Very well. I will act as a quantitative trading researcher proficient in the Wyckoff Method and compose a comprehensive, in-depth quantitative analysis report based on the data you provided (000001.SH, 2025-11-13 to 2026-01-12) and historical ranking indicators. The report will strictly adhere to the six specified dimensions, with all conclusions derived from data and Wyckoff's price-volume principles.

Quantitative Analysis Report: Shanghai Composite Index (000001.SH) - Alpha Signals and Institutional Intent Identification Based on the Wyckoff Method

Product Code: 000001.SH

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-12

Analyst: Wyckoff Quantitative Trading Researcher

1. Trend Analysis and Market Phase Identification

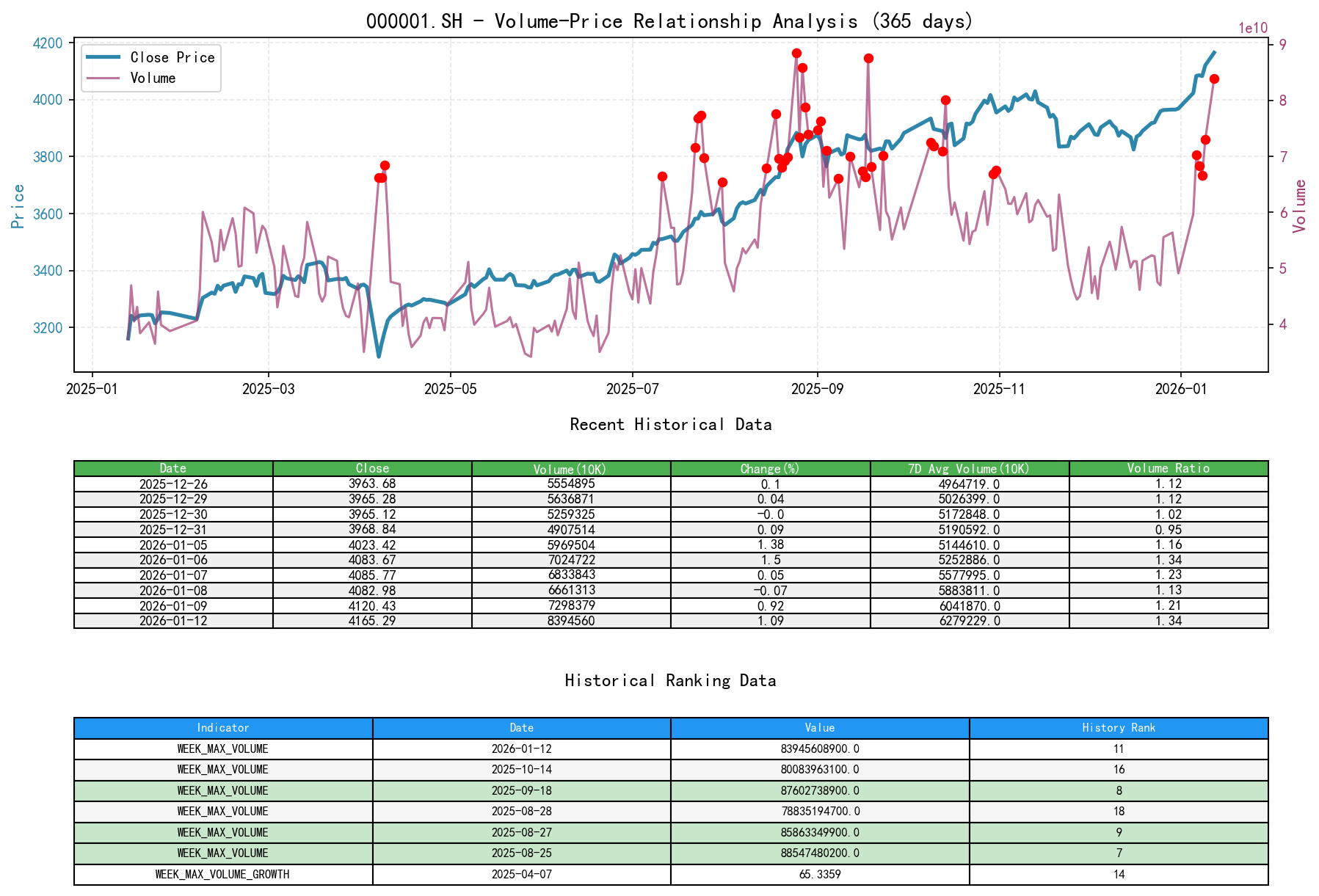

As of 2026-01-12, for the target 000001.SH: Open Price 4134.89, Close Price 4165.29, MA_5D 4079.25, MA_10D 4021.88, MA_20D 3954.48, Daily Change 1.09%, Weekly Change 3.53%, Monthly Change 4.95%, Quarterly Change 4.95%, Year-to-Date Change 4.95%

- • Moving Average Alignment Analysis:

- • Initial Phase (Mid-November): From 2025-11-13 to 2025-11-20, prices fluctuated downward. A critical signal occurred on November 21st when the index plunged 2.45%, and its closing price (3834.89) decisively broke below the MA_5D (3956.03), MA_10D (3982.87), MA_20D (3981.80), and MA_30D (3952.41), remaining only above the MA_60D (3897.60). This exhibited a bearish alignment characteristic, marking the breakdown of the intermediate-term uptrend.

- • Middle Phase (Late November to December): The market stabilized and consolidated within the 3830-3880 range in late November. The MA_5D and MA_10D intertwined with the MA_20D and MA_30D, indicating a trendless state, typical of a consolidation and recovery period.

- • Final Phase (Early January to present): Starting from 2026-01-05, the index began a strong rally. By January 12th, the closing price (4165.29) is positioned above the MA_5D(4079.25) > MA_10D(4021.88) > MA_20D(3954.48) > MA_30D(3935.19) > MA_60D(3941.17). All short-term moving averages are steeply rising and have crossed above the long-term averages, forming a classic bullish alignment, confirming a robust short-term uptrend. The sharp widening of the spread between MA_5D and MA_20D indicates strong trend momentum.

- • Market Phase Inference (Wyckoff Perspective):

- • The Sharp Decline on 2025-11-21: Combined with high volume (63.16 billion, VOLUME_AVG_7D_RATIO=1.085) and the large decline (-2.45%), this aligns with the characteristics of "Panic Selling" in Wyckoff theory. It represents an extreme release of emotions at the end of a downtrend.

- • 2025-11-24 to 2025-12-26: After the panic low, the market entered a phase of "Automatic Rally" followed by a "Secondary Test." During this period, volume notably contracted (e.g., VOLUME frequently fell below 50 billion before Dec 26th), and prices fluctuated within a narrow range. This matches the typical features of an "Accumulation Phase" — smart money quietly accumulating shares in the low-price area post-panic, while public trading interest remains low.

- • 2026-01-05 to present: The market broke through the previous high (around 4030 points) with high-volume, strong bullish candles, entering the "Markup Phase." The action on January 12th, especially the price performance reaching multi-year highs, suggests the market may be entering an acceleration period within the uptrend.

2. Price-Volume Relationship and Supply-Demand Dynamics

As of 2026-01-12, for the target 000001.SH: Open Price 4134.89, Close Price 4165.29, Volume 83945608900, Daily Change 1.09%, Volume 83945608900, 7-Day Average Volume 62792292528.57, Volume Ratio to 7-Day Avg 1.34

- • Critical Day Analysis:

- • Supply-Dominated Day (2025-11-21): Price plunged (-2.45%) with a massive surge in volume (+18.12%) to 63.16 billion, significantly exceeding the 7-day and 14-day average volumes (VOLUME_AVG_7D_RATIO=1.085). This is a textbook case of "downside volume expansion," indicating supply (selling pressure) completely overwhelmed demand, leading to market panic.

- • Demand Exhaustion Days (2025-11-24 to early December): Post-panic, prices rebounded slightly or moved sideways, but volume continued to shrink (e.g., volume on 11-26 was 45.76 billion, VOLUME_AVG_7D_RATIO=0.828). This fits the Wyckoff price-volume signature of an "Accumulation Phase" — no follow-through selling (lack of supply) and weak rebounds (suppressed demand), indicating smart money is in control.

- • Demand Surge Days (2026-01-06 & 2026-01-12):

- • 01-06: Price rose sharply by 1.50%, with volume surging to 70.25 billion (VOLUME_AVG_7D_RATIO=1.337, VOLUME_AVG_60D_RATIO=1.249). This is "upside volume expansion," confirming a significant influx of new demand.

- • 01-12: Price rose another 1.09%, volume hit a 10-year high ranking of 11th at 83.95 billion (HISTORY_RANK: 11), and the VOLUME_AVG_30D_RATIO reached a high of 1.575. This is "volume-price confirmation" after breaking through a key resistance level, a strong signal of robust demand and trend validation.

- • Supply-Demand Strength Transition:

- • Data clearly shows that the supply-demand relationship underwent a fundamental shift by the end of 2025. VOLUME_GROWTH transitioned from frequent negative readings in Nov-Dec to sustained positive growth starting in January. The VOLUME_AVG_60D_RATIO reached 1.496 on January 12th, meaning the day's volume was nearly 50% higher than the 60-day average. This is quantitative evidence of large-scale capital inflow.

3. Volatility and Market Sentiment

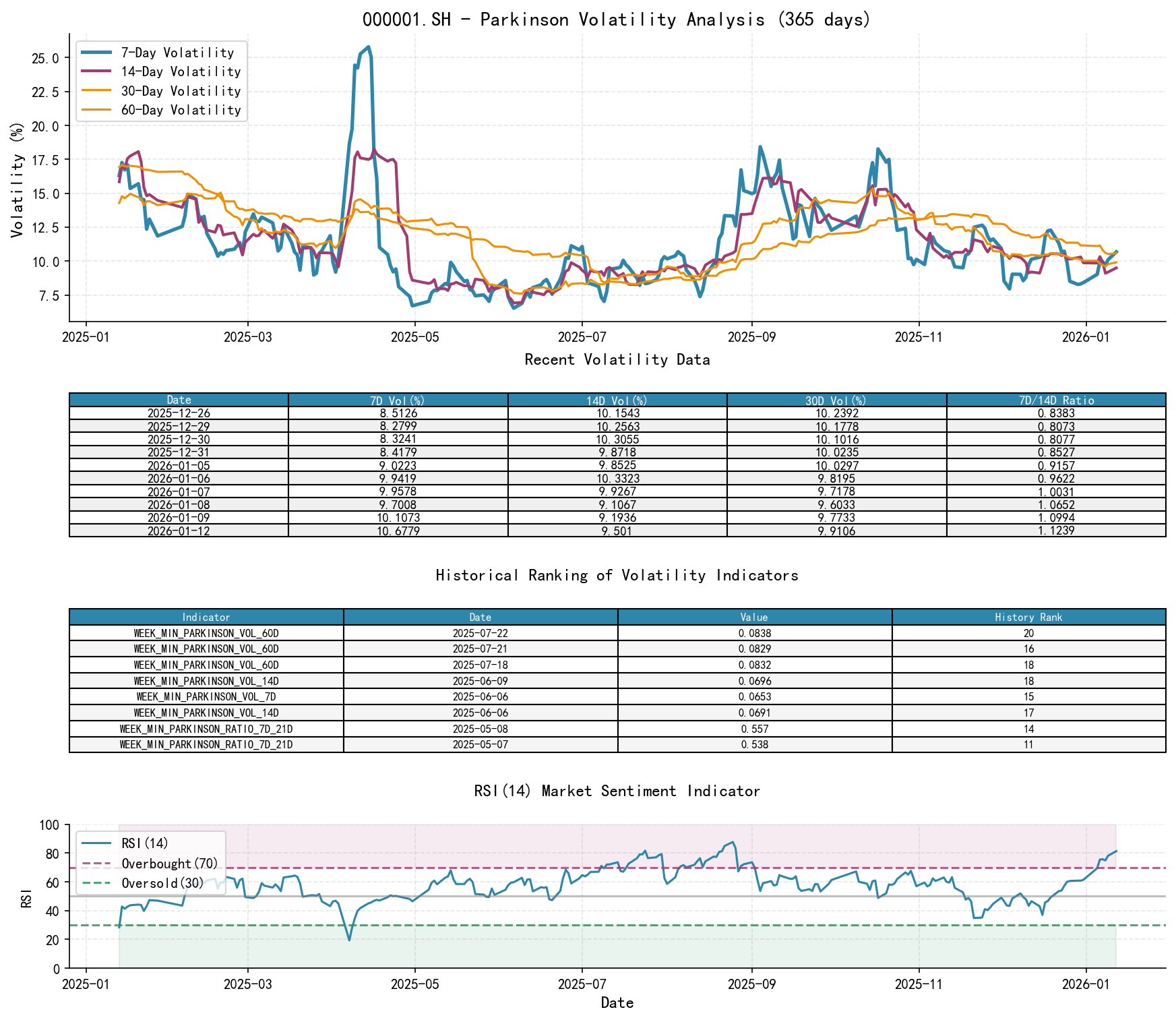

As of 2026-01-12, for the target 000001.SH: Open Price 4134.89, 7-Day Intraday Volatility 0.11, 7-Day Intraday Vol Ratio 1.12, 7-Day Historical Volatility 0.13, 7-Day Historical Vol Ratio 1.23, RSI 81.40

- • Volatility Analysis:

- • Panic Period: On 2025-11-21, HIS_VOLA_7D (19.33%) spiked, and its ratio to long-term volatility (HIS_VOLA_RATIO_7D_60D=1.148) indicated abnormally amplified short-term volatility, confirming panic sentiment.

- • Recovery and Uptrend Period: Entering January 2026, despite accelerating price increases, HIS_VOLA_7D (12.65%) has significantly decreased compared to the November panic period, and HIS_VOLA_RATIO_7D_60D (0.880) is below 1. This indicates the current rally is accompanied by relative volatility convergence, not disorderly frenzy, suggesting a relatively healthy trend-driven advance. Parkinson volatility indicators show similar characteristics.

- • Sentiment Indicator (RSI):

- • RSI_14 touched a low of 34.86 after the plunge on November 21st, entering oversold territory.

- • RSI has climbed steadily with the rally. As of January 12th, RSI_14 reached 81.40, achieving a 10-year high rank of 17th (HISTORY_RANK: 17) in overbought levels. This clearly shows market sentiment has entered a state of extreme optimism and overbought conditions. From a Wyckoff perspective, this suggests the markup phase may be entering its later stages, warranting close attention to potential "distribution" behavior.

4. Relative Strength and Momentum Performance

- • Momentum Analysis:

- • Strong Short-Term Momentum: Both WTD_RETURN (3.53%) and MTD_RETURN (4.95%) are significantly positive, indicating very strong short-term upward momentum.

- • Mid-Term Trend Reversal Upward: QTD_RETURN (4.95%) and YTD (4.95%) have simultaneously turned positive and align with the short-term momentum direction. This suggests the rally is not merely a short-term bounce but is supported by a mid-term trend reversal. From the late November low, the index has rebounded over 8%, indicating a clear momentum shift.

5. Large Investor ("Smart Money") Behavior Identification

Based on the above price-volume, trend, and volatility analysis, the behavioral path of large investors can be inferred:

- 1. Panic Absorption (Late November 2025): The massive volume during the "Panic Selling" on November 21st implies a significant exchange of shares. The subsequent persistent low-volume consolidation indicates selling pressure (public selling) quickly dried up after the concentrated release on the panic day, while prices did not make new lows. This is a classic sign of "smart money accumulation" — they absorbed the shares sold by the panicked public.

- 2. Testing and Shakeout (December 2025): Within the accumulation phase, the market tested support multiple times (e.g., dropping to 3824 on Dec 16th), but volume did not expand significantly, indicating supply did not re-emerge. This was likely a "shakeout" conducted by smart money to flush out weak holders.

- 3. Markup and Breakout (January 2026): The consecutive high-volume, strong bullish candles starting in early January are a clear signal that smart money concluded accumulation and initiated "markup." The record-breaking volume accompanied by price increases on January 12th indicates large capital is still actively buying at key levels (breaking historical highs), propelling the trend. "Who is absorbing the huge volume?" In the current context, the answer leans towards institutional funds following up or adding positions after trend confirmation.

- 4. Current Risk: However, considering the price at historical highs and the extremely overbought RSI ranking 17th, caution is warranted that the market may be entering the early stages of "distribution" at current or slightly higher levels. Smart money might be utilizing extreme public optimism to begin exchanging low-cost shares to chasing public investors. Future appearances of "high-volume stalling" or "high-volume candles with long upper shadows" would be key signals of distribution behavior.

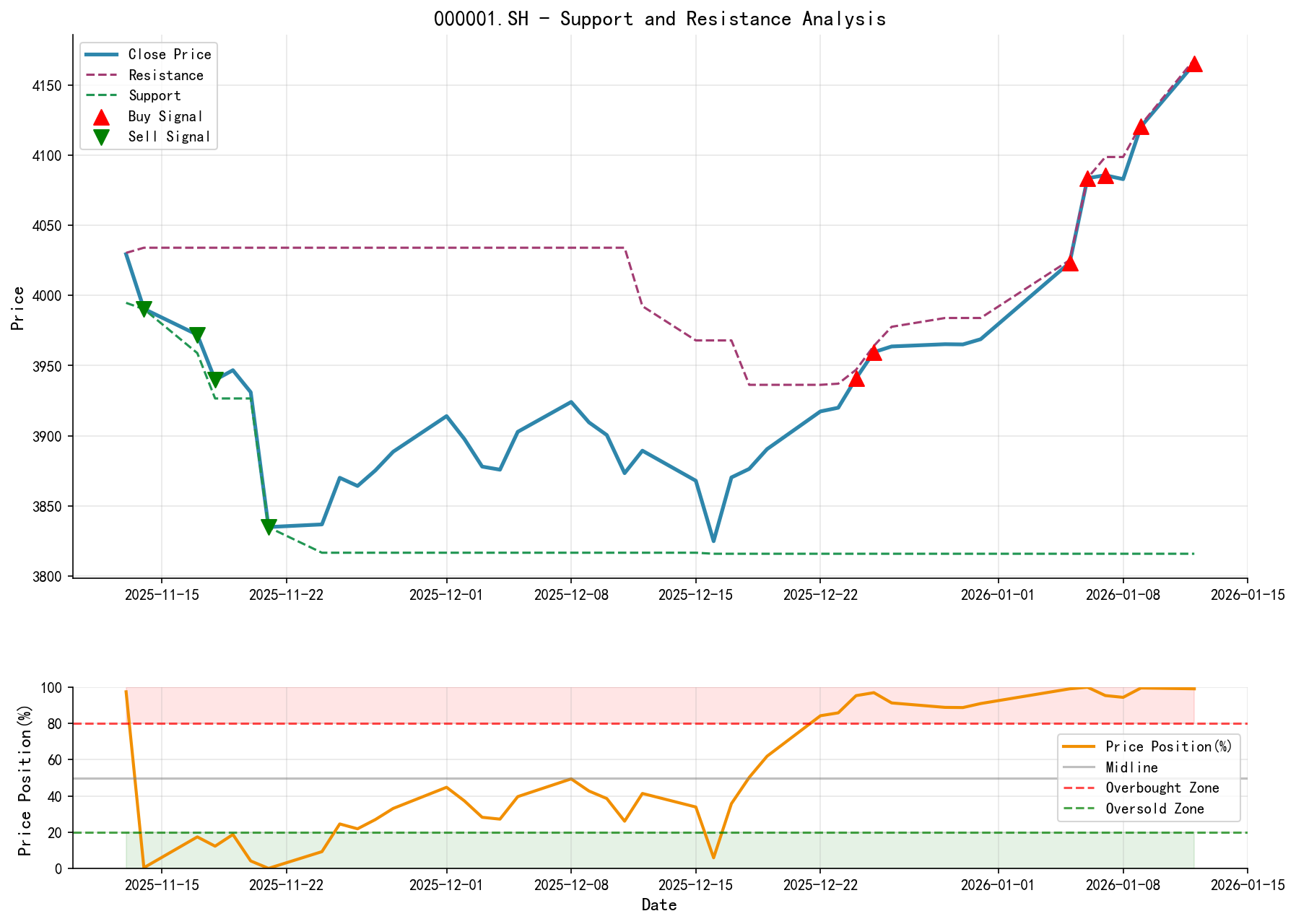

6. Support/Resistance Level Analysis and Trading Signals

- • Key Levels:

- • Resistance (Breached): 4030 points (pre-2025-11-13 high), now transformed into strong support.

- • Current Resistance/Target: 4168 points (intraday high on 2026-01-12), also the historical high point. The next psychological resistance is around 4200 points.

- • Core Support Levels: 4030-4000 point zone (previous high conversion + round number + near MA_5D). 3930-3950 point zone (concentration area of MA_20D and MA_30D, the lifeline of the intermediate-term trend).

- • Integrated Trading Signals and Operational Recommendations:

- • Market State: The market is in a clear short-term uptrend but has entered an extremely overbought zone.

- • Wyckoff Event: We have just experienced the "Jump Across the Creek" breakout from the "Accumulation Phase" into the "Markup Phase." Currently in the trend progression.

- • Operational Recommendations (Based on 2026-01-12 Close):

- • For Holders: The trend remains intact; positions can be held. However, given the extreme RSI overbought condition, the stop-loss level should be raised from an aggressive MA_5D level to below the key support at 4030 points. Any close below this level should prompt consideration for significant position reduction, as it could signal a failed breakout and the start of a trend reversal.

- • For Non-Holders/Seeking Entry: Chasing at current levels (around 4165) is strictly prohibited. Patience is required for a healthy market pullback. The ideal entry opportunity would be: a price retracement to the 4030-4050 support zone, accompanied by signals of diminished volume stabilization and re-emerging demand (e.g., declining volume on down days, or candlesticks with long lower shadows indicating support). This represents the "Last Point of Support (LPS)" buying opportunity in Wyckoff theory.

- • Future Verification Points:

- 1. Bullish Validation: Whether the price can digest overbought technical indicators through sideways movement or a minor pullback (without breaking 4030) after the overbought condition, then resume a gentle, volume-supported advance.

- 2. Bearish/Risk Validation: Closely monitor for signs of "one-day reversal" or "high-volume stalling" (e.g., a single day with huge volume but the price closes flat or slightly down, or a candlestick with a long upper shadow). The appearance of such signals, especially near historical highs, would be a strong short-term cautionary signal, suggesting distribution may have begun.

- • Executive Summary:

The data indicates that after experiencing panic selling in late November 2025 and subsequent institutional accumulation, the Shanghai Composite Index was driven by large capital to launch a robust, trend-driven rally in early January 2026. Current market momentum is sufficient, but sentiment has reached extremes. The strategy should be to "follow the trend but avoid chasing highs," shifting the core focus from "finding buy points" to "identifying risk signals and protecting profits." The current market offers a poor risk-reward ratio for buyers and is more suitable for holders to manage risk or await the next high-quality pullback entry point.

Disclaimer: This report/analysis is solely for market analysis and research based on public information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risks; investments require caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff price-volume market analysis is released daily at 8:00 AM before the market opens. Please feel free to leave comments and share; your recognition is crucial. Let's work together to see the market signals.

Member discussion: