The massive volume on January 2nd and 12th, combined with significant price appreciation, is definitely not retail behavior, but rather the concentrated, planned entry of institutional capital. It answers "who is buying" – it is the smart money that completed accumulation at the end of the downtrend, plus incremental trend-following institutional funds.

6. Support/Resistance Level Analysis and Integrated Trading Signals

6.1 Key Price Levels:

- • Major Support Zone: The

34.50 - 34.00area. This is the low point of the late-December panic selling and the lower boundary of the accumulation range, also where strong demand first appeared (Jan 2nd open at 35.30). - • Immediate Support Zone: The

36.80 - 36.40area. This represents the mid-point of the January 12th bullish candle and the price consolidation area from January 5-6. - • Major Resistance (Already Broken):

37.66(the high on 2026-01-12, also the recent breakout level). - • Next Resistance Zone: The

40.00 - 40.50area. This is a strong resistance zone containing the 60-day MA (37.72) and the consolidation platform from late November 2025 during the downtrend.

6.2 Wyckoff Integrated Trading Signals and Action Plan:

| Signal Type | Assessment | Confidence | Core Basis |

| Trend Direction | Bullish | High | Consecutive high-volume demand entry (SOS), short-term MA golden cross, positive momentum across timeframes. |

| Market Phase | End of Accumulation, Early Markup | Medium-High | Panic Selling (Dec) -> Apathetic Accumulation (Late Dec) -> Demand Confirmation & Markup (Jan). |

| Trading Recommendation | Look for Long Opportunities | High | Clear smart money behavior, supply-demand structure has reversed. |

Specific Action Plan:

- 1. Entry Timing: Consider establishing long positions in tranches on a price pullback to the immediate support zone

36.80 - 37.20. - 2. Stop-Loss Setting: Set a strict stop-loss below the key support level

35.80(below the January 7th low and the bottom of the breakout candle). A breach of this level would invalidate the short-term bullish structure. - 3. Target Zone: The first target is the previous congestion area near the 60-day MA, the

40.00 - 40.50zone. - 4. Future Validation Points:

- • Confirmation Signal: In the coming sessions, the price holds above

37.66, and pullbacks exhibit a healthy volume-price structure of "light volume on declines, heavy volume on advances". - • Invalidation Signal: If the price quickly falls back below

36.40with increased volume, it would suggest the January 12th breakout might be a "false breakout" (UT), requiring re-evaluation.

- • Confirmation Signal: In the coming sessions, the price holds above

End of Report. This report is based entirely on an objective analysis of the provided data, consistent with Wyckoff's volume-price principles, aiming to identify changes in supply-demand and smart money intentions. It does not constitute direct investment advice. Markets involve risk; decision-making requires caution.

Disclaimer: The content of this report/analysis is solely market analysis and research based on publicly available information and does not represent any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risk; investment requires caution. Any investment actions taken based on this report are at the investor's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Analysis is published daily at 8:00 AM before the market opens. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: