Alright. As a quantitative trading researcher proficient in the Wyckoff Method, I will draft the following comprehensive and in-depth quantitative analysis report based on the 000987.SH data you provided.

Wyckoff Quantitative Analysis Report: 000987.SH

Ticker: 000987.SH

Analysis Period: 2025-11-13 to 2026-01-12

Report Generated: 2026-01-12

1. Trend Analysis and Market Phase Identification

As of January 12, 2026, the underlying asset 000987.SH has an opening price of 5435.80, a closing price of 5394.46, with moving averages: MA_5D: 5265.47, MA_10D: 5107.86, MA_20D: 4895.04. The daily change is +0.82%, weekly change +5.60%, monthly change +7.66%, quarterly change +7.66%, and annual change +7.66%.

- • Bullish Alignment Established: As of the latest trading day (2026-01-12), the closing price (5394.46) is significantly above all moving averages (MA_5D: 5265.47, MA_10D: 5107.86, MA_20D: 4895.04, MA_30D: 4794.22, MA_60D: 4663.77), presenting a standard bullish alignment pattern. The price trading above all moving averages indicates the market is in a strong upward trend.

- • Moving Average Crossovers and Trend Evolution:

- • Mid-to-late November Correction and Bottoming: Following a sharp single-day decline (-4.53%) on November 21, 2025, the price briefly fell below the MA_5D and MA_10D but found support at the MA_20D and MA_30D. Subsequently, the MA_5D and MA_10D formed a golden cross in early December, signaling the end of the short-term correction.

- • Trend Recovery in December: Throughout December, the price steadily climbed, supported by the MA_5D and MA_10D, while the MA_20D and MA_30D continued to rise, repairing and strengthening the medium-to-long-term trend.

- • Accelerated Uptrend in January: Entering January 2026, the price has detached from all moving averages, showing an accelerating upward trend. The gap between MA_5D and MA_20D, and between MA_10D and MA_30D, has continued to widen, indicating extremely strong short-term momentum.

- • Inferred Market Phase: Based on Wyckoff theory, the market has clearly experienced a complete cycle:

- • Accumulation Phase (Mid-to-late November 2025): Following a panic sell-off (high-volume plunge on Nov 21), the price stabilized below the 4500 level, with volume contraction (Nov 24-27) followed by a moderate rebound on increasing volume, consistent with "testing" and "secondary test" characteristics, indicating large-scale accumulation at lower levels.

- • Markup Phase (December 2025 to present): After breaking above the November high (4809 points), the price entered a clear upward channel. Volume significantly expanded on key breakout days (e.g., Dec 1, Dec 22, Jan 6), exhibiting a healthy "rising price with rising volume" pattern. It is currently in the latter stages or climax phase of the markup, with prices rising at a steep slope and high sentiment.

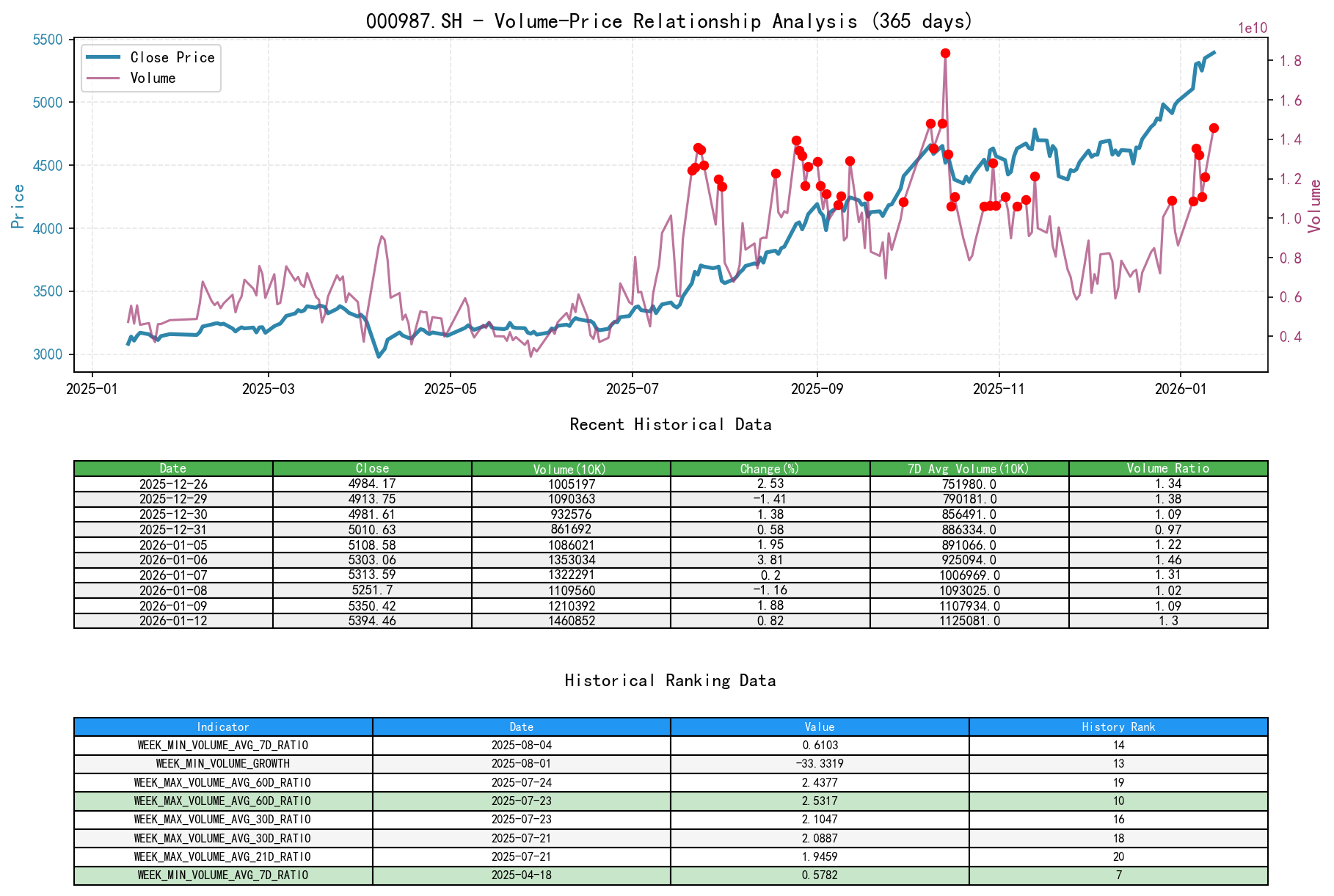

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 12, 2026, the underlying asset 000987.SH has an opening price of 5435.80, closing price of 5394.46, volume of 14608527900, daily change +0.82%, 7-day average volume 11250813142.86, and 7-day volume ratio of 1.30.

- • Core Supply-Demand Feature: Throughout the analysis period, Demand (buying power) has generally dominated, but clear supply-demand struggles are evident at key levels.

- • Key Session Analysis:

- • Demand-Driven Breakout Days:

- • 2025-11-13: Price surged +3.42%, with volume spiking 30.6% (

VOLUME_GROWTH), reaching 1.14 times the 60-day average volume (VOLUME_AVG_60D_RATIO). This is a classic high-volume breakout, indicating strong demand entry. - • 2025-12-22 / 12-26: Prices rose consecutively with volume expanding 14.5% and 39.6% respectively.

VOLUME_AVG_60D_RATIOreached 0.90 and 1.09, confirming demand driving the price above previous highs. - • 2026-01-06 / 01-12: Prices accelerated higher (+3.81%, +0.82%) with volume sustained at historically extreme levels (

VOLUME_AVG_60D_RATIOas high as 1.48 and 1.62), indicating demand entering a climax.

- • 2025-11-13: Price surged +3.42%, with volume spiking 30.6% (

- • Warning Signs of Supply Emergence:

- • 2025-11-21: Price plummeted -4.53% on volume expanding 18.4%. Although this appears as panic selling (supply), the subsequent session (Nov 25) was immediately reclaimed with a strong bullish candle, suggesting the supply during the decline was absorbed by even stronger demand, characteristic of a "shakeout" or washout by large investors.

- • 2025-12-29: Price corrected -1.41%, but volume reached the 15th highest in nearly a decade (

HISTORY_RANKdata). This "high-volume pullback at elevated levels" could represent initial supply emergence or active demand buying during the dip. Given the high-volume reversal on the next day (Dec 30), the latter is more likely, representing a "supply test" that was overcome by demand.

- • Demand-Driven Breakout Days:

- • Volume Anomaly Analysis: Recent volume levels (

VOLUME_AVG_60D_RATIO) have consistently exceeded 1.2, particularly reaching 1.48 and 1.62 on Jan 6 and Jan 12 respectively. Coupled with historical ranking data (turnover on Jan 12 is the 2nd highest in nearly a decade), this indicates extremely high market participation and intense capital competition.

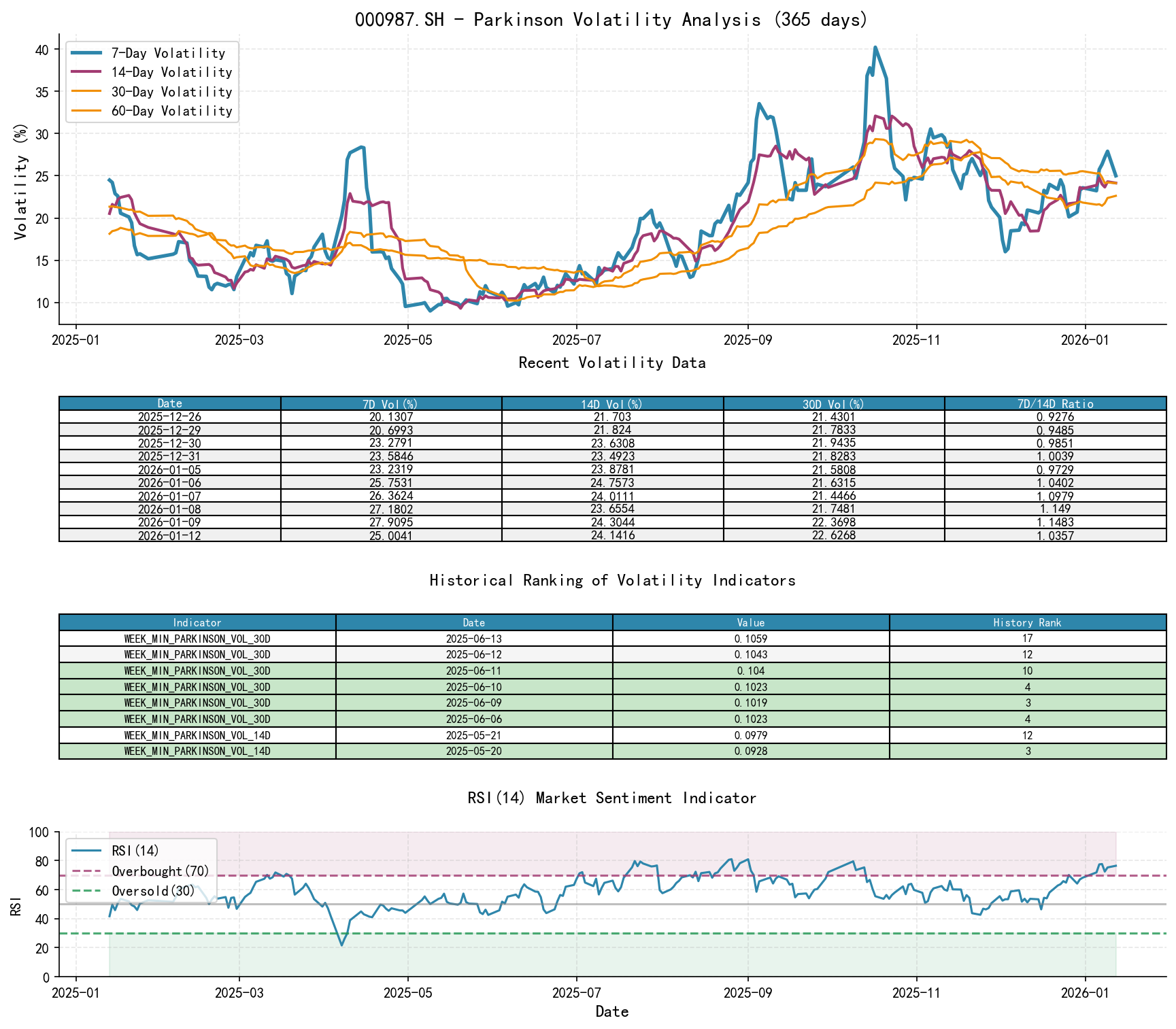

3. Volatility and Market Sentiment

As of January 12, 2026, the underlying asset 000987.SH has an opening price of 5435.80, 7-day Parkinson volatility 0.25, 7-day Parkinson volatility ratio 1.04, 7-day historical volatility 0.30, 7-day historical volatility ratio 1.10, and RSI 76.49.

- • Volatility Changes:

- • Elevated Short-term Volatility: Entering January 2026, the ratio of 7-day and 14-day historical volatility (

HIS_VOLA_7D,HIS_VOLA_14D) to the longer-term 60-day volatility (HIS_VOLA_RATIO_7D_60D) has consistently exceeded 1, approaching 1.0 on Jan 6, indicating increased short-term volatility and active, unstable market sentiment. - • Synchronized Rise in Intraday Volatility: The 7-day Parkinson volatility (

PARKINSON_VOL_7D) remained above 0.25 in January, with its ratio to the 60-day level (PARKINSON_RATIO_7D_60D) mostly above 1, confirming widening intraday price ranges and increased divergence between bulls and bears.

- • Elevated Short-term Volatility: Entering January 2026, the ratio of 7-day and 14-day historical volatility (

- • Market Sentiment (RSI):

- • Persistent Overbought Condition: The 14-day RSI entered and remained in the overbought zone above 70 multiple times in January 2026, reaching a peak of 77.43 on Jan 6, with the latest reading at 76.49. This clearly indicates market sentiment is in an extremely optimistic state.

- • Wyckoff Interpretation: In a strong bull market, RSI overbought conditions can persist for extended periods. The current extreme overbought reading reflects the powerful momentum of the uptrend but also suggests the market may be entering a "climactic rise" phase, where prices become sensitive to negative news and volatility can easily amplify. This is not a signal to short immediately, but rather a confirmation of trend acceleration and a warning of potential future correction risks.

4. Relative Strength and Momentum Performance

- • Extremely Strong Momentum: All periodic return metrics indicate exceptionally strong positive momentum.

- • Short-term Momentum (WTD_RETURN): Weekly return of +5.60%, with positive returns for the last three consecutive weeks (+6.78%, +4.81%, +5.60%), showing no signs of short-term upward momentum fading.

- • Medium-term Momentum (MTD_RETURN, QTD_RETURN): Month-to-date return of +7.66%, quarter-to-date return of +7.66%, indicating a clear and forceful medium-term uptrend.

- • Long-term Momentum (YTD, TTM_12): Annualized return of 61.59%, and a 12-month trailing return of 77.24%, demonstrating absolute strength over the long term.

- • Conclusion: Momentum indicators are highly consistent with the conclusions from trend and volume-price analysis, confirming the market is in a powerful uptrend with no divergence signaling weakness across any timeframe.

5. Large Investor ("Smart Money") Behavior Identification

Based on the analysis of the above four dimensions, the behavioral path of large investors can be clearly outlined:

- 1. Accumulation: During the panic decline (21st) of November 2025 and the subsequent low-volume consolidation period, large investors systematically accumulated positions below the 4500 level. The high-volume rebounds on November 25th and 30th were signs of them beginning to push prices higher after completing accumulation.

- 2. Markup and Position Building: Throughout December, smart money consistently guided prices higher in a healthy "rising price with rising volume" pattern. The huge volume on December 22nd and 26th during breakouts above previous highs demonstrated their strong bullish conviction and intent to attract followers.

- 3. Inference on Current Behavior (Potentially entering early distribution or the climax end):

- • Positive Aspect: Record-high volumes in January (turnover ranking in the top 10 historically) indicate substantial capital (including institutions) continues to flow in and provide support.

- • Risk Aspect: This massive volume occurs in an environment of significant price appreciation, extremely euphoric sentiment (overbought RSI), and increased volatility. Historical ranking data shows that current price levels (open, close, turnover) have entered the highest ranges in nearly a decade. This aligns with potential characteristics of the "Distribution Phase" in Wyckoff theory—large investors may be conducting organized, phased selling (distribution) at elevated levels, capitalizing on market frenzy, while retail investors buy aggressively. The "high-volume pullback at elevated levels" on 2025-12-29 can be viewed as a distribution test.

- • Comprehensive Judgment: Smart money still largely dominates the trend, but their operations may be gradually shifting from pure "markup" to a mix of "markup and distribution." The market is in the final stages of the markup phase, potentially transitioning from the "Markup" phase to the early stages of the "Distribution" phase. Close attention is required for the subsequent appearance of the key distribution signal: "high-volume stalling" (single or consecutive sessions with high volatility, small real bodies/Dojis at elevated prices, accompanied by extreme volume).

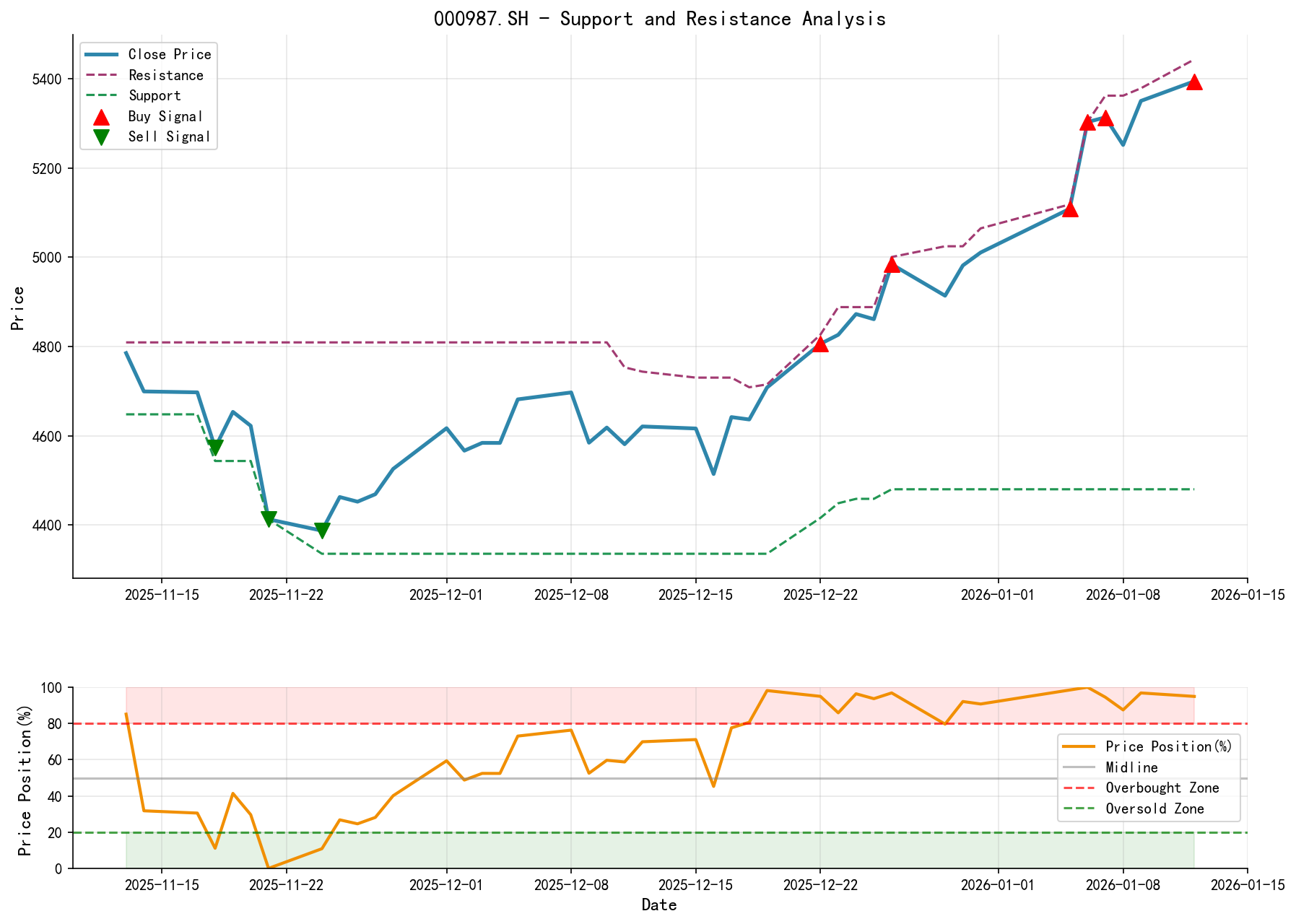

6. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- • S1 (Strong Support): 5000 points. A psychological barrier and volume concentration zone tested multiple times recently (late Dec to early Jan). A break below this level would signal a severe weakening of short-term upward momentum.

- • S2 (Trend Support): 4800 points. The breakout platform from late December and the previous high area, also near the current MA_20D level. A decline to this zone would trigger a deeper correction.

- • Key Resistance Levels:

- • With prices making new highs, there is no clear historical overhead resistance. R1: 5500 points serves as a psychological round-number barrier.

- • Wyckoff Comprehensive Trading Signal:

- • Primary Assessment: Bullish trend, but in a potentially overheated climax phase. The current level is not ideal for establishing new long positions, offering an unfavorable risk-reward ratio.

- • For Existing Long Positions: Continue holding, but raise the stop-loss level from a trailing stop (e.g., MA_10D) to just below the key support at 5000 points to protect most profits. Consider partial profit-taking during accelerated intraday rallies.

- • For Flat Positions: Avoid chasing highs to establish long positions. Maintain a wait-and-see approach, looking for one of two opportunities:

- 1. Healthy Pullback Buying Opportunity: Wait for a price pullback to the 5200-5250 (near MA_5D) or 5000-5050 support zones, accompanied by signs of stabilization on low volume and renewed demand (e.g., small-body candles forming a base, long lower wicks, followed by a high-volume bullish engulfing candle). Consider establishing a light long position with a stop-loss below 4950.

- 2. Trend Reversal Shorting Opportunity (Requires Confirmation): Not present yet. Requires clear "distribution completion" signals, such as: a "high-volume stalling" pattern on daily or weekly charts at elevated levels (e.g., above 5400), followed by a high-volume break below the key 5000 support. Only then consider trend reversal shorting opportunities.

- • Future Validation Points:

- 1. Confirm Bullish Thesis: Price finds support above 5000 and makes new highs (e.g., breaking 5450) again on high volume (volume not less than 1.2 times the 60-day average).

- 2. Invalidate Bullish Thesis / Signal Risk: Price shows consecutive sessions around 5400 with long upper wicks, weak closes, and accompanied by extreme volume (turnover ranking top 5 historically); OR price falls more than 2% on high volume (

VOLUME_AVG_60D_RATIO> 1.5) and closes below 5150 in a single session. - 3. Confirm Distribution / Trend Reversal: Price decisively breaks below and closes below 4800 points for three consecutive sessions with weak rebounds.

Disclaimer: This report is based on objective analysis using publicly available data and Wyckoff volume-price principles. All conclusions are derived from the provided data. The market involves risks, and past performance does not guarantee future results. This report does not constitute specific investment advice. Investors should make independent judgments and bear corresponding risks.

Thank you for your attention! Wyckoff volume-price market insights are published daily at 8:00 AM before the market opens. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: