BOTZ Quantitative Analysis Report (Based on the Wyckoff Method)

Product Code: BOTZ

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

I. Trend Analysis and Market Phase Identification

As of 2026-01-12, for the underlying asset BOTZ: Opening Price 38.37, Closing Price 38.44, 5-Day Moving Average (MA) 37.93, 10-Day MA 37.25, 20-Day MA 36.70, Daily Change +0.55%, Weekly Change +2.21%, Monthly Change +6.10%, Quarterly Change +6.10%, Year-to-Date Change +6.10%.

- 1. Trend Assessment:

- • Long-term Trend (MA_60D): MA_60D steadily rose from 35.62 to 36.34, indicating a clear long-term uptrend. The price at the end of the analysis period (38.44) is significantly above the MA_60D (36.34), confirming a positive long-term trend.

- • Medium-term Trend (MA_20D, MA_30D): In mid-to-late November, the price remained below all medium-term moving averages, forming a bearish alignment (MA_5D < MA_10D < MA_20D < MA_30D), indicating a downtrend. A turning point occurred on December 4th, where the price broke strongly above all medium-term moving averages on high volume (VOLUME_AVG_30D_RATIO=1.66). Subsequently, the price has consistently held above the MA_20D and MA_30D, and formed a bullish alignment (MA_5D > MA_10D > MA_20D > MA_30D) in early January 2026, confirming that the medium-term trend has clearly shifted to upward.

- • Short-term Trend (MA_5D, MA_10D): The short-term moving averages frequently intertwine, reflecting normal fluctuations and pullbacks within the rising channel. Currently, MA_5D (37.93) > MA_10D (37.25), indicating a short-term upward trend.

- 2. Market Phase Identification (Wyckoff Framework):

- • Phase A: Preliminary Support (Nov 13 - Nov 20): Price fell consecutively from 35.30 to 33.08 with expanding volume (Nov 14 VOLUME_AVG_30D_RATIO=2.55), showing signs of a Selling Climax (SC) (Nov 14, high-volume candle with a long lower shadow). This was followed by an Automatic Rally (AR) (Nov 21).

- • Phase B: Accumulation Range Construction (Nov 21 - Dec 3): Price oscillated repeatedly within the 33.08-35.51 range, with volume contracting and then expanding again (Dec 4). The price tested the previous low (33.08) but did not make a new low, forming a Secondary Test (ST). During this phase, volatility (PARKINSON_VOL) declined from high levels.

- • Phase C: Test and Confirmation (Dec 4): A Sign of Strength (SOS) occurred on Dec 4, with a large-volume (volume up 140%) bullish candle breaking above the upper boundary of the trading range and all medium-term moving averages. RSI_14 jumped from 51 to 62, confirming that demand overwhelmed supply and completing the accumulation phase.

- • Phase D: Uptrend (Dec 4 - Present): Price entered an upward channel. It has experienced several successful Last Point of Support (LPS) tests (e.g., Dec 12, Dec 17), where each pullback saw diminished volume (VOLUME_AVG_*D_RATIO < 1), followed by a resumption of the uptrend on increased volume. Currently, the price is progressing within the uptrend of Phase D but is approaching historical high territory.

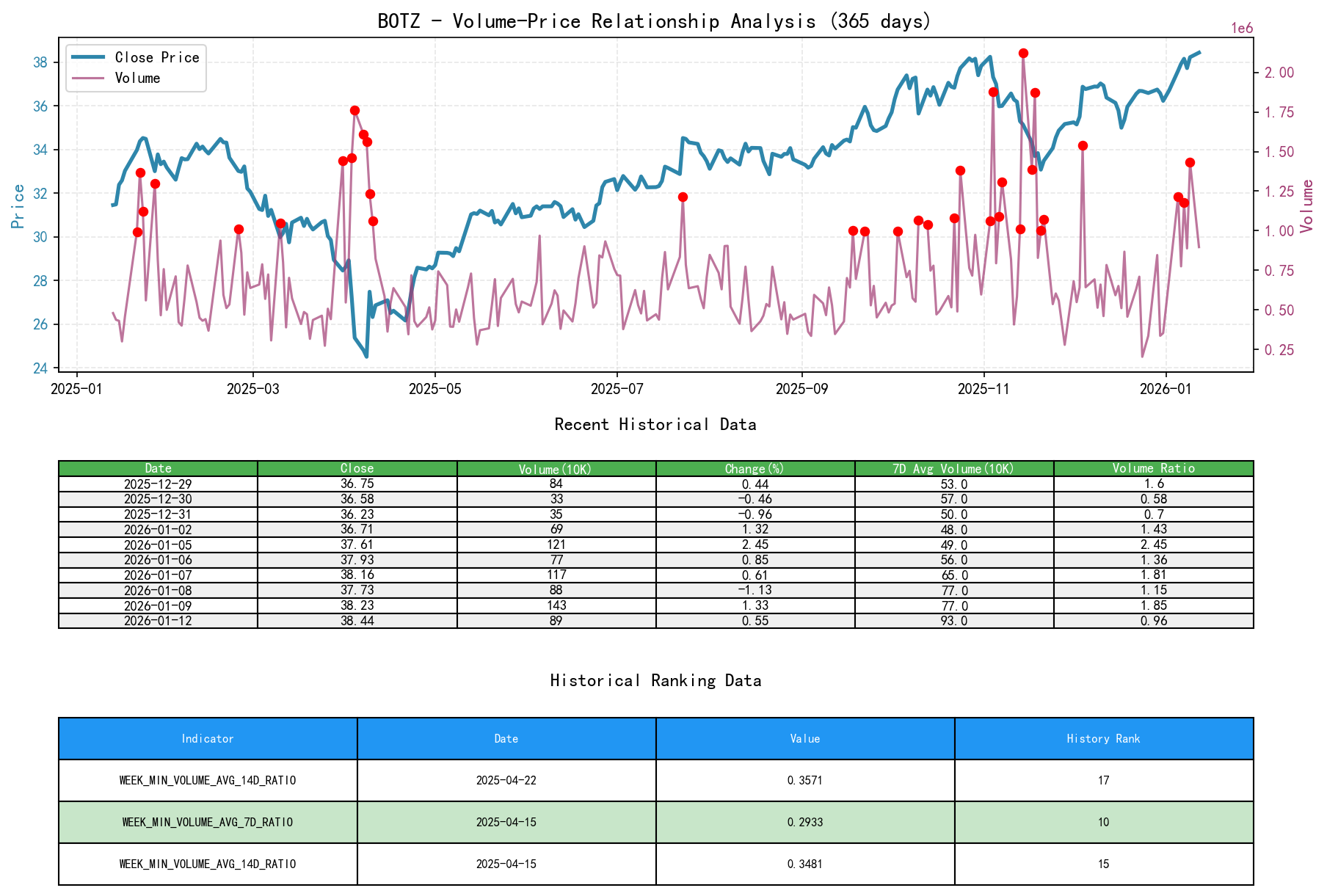

II. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-12, for the underlying asset BOTZ: Opening Price 38.37, Closing Price 38.44, Volume 896,035, Daily Change +0.55%, 7-Day Average Volume 934,306.43, 7-Day Volume Ratio 0.96.

- 1. Key Demand Days (Demand Dominant):

- • 2025-12-04: Price +3.86%, volume reached 1.538 million (VOLUME_AVG_30D_RATIO=1.66), a high-volume breakout, serving as a decisive signal of demand entering.

- • 2026-01-05: Price +2.45%, volume 1.217 million (VOLUME_AVG_30D_RATIO=1.90), breaking recent consolidation with renewed demand.

- • 2026-01-09: Price +1.33%, volume 1.434 million (VOLUME_AVG_14D_RATIO=2.12), confirming the uptrend's sustainability with increased volume.

- 2. Key Supply Days / Lack of Demand Days:

- • 2025-11-14: Price -0.42%, volume 2.126 million (VOLUME_AVG_60D_RATIO=3.04), high-volume failure to decline, indicating significant supply emerged early in the decline, but the closing price did not set a new low, potentially signaling panic selling.

- • 2025-12-12: Price -1.49%, volume 783k (VOLUME_AVG_14D_RATIO=1.16), a decline on higher volume, representing an effective test (LPS) of the uptrend, later recaptured by demand.

- • 2026-01-12 (Latest Trading Day): Price +0.55%, volume 896k (VOLUME_AVG_7D_RATIO=0.96). After consecutive gains, a low-volume advance appears, warranting caution for potential weakening short-term momentum and possible supply testing.

- 3. Supply-Demand Shift Signals:

- • High-volume decline -> Low-volume stabilization in late November indicates absorption of supply.

- • The high-volume advance on Dec 4 is a clear marker of the shift in supply-demand forces, with demand taking control.

- • Pullbacks during the uptrend are generally low-volume, while rallies are high-volume, indicative of a healthy uptrend structure.

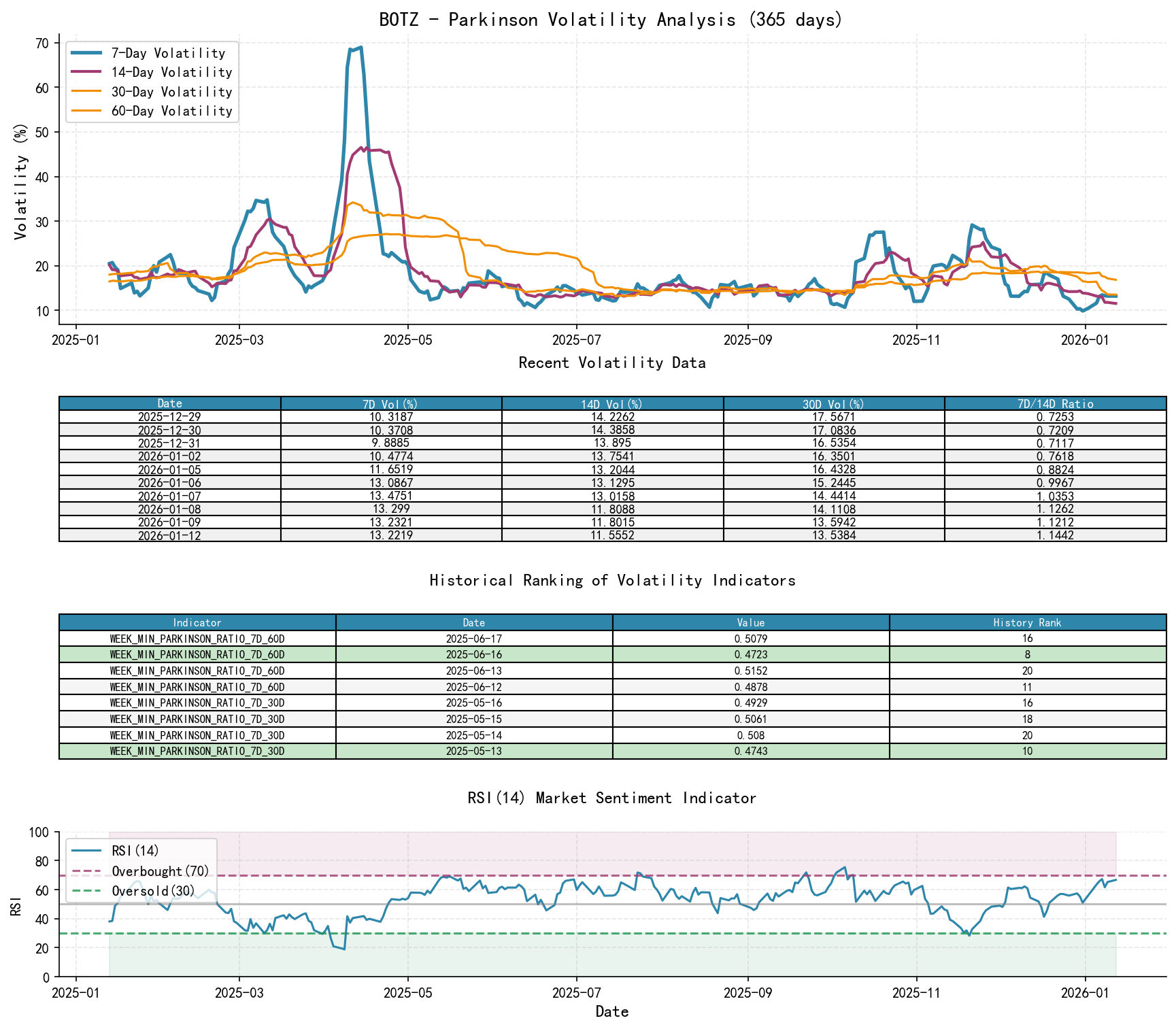

III. Volatility and Market Sentiment

As of 2026-01-12, for the underlying asset BOTZ: Opening Price 38.37, 7-Day Intraday Volatility 0.13, 7-Day Intraday Volatility Ratio 1.14, 7-Day Historical Volatility 0.21, 7-Day Historical Volatility Ratio 1.08, RSI 66.73.

- 1. Volatility Levels:

- • Historical Volatility (HIS_VOLA_30D) gradually declined from a high of 0.33 (around Nov 20) and stabilized around 0.23 (as of Jan 12), indicating a market shift from panicked selling to orderly advance, with sentiment stabilizing.

- • Intraday Volatility (PARKINSON_VOL_30D) followed a similar pattern, declining from 0.22 to 0.14, showing converging intraday price swings and strengthening trendiness.

- 2. Volatility Anomalies:

- • Panic Period: On Nov 14, PARKINSON_RATIO_7D_60D=1.31, where short-term volatility far exceeded long-term, corresponding to panic selling.

- • Breakout Period: On Dec 4, HIS_VOLA_RATIO_7D_14D=0.77, but volume was exceptionally high, indicating the breakout was driven by concentrated, massive demand rather than amplified volatility.

- • Recent Period: Volatility ratios (HIS_VOLA_RATIO, PARKINSON_RATIO) are generally near or slightly above 1, with no extreme values, suggesting a market sentiment of moderate optimism.

- 3. Overbought/Oversold (RSI):

- • RSI_14 touched a low of 28.26 on Nov 20, entering oversold territory, coinciding with the price low (33.08).

- • Since then, RSI has trended upward, reaching a high of 67.30 on Jan 7, approaching but not entering the overbought zone (70). The current RSI is 66.73, indicating the market is in a strong but not extreme state.

IV. Relative Strength and Momentum Performance

- 1. Absolute Momentum:

- • Short-term (WTD): +2.21%, strong momentum.

- • Medium-term (MTD/QTD): +6.10%, very strong momentum, confirming the uptrend since early December.

- • Long-term (YTD): +6.10%, positive performance year-to-date.

- 2. Momentum Confirmation:

- • The strong MTD/QTD returns fully align with the conclusions from the Phase D (Uptrend) volume-price analysis.

- • Momentum was effectively confirmed by increased volume on key breakout days (Dec 4) and recent acceleration days (Jan 5, 9), indicating momentum is supported by genuine demand.

- 3. Historical Ranking Integration:

- • According to

historical_rank_data, the weekly closing high of 38.44 on 2026-01-12 ranks 20th in the past 10 years. This indicates the current price is in the upper region of its historical price range (assuming ~500 weeks of data, this places it in the top 4th percentile). This is important context, meaning the price is testing a historically significant resistance area. Subsequent price action should be closely monitored for supply-demand behavior at this critical level.

- • According to

V. Large Investor ("Smart Money") Behavior Identification

- 1. Accumulation Behavior:

- • Location: Mid-to-late November, price within the 33-35 range.

- • Evidence: The Automatic Rally (AR) and Secondary Test (ST) following the Selling Climax (SC), and characteristics of low volume on declines and slightly higher volume on bounces within the trading range. Smart money accumulated positions at lows, exploiting public panic.

- • Confirmation: The high-volume breakout (SOS) on Dec 4 was a clear signal that smart money had completed accumulation and began pushing the price higher.

- 2. Mark-up Behavior:

- • Location: The rising channel from Dec 4 to present.

- • Evidence: Advance days are frequently accompanied by volume significantly above average (VOLUME_AVG_*D_RATIO > 1.2), while pullback days see rapid volume contraction. This pattern suggests the advance is driven by organized demand (smart money) rather than retail chasing.

- • Intent: To push the price into a high zone suitable for distribution. The current level is near historical highs (rank 20), warranting vigilance for potential initiation of distribution behavior.

- 3. Current Behavior Inference:

- • Large investors are currently likely still in a mark-up/holding phase. The recent low-volume advance (Jan 12) may indicate that dominant players are temporarily easing the push or conducting an initial supply test at these highs to gauge market follow-through and selling pressure.

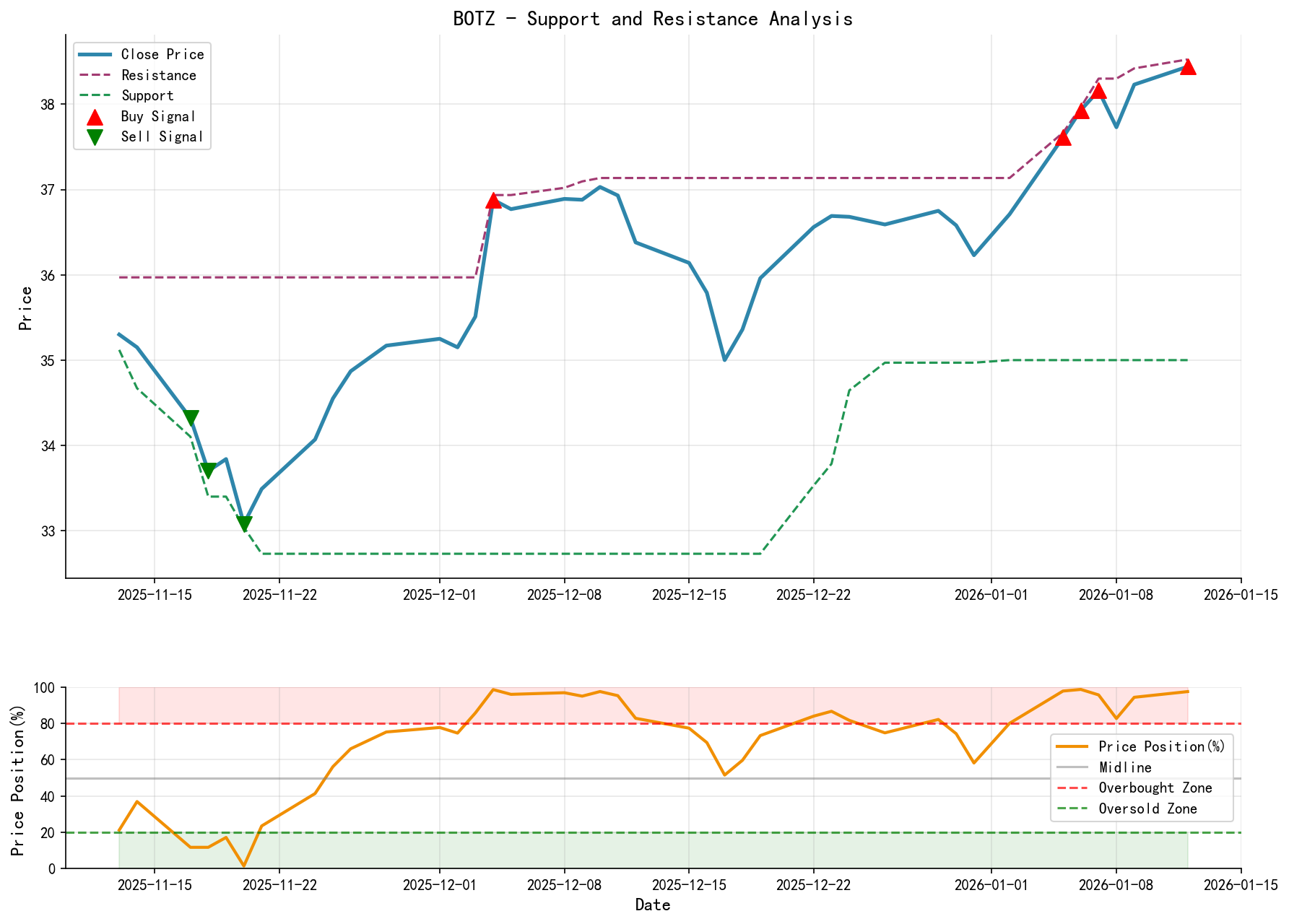

VI. Support/Resistance Level Analysis and Trading Signals

- 1. Key Support Levels:

- • Primary Support: 36.70 - 37.00 zone. This is the upper boundary of the early January consolidation platform and the area of the recent MA_20D. A pullback to this level on low volume would be an ideal point for adding or entering positions.

- • Secondary Support: 36.00 - 36.20 zone. Corresponds to the late December oscillation lows and the confluence area of MA_30D/MA_60D. A break below this zone could damage the uptrend.

- • Strong Support: 35.00. Corresponds to the upper boundary of the early December accumulation range and a key psychological level.

- 2. Key Resistance Levels:

- • Immediate Resistance: 38.50 - 39.00 zone. The current price is testing this area, which is also the top-20 historical high zone, where historical supply may emerge.

- • Upper Resistance: Observe whether the price can quickly move away from the 38.50 area after a potential breakout to judge the validity of the breakout.

- 3. Comprehensive Wyckoff Trading Signals and Action Plan:

- • Overall Assessment: Bullish, but at a key resistance zone in the short-term. Avoid chasing highs; wait for pullback confirmation.

- • Trend Status: Primary trend (MA_60D) up, medium-term trend (price > MA_20D/30D) up, short-term trend (MA_5D > MA_10D) up.

- • Action Plan:

- • Existing Positions: Continue holding. Raise stop-loss to just below 36.70 (lower boundary of primary support). Consider partial profit-taking if the price first reaches the 38.80-39.20 resistance zone and shows signs of high-volume stalling (e.g., long upper shadow, bearish candle).

- • Seeking New Entry: Wait patiently for a pullback. Ideal entry is in the 36.80-37.10 support zone. Entry signal: Price pulls back to this zone, forms a low-volume stabilization candle (doji, hammer), followed by a high-volume (VOLUME_AVG_7D_RATIO > 1.2) bullish candle reclaiming ground.

- • Stop-Loss Setting: Set stop-loss for new entries below 36.20.

- • Future Validation Points (Close Monitoring):

- 1. Demand Sustainability Test: Over the next 1-3 trading days, how does price behave around 38.50? Is it a high-volume breakout (strong demand) or high-volume stalling/decline (supply emerging)?

- 2. Pullback Quality Test: If a pullback occurs, does volume contract significantly? Is there positive buyer response (high-volume bounce) near support levels?

- 3. Failure Signal: If the price breaks below 36.70 on high volume and fails to recover quickly within the same or next day, it suggests the uptrend may be interrupted. Reassess whether the market is entering a distribution phase, and consider exiting all long positions.

Core Report Conclusion: BOTZ has completed a classic Wyckoff accumulation process and initiated an uptrend in early December. The price, driven by smart money, has now advanced into historical high territory. Although the trend remains upward, the short-term faces a critical resistance test. The trading strategy should center on holding existing positions and accumulating on dips, strictly avoiding chasing highs, and closely monitoring price-volume behavior at key support levels and as price approaches resistance, to identify potential early signals of distribution.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding accuracy or completeness. Markets involve risks; invest with caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff volume-price market analysis is published daily at 8:00 AM before market open. Your feedback and shares are greatly appreciated. Let's see the market signals together.

Member discussion: