Quantitative Analysis Report on HSTECH Based on Wyckoff Methodology

Product Code: HSTECH

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Time: 2026-01-12

1. Trend Analysis and Market Phase Identification

As of January 12, 2026, for the subject HSTECH: opening price 5737.43, closing price 5863.20, 5-day moving average 5734.18, 10-day moving average 5648.40, 20-day moving average 5575.48, daily return 3.10%, weekly return 2.12%, monthly return 6.29%, quarterly return 6.29%, annual return 6.29%.

Conclusion: The market has experienced a complete sequence of panic - accumulation - test - markup, and is currently in the early stage of a new uptrend, but is facing a test of resistance from the medium-term moving averages.

- • Moving Average Alignment and Price Action:

- • Initial Phase (Mid to Late November): The price (CLOSE) declined continuously from 5981.30 on November 13th, reaching a phase low of 5402.51 on December 16th. During this period, the price successively broke below all short-term moving averages (5D, 10D, 20D) and remained below the 30-day and 60-day moving averages, forming a bearish alignment. This phase aligns with the Panic Decline or Markdown Phase in Wyckoff theory.

- • Turning and Repair Phase (Late December to Early January): The price found support around the 5400 level and began to rebound. By the last day of the reporting period (January 12th), the closing price of 5863.20 had successfully risen above the 5-day (5734.18), 10-day (5648.40), and 20-day (5575.48) moving averages, but was still hovering near the 30-day (5587.47) and 60-day (5725.00) moving averages. The short-term moving averages have turned upward, with the 5-day line crossing above the 20-day line, indicating the moving average system is repairing from a bearish to a bullish alignment.

- • Inferred Market Phase:

- • November-December 2025: Accumulation Phase. After the price fell to a low level, accompanied by extreme volume expansion (140.64% volume growth on December 29th, ranking as the 12th highest in the past 10 years) and sharp contraction in volatility (7-day, 14-day, and 21-day historical and intraday volatility all reached their lowest ranks in nearly 10 years), this matches the characteristics of a Wyckoff Selling Climax followed by an Automatic Rally and Secondary Test. Large investors may have been absorbing shares amidst market panic.

- • Early January 2026 to Present: Early Markup Phase. The price broke above the upper boundary of the previous consolidation range (around 5750) on increased volume. The short-term moving averages are in a bullish alignment, and the RSI has entered the strong zone, indicating that demand is beginning to dominate the market, potentially entering the initiation phase of the Markup Phase.

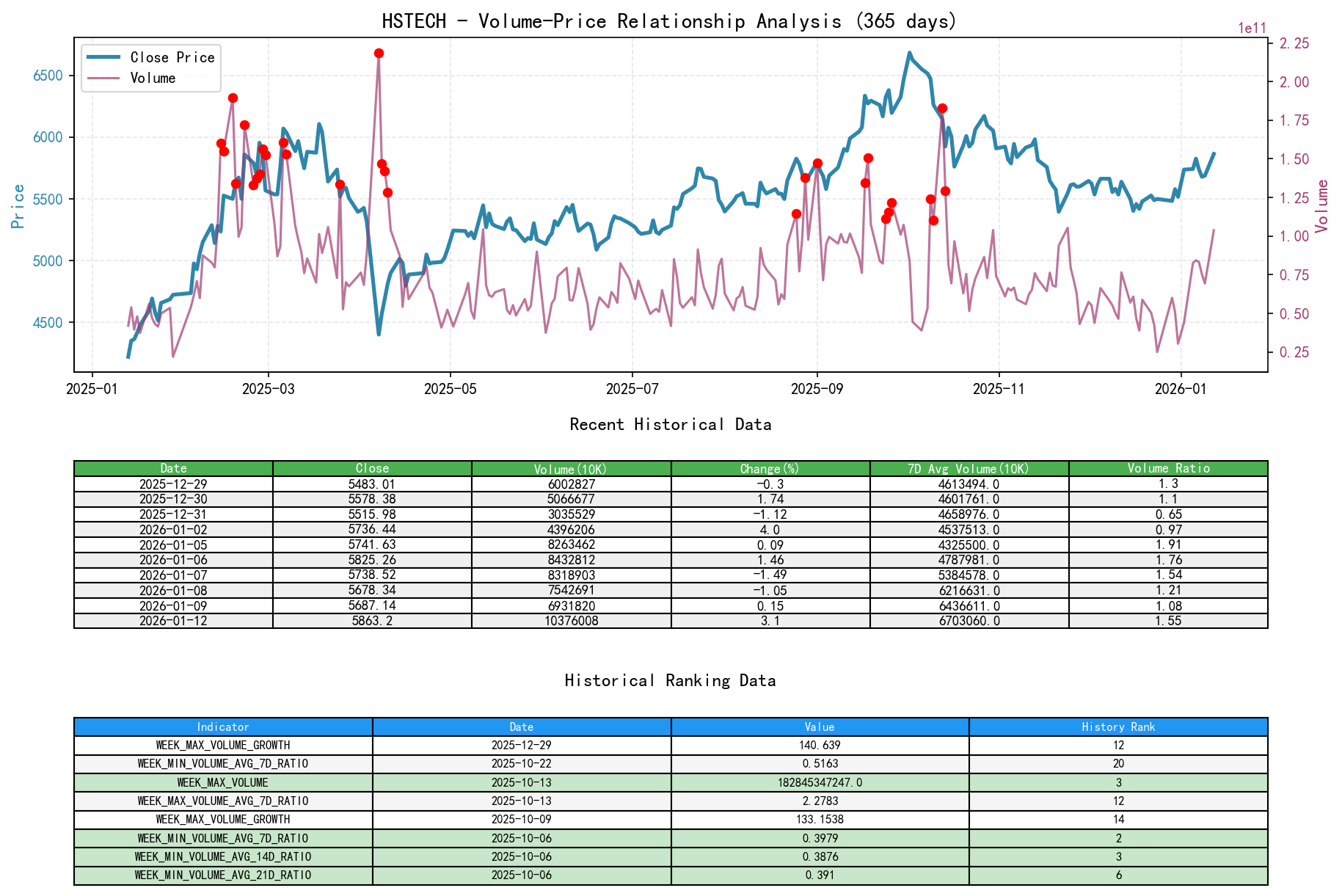

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 12, 2026, for the subject HSTECH: opening price 5737.43, closing price 5863.20, volume 103760083785, daily return 3.10%, volume 103760083785, 7-day average volume 67030609862.29, 7-day volume ratio 1.55.

Conclusion: The volume data clearly reveals the shift in supply and demand forces at key levels (lows and highs), validating the judgment of accumulation and the early markup phase.

- • Demand-Dominated Signals (Bullish):

- 1. Massive Absorption During Panic (2025-12-29): The price declined slightly by 0.30%, but volume surged 140.64% (

VOLUME_GROWTH), ranking among the highest levels in the past 10 years (historical rank 12). Following a prolonged decline and volatility hitting rock bottom, this massive volume indicates significant buying interest actively intervening at low levels, absorbing panic selling pressure, which is typical accumulation behavior. - 2. Breakout on High Volume (2026-01-02, 01-12):

- • On January 2nd, the price rose sharply by 3.99%, with a

VOLUME_AVG_60D_RATIOof 0.65. While volume was not exceptionally high, it initiated the rebound. - • On January 12th (the last day of the period), the price rose 3.10% with a

VOLUME_AVG_60D_RATIOas high as 1.58, significantly above the long-term average. A price rise on high volume confirms the effectiveness of demand and signals the entry of new capital.

- • On January 2nd, the price rose sharply by 3.99%, with a

- 1. Massive Absorption During Panic (2025-12-29): The price declined slightly by 0.30%, but volume surged 140.64% (

- • Supply Exhaustion and Test Signals:

- • Diminishing Volume and Halt of Decline During Secondary Test (2025-12-17 to 12-31): Following the massive transaction on December 29th, the market experienced several pullbacks (e.g., after rising on 12-30, falling on 12-31), but volume quickly diminished (the

VOLUME_AVG_60D_RATIOdropped to 0.44). A decline on low volume indicates supply exhaustion and reduced selling pressure, further validating the effectiveness of the low-level support.

- • Diminishing Volume and Halt of Decline During Secondary Test (2025-12-17 to 12-31): Following the massive transaction on December 29th, the market experienced several pullbacks (e.g., after rising on 12-30, falling on 12-31), but volume quickly diminished (the

- • Abnormal Volume Points: Besides December 29th, the

VOLUME_AVG_60D_RATIOon January 5th and 6th also reached 1.22 and 1.23, respectively, indicating sustained and strong buying power during the early rebound phase.

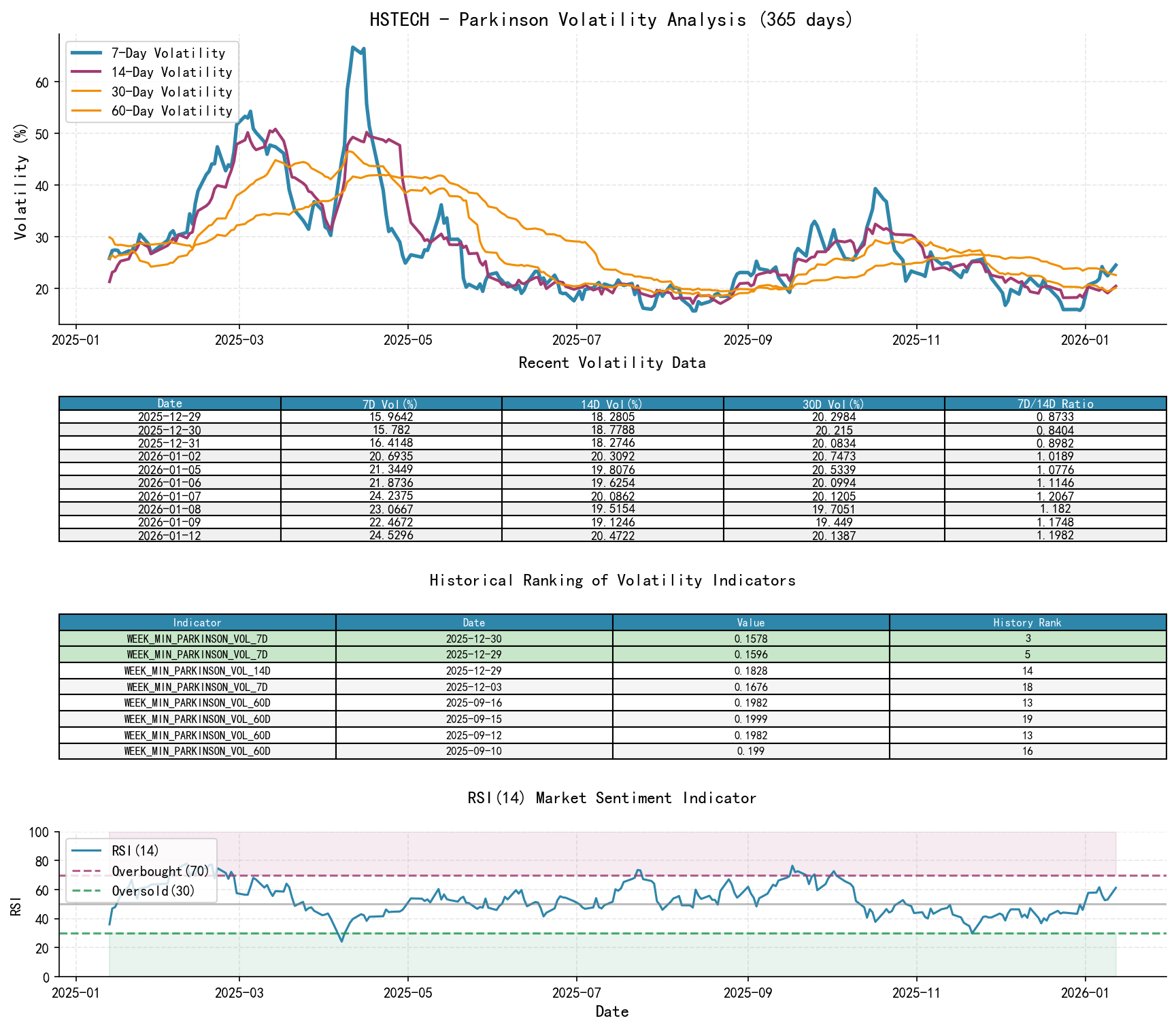

3. Volatility and Market Sentiment

As of January 12, 2026, for the subject HSTECH: opening price 5737.43, 7-day intraday Parkinson volatility 0.25, 7-day intraday volatility ratio 1.20, 7-day historical volatility 0.39, 7-day historical volatility ratio 1.29, RSI 61.27.

Conclusion: Market sentiment has undergone a complete cycle from extreme compression (panic/apathy) to rapid expansion (optimism/participation), providing a sentiment-based foundation for the trend reversal.

- • Volatility Compression to Extreme Lows: By late December 2025, multiple volatility metrics touched or approached their lowest levels in nearly 10 years. For instance, the 7-day historical volatility on December 29th (0.153) was the 13th lowest in the past decade, and the 14-day and 21-day Parkinson intraday volatility also reached their 14th lowest and 11th-13th lowest, respectively. This aligns with the Wyckoff characteristic of volatility convergence in the late stages of accumulation, where market sentiment is extremely suppressed, accumulating energy for a subsequent directional breakout.

- • Volatility Expansion Confirms the Trend: Entering January 2026, short-term volatility metrics (

HIS_VOLA_7D,PARKINSON_VOL_7D) rose rapidly and significantly exceeded the medium-to-long-term volatility averages (HIS_VOLA_RATIO_7D_60Dincreased from 0.47 to 1.22;PARKINSON_RATIO_7D_60Dincreased from 0.67 to 1.09). Expanding short-term volatility accompanied by rising prices is a typical characteristic of trend acceleration, indicating increasing market participation and sentiment heat. - • RSI Sentiment Indicator: The RSI_14 fell into the oversold territory below 30 in mid-December (reaching a low of 36.83 on December 16th) and then fluctuated higher. The RSI on the last day was 61.27, within the strong zone but not yet overbought (>70), suggesting there is still room for upward momentum.

4. Relative Strength and Momentum Performance

Conclusion: Short-term momentum has significantly strengthened, successfully reversing the medium-term downtrend and exhibiting strong bottom reversal characteristics.

- • Return Analysis:

- • Strong Short-Term Momentum: The

WTD_RETURN(Week-to-Date Return) is +2.12%, andMTD_RETURN(Month-to-Date Return) is +6.29%, indicating very active buying power recently. - • Medium-Term Downtrend Reversed: The

QTD_RETURN(Quarter-to-Date Return) has turned positive (+6.29%), successfully recouping all losses from Q4 2025 (QTD had been as low as -16.55%). TheYTD(Year-to-Date Return) is also +6.29%, indicating a strong start to the year.

- • Strong Short-Term Momentum: The

- • Momentum and Volume-Price Validation: The strong short-term returns, combined with the price rise on high volume at period-end, volatility expansion, and bullish alignment of short-term moving averages, collectively form a solid momentum structure for a bottom reversal.

5. Identification of Smart Money Behavior

Conclusion: The data strongly suggests that smart money, represented by institutions, completed large-scale accumulation during the market panic and low-volatility environment in late December 2025 and subsequently led this round of markup beginning in early January 2026.

- • Accumulation Behavior Identification (Mid to Late December 2025):

- • Location: Prices were in the 5400-5600 range, a relatively low area for the year.

- • Method: During the "market apathy period" with volatility and volume hitting multi-year lows, absorbing the final panic selling through a single massive absorption event (December 29th). The subsequent low-volume pullback test (December 30-31) did not make new lows, confirming that supply was effectively absorbed.

- • Intention: To establish positions at a lower cost while retail investors exited due to panic and low trading activity.

- • Markup Initiation Behavior Identification (Early January 2026):

- • Method: After completing accumulation, pushing prices higher through consecutive price rises on increased volume (January 2nd, 5th, 6th, 12th) to move away from the cost zone.

- • Intention: To attract trend followers and retail investor buying, pushing the market into the markup phase. The high-volume bullish candlestick near the previous high (5875.32) on January 12th is an active test of the resistance level.

- • Comprehensive Judgment: The entire behavioral chain (panic selling -> massive accumulation -> low-volume test -> markup on high volume) aligns with the Composite Accumulation Structure described by Wyckoff, with clear indications of smart money's positioning intent and market control.

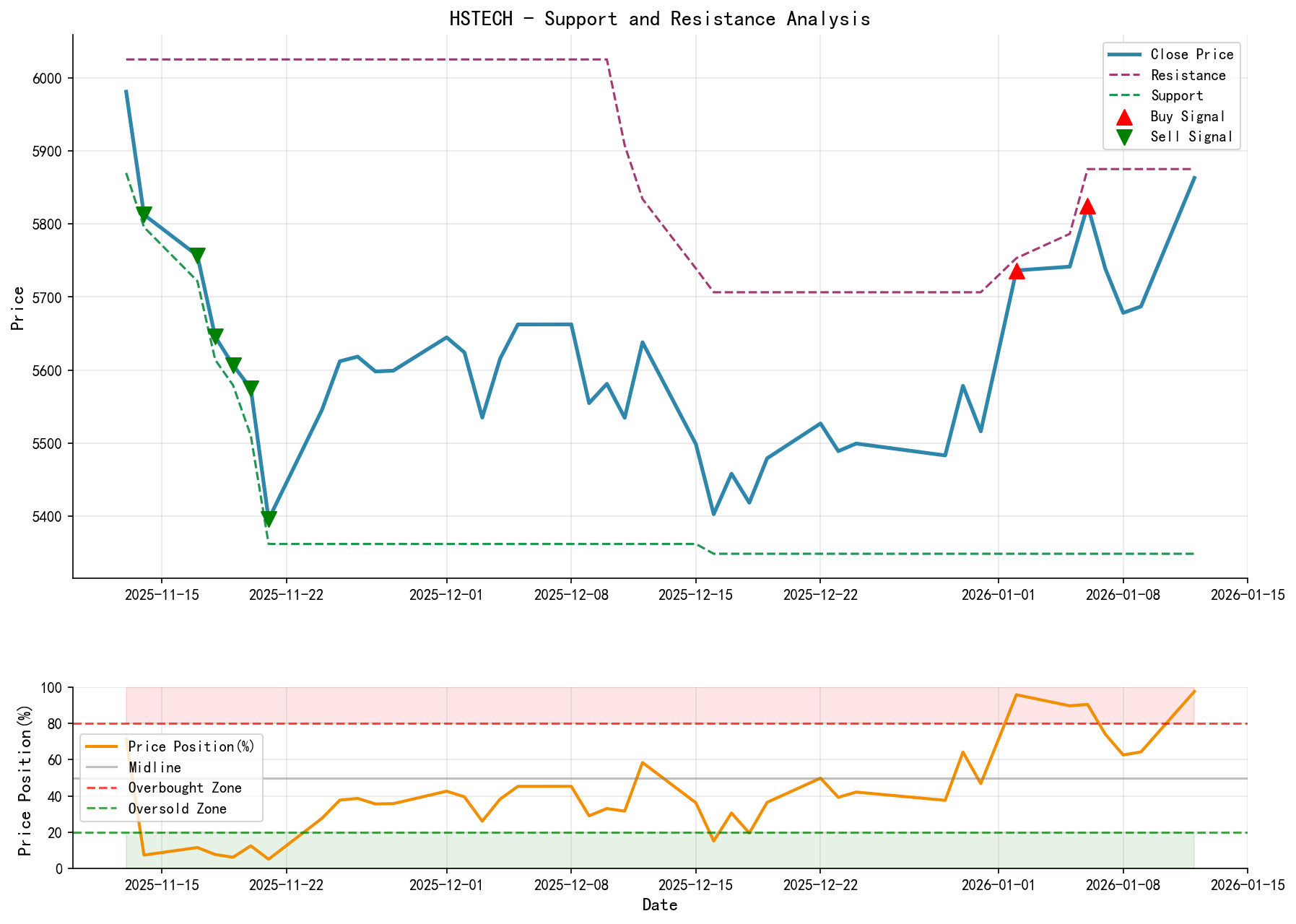

6. Support/Resistance Level Analysis and Trading Signals

Conclusion: Synthesizing Wyckoff events, the current market is issuing a Bullish trading signal. Key resistance is near the recent high, and support has shifted higher.

- • Key Price Levels:

- • Resistance Level (R1): 5875-5900 zone. The recent rebound high (5875.32 on January 6th), together with the 60-day MA (5725) and 30-day MA (5587), forms a technical resistance cluster. A decisive break above this zone would open up space towards levels above 6000.

- • Strong Resistance Level (R2): 6000-6100 zone. The lower boundary of the consolidation platform preceding the November 2025 decline and an area of concentrated medium-to-long-term moving averages.

- • Support Level (S1): 5730-5750 zone. The recently broken platform level, now converted into primary support, also coincides with the 5-day and 10-day MAs.

- • Strong Support Level (S2): 5600-5650 zone. The upper boundary of the December 2025 consolidation range and near the 20-day MA, serving as the upper boundary of the accumulation phase and the core defensive line for the bulls.

- • Wyckoff Composite Trading Signal:

- • Signal Direction: Bullish.

- • Event Basis: The composite structure of "Selling Climax (December low + massive volume)" + "Secondary Test (low-volume halt of decline)" + "Jump Across the Trading Range (SOS, markup on high volume in early January)" has been completed.

- • Operational Recommendations:

- 1. Entry Strategy: Employ a phased entry approach.

- • Aggressive: Consider establishing a partial position when the price pulls back to the S1 support zone (5730-5750) and shows signs of halting decline on low volume.

- • Conservative: Wait for the price to decisively break above the R1 resistance zone (5875-5900) on high volume and then enter on a confirmed pullback.

- 2. Stop-Loss Setting: Place a stop-loss below the S2 strong support level (e.g., 5580 points). This level is the upper boundary of the accumulation range; a break below it would imply the failure of the markup structure.

- 3. Target Outlook: The initial target is in the R2 resistance zone (6000-6100). If R2 is breached, further upside space would open.

- 1. Entry Strategy: Employ a phased entry approach.

- • Future Validation Points:

- • Bullish Validation: The price can stabilize on low volume above the S1 or S2 support levels during subsequent pullbacks and then resume its upward move on increased volume.

- • Risk Warning (Bullish Invalidation): If the price fails to break the R1 resistance and falls below the S2 support (5600 points) on high volume, it indicates a failed markup effort, and the market may revert to consolidation or a downtrend, necessitating a decisive stop-loss.

Disclaimer: This report is entirely based on an objective derivation from the provided data and Wyckoff's volume-price principles. It does not constitute any investment advice. The market involves risks, and investment requires caution. The conclusions in this report need to be dynamically evaluated and validated based on new data emerging from the subsequent market.

Thank you for your attention! Wyckoff Volume-Price Market Interpretations are published daily at 8:00 AM before the market opens. We kindly request your comments and shares; your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: