As a quantitative trading researcher proficient in the Wyckoff Method, I will compose a comprehensive, in-depth, and strictly data-driven quantitative analysis report based on the data you provided for 000986.SH.

Quantitative Analysis Report: Insights into Supply-Demand Dynamics and Institutional Intentions Based on the Wyckoff Method

Product Code: 000986.SH

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-12

1. Trend Analysis and Market Phase Identification

As of January 12, 2026, for the subject 000986.SH: Opening Price 2402.30, Closing Price 2390.21, 5-day MA 2367.90, 10-day MA 2343.54, 20-day MA 2317.55, Daily Change -0.69%, Weekly Return 2.97%, Monthly Return 2.40%, Quarterly Return 2.40%, Annual Return 2.40%

- • Moving Average Alignment Analysis: In the latter part of the analysis period (2026-01-12), the short-term trend shows signs of a bullish recovery. The price (2390.21) has moved above the 5-day (2367.90), 10-day (2343.54), and 20-day (2317.55) moving averages but is consolidating near the 30-day MA (2322.64) and remains significantly below the 60-day MA (2340.56). The moving average system exhibits a pattern of "short-term bullish alignment recovery, but the overall trend has not yet broken free from the suppression of long-term moving averages."

- • Moving Average Crossover Signals: From late December 2025 to early January 2026, the price underwent a process from deep decline (low point of 2300.35 on November 24) to a strong rebound. The 5-day MA successfully crossed above the 20-day and 30-day MAs in late December to early January, issuing a short-term bullish crossover signal. However, this crossover occurred after a prolonged downtrend, and the 10-day and 20-day MAs were still declining, classifying it as a "technical recovery crossover following oversold conditions." Its sustainability requires confirmation by volume.

- • Inferred Market Phase (Wyckoff Perspective): Throughout the entire analysis cycle:

- • Mid-to-late November 2025: Price declined rapidly from highs above 2420, accompanied by increased volume (November 21), aligning with characteristics of either "Distribution after Markup" or entry into a "Markdown" phase.

- • December 2025: After falling to around 2300, volume shrank significantly (VOLUME_AVG_30D_RATIO=0.647 on December 25, ranking 20th lowest in the past decade), and price volatility narrowed, presenting classic features of an "Accumulation" phase — waning downward momentum and exhaustion of supply.

- • Early January 2026 to present: The price rebounded from lows with increased volume, particularly during consecutive rising sessions from January 6-9. Combined with historical ranking data (trading volume on January 7 and 9 ranked 18th and 20th highest in the past decade, respectively), this process aligns more with characteristics of the "late Accumulation or early Markup" phase, where large investors transition from cautious accumulation to active price advancement.

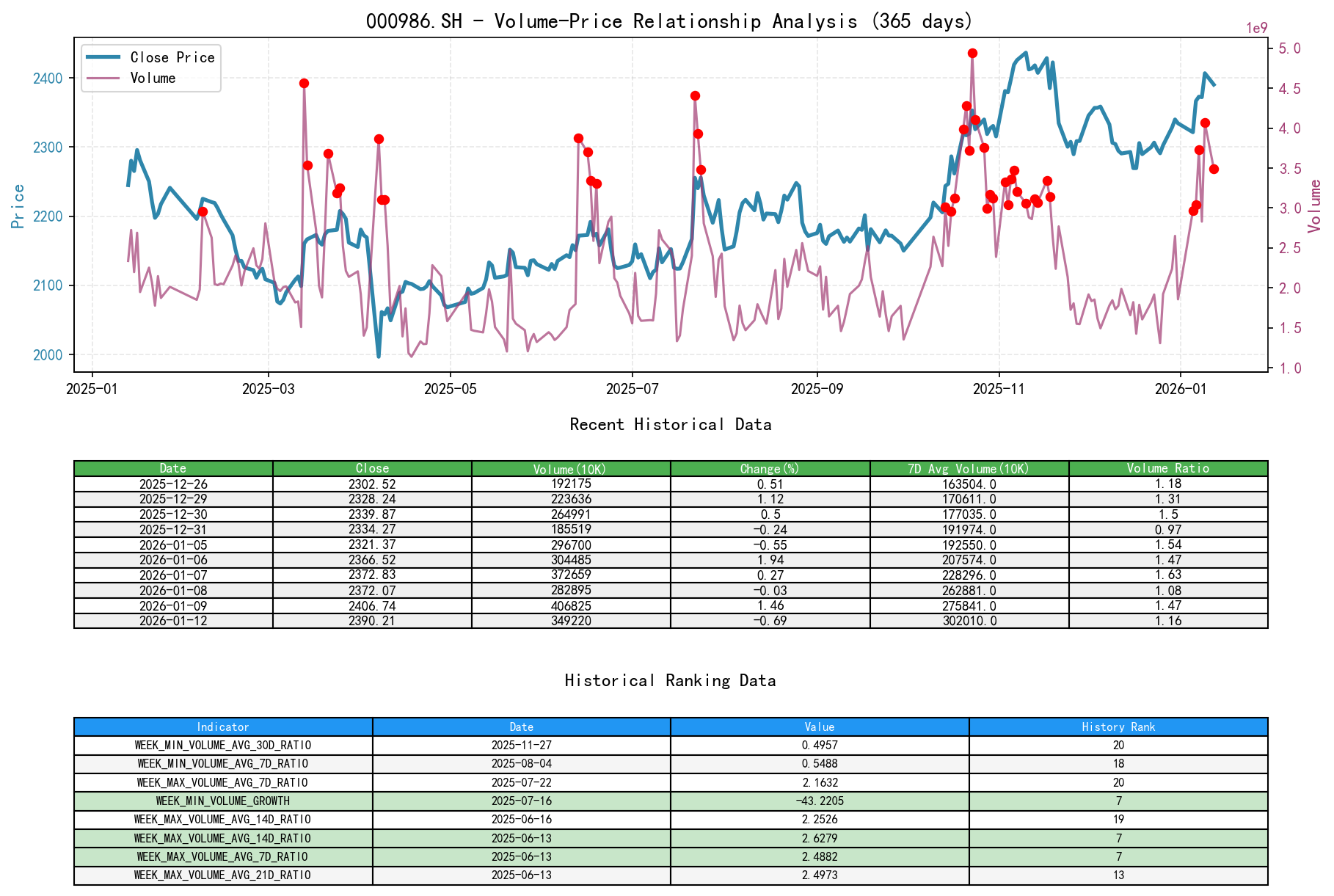

2. Price-Volume Relationship and Supply-Demand Dynamics

As of January 12, 2026, for the subject 000986.SH: Opening Price 2402.30, Closing Price 2390.21, Volume 3492205500, Daily Change -0.69%, Volume 3492205500, 7-day Average Volume 3020109900.00, 7-day Volume Ratio 1.16

- • Key Day Analysis (Wyckoff Event Identification):

- • Panic Selling: 2025-11-21, price plummeted -1.99%, volume grew 23.76% (VOLUME_GROWTH), and volume was significantly above the 30-day average (RATIO=0.868). This is a typical panic selling day, indicating concentrated release of supply.

- • Oversold Rebound / Reaction: 2025-11-27, price rebounded 0.83%, but volume contracted -14.19%, and the ratio to the 30-day average volume was only 0.496 (ranking 20th lowest historically). This is a clear sign of a "rebound lacking demand," indicating an absence of large buyer participation and unsustainable momentum.

- • Demand-Driven Advance (Sign of Strength - SOS): 2026-01-06 & 09, prices rose 1.94% and 1.46% respectively, with volume increasing 2.62% and 43.81%, and the ratios to the 30-day average volume reaching 1.63 and 2.07 respectively. These are strong "signs of demand entering the market." Particularly on January 9, record-breaking volume accompanied the price rise, indicating large buyers overcame supply resistance.

- • Test of Supply: 2026-01-12, price experienced a minor pullback of -0.69%, volume decreased -14.16%, but remained significantly above the 30-day average (RATIO=1.71). This is a "low-volume test" of the previous supply area following a strong advance. The closing price stabilized above the 5-day MA, suggesting supply has not returned in force.

- • Supply-Demand Power Shift: The data clearly shows a shift in the balance of power between supply and demand in late December. The evolution of volume from "high volume on decline -> low volume consolidation -> high volume on advance" perfectly illustrates Wyckoff's "Law of Supply and Demand": supply dominated the market from November to December and eventually exhausted itself; demand began to take control in early January, driving prices higher.

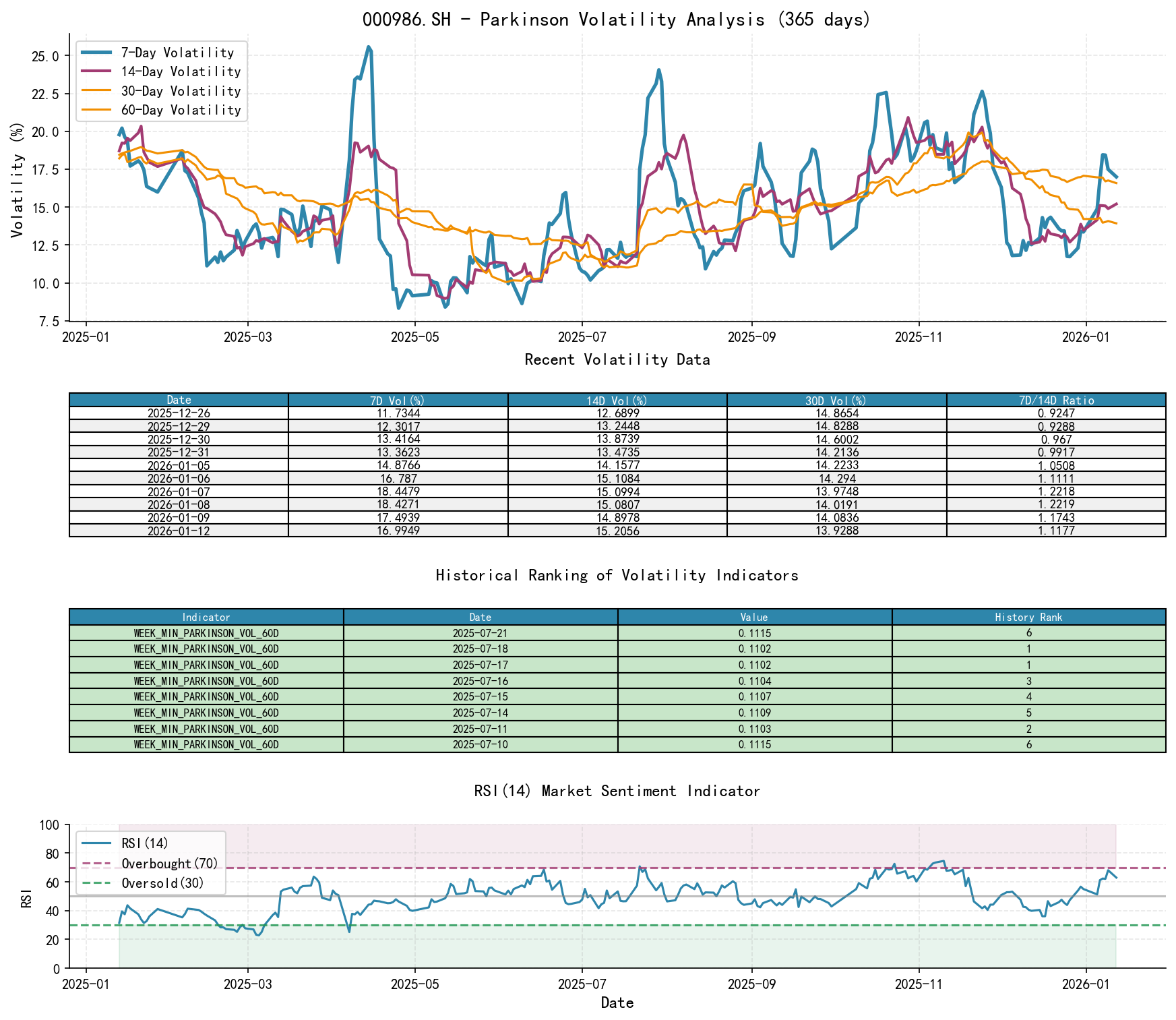

3. Volatility and Market Sentiment

As of January 12, 2026, for the subject 000986.SH: Opening Price 2402.30, 7-day Intraday Volatility 0.17, 7-day Intraday Volatility Ratio 1.12, 7-day Historical Volatility 0.19, 7-day Historical Volatility Ratio 1.31, RSI 62.98

- • Volatility Level and Changes: During the decline in late November, both Historical Volatility (HIS_VOLA) and Intraday Volatility (PARKINSON_VOL) increased significantly (e.g., HIS_VOLA_7D reached 0.272 on November 24). Sustained elevated short-term volatility compared to long-term volatility (e.g., HIS_VOLA_RATIO_7D_60D > 1.3) indicates panic sentiment and accelerating trends.

- • Volatility Convergence: Entering December, volatility indicators began to systematically decline and converge. By the rebound in early January, short-term volatility had retreated to levels near or slightly above long-term volatility (HIS_VOLA_RATIO_7D_60D ≈ 0.9-1.0), suggesting relatively stable sentiment in the early stages of the advance, not purely emotion-driven froth.

- • RSI Sentiment Confirmation: The RSI_14 fell below the oversold zone of 40 in late November, reaching a low of 36.10 (December 16), confirming a sentiment extreme of pessimism. Subsequently, the RSI oscillated higher, rising to 68.11 on January 9, indicating a shift to positive short-term sentiment without entering the extreme overbought zone (>70), leaving room for further potential advance.

4. Relative Strength and Momentum Performance

- • Momentum Trend: Momentum indicators clearly show a "V-shaped reversal."

WTD_RETURNshifted from deeply negative values in mid-December (-5.49%) to positive by January 12 (2.97%);MTD_RETURNsimilarly turned from negative to positive. Short-term momentum has improved significantly. - • Strength Confirmation: The strong momentum rebound corroborates the aforementioned supply-demand signals of "advance on high volume" and the sentiment signal of "healthy volatility convergence," enhancing the reliability of the current rebound's quality. This suggests the rebound is not merely a technical pullback but a momentum recovery driven by genuine capital inflows.

5. Large Investor (Smart Money) Behavior Identification

- • Inferred Operational Intent:

- 1. Selling and Distribution (November 2025): High-volume stalling and decline at highs (e.g., November 14, 18) indicate large investors were distributing above the 2400 point level.

- 2. Observation and Testing (December 2025): Extremely low volume (historically low rankings), narrow price range. Smart money was in a silent period, neither selling aggressively (exhausted supply) nor buying aggressively, but testing the solidity of the market's bottom structure.

- 3. Active Accumulation and Pushing (Early January 2026): This is the most critical behavioral signal. Consecutive, massive advances on January 6, 7, and 9, with volumes ranking among the highest in the past decade (confirmed by historical ranking data), clearly reveal the active operational intent of large investors — transitioning from testing to active buying and price advancement. The massive volume absorption indicates their capability and willingness to digest all the selling pressure from the prior decline.

- • Behavioral Phase Summary: The complete behavioral path of large investors is: High-level distribution -> Observation and waiting (supply exhaustion) -> Low-level massive accumulation/pushing. The current market is in the initial stage of the third phase.

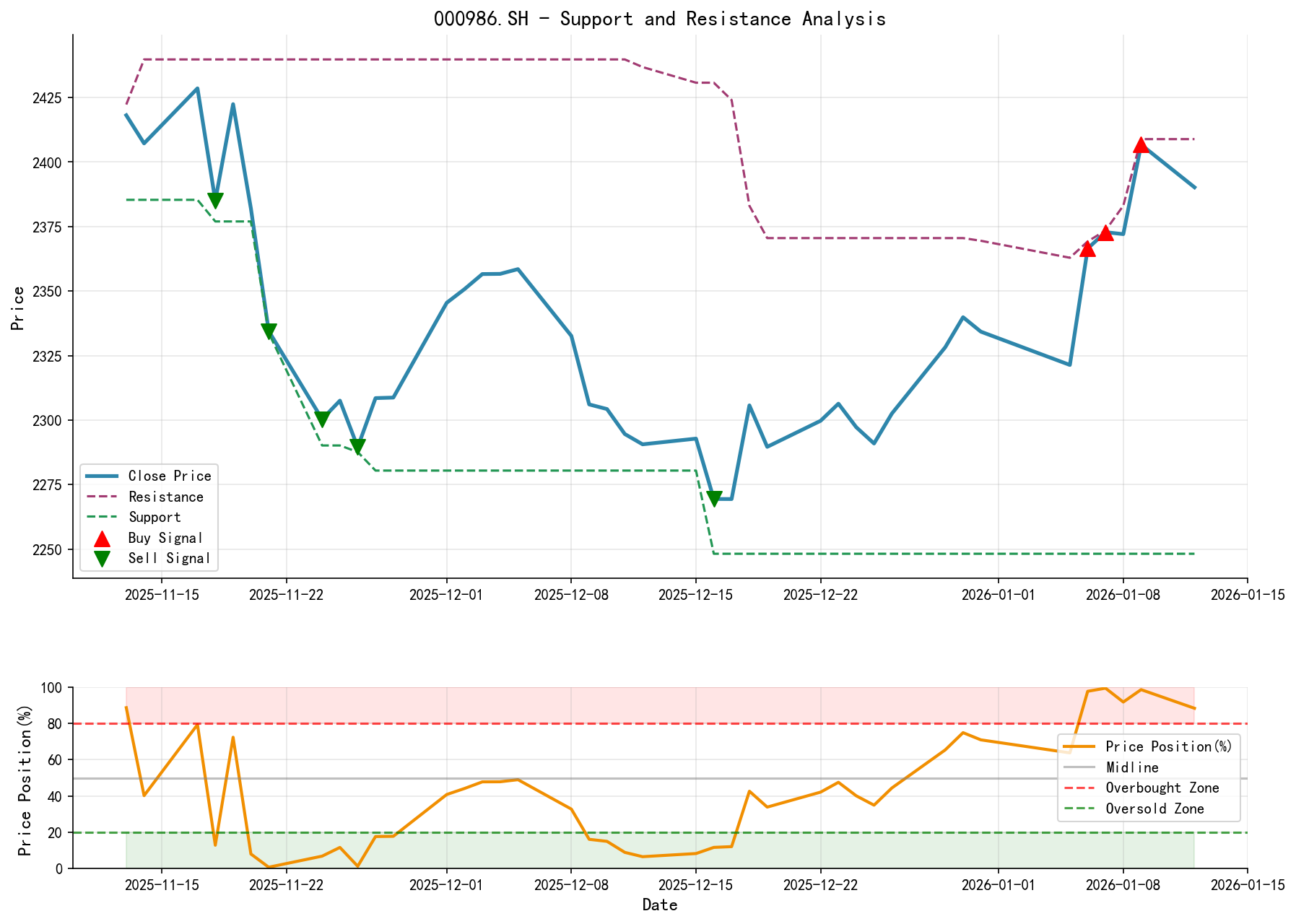

6. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Support Levels:

- • Primary Support: 2300-2310 Zone. This is the low-point platform tested multiple times in December and the starting point of this rebound, holding strong technical and psychological significance.

- • Secondary Support: 2260 Zone. The low point on December 16 serves as the last line of defense if 2300 is breached.

- • Resistance Levels:

- • Near-term Resistance: 2420-2440 Zone. This is the high-point platform before the November decline and a level the price has not yet reached as of January 12. It is expected to contain supply from previously trapped positions.

- • Medium-term Resistance: Previous high above 2480.

- • Support Levels:

- • Comprehensive Wyckoff Trading Signals:

- • Current Signal: Bullish, but awaiting confirmation. The market structure has shifted from downtrend to a potential uptrend, supported by smart money behavior. However, the price is currently testing a key resistance zone.

- • Operational Recommendations:

- 1. Entry Conditions: Consider a low-risk entry point when the price retraces to the 2350-2360 zone (support area of the 5-day and 10-day MAs) and exhibits "low-volume stabilization" (VOLUME_AVG_30D_RATIO < 1.2). Alternatively, wait for a pullback confirmation after a high-volume (VOLUME_AVG_30D_RATIO > 1.5) breakout above the 2420 resistance.

- 2. Stop-Loss Level: Set below the 2300 key support level (e.g., 2290).

- 3. Target Level: Initially target the 2440-2460 zone.

- • Future Validation Points:

- 1. Bullish Validation: When testing the 2420 resistance, volume must remain active (VOLUME_AVG_30D_RATIO > 1.3), demonstrating sustained demand overcoming supply. Volume should contract significantly during pullbacks.

- 2. Bearish Risk (Falsification Points): If the price fails to break above 2420 and experiences another "high-volume decline" or directly "falls below 2350 accompanied by increased volume," it indicates the advance attempt has failed, supply has regained dominance, and exiting positions promptly is advised.

Conclusion Summary: In-depth analysis based on Wyckoff price-volume principles indicates that after experiencing distribution/decline in November-December 2025 and accumulation/consolidation, 000986.SH initiated the early stages of a new uptrend in early January 2026, driven by massive buying from large investors. Trading volume ranking among the highest in the past decade confirms the intensity of institutional participation. The current strategy should primarily adopt a bullish perspective, seeking buying opportunities near key support levels, with the price's reaction to the 2420 resistance zone serving as the core validation for trend sustainability.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantee regarding the accuracy or completeness of the content. The market involves risks; investment requires caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Daily Wyckoff Price-Volume Market Interpretations are published promptly at 8:00 AM before the market opens. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: