As a quantitative trading researcher proficient in the Wyckoff Method, I will compose a comprehensive and in-depth quantitative analysis report based on the ETHUSDT data (Analysis Period: 2025-11-13 to 2026-01-12) and historical ranking metrics you have provided. All conclusions are strictly derived from the data and adhere to the Wyckoff principles of price and volume.

Quantitative Analysis Report: ETHUSDT

Product Code: ETHUSDT

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Time: 2026-01-13

1. Trend Analysis and Market Phase Identification

As of January 12, 2026, the underlying asset ETHUSDT had an opening price of 3123.46, a closing price of 3103.19, a 5-day moving average (MA) of 3114.79, a 10-day MA of 3149.30, and a 20-day MA of 3051.24. The daily change was -0.65%, the weekly change was -3.78%, the monthly change was 4.43%, the quarterly change was 4.43%, and the annual change was 4.43%.

Based on moving average and price action analysis, ETHUSDT was in a clear intermediate-term downtrend throughout the analysis period, exhibiting characteristics of a potential bottom formation towards the end.

- • Bearish Alignment Confirmed: For most trading days (especially from mid-November to late December), the price (CLOSE) consistently traded below all key moving averages (MA_5D < MA_10D < MA_20D < MA_30D < MA_60D), forming a standard bearish alignment. The MA_60D (representing the long-term trend) declined continuously from 4044 to 3033, clearly indicating an intermediate-term downtrend.

- • Market Phase Classification:

- • Panic Phase: From 2025-11-20 to 2025-11-21, the price plummeted from 3025.48 to 2765.85, a cumulative decline of 8.6% over two days, accompanied by a surge in trading volume (VOLUME increased from 738k to 1.18 million). This is a classic panic phase (Wyckoff Phase 3) at the end of a decline.

- • Automatic Rally: From 2025-11-24 to 2025-12-11, the price rebounded from 2765.85 to 3324.14, a gain of over 20%. This rally occurred following the initial panic selling, consistent with the Wyckoff model.

- • Secondary Test: From 2025-12-12 to the end of the report period (2026-01-12), the price entered a sideways consolidation range (approximately 2900-3200) after the rally, with significantly diminished volume. This represents a test of the previous low support, aiming to confirm whether supply has been exhausted. The failure to make a new low (minimum 2833.49 > previous low 2765.85), coupled with converging volatility, suggests the market may be transitioning from a downtrend into an accumulation phase.

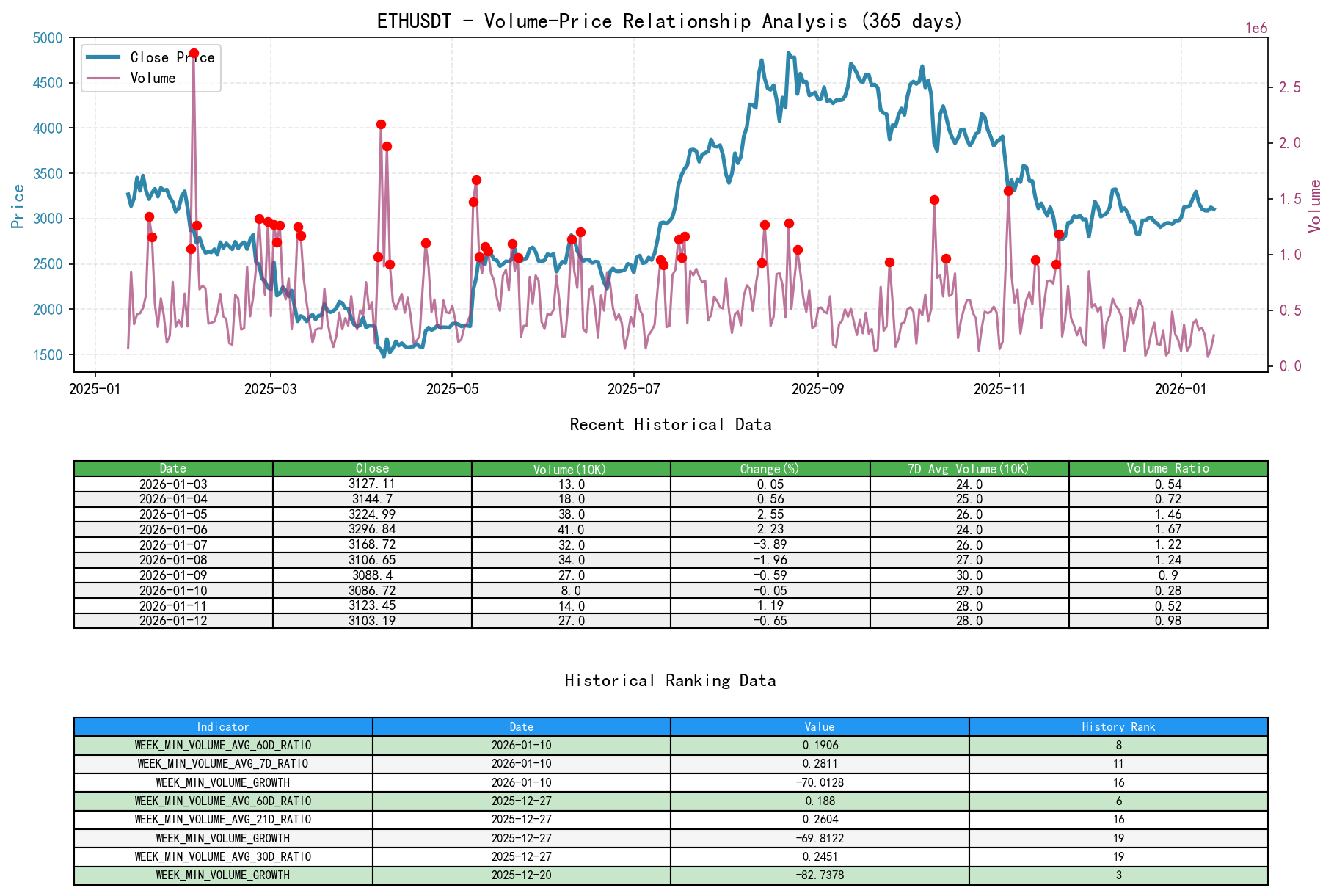

2. Price-Volume Relationship and Supply-Demand Dynamics

As of January 12, 2026, the underlying asset ETHUSDT had an opening price of 3123.46, a closing price of 3103.19, trading volume of 274511.23, a daily change of -0.65%, trading volume of 274511.23, a 7-day average volume of 280889.46, and a 7-day volume ratio of 0.98.

Price-volume analysis reveals the intense shift in supply and demand forces at key levels, providing core evidence for identifying smart money behavior.

- • Panic Selling (Supply Dominated): On 2025-11-20, the price fell sharply by -6.32%, with volume surging to 913k. The Volume to 14-day Average Volume Ratio (VOLUME_AVG_14D_RATIO) was as high as 1.45, indicating absolute dominance by supply (selling). The following day (Nov 21) continued the decline on high volume, confirming the panic.

- • Heavy Volume Halting the Decline and Rally (Demand Entry): On 2025-11-24, the price surged 5.40% with volume expanding to 715k, and Volume Growth (VOLUME_GROWTH) reached 74.54%, showing significant buying (demand) entering at the panic lows, absorbing the panic selling. Subsequent rallies, such as on 2025-12-09 with a 6.21% gain accompanied by 604k volume, further confirmed the persistence of demand.

- • Low Volume Testing (Insufficient Demand but Exhausted Supply): Since mid-December 2025, the price has shown extremely low volume multiple times during consolidation. For example, on 2025-12-20, volume was only 92k, with a Volume to 7-day Average Volume Ratio (VOLUME_AVG_7D_RATIO) as low as 0.22, ranking as the 4th lowest in nearly a decade (HISTORY_RANK: 4). This "low volume test of lows" indicates a significant reduction in selling pressure (supply) while buyers (demand) are also on the sidelines. This is a typical characteristic of the accumulation phase.

- • Historical Extreme Signal: On 2025-12-01, volume skyrocketed by 364.64%, setting the 11th highest single-day volume growth record in nearly a decade (HISTORY_RANK: 11). The price fell -6.43% on that day. Combined with the extreme historical ranking, this was likely a Selling Climax, marking the point where massive supply was absorbed by the market in a short period.

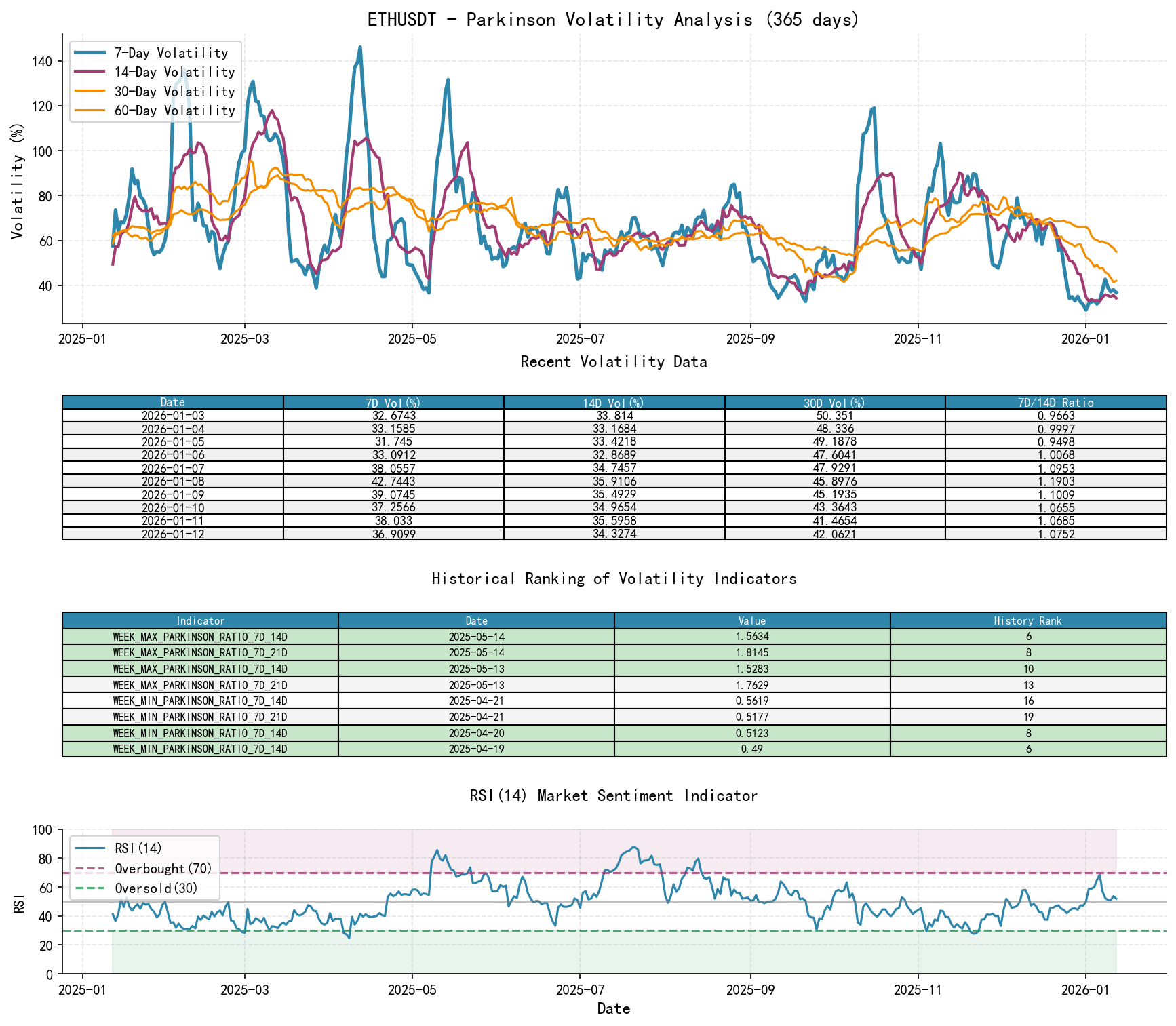

3. Volatility and Market Sentiment

As of January 12, 2026, the underlying asset ETHUSDT had an opening price of 3123.46, a 7-day intraday volatility of 0.37, a 7-day intraday volatility volume ratio of 1.08, a 7-day historical volatility of 0.39, a 7-day historical volatility volume ratio of 1.04, and an RSI of 52.00.

Volatility indicators and RSI together depict the evolution of market sentiment from extreme panic to gradual calm.

- • Volatility Spike During Panic: During the November decline, the 7-day Historical Volatility (HIS_VOLA_7D) peaked at 0.946 (2025-12-05), and the 7-day Parkinson Volatility (PARKINSON_VOL_7D) peaked at 0.898 (2025-11-21), indicating intense intraday price swings and panicked market sentiment.

- • Volatility Contraction and Sentiment Recovery: Entering late December and January, volatility systematically declined. The 7-day Historical Volatility dropped to an extremely low level of 0.121 on 2026-01-01, ranking as the 12th lowest record in nearly a decade (HISTORY_RANK: 12). Simultaneously, the 7-day/60-day Volatility Ratio (HIS_VOLA_RATIO_7D_60D) was only 0.187 that day, ranking as the 8th lowest historically (HISTORY_RANK: 8), indicating that short-term volatility had contracted extremely, with market sentiment recovering from panic to calm, entering a consolidation period.

- • RSI Confirms Oversold Condition and Recovery: The RSI_14 dropped to a deeply oversold level of 27.72 during the panic selling period (2025-11-21), confirming extreme sentiment. It subsequently recovered to a neutral-to-high region (peaking at 68.68) during the rally. Currently (2026-01-12), it sits at 52.0, indicating market sentiment has moved away from extremes towards balance.

4. Relative Strength and Momentum Performance

Returns across different periods show improvement in short-term momentum, while medium-term momentum remains in a recovery process.

- • Short-term Momentum Turns Positive: Entering January 2026, the Weekly Return (WTD_RETURN) recorded positive values multiple times (e.g., 6.74% on Jan 2). The Monthly Return (MTD_RETURN) also turned positive (4.43% as of Jan 12), indicating the short-term downward momentum has reversed, providing a foundation for a rebound.

- • Medium-term Momentum Remains Weak: Although the Quarterly Return (QTD_RETURN) and Annual Return (YTD) have also turned positive due to the recent rally, their magnitude (~4.4%) remains weak compared to the previous significant decline (QTD was as low as -32.5% on Dec 1), indicating the market is still in the early stages of recovery from a deep decline, with long-term investor confidence not yet fully restored.

5. Identification of Large Investor (Smart Money) Behavior

Integrating price-volume, volatility, and trend analysis allows for inferring the behavior trajectory of large investors:

- • Absorbing During the Panic Phase: During the panic-driven, high-volume plunge on November 20-21, and on the record-breaking volume growth day of December 1, a massive amount of sell orders (retail capitulation) must have been absorbed by strong buying. Who was buying? Smart money (institutions/large players) utilized market panic to conduct initial, selective accumulation at low levels.

- • Distributing Some Holdings and Observing During the Automatic Rally: The subsequent strong rally (Nov 24 to early Dec) occurred on overall lower volume than the panic phase, suggesting the rally was primarily driven by short covering and some chase buying. Smart money likely took partial profits or conducted wash trades near resistance levels (e.g., around the MA_20D) to gauge market reaction and manage position costs.

- • Patient Accumulation During the Secondary Test Phase: During the "Secondary Test" consolidation range from mid-December to the present, trading volume has consistently contracted to historically low levels (multiple VOLUME_AVG_*_RATIO indicators reached their lowest rankings in nearly a decade). This is the most critical signal. Who is on the sidelines during low volume? Retail trading interest is low. Who is active? Smart money is using low volatility and subdued sentiment to conduct slow, patient, batch accumulation within the key support zone (2900-3000), avoiding pushing the price up too quickly. This behavior pattern closely aligns with Wyckoff's "Accumulation Phase."

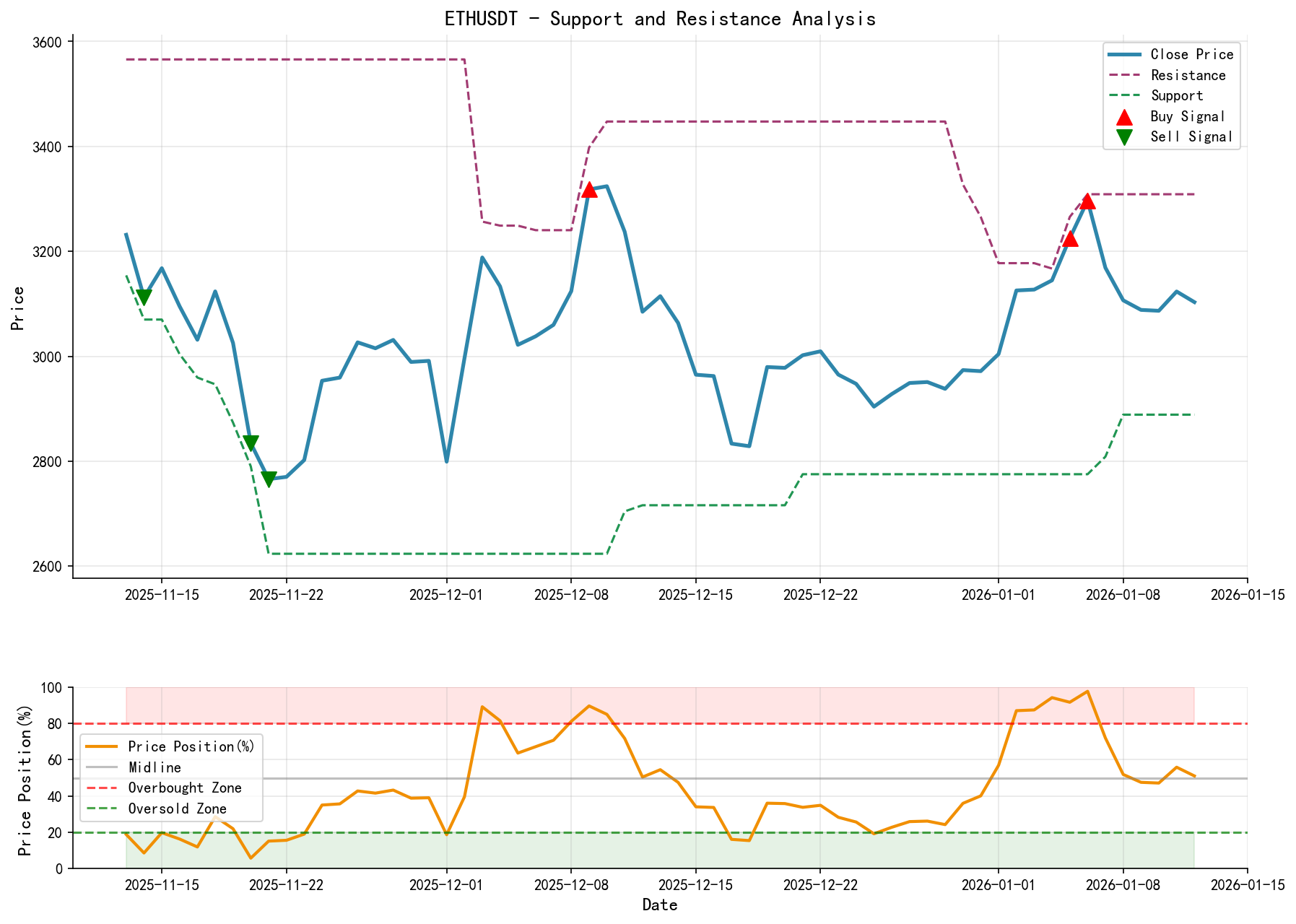

6. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- • Primary Support: The 2700-2800 zone (formed by the panic lows of November 2025). This area has endured panic selling and multiple tests and is the critical line for determining a potential trend reversal.

- • Secondary Support: The 3000-3050 zone (the lower boundary of the recent consolidation range and a level tested multiple times in January 2026).

- • Key Resistance Levels:

- • Primary Resistance: The MA_20D moving average (currently around 3050). The price needs to break above and sustain above the MA_20D on significant volume to preliminarily confirm a reversal of the downtrend.

- • Next Resistance: The 3200-3300 zone (the high-volume congestion area formed by the December 2025 rally highs).

- • Integrated Wyckoff Events and Trading Signals:

- • Current Phase Judgment: The market is highly likely in the later stages of the "Accumulation Phase" (Secondary Test range). The Panic Selling (SC) and Automatic Rally (AR) are complete. Currently, it is in the process of low-volume testing of support (ST) and potentially forming a "Spring" (a false breakdown before the final breakout).

- • Trading Signal: Cautiously bullish, seeking opportunities to buy on dips. Market structure shows exhaustion of supply and smart money accumulation, but demand has not yet manifested on a large scale.

- • Operational Recommendations:

- 1. Entry Zone: Watch for signs of price stabilization in the 3000-3050 support zone (e.g., candlesticks with long lower wicks or small advances on increased volume).

- 2. Confirmation Signal: The ideal signal for adding to positions or confirming a trend change is the price breaking above and holding above the MA_20D (currently ~3050) on significant volume, with volume notably higher than recent averages (VOLUME_AVG_7D_RATIO > 1.2).

- 3. Stop Loss Level: A strict stop loss for any long position should be placed below 2900, as a break below this level would indicate failure of the secondary test, prompting the market to seek lower support.

- 4. Target Zone: The initial target can be set towards 3400 (the previous rally high and congestion area). A decisive break above could open up greater upside potential.

- • Future Validation Points:

- • Confirming Signal: After low-volume, narrow-range consolidation at or slightly below current levels, a medium-sized bullish candlestick (gain >3%) breaking above the consolidation range's upper boundary (~3150) on increased volume.

- • Invalidating Signal: The price breaking below 2950 on increased volume, especially if accompanied by a re-expansion of volatility (HIS_VOLA_7D), would indicate accumulation failure and a potential continuation of the downtrend, requiring an immediate shift to a neutral or bearish stance.

Disclaimer: The content of this report/analysis is solely for market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantee regarding the accuracy or completeness of the content. Markets involve risks, and investment requires caution. Any investment actions taken based on this report are at your own risk.

Thank you for your attention! Daily Wyckoff price-volume market analysis is published punctually before the market opens at 8:00. Please feel free to leave comments and share. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: