BNBUSDT Quantitative Analysis Report (Based on the Wyckoff Method)

Product Code: BNBUSDT

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Time: 2026-01-13

Core Summary:

Analysis of the last two months of data based on Wyckoff's price-volume principles indicates that BNBUSDT has undergone a complete cycle transition from panic selling (late November) to a phase of accumulation (mid-December). The current price (~905) is situated below a key resistance zone, showing characteristics of contracting supply but not yet effective demand expansion. This aligns with a typical "post-accumulation test" or "re-accumulation" stage. The extreme volume surge on December 19 by large investors (smart money) represents the most significant recent signal, indicating substantial absorption at the panic lows. Short-term momentum has shown some repair, but a confirmed uptrend has not yet materialized. Operationally, it is advisable to seek dip-buying opportunities near key support levels and await confirmation signals for a strong return of demand.

1. Trend Analysis and Market Phase Identification

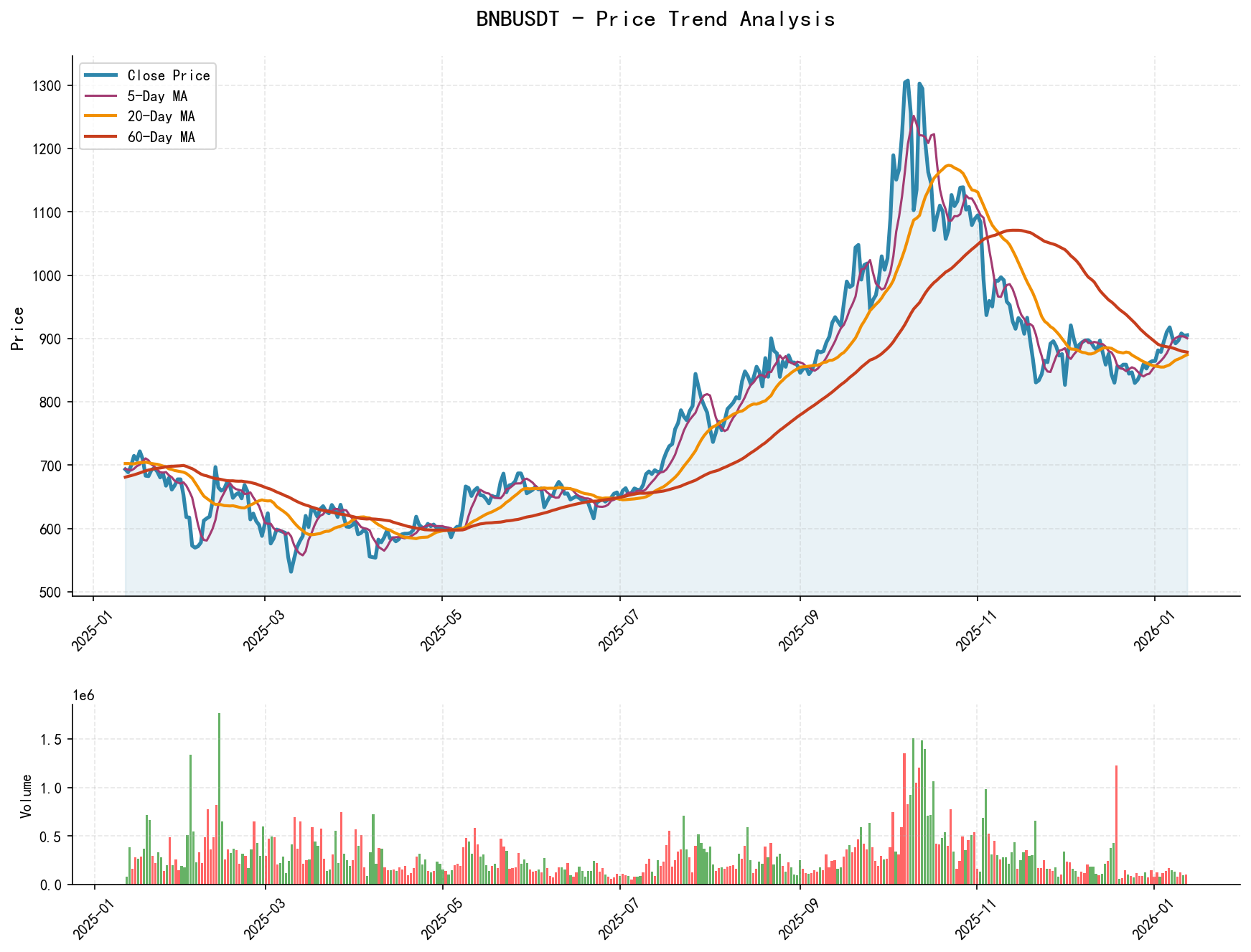

As of January 12, 2026, for the subject BNBUSDT: Opening Price 904.32, Closing Price 905.20, 5-day MA 900.33, 10-day MA 898.49, 20-day MA 874.37, Daily Change 0.10%, Weekly Change -0.56%, Monthly Change 4.73%, Quarterly Change 4.73%, Year-to-Date Change 4.73%.

- • MA Alignment and Price Action:

- • Overall Trend: During the analysis period, price declined from approximately $950 to a low of 790.79 (November 21), subsequently rebounding to the current level of 905.2. All period moving averages (MA_5D to MA_60D) are in a bearish alignment and persistently declining, indicating the market is in a mid-to-long-term downtrend.

- • Phase Breakdown:

- 1. Distribution & Decline (Nov 13 - Nov 21): Price broke below all MAs, with MA_5D persistently crossing below longer-term MAs, accompanied by intermittent high-volume declines (e.g., Nov 19, 21), consistent with Wyckoff's "decline after distribution" and "panic selling" characteristics.

- 2. Initial Support & Panic Low (Nov 21): Price reached the cycle low of 790.79. The day's volume (654,486) relative to its 14-day average ratio reached 2.15 (historically extreme level). The candlestick featured a long body with a short lower shadow, indicative of panic selling.

- 3. Automatic Rally & Secondary Test (Nov 22 - Dec 18): Price rebounded from the low, but the rally high (928.24 on Dec 4) failed to effectively challenge the starting point of the prior decline. Price subsequently retraced and repeatedly tested the 820-860 zone, with volume gradually contracting (e.g., Dec 20 volume hit a new phase low), aligning with "Automatic Rally" and "Secondary Test" features.

- 4. Signs of Accumulation (Dec 19): A key reversal day occurred. Price opened near the prior low (830.08), surged 3.14% to close at 856.17, with volume exploding to 1,227,346. Multiple volume ratios hit their highest levels in nearly a decade (see historical rankings). This is a clear smart money accumulation signal.

- 5. Narrow Range Consolidation & Testing (Dec 20 - Jan 12): Price consolidated within a narrow 840-920 range. Volume rapidly receded from extreme highs to below average levels. The MA system gradually flattened from a bearish alignment. The market entered a consolidation/accumulation or re-testing phase.

- • Market Phase Conclusion: The market has transitioned from the "Panic Selling" (Phase C) to the "Accumulation Range" (Phase A-B). It is currently within the consolidation and testing segment of the accumulation range, using price fluctuations to test whether supply is exhausted and if demand can strengthen.

2. Price-Volume Relationship and Supply-Demand Dynamics

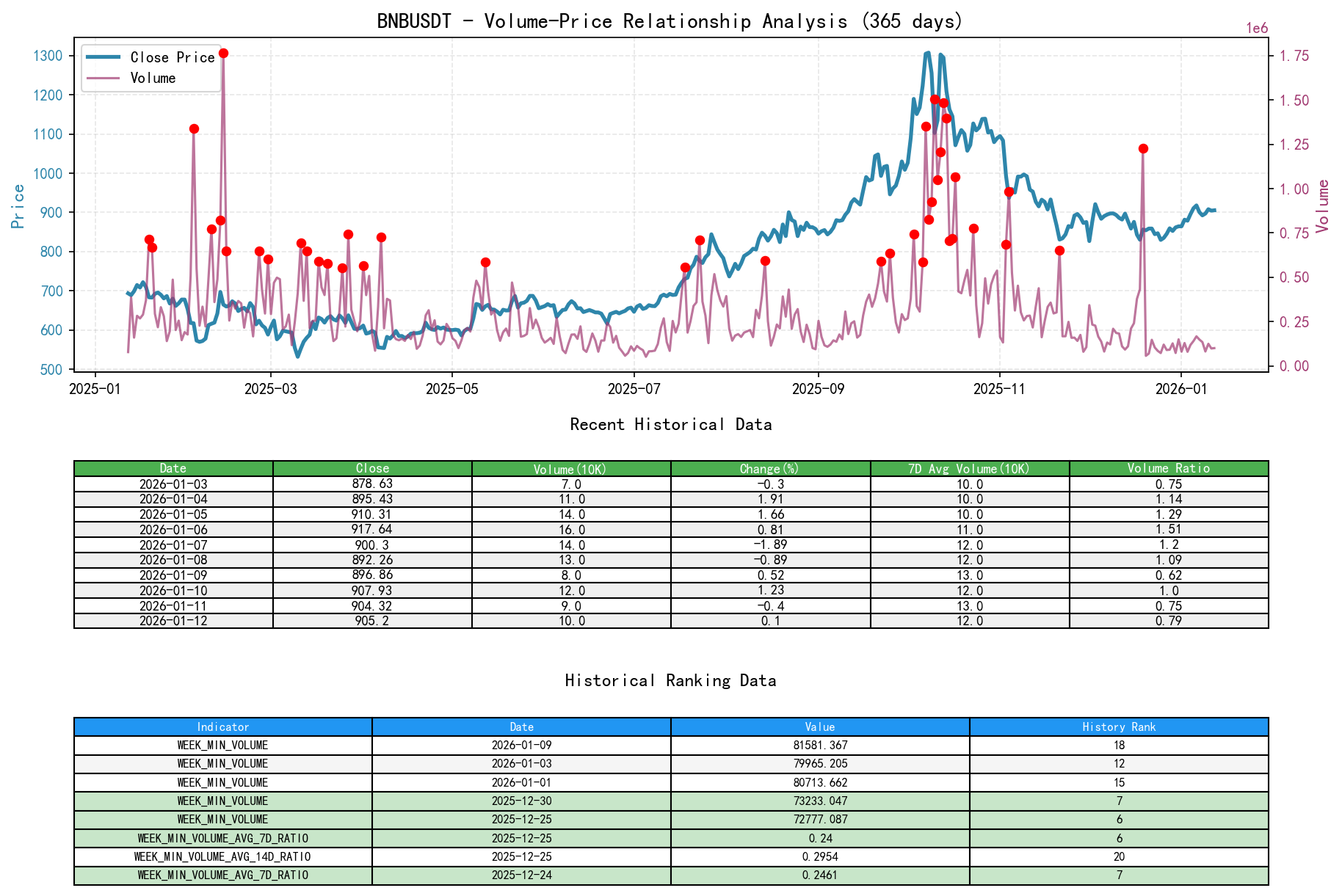

As of January 12, 2026, for the subject BNBUSDT: Opening Price 904.32, Closing Price 905.20, Volume 100601.48, Daily Change 0.10%, Volume 100601.48, 7-day Avg Volume 127934.21, 7-day Volume Ratio 0.79.

- • Analysis of Key Price-Volume Days:

- • Supply-Driven Decline (2025-11-21): Price fell sharply (-4.16%), with volume surging 116.86% from the previous day. The

VOLUME_AVG_14D_RATIOreached 2.15. This is a classic Selling Climax, with a flood of sell-side (supply) activity, though the extreme volume also hints at underlying absorption. - • Demand-Driven Rebound (2025-12-19): Price rose (+3.14%), with volume reaching the highest level in the analysis period (1,227,346). The

VOLUME_AVG_7D_RATIOwas 5.45 (ranking #2 in the past decade), andVOLUME_AVG_14D_RATIOwas 6.54 (ranking #2 in the past decade). This is a clear signal of strong demand entry and the key turning point from panic to accumulation. Historically, such extreme volume ratios typically correspond to major trend inflection points or large institutional positioning. - • Supply Exhaustion & Insufficient Demand (2025-12-20, 2025-12-30): On Dec 20, price declined slightly, with volume plummeting 95.35% to 57,015, and the

VOLUME_AVG_7D_RATIOat only 0.148 (ranking #2 lowest in the past decade). This indicates severe supply contraction following the panic and accumulation volume extremes. On Dec 30, price rebounded (+1.08%) but on a volume of only 73,233 (ranking #7 lowest weekly volume in the past decade), constituting a Low Volume Rally, showing insufficient demand follow-through and a weak foundation for the rise. - • Recent Price-Volume (2026-01-12): Price increased slightly (+0.10%), with volume (100,601) slightly above recent lows but still weak. The

VOLUME_AVG_7D_RATIOof 0.79 indicates light trading and temporary balance between buyers and sellers.

- • Supply-Driven Decline (2025-11-21): Price fell sharply (-4.16%), with volume surging 116.86% from the previous day. The

- • Supply-Demand Dynamics Conclusion: Panic supply was largely exhausted on Nov 21 and Dec 1. Clear, large-scale smart money demand entered decisively on Dec 19. The subsequent market characteristic is continued supply contraction, but lack of sustained demand expansion, leading to range-bound price action. The current state is a period of demand building following supply exhaustion.

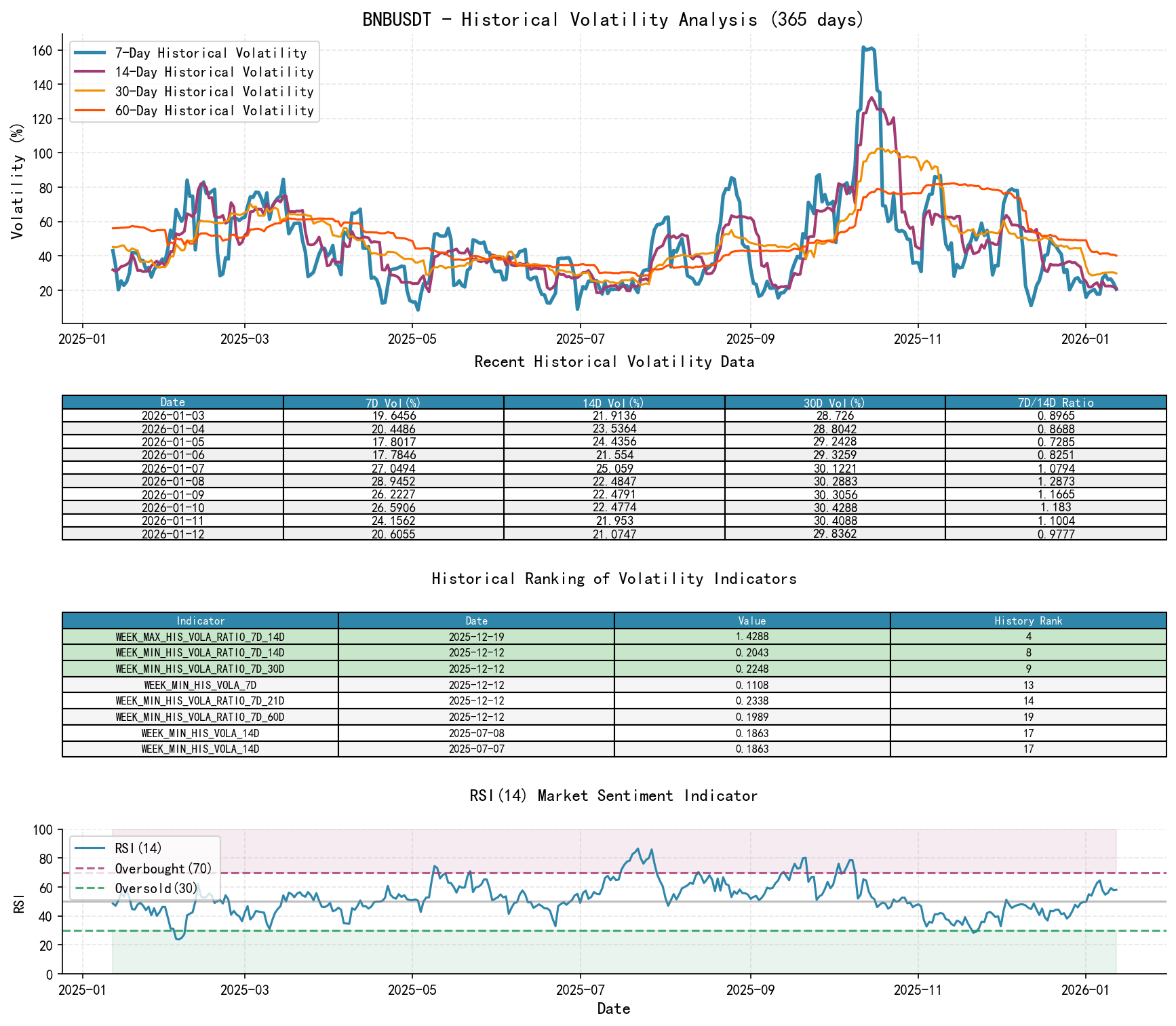

3. Volatility and Market Sentiment

As of January 12, 2026, for the subject BNBUSDT: Opening Price 904.32, 7-day Intraday Volatility 0.29, 7-day Intraday Volatility Ratio 1.02, 7-day Historical Volatility 0.21, 7-day Historical Volatility Ratio 0.98, RSI 58.11.

- • Volatility Analysis:

- • Volatility Expansion During Panic: During the November decline and the secondary test around December 1, short-term historical volatility (

HIS_VOLA_7D) and Parkinson volatility (PARKINSON_VOL_7D) rose significantly. Their ratios relative to longer-term volatility (e.g.,HIS_VOLA_RATIO_7D_14D,PARKINSON_RATIO_7D_60D) exceeded 1.0 multiple times, even reaching 1.43 (Dec 19, ranking #4 in the past decade), indicating heightened short-term market fear and volatility. - • Volatility Contraction: Entering January, short-term volatility (

HIS_VOLA_7Dfell below 0.21,PARKINSON_VOL_7Dfell to 0.29) declined significantly, falling notably below mid-term (14D/21D) volatility (ratios < 1), entering a contraction state. This typically occurs during pauses in trend movement when the market seeks direction, aligning with the current consolidation market feature.

- • Volatility Expansion During Panic: During the November decline and the secondary test around December 1, short-term historical volatility (

- • Sentiment Indicator (RSI):

- • RSI_14 entered the oversold zone during the panic selling period (minimum 28.42) but did not reach extreme oversold levels (e.g., below 20), suggesting selling pressure stemmed more from event-driven or emotional shocks rather than deep despair from a prolonged bear market.

- • Recently, RSI_14 has fluctuated around the 50 mid-line (currently 58.11). Sentiment has recovered from pessimism but is not yet overbought, leaving room for potential subsequent price movement.

- • Sentiment Conclusion: The market has passed through the period of panic-driven volatility and entered a low-volatility equilibrium phase. Sentiment indicators show the market in a neutral-to-slightly-bullish state, with no extreme sentiment present, providing a stable "emotional foundation" for further trend development.

4. Relative Strength and Momentum Performance

- • Periodic Return Analysis:

- • Short-Term Momentum Repair:

WTD_RETURN(Week-to-Date) andMTD_RETURN(Month-to-Date) turned positive in January (-0.56% and +4.73% respectively), indicating the short-term downtrend has halted and positive momentum has emerged. - • Mid-Term Momentum Remains Weak:

QTD_RETURN(Quarter-to-Date) is still -14.29% (Note: Data crosses the year-end, making this figure of limited reference). A more reliable indicator,YTD(Year-to-Date), is +4.73%, showing that from a mid-term (monthly) perspective, the market is only beginning to repair the sharp declines of November-December. - • Long-Term Context:

TTM_12(Trailing 12-month return) remains at +30.56%, indicating that despite the significant retracement, from a one-year perspective, the market is still in an uptrend.

- • Short-Term Momentum Repair:

- • Momentum Conclusion: The short-term downtrend has ended, with momentum shifting from negative to positive, but the strength of the rebound is not yet sufficient to reverse the medium-term downtrend weakness. The market is in the initial repair phase following a deep correction within a long-term uptrend.

5. Large Investor (Smart Money) Behavior Identification

- • Core Behavioral Assessment:

- 1. Absorption During Low-Point Panic Selling: The high-volume declines on November 21 and December 1 were not purely panic capitulation. Inferred from the extreme-volume rebound on December 19, smart money conducted large-scale, organized absorption at the panic lows (790-830 zone). This is classic Accumulation behavior.

- 2. Quiet Period and Testing After Accumulation: Following the massive buy-in on December 19, the market did not immediately surge but entered a low-volume consolidation. This aligns with Wyckoff's "accumulation range" characteristics: smart money controls the price to prevent rapid appreciation, continuing to accumulate at lower costs, and testing remaining market supply through fluctuations. The record-low volumes in early January (ranking high on historical lists) indicate floating supply has been largely cleaned out.

- 3. Current Intent: Smart money has completed its first major wave of accumulation. They are likely now in a position-holding and market-testing phase. They await a signal of spontaneous demand strengthening or an external catalyst to lead a price breakout from the current consolidation range.

- • Behavioral Conclusion: Large investors completed significant accumulation positioning in the ~$800-860 zone. The current market is in a "quiet period" or "re-testing period" under their influence. Their next intent depends on successfully guiding a high-volume breakout above the key resistance zone.

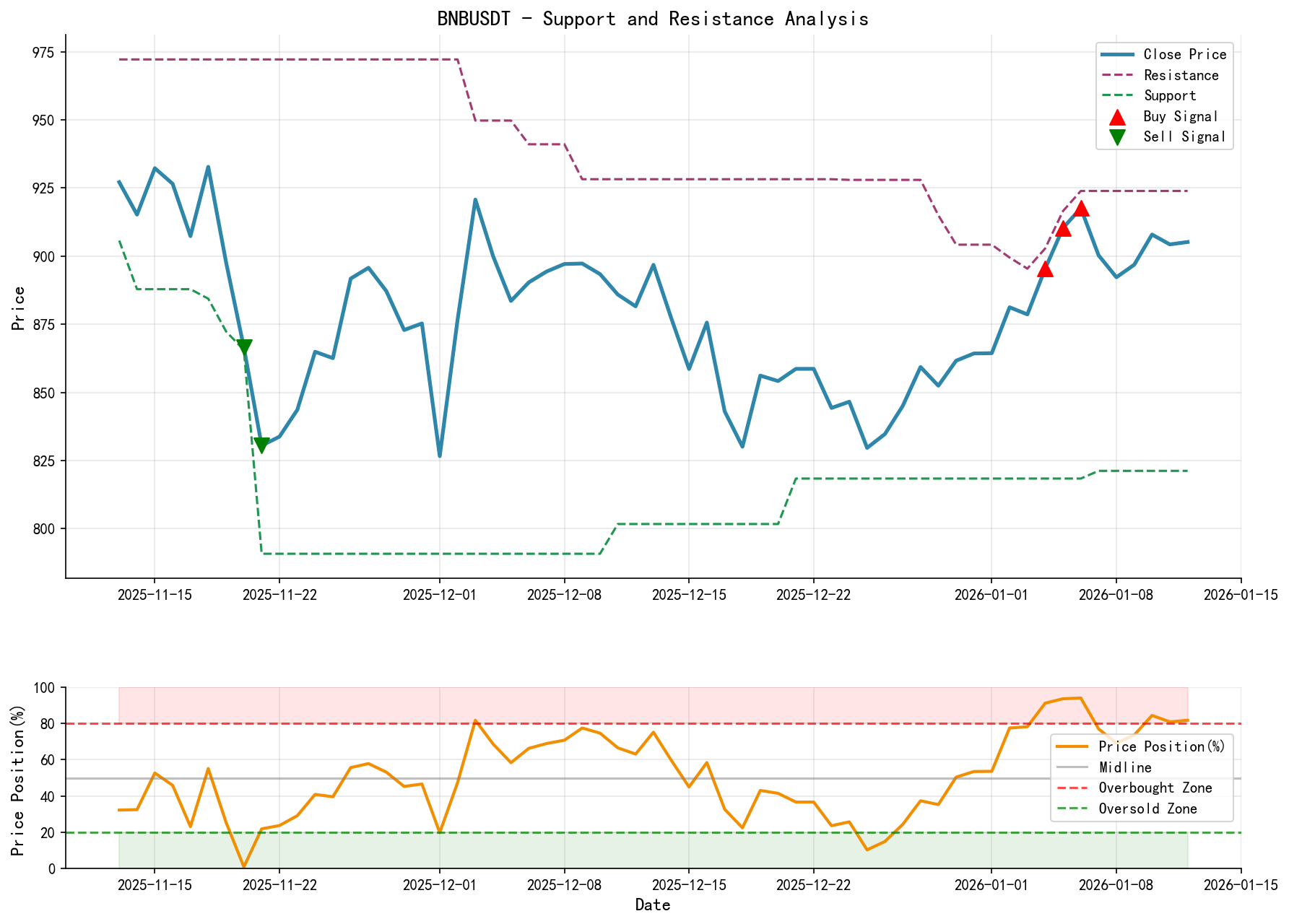

6. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Primary Support (S1): $830-860 zone. This is the zone containing the December panic low, secondary test lows, and the smart money high-volume accumulation event. It represents the strongest support band.

- • Secondary Support (S2): $790-800 zone. The absolute low point of the November 21 panic selling, acting as the ultimate support.

- • Primary Resistance (R1): $920-930 zone. The December early rebound high and a level that price has repeatedly failed to decisively break above in January. This is the range ceiling and key supply zone.

- • Secondary Resistance (R2): $950-970 zone. The starting zone of the November breakdown, constituting stronger resistance.

- • Integrated Wyckoff Events and Trading Signals:

- • Current Event Assessment: The market exhibits characteristics following a successful "Spring" or "Test" (price drops into support and quickly recovers), and is currently in the upper half of the accumulation trading range.

- • Bullish Signal Confirmation Condition: Price breaks above and holds above $930 on high volume (

VOLUME_AVG_7D_RATIO> 1.2). This would signify an upward breakout from the accumulation range, with demand finally overcoming supply, potentially turning the trend bullish. - • Bearish Signal Confirmation Condition: Price breaks below the $860 support on increased volume. This would signify accumulation failure, with the market potentially retesting or even breaking below the $790 low.

- • Operational Recommendations:

- • Aggressive Strategy (Range Traders): Near the $860-880 support zone, combined with low-volume reversal candlestick patterns (e.g., hammer, inside bar), consider a light long position. Target the850.

- • Conservative Strategy (Trend Traders): Maintain a wait-and-see approach, awaiting confirmation of the bullish or bearish signals mentioned above. If a high-volume breakout above970. If a high-volume breakdown below $860 occurs, consider exiting or reversing positions.

- • Risk Warning: Chasing rallies within the range (near $920) carries higher risk, as it is prone to encountering supply pressure at the range top. The current low-volatility environment could be disrupted at any time, necessitating close attention to volume changes.

- • Future Validation Points:

- 1. Demand Validation: When price approaches the $920-930 resistance again, observe whether volume expands significantly alongside the price rise. This is key to determining if demand is sufficiently strong.

- 2. Supply Validation: When price retests the $860-880 support, observe if low-volume stabilization occurs. Low volume indicates supply exhaustion and validates support.

- 3. Structure Validation: Observe whether a structure of higher lows (HL) and higher highs (HH) gradually forms within the $830-930 range. This is an early technical signal for the start of an uptrend.

Disclaimer: All conclusions in this report are derived from quantitative analysis of the provided historical data and Wyckoff principles and do not constitute any investment advice. The cryptocurrency market carries extremely high risk with intense price volatility. Investors should make independent judgments and bear all associated risks.

Thank you for your attention! Wyckoff price-volume market analysis is released daily at 8:00 AM before the market opens. We appreciate your comments and shares—your recognition is vital. Let's work together to understand market signals.

Member discussion: