Okay, received. As your quantitative trading researcher, I will strictly adhere to the Wyckoff Method to conduct an in-depth analysis of the market data for product code 399006 during the period 2025-11-13 to 2026-01-12, and integrate nearly 10 years of historical ranking data to present you with an objective, data-driven quantitative analysis report.

Wyckoff Quantitative Analysis Report: Product Code 399006 (China Growth Enterprise Market Index)

Report Date: 2026-01-12

Analysis Period: 2025-11-13 to 2026-01-12

Core Methodology: Wyckoff Principles of Price and Volume

1. Trend Analysis and Market Phase Identification

As of 2026-01-12, the target 399006's opening price was 3323.64, closing price 3388.34, 5-day moving average 3314.73, 10-day moving average 3272.56, 20-day moving average 3216.25, daily change 1.82%, weekly change 2.85%, monthly change 5.78%, quarterly change 5.78%, yearly change 5.78%.

- • Moving Average Alignment and Trend State:

- • At the end of the analysis period (2026-01-12), the price (

CLOSE: 3388.34) has significantly broken above all major moving averages (MA_5D: 3314.73, MA_10D: 3272.56, MA_20D: 3216.25, MA_30D: 3179.83, MA_60D: 3147.06). Short-term moving averages (MA_5D, MA_10D) have crossed above the long-term moving average (MA_60D), with MA_20D and MA_30D following closely, indicating the market has recovered from the mid-term correction and transitioned to the early stages of a bullish alignment. - • Key Moving Average Crossover Signals: Looking back to the sharp decline phase in late November 2025 (Nov 21st, close 2920.08), the price had once fallen below all short-term moving averages, creating a large deviation from the MA_60D. During the subsequent rebound, the MA_5D crossed above the MA_20D in early December (e.g., Dec 8th), confirming the end of the short-term downtrend and the formation of a rebound structure.

- • At the end of the analysis period (2026-01-12), the price (

- • Price Action and Inferred Wyckoff Phase:

- • Phase One - Panic Selling: 2025-11-21, the index experienced a significant decline (-4.02%) on high volume (volume 26.15 billion,

VOLUME_AVG_30D_RATIO: 1.27), closing at the phase low of 2920.08. This aligns with the characteristics of "Panic Selling" in Wyckoff theory, representing indiscriminate selling driven by fear. - • Phase Two - Automatic Rally & Secondary Test: Following the panic day, the market saw an "Automatic Rally" (consecutive gains on Nov 25th-26th), followed by multiple pullbacks testing the 2950-3050 area in early December, but with significantly reduced volume (e.g., Dec 4th

VOLUME_AVG_30D_RATIO: 0.87). This structure of "high volatility decline, low volatility test" suggests supply was effectively absorbed at the lows, indicating the market entered the final stage of the Accumulation Phase. - • Phase Three - Markup: Starting from mid-December 2025, the price climbed steadily with increasing volume, culminating in a breakout on high volume (42.11 billion) on Jan 12, 2026, surpassing the previous high (Dec 26th high of 3268.69) and reaching a new high of 3388.34. This behavior signifies the market has successfully moved away from the accumulation range and entered a new Markup Phase.

- • Phase One - Panic Selling: 2025-11-21, the index experienced a significant decline (-4.02%) on high volume (volume 26.15 billion,

2. Volume-Price Relationship and Supply-Demand Dynamics

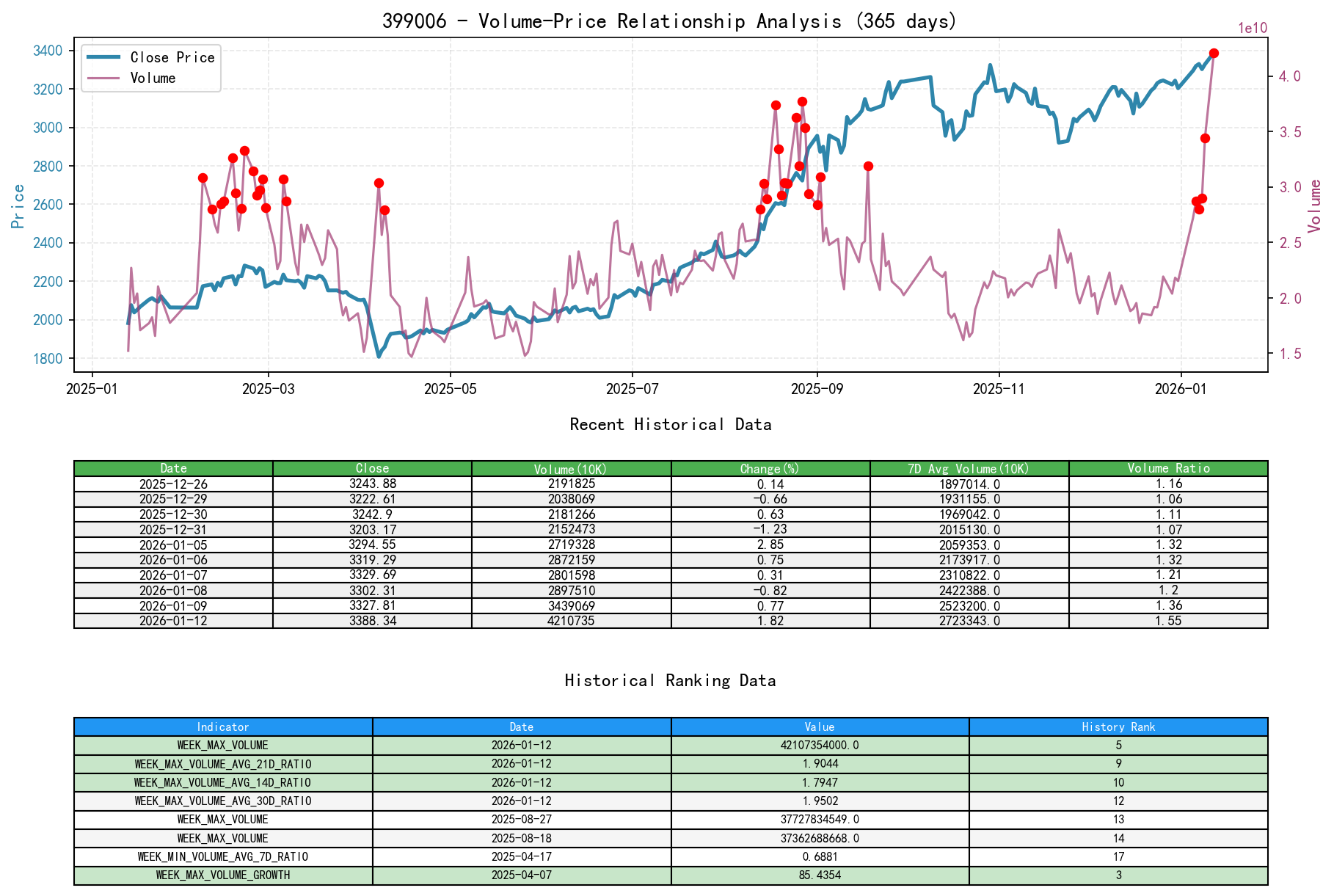

As of 2026-01-12, the target 399006's opening price was 3323.64, closing price 3388.34, volume 42107354000, daily change 1.82%, volume 42107354000, 7-day average volume 27233436128.57, 7-day volume ratio 1.55.

- • Key Day Volume-Price Analysis:

- • Supply-Dominated Day (2025-11-21): Price plunged -4.02%, volume surged by 25.25% (

VOLUME_GROWTH), withVOLUME_AVG_30D_RATIOas high as 1.27. This is a typical panic-selling day, with supply (selling pressure) completely dominating the market. - • Demand Recovery Day (2025-12-08): Price rose 2.60%, volume increased by 12.83%, and

VOLUME_AVG_30D_RATIOwas 1.04. This was the first significant advance on increased volume following the accumulation range, showing demand actively entering the market. - • Breakout Confirmation Day (2026-01-12): This is the most analytically valuable trading day. Price rose 1.82%, but volume surged by 22.44%, reaching 42.11 billion. Combined with historical ranking data, the day's volume ratio relative to the 14-, 21-, and 30-day moving averages ranks at the 10th, 9th, and 12th highest levels in the past 10 years (

HISTORY_RANK: 10, 9, 12). This "high-volume breakout approaching ten-year highs" is a strong signal of overwhelming demand in Wyckoff theory, indicating large buyers conducted substantial accumulation and breakout confirmation above the key resistance level.

- • Supply-Dominated Day (2025-11-21): Price plunged -4.02%, volume surged by 25.25% (

- • Supply-Demand Strength Shift:

- • Following the panic day (Nov 21st), volume diminished rapidly during the rebound and tests (e.g., Nov 28th, Dec 4th), indicating exhaustion of supply.

- • Entering January, the volume level systematically elevated (

AVERAGE_VOLUME_7Djumped from about 19 billion in December to 27.2 billion), and days characterized by rising prices on increasing volume became significantly more frequent. The supply-demand relationship has clearly shifted to sustained demand dominance.

3. Volatility and Market Sentiment

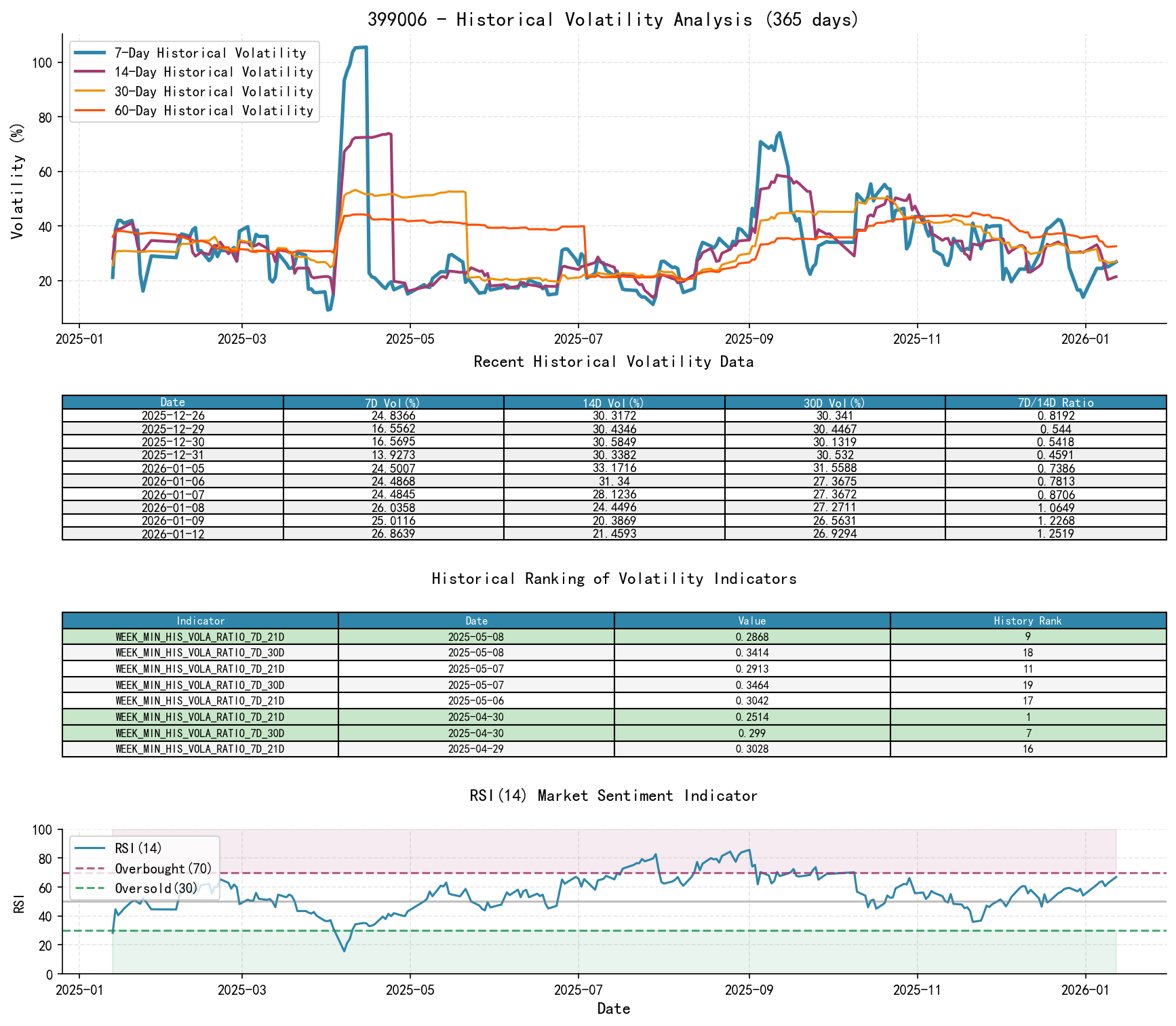

As of 2026-01-12, the target 399006's opening price was 3323.64, 7-day Parkinson volatility 0.22, 7-day Parkinson volatility volume ratio 1.17, 7-day historical volatility 0.27, 7-day historical volatility volume ratio 1.25, RSI 66.96.

- • Volatility Analysis:

- • The current short-term volatility (

HIS_VOLA_7D: 0.269) is higher than the 14-day and 60-day volatility (ratiosHIS_VOLA_RATIO_7D_14D: 1.25,HIS_VOLA_RATIO_7D_60D: 0.82), indicating amplified volatility during the breakout process, yet not reaching the extreme levels of the panic day (Nov 21stHIS_VOLA_7Dwas 0.411). The Parkinson intraday volatility (PARKINSON_VOL_7D: 0.224) is also at relatively high recent levels, consistent with the active breakout-on-volume market. - • Historical Comparison: The current volatility level is significantly lower than during the panic period of November 2025, indicating market sentiment has recovered from extreme fear to optimistic activity.

- • The current short-term volatility (

- • Sentiment Indicator (RSI):

- •

RSI_14at the end of the analysis period is 66.96, having entered the moderately strong zone but not yet reaching the overbought extreme above 70. This aligns with the price having just broken out and showing strong momentum. At the prior panic low (Nov 21st),RSI_14touched 35.95, approaching oversold territory, providing a technical basis for the rebound.

- •

4. Relative Strength and Momentum Performance

- • Momentum Trend:

- • Strong Short-Term Momentum:

WTD_RETURN(weekly return) is +2.85%,MTD_RETURN(monthly return, as January is only about two weeks) is as high as +5.78%, indicating extremely strong short-term upward momentum. - • Strong Mid-to-Long-Term Performance:

YTD(year-to-date) return is an impressive +49.50%,TTM_12(trailing twelve months) return is +71.54%. Despite the deep correction in November, the index's mid-to-long-term uptrend remains intact and has been reinforced by the breakout. - • Conclusion: The target exhibits strong positive momentum across all observed periods, with short-term momentum showing signs of acceleration, mutually validating the breakout scenario.

- • Strong Short-Term Momentum:

5. Large Investor ("Smart Money") Behavior Identification

- • Intent Inference:

- 1. Accumulation: During the panic selling in late November 2025 and the subsequent "Secondary Tests," the significant shrinkage of volume at low levels indicates panic selling was effectively absorbed, with smart money quietly accumulating.

- 2. Breakout Accumulation/Position Addition (Breakout Accumulation): The high-volume breakout on 2026-01-12 is key evidence. Achieving a price breakout at nearly decade-high volume levels is not retail investor behavior. This clearly indicates large institutional investors are conducting decisive, large-scale buying at higher levels, with the intent to quickly raise the cost basis and move away from the previous trading congestion zone, opening space for further advances. This is typical "smart money" operation in the early stages of a confirmed trend.

- 3. No Distribution Signs: Throughout the advance, no Wyckoff distribution patterns such as "high-volume stagnation" or "high-volume long bearish candles at highs" have been observed. The current high volume accompanies a strong price breakout, representing healthy demand release.

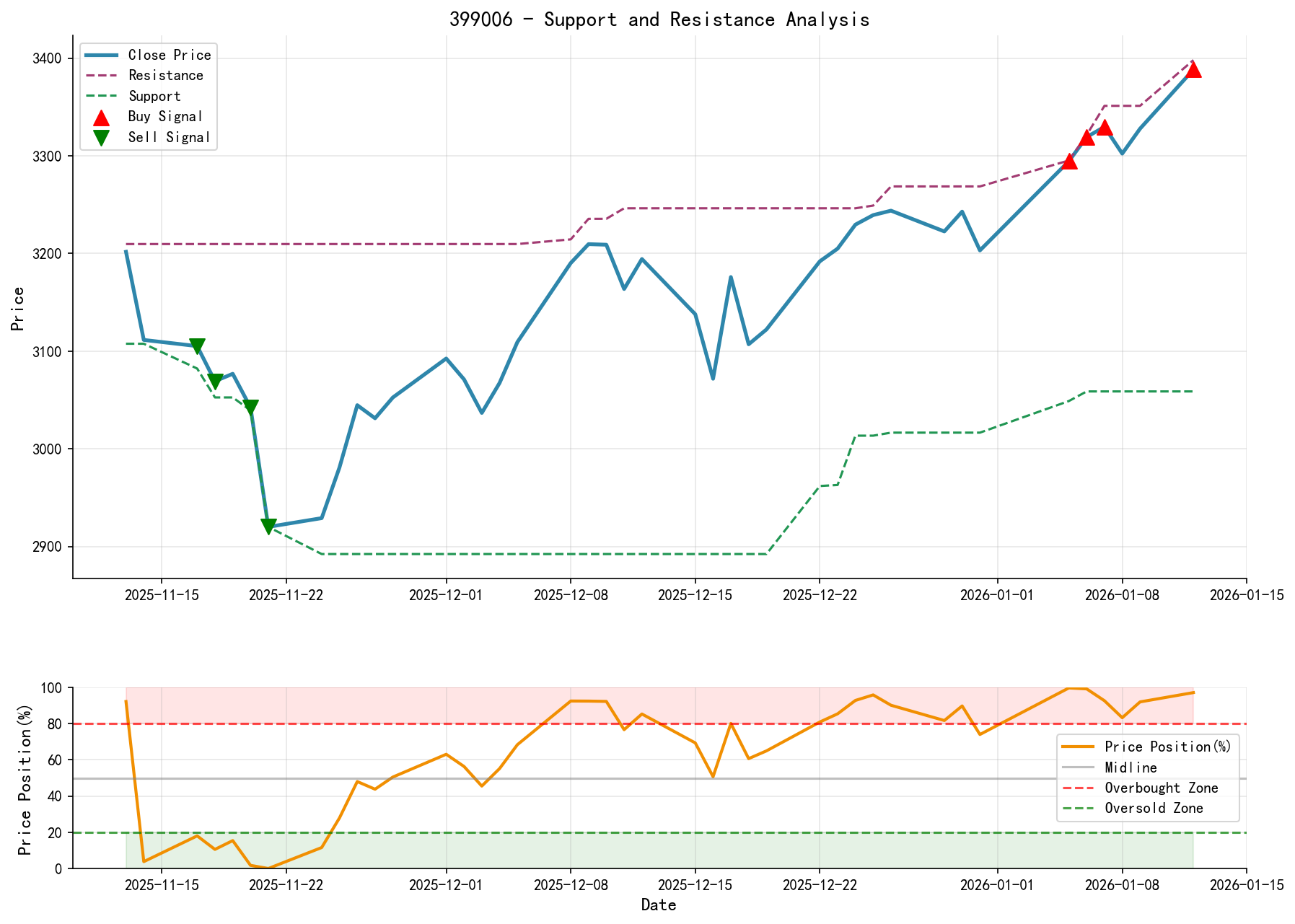

6. Support/Resistance Level Analysis and Trading Signals

- • Key Levels:

- • Key Support Level: 3050 - 3100 zone. This area represents the lows of multiple pullbacks in December 2025 and a volume congestion zone, currently also where the MA_30D and MA_60D converge, forming strong support.

- • Newly Established Support/Breakout Level: 3250 - 3280 zone. This is the recently broken previous high (Dec 26th) and the early January consolidation platform, which has now transformed into primary support.

- • Overhead Resistance/Target: With new highs established, there is no clear technical overhead resistance. The next targets can be referenced against psychological round numbers (e.g., 3400, 3500). A psychological resistance point is near the intraday high of 3398 on Jan 12th.

- • Comprehensive Wyckoff Trading Signal and Operational Recommendations:

- • Signal Strength: Strongly Bullish.

- • Signal Basis: Panic Selling + Accumulation Structure + High-Volume Breakout (near-decade high volume) + Bullish Moving Average Divergence + Accelerating Momentum. All dimensional data are highly synergistic, pointing to the initiation of a new uptrend.

- • Operational Recommendations:

- 1. Entry Strategy: For trend followers, the current breakout level (~3388) serves as the first entry point. More conservative investors may wait for a pullback to the 3250-3280 breakout confirmation zone for low-risk entry.

- 2. Stop-Loss Setting: Place the stop-loss below the key support zone of 3050-3100. If the price breaks below this zone, it would indicate a failed breakout and a damaged accumulation structure, warranting an exit for long positions.

- 3. Position Management: Given the amplified volatility, a progressive position-building approach is recommended, with strict control over single-trade risk.

- • Future Validation Points:

- 1. Confirmation Signal: The price needs to hold above 3250 in the coming few trading sessions, with noticeably reduced volume on pullbacks (indicating no reappearance of significant supply).

- 2. Risk Signal: If the price quickly falls back below the previous high (3268) accompanied by increased volume, this breakout could be a "false breakout" (UT/Upthrust), requiring high vigilance and consideration for position reduction.

- 3. Trend Continuation Signal: Observe whether subsequent advances consistently show a healthy volume-price structure of "rising price on increasing volume, falling price on decreasing volume."

Disclaimer: This report is derived entirely from the provided data and Wyckoff principles for quantitative inference and does not constitute any investment advice. The market involves risk; investment requires caution. The conclusions in this report require dynamic evaluation and adjustment based on new market data that emerges subsequently.

Thank you for your attention! Daily Wyckoff price-volume market interpretations are released promptly by 8:00 AM before the market opens. Your comments and shares are sincerely appreciated; your recognition is crucial. Let's see the market signals together.

Member discussion: