Excellent, as per your instructions. As a quantitative trading researcher proficient in the Wyckoff Method, I will, based on the ICLN data and historical ranking indicators you provided, compose a comprehensive and in-depth quantitative analysis report.

Quantitative Analysis Report: ICLN (iShares Global Clean Energy ETF)

Report Date: 2026-01-13

Analysis Target: ICLN

Analysis Period: 2025-11-13 to 2026-01-12

I. Trend Analysis & Market Phase Identification

As of January 12, 2026, the target ICLN had an opening price of 17.19, a closing price of 17.56, a 5-day moving average (MA) of 17.15, a 10-day MA of 16.89, a 20-day MA of 16.69, with a daily gain of 1.39%, a weekly gain of 2.51%, a monthly gain of 6.88%, a quarterly gain of 6.88%, and an annual gain of 6.88%.

Based on the dynamic relationship between price and moving averages, we can clearly delineate the evolution of ICLN's market phase over the past two months.

- 1. Trend Structure & MA Alignment:

- • Bearish Alignment & Deep Retracement (Mid-to-Late November 2025): At the start of the analysis period, the price (e.g., closing at 16.08 on 2025-11-20) had already fallen significantly below all short-term MAs (MA_5D: 16.77, MA_20D: 17.20), leading to a death cross of the MA_5D and MA_10D with the MA_30D and MA_60D, forming a standard bearish alignment. The price dropped rapidly from the high of 17.54 on November 13th to the low of 15.625 on November 21st, constituting a clear downtrend.

- • Bottoming & Trend Reversal (December 2025): Entering December, the price oscillated repeatedly within the 15.625-16.50 range. Moving averages across timeframes gradually shifted from a bearish alignment to a highly converged state. The flattening of MA_20D, MA_30D, and MA_60D indicated waning medium-term downward momentum. The price repeatedly tested and held near the 16.00 low, forming a potential support platform.

- • Initial Formation of Bullish Alignment & Breakout (Early January 2026): Starting from 2026-01-02, the price broke out strongly above the entire cluster of converged MAs with a high-volume long bullish candlestick (+4.08%). Subsequently, MA_5D (17.15) successively crossed above MA_10D (16.89), MA_20D (16.69), and longer-period MAs, with MA_10D also beginning to turn upwards. By the end of the analysis period (2026-01-12), the price (17.56) was operating stably above all MAs, presenting a short-term bullish alignment pattern.

- 2. Market Phase Inference (Based on Wyckoff Theory):

- • Distribution & Markdown Phase (November 2025): The high-volume decline in mid-November aligns with characteristics of the late "distribution" or the "markdown" phase, where supply dominates the market.

- • Accumulation Phase (December 2025): The narrow-range, low-volatility consolidation in December, combined with extremely low trading volume (average around 2 million shares daily) and historically low short-term volatility (see Section III), perfectly fits the "accumulation" phase in Wyckoff theory. The market underwent a change of ownership at low levels, with supply being gradually absorbed.

- • Initial Uptrend (January 2026 to Present): The high-volume breakout on January 2nd is a key "Jump Across the Creek" signal, indicating that demand is beginning to overpower supply, and the market is entering the initial stage of the "markup" phase. The subsequent steady price rise driven by increasing volume validates the effectiveness of the breakout.

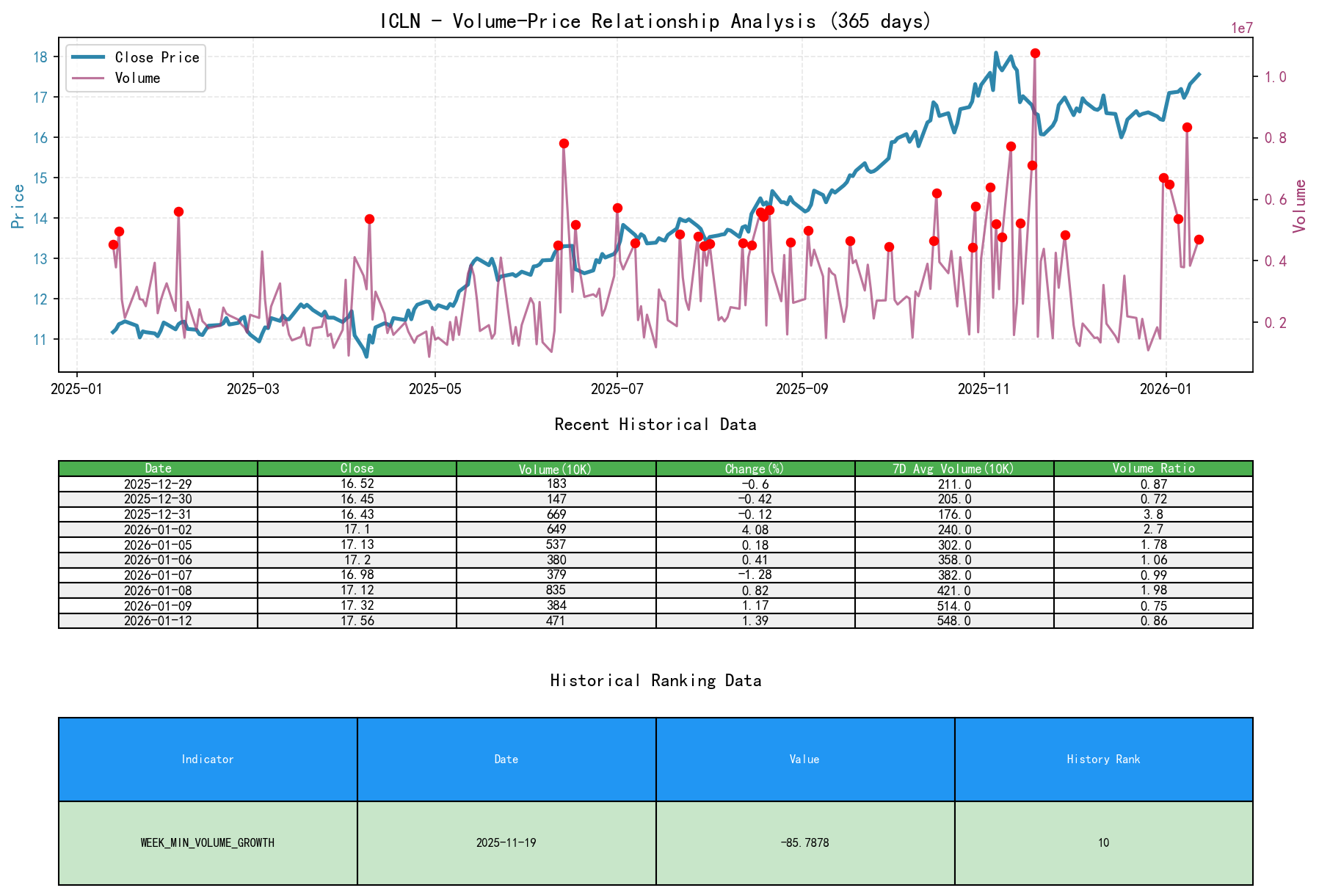

II. Volume-Price Relationship & Supply-Demand Dynamics

As of January 12, 2026, the target ICLN had an opening price of 17.19, a closing price of 17.56, volume of 4,711,214, a daily gain of 1.39%, volume of 4,711,214, a 7-day average volume of 5,480,999.86, and a 7-day volume ratio of 0.86.

Volume-price analysis is central to identifying supply-demand shifts. The volume-price action on key days reveals the transfer of dominant control.

- 1. Key Demand Days (Demand Overpowers Supply):

- • 2026-01-02: Price surged +4.08% on a volume of 6.497 million shares, 97% of the previous trading day (a year-end effect day) but significantly higher than the average volume of the preceding weeks (60-day average 3.535 million). This is a classic "high-volume breakout," indicating strong demand absorbing supply aggressively at the start of the new year, a clear signal of trend reversal.

- • 2026-01-12 (Report Date): Price increased +1.39% on a volume of 4.711 million shares (

VOLUME_AVG_60D_RATIO=1.34), showing a healthy "price rise with increasing volume" pattern, confirming sustained demand during the advance.

- 2. Key Supply Days/Panic Days (Supply Overpowers Demand):

- • 2025-11-20: Price plummeted -2.90% on a volume of 3.986 million shares, with a large intraday range (High:16.95, Low:16.05). Volume increased 160% compared to the previous day, a classic feature of a "Selling Climax," often appearing at the end of a downtrend where a wave of stop-loss selling occurs.

- • 2025-12-31 (Year-End Final Trading Day): Price edged down -0.12%, but volume surged to 6.697 million shares, a volume growth of 355% (

VOLUME_GROWTH). Combined with the extremely narrow price range that day, this qualifies as "high-volume stagnation." Historical rankings show itsWEEK_MIN_VOLUME_GROWTHranking is the 10th lowest in nearly a decade. Such an anomalous year-end high volume typically signifies significant change of ownership, possibly involving institutional portfolio adjustments mixed with some profit-taking.

- 3. Supply-Demand Transition Signals:

- • Supply Exhaustion & Demand Test: In mid-to-late December 2025, there were multiple instances of minor price rebounds on anemic volume (

VOLUME_AVG_60D_RATIOoften below 0.5), indicating selling pressure (supply) had weakened substantially. The subsequent high-volume breakout (2026-01-02) proved demand was capable and willing to accept supply at higher prices. - • Conclusion: The supply-demand landscape underwent a fundamental shift from late December to early January. The market transitioned from the balanced state of "supply exhaustion, demand on the sidelines" in December to the rising state of "active demand, limited supply" in January.

- • Supply Exhaustion & Demand Test: In mid-to-late December 2025, there were multiple instances of minor price rebounds on anemic volume (

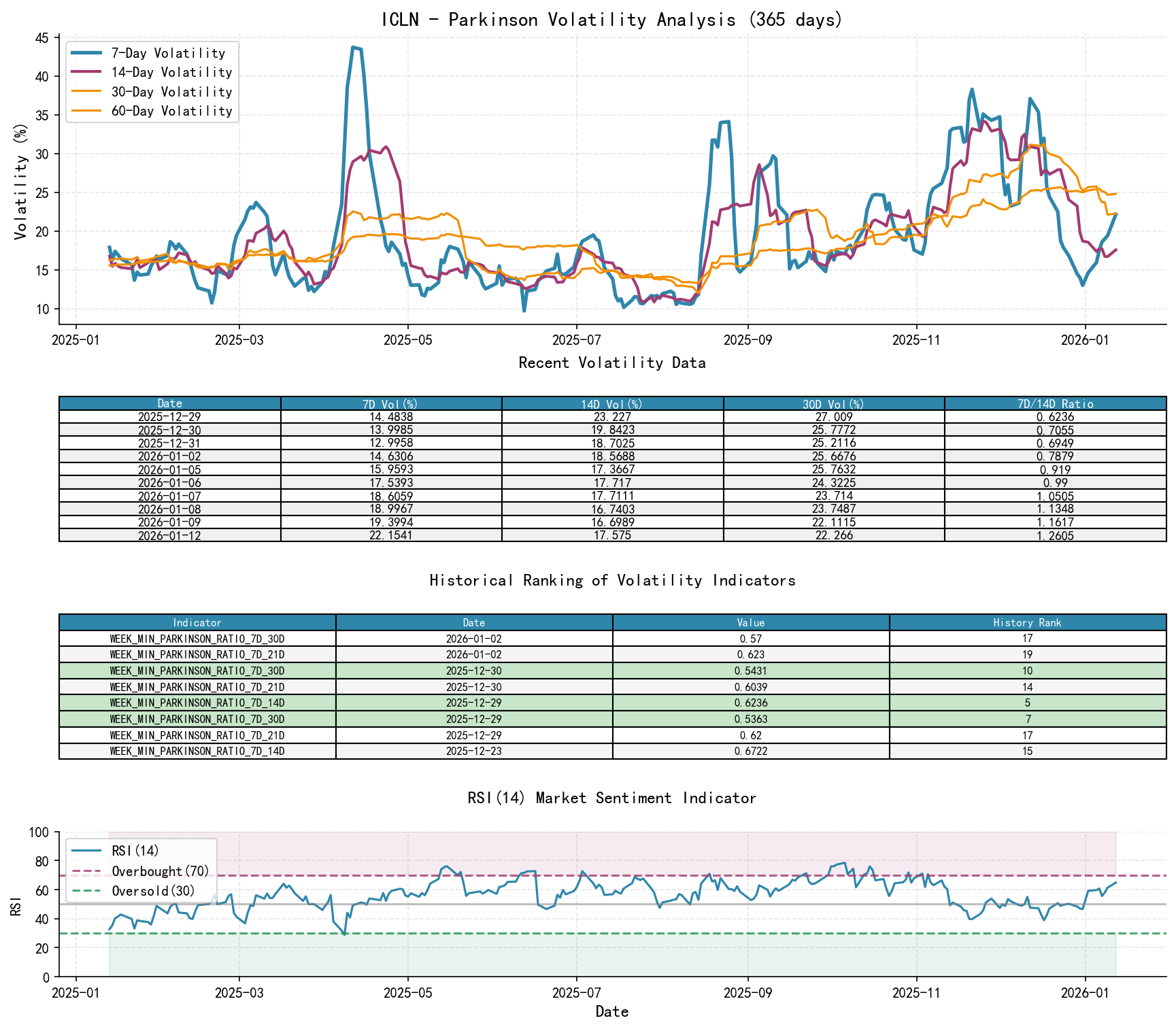

III. Volatility & Market Sentiment

As of January 12, 2026, the target ICLN had an opening price of 17.19, a 7-day intraday Parkinson volatility of 0.22, a 7-day Parkinson volatility ratio of 1.26, a 7-day historical volatility of 0.31, a 7-day historical volatility ratio of 1.25, and an RSI of 64.91.

Volatility data reveals the process of market sentiment shifting from extreme compression to active expansion, highly consistent with price phases.

- 1. Volatility Contraction & Extreme Calm:

- • At the end of December 2025, Parkinson volatility (

PARKINSON_VOL_*D) and historical volatility (HIS_VOLA_*D) across all timeframes dropped to their lowest levels within the period. The historical ranking data is highly convincing:- •

MIN_7天/14天Parkinson波动率比reached the 5th lowest value in nearly a decade (0.6236) on 2025-12-29. - •

MIN_7天/21天Parkinson波动率比reached the 14th lowest value in nearly a decade (0.6039) on 2025-12-30. - •

MIN_7天/30天Parkinson波动率比reached the 7th lowest value in nearly a decade (0.5363) on 2025-12-29.

- •

- • Interpretation: Short-term volatility compressed to extremely low levels relative to medium/long-term volatility. In Wyckoff theory, this corresponds to the characteristic of the "accumulation" range—the market falls into a dull equilibrium. Volatility contraction often precedes subsequent volatility expansion and trending moves.

- • At the end of December 2025, Parkinson volatility (

- 2. Volatility Expansion & Sentiment Warming:

- • Entering January 2026, volatility increased rapidly. By 2026-01-12,

PARKINSON_RATIO_7D_14Drose to 1.26, andHIS_VOLA_RATIO_7D_14Drose to 1.25, indicating that short-term volatility has significantly surpassed medium-term volatility, confirming increased market activity, warming sentiment, and the initiation of a trending move.

- • Entering January 2026, volatility increased rapidly. By 2026-01-12,

- 3. RSI Validation of Sentiment Shift:

- • RSI_14 briefly fell below 40 (minimum 39.70) around the panic day on 2025-11-20, indicating oversold conditions.

- • Throughout the accumulation phase in December, RSI mostly fluctuated within the neutral 40-55 range, showing no extreme readings.

- • By 2026-01-12, RSI_14 climbed to 64.91, entering strong territory but not yet overbought (>70), indicating healthy upward momentum and optimistic sentiment not yet reaching exuberance.

IV. Relative Strength & Momentum Performance

Returns across different periods clearly demonstrate the recovery and acceleration of momentum.

- • Strong Short-Term Momentum: As of 2026-01-12,

WTD_RETURN(weekly return) is +2.51%, andMTD_RETURN(month-to-date return) reached +6.88%. Short-term momentum is very positive. - • Mid-Term Momentum Turns Positive: From a longer quarterly (

QTD_RETURN) and annual (YTD) perspective, the return is also +6.88%. This means that after the Q4 2025 correction (inferred from QTD data), ICLN strongly reversed its mid-term weakness at the beginning of 2026, initiating a new upward wave. - • Momentum Synergy with Volume-Price Trend: The strong short and mid-term momentum is fully consistent with the observed "high-volume breakout → price rise with increasing volume" price action and volatility expansion, mutually validating the effectiveness of the uptrend.

V. Large Trader ("Smart Money") Behavior Identification

Integrating the above dimensions allows us to infer the operational path of large traders:

- 1. Accumulation Period (December 2025): Amid low prices, extremely low volatility, and light volume, smart money engaged in patient, stealthy accumulation. They utilized the market doldrums and lower year-end liquidity environment to continuously absorb shares sold by retail investors due to disappointment. The huge volume on December 31st may partly originate from their final batch of accumulation or portfolio adjustments.

- 2. Initiation & Markup Period (January 2026): At the beginning of the new year, smart money formally initiated the move through a high-volume surge (2026-01-02). This action aims to attract market attention and test overhead supply (i.e., "test" supply). After the successful breakout, they continued to push the price higher with moderately increasing volume (e.g., January 8th, 12th), while controlling the pace of advance to avoid prematurely exhausting momentum. The high volume (8.355 million) on January 8th with a modest price gain (+0.82%) may indicate some short-term profit-taking, but stronger buying interest absorbed it, suggesting smart money is still maintaining control.

- 3. Current Intent: Smart money has evidently completed the transition from "accumulation" to "markup." The current objective is likely to push the price to a more significant technical/psychological resistance level (e.g., the prior high zone of 17.54-17.59) to observe market reaction and prepare for the next phase of operation (continued markup or phase distribution).

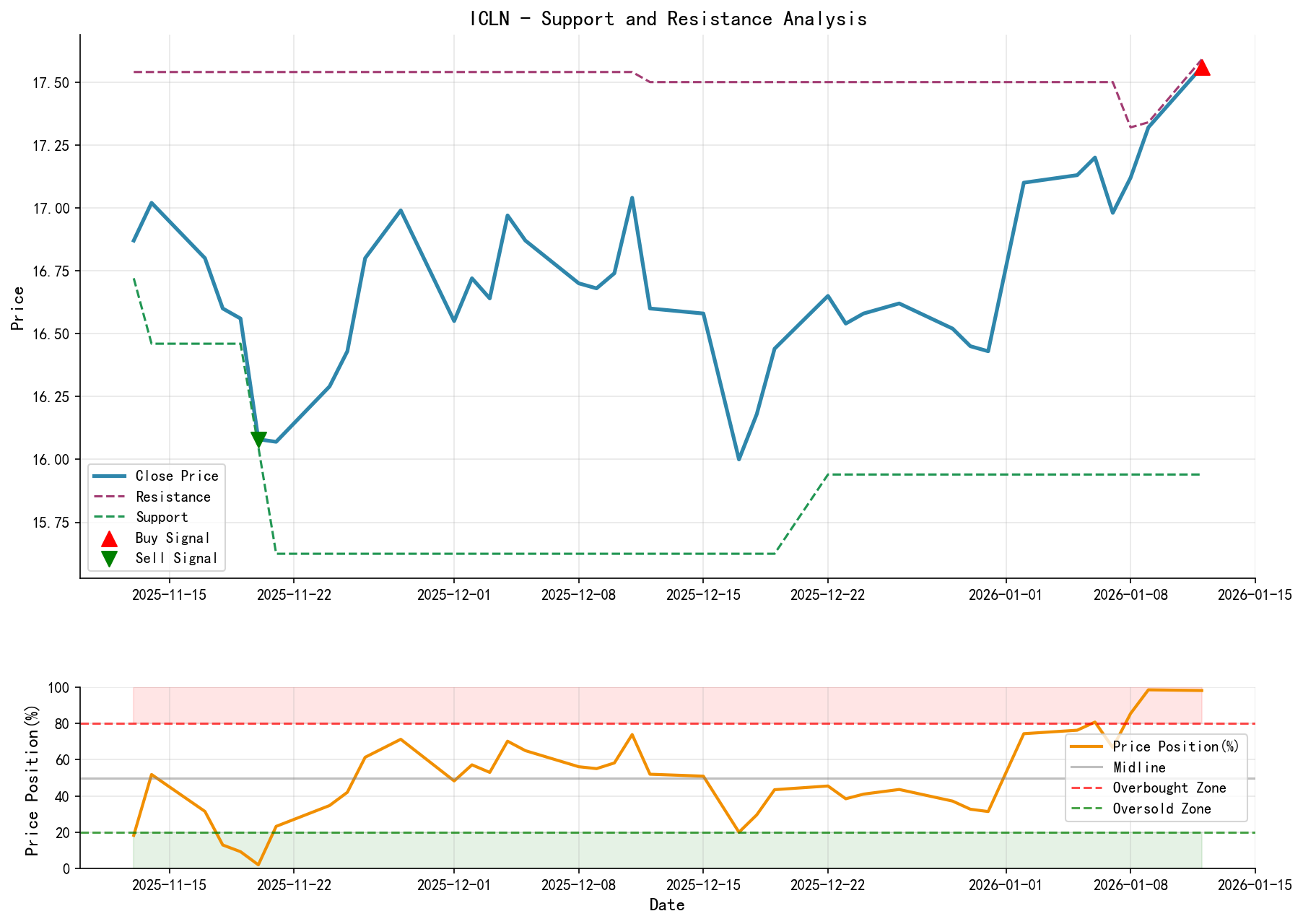

VI. Support/Resistance Level Analysis & Trading Signals

- 1. Key Price Levels:

- • Major Support Levels:

- • S1: 16.80 - 17.00 Zone. This is the recent breakout platform high, near MA_20D, and also the consolidation area from early January, forming the first strong support.

- • S2: 16.00 - 16.20 Zone. This is the core bottom of the December 2025 accumulation range, also the high-volume area above the panic low (15.625), serving as the ultimate strong support.

- • Major Resistance Levels:

- • R1: 17.54 - 17.59 Zone. The November 13, 2025 high and the starting high of the analysis period, serving as the immediate resistance to be tested.

- • R2: 18.00 and above psychological level.

- • Major Support Levels:

- 2. Integrated Wyckoff Events & Trading Signals:

- • Current Market State: In the initial stage of an uptrend. Has completed "accumulation" (December) and "breakout" (January 2nd), currently undergoing a "pullback test" or "continuation" process.

- • Comprehensive Signal: Cautiously Bullish. The trend has turned upward, supported by smart money behavior favoring further advance.

- • Operational Suggestions:

- • Long Strategy (Primary): Favor looking for buying opportunities on pullbacks to the S1 (16.80-17.00) support area. Stop-loss can be placed below S2 (16.00).

- • Target Levels: Initial target is a test of R1 (17.54-17.59). A high-volume, effective breakout above R1 could extend targets towards R2 (18.00+).

- • Risk Warnings & Future Validation Points:

- • Invalidation Signal for Bullish Hypothesis: If price breaks below S2 (16.00) on high volume, it would mean the uptrend has failed, potentially returning to consolidation or downtrend, requiring decisive exit.

- • Validation Points to Observe:

- 1. Volume-price behavior when testing R1: Is it a high-volume breakout or a rejection with reversal?

- 2. In subsequent advances, whether volume can sustain moderate expansion (healthy demand), rather than showing persistent, abnormal high-volume stagnation (potential signs of distribution).

- 3. Whether short-term MAs (MA_5D, MA_10D) can maintain their bullish alignment and provide effective support to the price.

Disclaimer: This report is based entirely on quantitative and theoretical analysis of the provided historical data. All conclusions are derived from data inference and do not constitute any investment advice. Financial markets carry risks, and past performance is not indicative of future results. Investors should make decisions based on their own independent judgment.

Thank you for your attention! Wyckoff volume-price market analysis is published daily at 8:00 AM before market open. Your comments and shares are sincerely appreciated; your recognition is vital. Let's see the market signals together.

Member discussion: