Quantitative Analysis Report - 000989.SH (2025-11-13 to 2026-01-12)

Report Generation Time: 2026-01-12 17:23:38

Analyst: Wyckoff Method Quantitative Researcher

1. Trend Analysis and Market Phase Identification

As of January 12, 2026, the subject asset 000989.SH has an opening price of 5733.42, a closing price of 5751.65, a 5-day moving average of 5679.17, a 10-day moving average of 5618.10, a 20-day moving average of 5522.94, a daily price change of +0.48%, a weekly price change of +2.07%, a monthly price change of +2.83%, a quarterly price change of +2.83%, and a yearly price change of +2.83%.

Based on the relationship between price and moving averages (MAs), crossover signals, and price action, the market phase is inferred.

- • Moving Average Alignment and Trend Structure:

- • Mid-to-late November 2025 (up to Nov 24): The price (CLOSE) consistently traded below all short-term moving averages (MA_5D, MA_10D, MA_20D, MA_30D), with the MAs aligned in a bearish order (MA_5D < MA_10D < MA_20D < MA_30D). This phase constituted a clear downtrend.

- • Late November to early December 2025 (Nov 25 to Dec 08): The price began to rebound, successively breaking above the MA_5D and MA_10D. Key signals emerged in December, with the MA_5D crossing above the MA_20D (around Dec 01) and the MA_10D (mid-December), forming bullish crossovers. By early January, the MA_5D, MA_10D, and MA_20D had formed a standard bullish alignment.

- • January 2026: The price is trading above all major short-term moving averages, and the MA_60D (long-term MA) has been effectively broken and transformed into dynamic support. Conclusion: The market trend has successfully transitioned from the bearish downtrend in November to a bottoming-out phase in December, establishing a bullish uptrend pattern in January.

- • Wyckoff Market Phase Identification:

- • Mid-to-late November 2025: Conforms to the decline phase post-distribution or the final stage of a downtrend. Prices made consecutive new lows while trading volume showed a contracting pattern (detailed later), suggesting diminishing supply.

- • Late November to mid-December 2025: A critical transition period. The price consolidated and stabilized near the November lows (~5329), exhibiting candlestick patterns such as "heavy-volume stopping of the decline" and "low-testing on light volume." This aligns with the characteristics of the Wyckoff Accumulation Phase—where large capital is absorbing shares at low levels.

- • Late December 2025 to January 2026: The price broke away from the consolidation range, accompanied by a significant and sustained increase in volume, breaking through key resistance upward. This marks the market's entry into the Markup Phase, where demand is dominant.

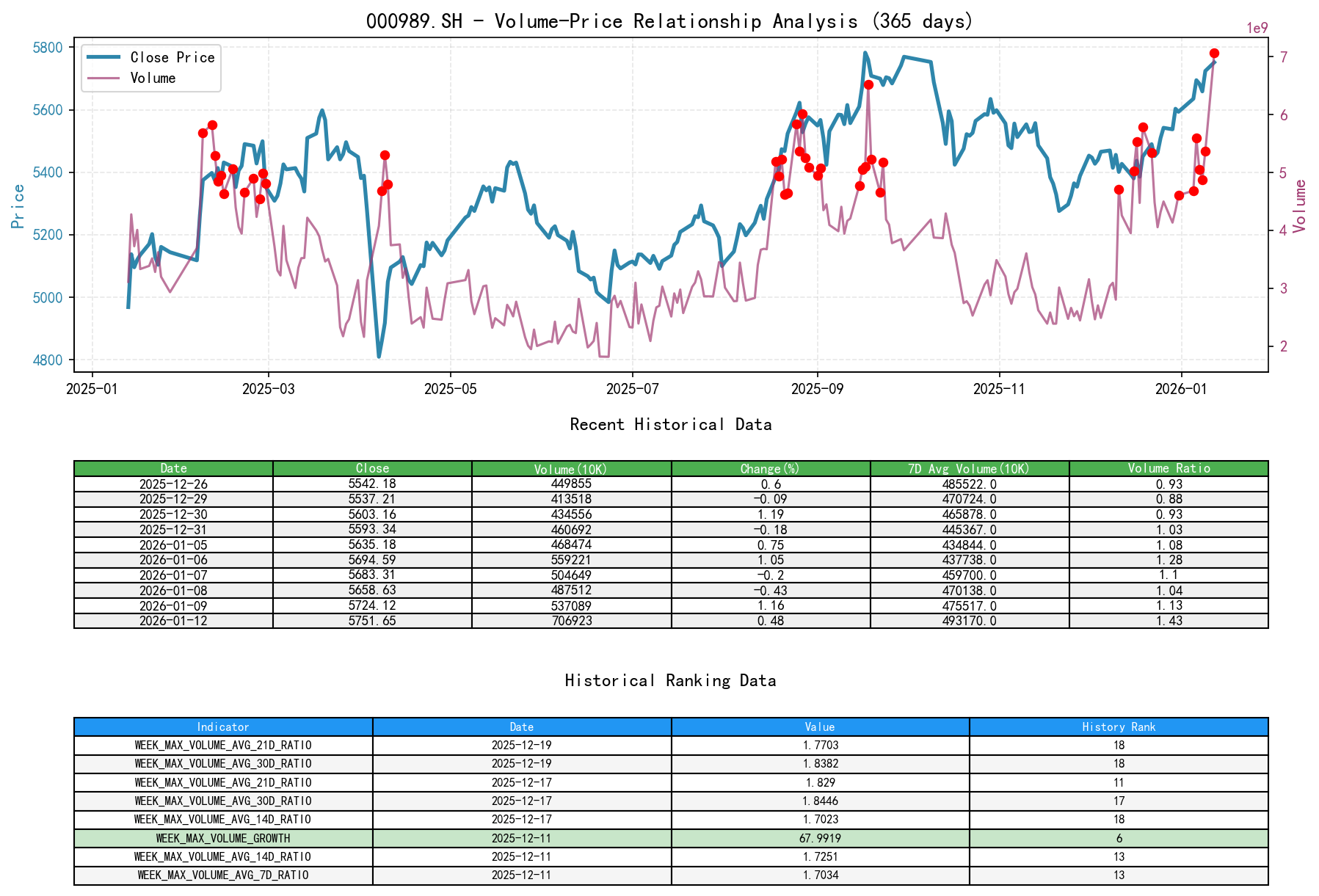

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 12, 2026, the subject asset 000989.SH has an opening price of 5733.42, a closing price of 5751.65, trading volume of 7,069,236,900, a daily price change of +0.48%, trading volume of 7,069,236,900, a 7-day average trading volume of 4,931,707,200.00, and a 7-day volume ratio of 1.43.

Based on the interaction between trading volume and price changes, the dominant force of supply/demand and key turning days are identified.

- • Supply Analysis in the Late Decline Phase (Mid-to-late November 2025):

- • The price fell from 5557 on Nov 13 to 5275 on Nov 21, a cumulative decline of approximately 5.1%. During this period, volume exhibited characteristics of "decline on decreasing volume" (e.g., from Nov 17 to Nov 20, the VOLUME_AVG_7D_RATIO was consistently below 0.9). This aligns with the Wyckoff principle: supply dries up during the decline (a Selling Climax may not be present, but signs of supply exhaustion are evident), indicating weakening downward momentum.

- • Key Turning Days and Accumulation Signals:

- • 2025-11-21: The price made a new phase low (5275.82), but the daily volume surged significantly to 3.01 billion (VOLUME_GROWTH: 26.12%, VOLUME_AVG_7D_RATIO: 1.15). This was a "down day on heavy volume" candlestick. However, combined with the subsequent day (Nov 24), which showed a "rebound on light volume" (VOLUME_AVG_7D_RATIO: 0.95), this candlestick pair forms a pattern of "natural rally following a panic sell-off (or heavy-volume decline)," which is a potential accumulation signal.

- • 2025-12-11: An extremely valuable day for analysis. The price fell by 1.00%, but volume exploded to 4.71 billion (VOLUME_GROWTH: 67.99%). Historical ranking data shows that the "MAX_Volume change compared to previous day" for this day was 67.99%, ranking 6th in the past 10 years; simultaneously, the "MAX_VOLUME / 7-day average volume" ratio reached 1.7034, ranking 13th in the past 10 years. Such an extreme down day on massive volume, yet with a limited price decline (only -1%), and the low not breaching the prior low, followed by rapid price stabilization in subsequent days, strongly suggests substantial buying absorption at a relatively low level (accumulation by large investors), a clear signal of supply being absorbed by demand.

- • Demand Confirmation in the Markup Phase:

- • 2025-12-17: The price rose by 1.06%, with volume expanding to 5.53 billion (VOLUME_GROWTH: 10.14%, VOLUME_AVG_14D_RATIO: 1.70). This was an "advance on increasing volume," confirming the effectiveness of demand.

- • 2026-01-12 (Latest Trading Day): The price rose by 0.48%, with volume again reaching an exceptionally high level of 7.07 billion. Historical ranking data indicates that the "MAX_Trading Value" for this day reached 138.756 billion CNY, ranking 4th in the past 10 years. The occurrence of such massive volume after breaking recent highs warrants caution for potential short-term distribution. However, considering the overall trend has just been established, it is more likely interpreted as strong demand, with the uptrend being powerfully supported by capital.

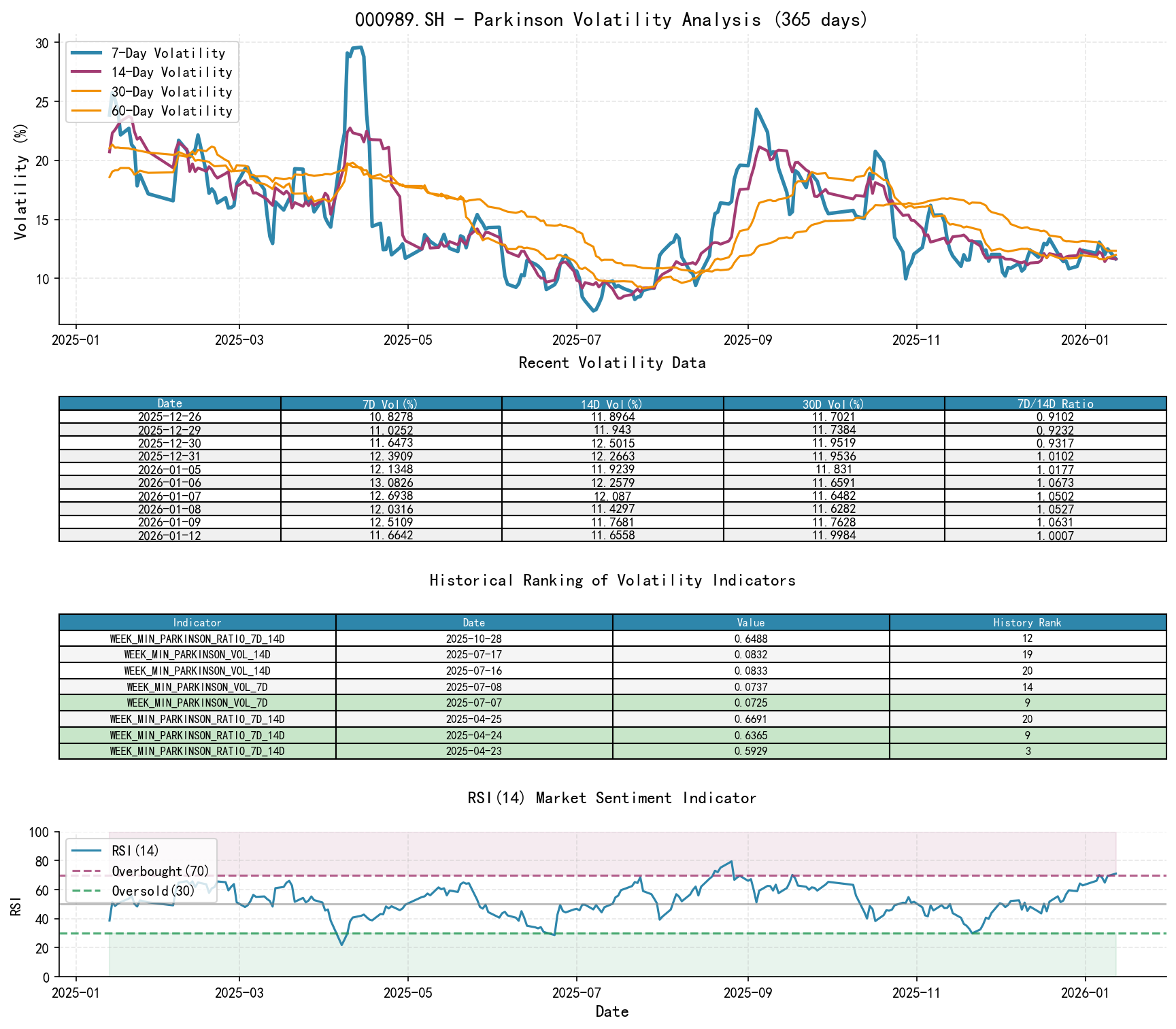

3. Volatility and Market Sentiment

As of January 12, 2026, the subject asset 000989.SH has an opening price of 5733.42, a 7-day intraday volatility (Parkinson) of 0.12, a 7-day intraday volatility ratio of 1.00, a 7-day historical volatility of 0.12, a 7-day historical volatility ratio of 1.05, and an RSI of 71.07.

Market sentiment state is assessed through volatility indicators and RSI.

- • Volatility Analysis:

- • Throughout the analysis period, both the historical volatility (HIS_VOLA) and Parkinson intraday volatility showed that their short-term (7D) to medium/long-term (30D/60D) ratios (e.g.,

HIS_VOLA_RATIO_7D_30D,PARKINSON_RATIO_7D_30D) mostly fluctuated around or below 1.0, with no sustained extreme expansion. - • Exception: On the key day 2025-12-11 (the day of massive volume decline), the

HIS_VOLA_7D(0.1339) was significantly higher thanHIS_VOLA_14D(0.1249), with the ratioHIS_VOLA_RATIO_7D_14Dat 1.07, indicating a rise in short-term volatility sentiment, confirming the intense battle between bulls and bears that day. However, volatility quickly converged afterward, and the market stabilized. - • Conclusion: The market did not experience a volatility spike due to panic. The rise in volatility on 12-11 was a localized event. Current volatility during the uptrend remains stable, suggesting relatively healthy bullish sentiment, not yet entering a frenzy.

- • Throughout the analysis period, both the historical volatility (HIS_VOLA) and Parkinson intraday volatility showed that their short-term (7D) to medium/long-term (30D/60D) ratios (e.g.,

- • RSI Sentiment Indicator:

- • In the late November decline phase, the RSI_14 once fell below 30 (Nov 20: 32.97, Nov 21: 29.91), entering the technically oversold zone, providing a technical condition for a rebound.

- • Upon entering December, the RSI recovered to the neutral range of 40-60. During the January advance, the RSI entered the 60-70 strong zone and reached 71.07 on the latest trading day. The current RSI indicates the market is in a strong phase but has not entered extreme overbought territory (>80), suggesting upward momentum remains.

4. Relative Strength and Momentum Performance

Analyzing returns over different periods to assess the asset's momentum strength.

- • Momentum Shift:

- • Short-term (WTD): Predominantly negative for most of November, turned positive in early December with some fluctuations, but became consistently positive and strengthened in January.

- • Medium-term (MTD/QTD): MTD turned positive in December (+1.21%) and accelerated in January (current MTD +2.83%). QTD also turned positive in January (+2.83%).

- • Conclusion: Momentum indicators fully corroborate the price trend analysis. Both short-term and medium-term momentum have clearly turned positive and show signs of acceleration, confirming the market has broken away from the bottom consolidation and entered a momentum-driven upward phase.

5. Large Investor ("Smart Money") Behavior Identification

Integrating the above dimensions to infer the operational intent of large capital.

- 1. Late November 2025 (Smart Money Accumulation): During the price decline, contracting volume, and pessimistic market sentiment (RSI oversold), smart money did not engage in large-scale selling. On the contrary, on Nov 21 and subsequently on Dec 11, they utilized market pessimism and record-breaking volume anomalies (top 20 historical ranking) to conduct proactive, large-scale buying (Accumulation) at low levels. This "heavy-volume stopping of decline" and "massive absorption" are typical smart money accumulation behaviors.

- 2. December 2025 (Shakeout and Test): During the consolidation in the first half of December, there may have been "shakeout" behavior (e.g., the massive down day on Dec 11), flushing out weak holders to reduce resistance for subsequent advances. The steady price lift in mid-to-late December represents a successful "test" and departure from the accumulation range.

- 3. January 2026 to Present (Driving the Advance): The price broke through key resistance levels (e.g., 5500, 5600 points) with volume expanding in a stepwise manner, especially reaching the 4th highest trading value in the past decade on Jan 12. This indicates smart money is not only accumulating but also actively driving the price higher (Markup), with demand forces fully dominating the market. The advance on massive volume is proof of robust demand, not merely distribution.

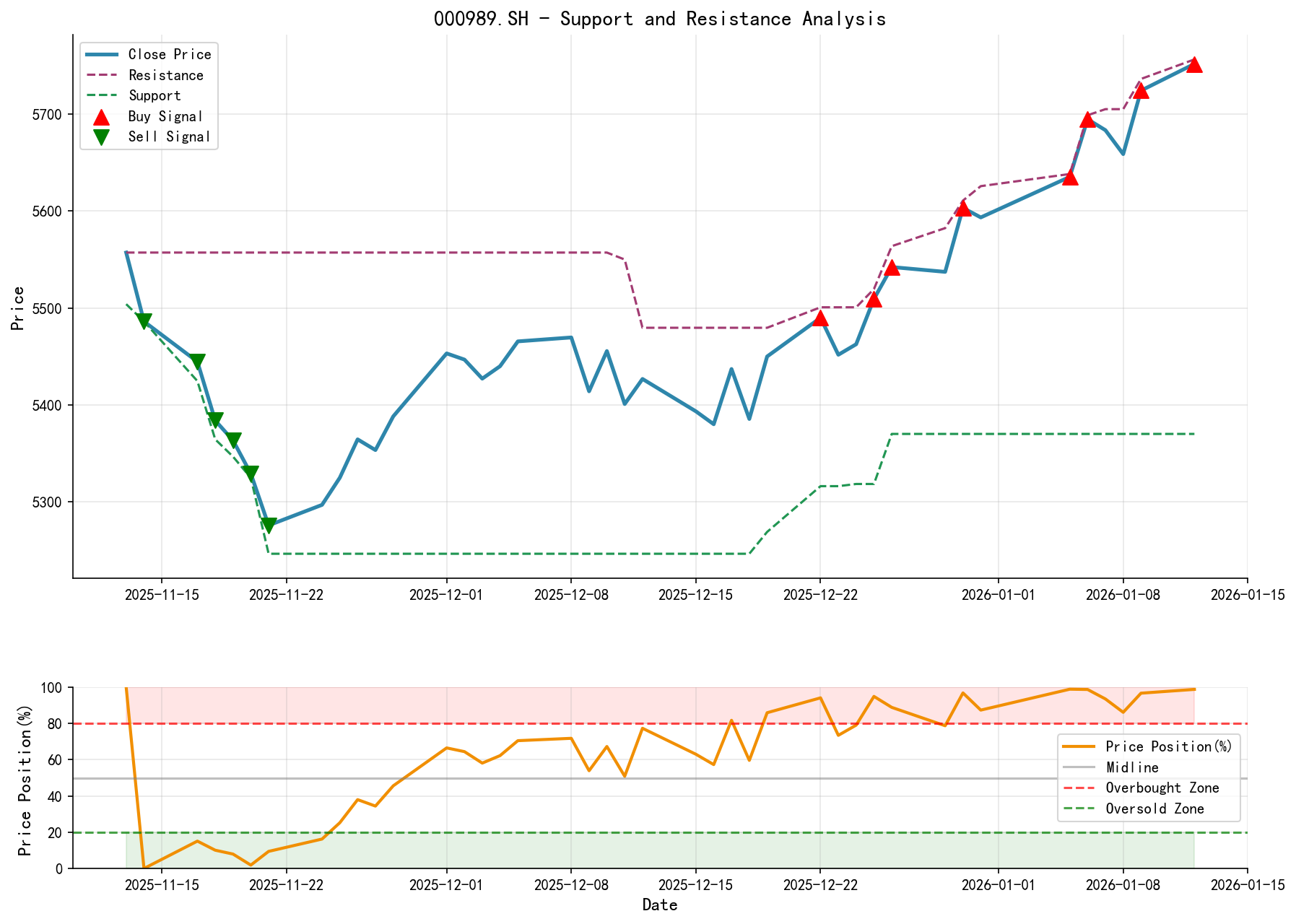

6. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- • S1 (Primary Support): 5450 – 5480 Zone. This area corresponds to the recent breakout gap and the high of the prior consolidation platform, also where the MA_20D and MA_30D are located.

- • S2 (Strong Support): 5329 (Nov 21, 2025 low). This is the bottom of the major accumulation range and the critical line for the trend's bullish/bearish conversion.

- • Key Resistance Levels:

- • R1: 5756 (Jan 12, 2026 high / Report day high), the most immediate resistance facing the current price.

- • R2: 5800 – 5850 Zone. This area is based on Fibonacci extensions from the prior decline wave (November high to low) and is also a psychological level.

- • Integrated Wyckoff Trading Signals and Action Recommendations:

- • Current Market State: Bullish. The market has completed accumulation and entered a demand-dominated markup phase. Smart money behavior indicates an active driving intent.

- • Action Recommendations:

- 1. Existing Long Positions: Continue holding. Raise the stop-loss level to below the S1 (5450-5480) Zone. As long as the price remains above S1 and pullbacks exhibit light volume characteristics, the uptrend remains intact.

- 2. Seeking Entry: Not recommended to chase highs. Wait for a healthy pullback near the S1 support zone, and observe signs of stabilization such as contraction in volume and reduced volatility for a lower-risk entry opportunity.

- 3. Bears or Sideline Observers: No basis for shorting at present. Counter-trend shorting carries extremely high risk.

- • Future Verification Points (Require close monitoring to confirm or adjust judgment):

- 1. Health of the Advance Verification: Any future price increase must be supported by modestly increasing or sustained volume. A "light-volume advance" would signal weakening demand.

- 2. Distribution Risk Verification: Monitor price action as it approaches the R2 resistance zone. If "high-volume stalling" occurs (high volume but price fails to make new highs or forms long upper shadows over one or several days), it may be an early signal of smart money beginning distribution.

- 3. Trend Failure Verification: If the price breaks below the S1 support zone on heavy volume and fails to recover quickly, it may indicate that this advance is merely a rally, necessitating a reassessment of the market structure and prioritizing risk management.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding the accuracy or completeness of the content. The market involves risks; investment requires caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Wyckoff Volume-Price Market Interpretations are published daily at 8:00 AM before the market opens. Your feedback and shares are greatly appreciated and crucial. Let's work together to better perceive market signals.

Member discussion: