Understood. As a quantitative trading researcher proficient in the Wyckoff Method, I will author a comprehensive quantitative analysis report for the CSI 300 Index (000300.SH) based on the provided data table and historical ranking information.

Product Code: 000300.SH (CSI 300 Index)

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-12

Quantitative Analysis Report: CSI 300 Index (000300.SH)

1. Trend Analysis and Market Phase Identification

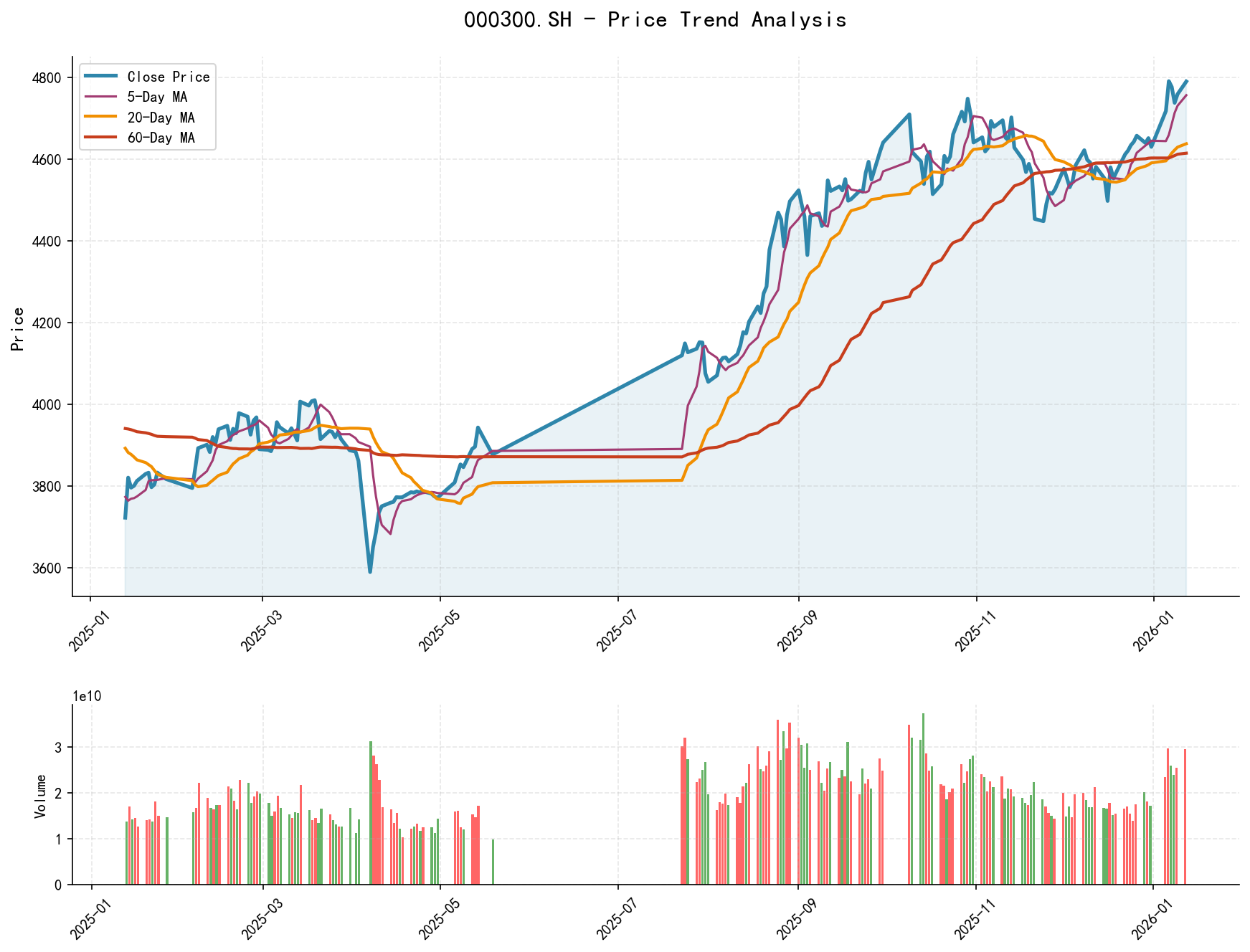

As of 2026-01-12, the underlying asset 000300.SH had an opening price of 4769.65, a closing price of 4789.92, with moving averages: MA_5D 4756.34, MA_10D 4700.21, MA_20D 4637.60. The daily return was 0.65%, weekly return 1.53%, monthly return 3.46%, quarterly return 3.46%, and yearly return 3.46%.

- • Moving Average Alignment and Trend Status:

As of the latest trading day (2026-01-12), the price (4789.92) is above all major moving averages (MA_5D: 4756.34, MA_10D: 4700.21, MA_20D: 4637.60, MA_30D: 4613.30, MA_60D: 4614.46). The order MA_5D > MA_10D > MA_20D > MA_30D > MA_60D presents a standard bullish alignment, confirming the market is in a long-term uptrend. Since the low of 4453.18 in late November, the price has rebounded over 7.6%, indicating strong intermediate-term momentum. - • Moving Average Cross Signals and Phase Classification:

- • Key Turning Point: On 2025-11-21, a high-volume plunge occurred (-2.44%, VOLUME_AVG_7D_RATIO: 1.16), with the price briefly falling below all short-term moving averages, signaling a brief panic phase.

- • Trend Recovery and Reversal: Starting November 25th, the price stabilized and rebounded around 4500. In early December (Dec 1st, 5th, 8th), consecutive sessions of high-volume advances drove the MA_5D to cross above the MA_10D and MA_20D, forming "golden crosses". This marked the market's successful transition from a decline/accumulation phase to an uptrend phase.

- • Current Phase: Entering January 2026, the price accelerated upwards (Jan 5th +1.90%, Jan 6th +1.55%) driven by significantly increased volume (see below). The widening gap between the price and short-term moving averages (MA_5D, MA_10D) indicates the market is in a strong markup phase. However, the high-level consolidation from Jan 7th to 9th warrants caution against short-term momentum exhaustion.

2. Price-Volume Relationship and Supply-Demand Dynamics

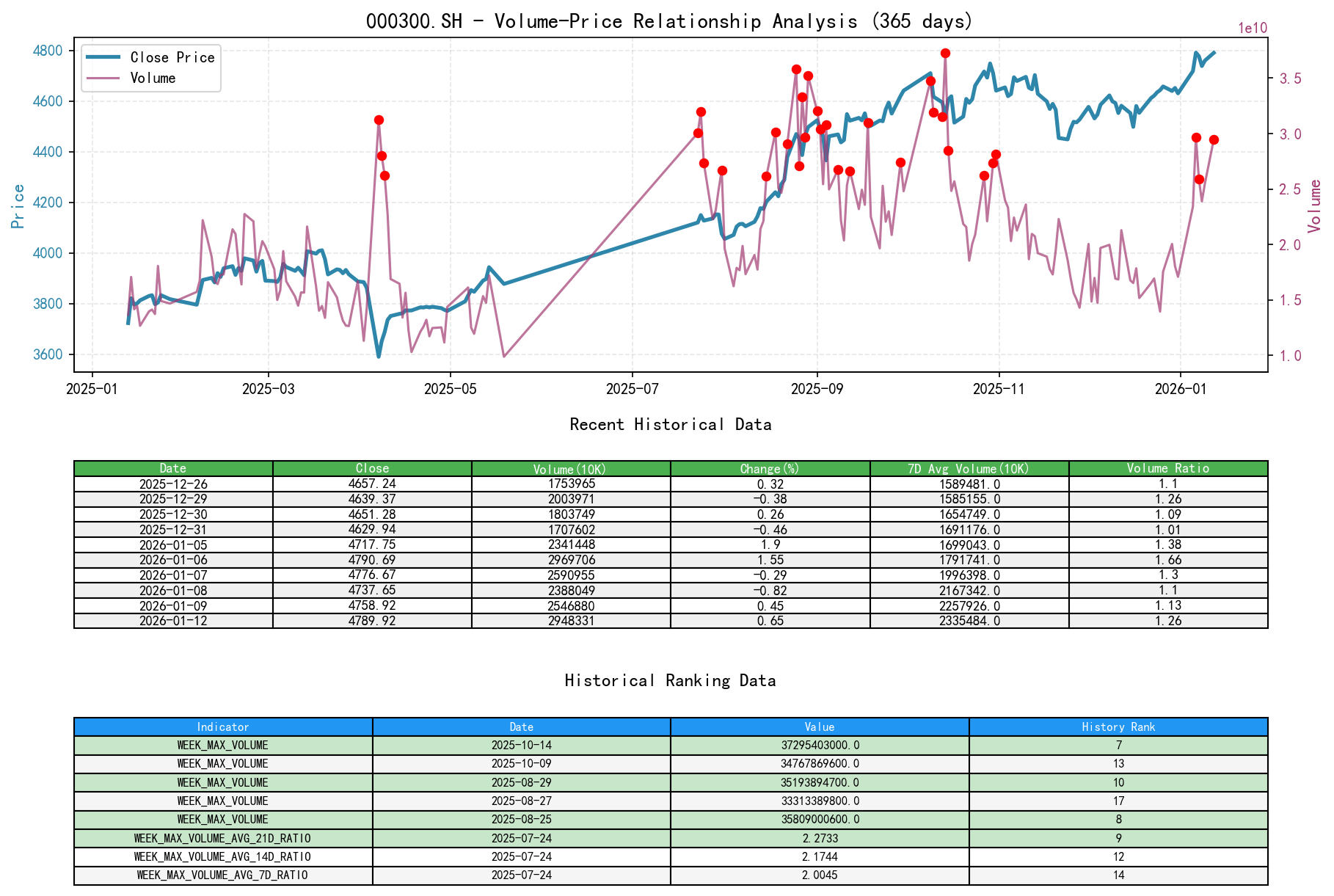

As of 2026-01-12, the underlying asset 000300.SH had an opening price of 4769.65, closing price 4789.92, volume 29483316500, daily return 0.65%, volume 29483316500, 7-day average volume 23354846885.71, 7-day volume ratio 1.26.

- • Key Price-Volume Behavior Analysis:

- • Panic Selling and Accumulation Signs (2025-11-21): The sharp drop of -2.44% accompanied by a surge in volume (VOLUME_AVG_7D_RATIO: 1.16), but without making a new low (higher than the Nov 24th low), is characteristic of a Selling Climax. The subsequent days (Nov 25-28) saw shrinking volume and narrow price range consolidation, suggesting supply exhaustion, potentially indicating large investors accumulating at low levels.

- • Demand-Driven Breakouts (2025-12-01 & 2026-01-06): Both days showed high volume (VOLUME_AVG_7D_RATIO >1.15) advances (PCT_CHANGE >1%), clear signals of strong demand entering the market, confirming the rebound initiation and the New Year acceleration, respectively.

- • Warning Signals of Emerging Supply (2026-01-12 & 2026-01-08):

- • Jan 12th: Volume hit a recent high (VOLUME_AVG_7D_RATIO: 1.26), but the price gain was only 0.65%, showing high-volume stagnation. RSI_14 is at a relatively high level of 65.92. Combined with historical ranking (daily turnover ranked 9th highest in the past decade), such massive volume with limited gain is a potential early sign of "Distribution", indicating increased supply near historically significant resistance areas.

- • Jan 8th: After making a new high, the session saw high volume (VOLUME_AVG_7D_RATIO: 1.10) decline (-0.82%), a direct manifestation of supply overwhelming demand, constituting a successful "Shakeout" or a supply test within the uptrend.

- • Volume Trend:

VOLUME_AVG_60Dwas at historically extreme highs (ranking 1st and 2nd) in mid-November before gradually declining. However, entering January 2026, volume levels have risen significantly again, withVOLUME_AVG_7D_RATIOexceeding 1.10 for multiple consecutive days, indicating extremely high market participation and intensifying divergence between bulls and bears.

3. Volatility and Market Sentiment

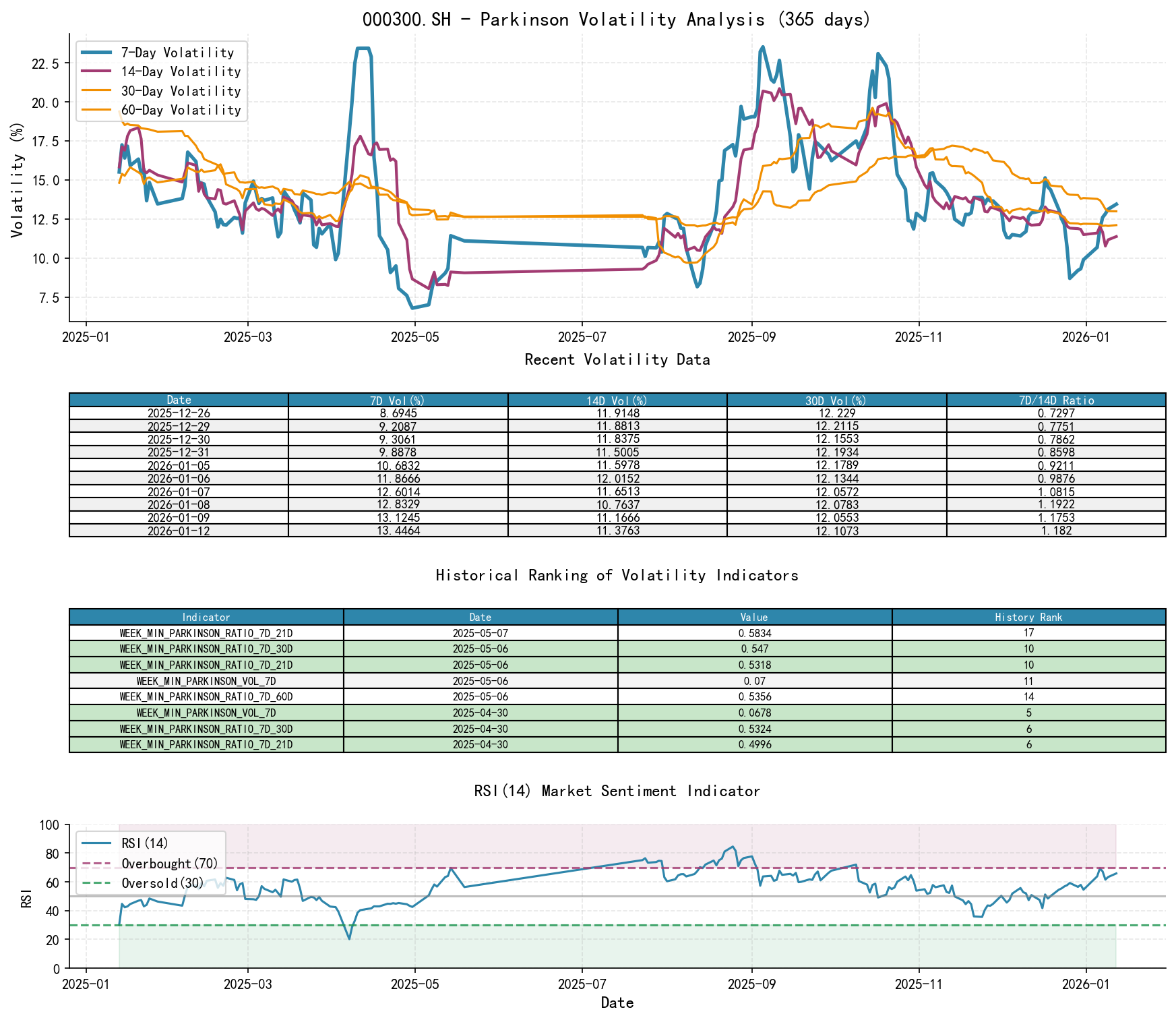

As of 2026-01-12, the underlying asset 000300.SH had an opening price of 4769.65, 7-day intraday Parkinson volatility 0.13, 7-day intraday volatility ratio 1.18, 7-day historical volatility 0.19, 7-day historical volatility ratio 1.37, RSI 65.92.

- • Volatility Analysis:

- • Current Levels: Short-term historical volatility (

HIS_VOLA_7D: 0.195) is significantly higher than medium-to-long-term levels (HIS_VOLA_60D: 0.177), with aHIS_VOLA_RATIO_7D_60Dof 1.102. Parkinson intraday volatility also shows short-term (0.134) exceeding long-term (0.130). This indicates increased short-term volatility and more active sentiment following the rapid price advance. - • Volatility Changes: Volatility peaked on the panic day of Nov 21st (

HIS_VOLA_7D: 0.231,HIS_VOLA_RATIO_7D_60D: 1.051) before converging. It has risen again recently (post Jan 6th), synchronizing with the price acceleration and volume expansion, consistent with characteristics of a trend acceleration phase.

- • Current Levels: Short-term historical volatility (

- • Sentiment Indicator (RSI):

The latestRSI_14value is 65.92, within a strong bullish zone but not yet overbought (>70). Rebounding from the low of 35.99 on Nov 21st to the current level shows market sentiment has fully recovered from extreme oversold conditions to strongly bullish. The current level suggests room for further upside but is also approaching a sensitive area where pullback vigilance is warranted.

4. Relative Strength and Momentum Performance

- • Momentum Trend:

All period momentum indicators are positive and strong:WTD_RETURN(1.53%),MTD_RETURN(3.46%),QTD_RETURN(3.46%),YTD(3.46%). This indicates the underlying asset possesses strong relative momentum across short, medium, and long-term horizons, positioning it as a leading force in the market. - • Momentum Validation: The robust momentum validates the bullish moving average alignment and the high-volume advance price-volume behavior on key days, confirming the validity of the current uptrend.

5. Identification of Large Investor (Smart Money) Behavior

Based on Wyckoff price-volume principles and the above analysis, inferences regarding large investor behavior are as follows:

- • Accumulation Behavior in Late November: The panic selling (Nov 21st) and subsequent low-volume consolidation within the 4450-4500 range align with the typical pattern of smart money absorbing panic-driven selling (Accumulation) during the final stages of a decline. The subsequent high-volume rebound indicates their success in guiding a trend reversal.

- • Markup and Potential Distribution Behavior in Early January:

- • Markup: The consecutive massive-volume advances on Jan 5-6th (turnover ranking 16th historically) represent a clear move by large capital to collectively propel prices away from their cost base.

- • Potential Distribution: The high-volume decline on Jan 8th and the historically massive volume (ranking 9th highest in a decade) with stagnation on Jan 12th are strong warning signals. They suggest that near the significant 4800 resistance area, some large investors have begun to distribute holdings at elevated prices, transferring risk to exuberant retail buyers. This is a "smart money" behavior shift that warrants high attention.

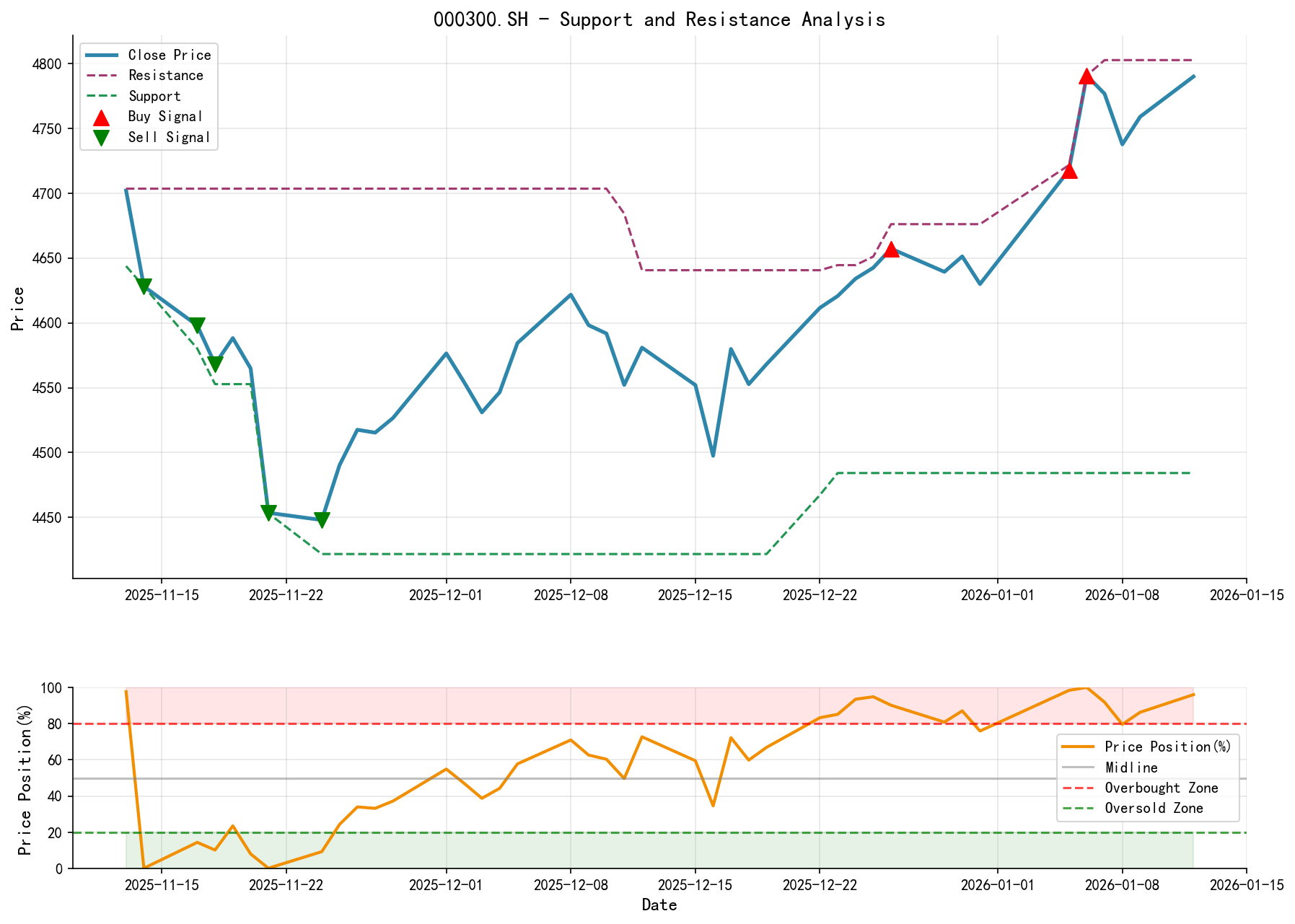

6. Support/Resistance Level Analysis and Trading Signals

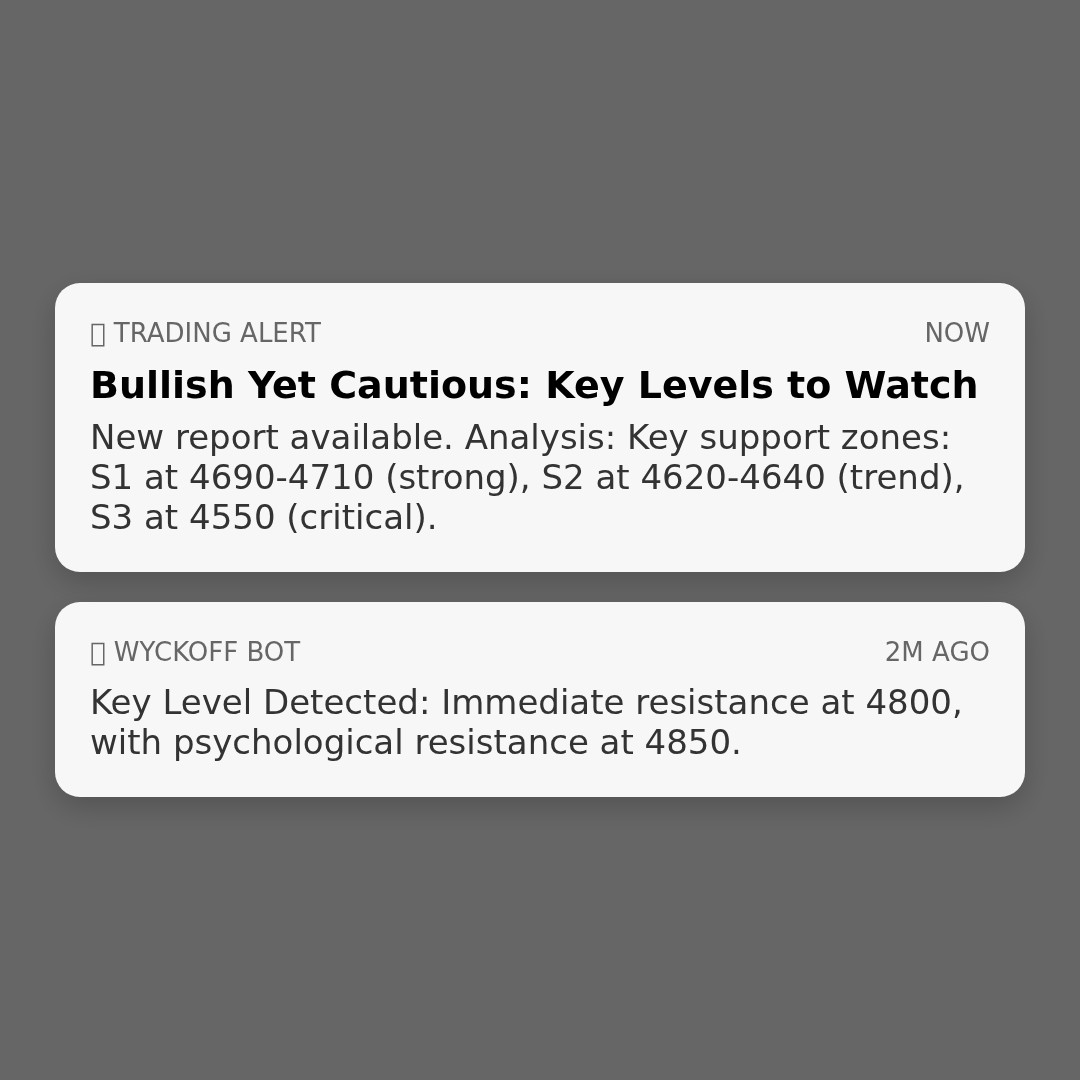

- • Key Support Levels:

- • S1 (Strong Support): The 4690-4710 zone. This is near the recent gap-up starting point and the MA_5D, also the area of the Jan 8th low.

- • S2 (Trend Support): The 4620-4640 zone. This is a confluence area for MA_10D, MA_20D, MA_30D, and the upper boundary of the late-December consolidation platform.

- • S3 (Critical Life-Line Support): The 4550 level. This aligns with the MA_60D and the middle of the December consolidation platform.

- • Key Resistance Levels:

- • R1 (Immediate Resistance): The 4800 psychological level and the Jan 12th high of 4795.93.

- • R2 (Psychological Resistance): The 4850 level.

- • Integrated Trading Signals and Operational Recommendations:

- • Overall Assessment: The market is in a bullish structural phase overall. However, the clear "high-volume stagnation" distribution signal appearing near historical highs poses a test to the upward momentum.

- • **Operational Recommendation: Shift to a cautious stance in the short term. Advise monitoring the situation or taking partial profits. It is not advisable to chase the rally at current levels.

- • Specific Strategies:

- 1. For Existing Long Positions: Consider raising stop-loss/take-profit levels to S1 (4690). If the price breaks below S1 on high volume, further position reduction should be considered.

- 2. For Those on the Sidelines/Awaiting Entry: Wait for the market to test the current supply pressure. Ideal conditions for re-entering long positions require one of the following:

a) The price experiences a low-volume pullback to the S2 (4620-4640) support zone, holds effectively, and shows signs of demand returning (e.g., a high-volume bullish candle).

b) The price demonstrates strong, high-volume breakout and sustains above R1 (4800), invalidating the current distribution hypothesis.

- • Future Validation Points:

- 1. Bearish Validation: If, over the next 1-3 trading sessions, the price continues to close with small bullish/bearish candles on low volume or with bearish candles on high volume below 4800, it will strengthen the distribution thesis, increasing the risk of a test down to S1.

- 2. Bullish Validation: If the price can swiftly reclaim and stabilize above 4800 with moderate volume expansion (not extreme volume), it would suggest the market has absorbed the supply, and the uptrend has potential to resume.

End of Report

Disclaimer: This report/analysis is solely for market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding accuracy or completeness. The market carries inherent risks, and investing requires caution. Any investment actions taken based on this report are undertaken at one's own risk.

Thank you for your attention! Wyckoff Price-Volume Market Interpretations are released daily at 8:00 AM before the market opens. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's work together to perceive market signals.

Member discussion: